Morning Call For Thursday, Jan. 25

OVERNIGHT MARKETS AND NEWS

Mar E-mini S&Ps (ESH18 +0.30%) this morning are up +0.21% as commodity producers and energy stocks rally with the dollar index sliding further to a new 3-year low. Metals prices all rallied with Feb COMEX gold (GCG18 +0.14%) up +0.16% and Mar silver (SIH18 +0.23%) up +0.18%, both at 4-1/2 month highs, and Mar COMEX copper (HGH18 +0.22%) is up +0.15% at a 1-week high. Mar WTI crude oil (CLH18 +1.01%) is up +0.72% at a new 3-year high on a weaker dollar along with carry-over support from Wednesday's EIA data that showed U.S. crude inventories fell for a record tenth consecutive week to a 2-3/4 year low. European stocks are up +0.30% ahead of the conclusion of today's ECB meeting and press conference from ECB President Draghi. Confidence in the European economic outlook is providing a lift to equities after the German Jan IFO business climate and the German Feb GfK consumer confidence both rose to record highs. Asian stocks settled mostly lower: Japan -1.13%, Hong Kong -0.92%, China -0.31%, Taiwan +0.12%, Australia -0.08%, Singapore -1.01%, South Korea +0.96%, India -0.31%. Chinese stocks retreated amid continuing protectionist rhetoric from the Trump administration on trade, while Japanese stocks fell back as the Nikkei Stock Index slid to a 1-1/2 week low after a fall in USD/JPY to a 4-1/2 month low undercut exporter stocks.

The dollar index (DXY00 -0.10%) is down -0.03% at a new 3-year low. EUR/USD (^EURUSD) is down -0.07%h. USD/JPY (^USDJPY) is down -0.18% at a 4-1/2 month low.

Mar 10-year T-note prices (ZNH18 +0.13%) are up +4 ticks.

The German Jan IFO business climate unexpectedly rose +0.4 to 117.6, stronger than expectations of -0.2 to 117.0 and matched the Nov reading as the highest since the data series began in 1991.

The German Feb GfK consumer confidence rose +0.2 to a record high of 11.0 (data from 2006), stronger than expectations of no change at 10.8.

U.S. STOCK PREVIEW

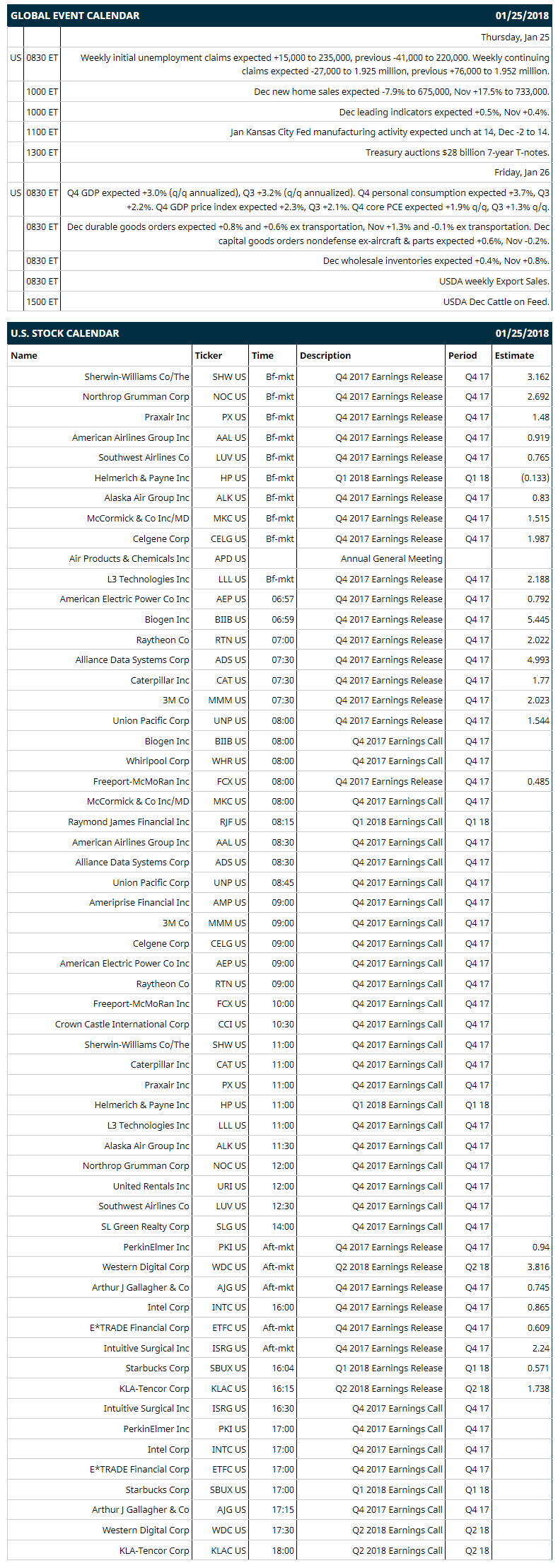

Key U.S. news today includes: (1) weekly initial unemployment claims (expected +15,000 to 235,000, previous -41,000 to 220,000) and continuing claims (expected -27,000 to 1.925 million, previous +76,000 to 1.952 million), (2) Dec new home sales (expected -7.9% to 675,000, Nov +17.5% to 733,000), (3) Dec leading indicators (expected +0.5%, Nov +0.4%), (4) Jan Kansas City Fed manufacturing activity (expected unch at 14, Dec -2 to 14), (5) Treasury auctions $28 billion 7-year T-notes.

Notable S&P 500 earnings reports today include: Intel (consensus 0.87), Starbucks (0.57), American Airlines (0.92), Southwest Air (0.77), Raytheon (2.02), Caterpillar (1.77), 3M (2.02).

U.S. IPO's scheduled to price today:

Equity conferences this week: none.

OVERNIGHT U.S. STOCK MOVERS

Dollar General (DG -0.47%) was upgraded to 'Outperform' from 'Market Perform' at Telsey Advisory Group with a price target of $120.

Lam Research (LRCX -2.48%) rallied over 4% in after-hours trading after it reported Q2 adjusted EPS of $4.34, well above consensus of $3.69.

Whirlpool (WHR +4.06%) lost almost 1% in after-hours trading after it reported Q4 net sales of $5.70 billion, below consensus of $5.84 billion.

F5 Networks (FFIV -0.32%) climbed almost 3% in after-hours trading after it reported Q1 net revenue of $523.2 million, better than consensus of $521.1 million, and then said it sees Q2 revenue of $525 million to $535 million, the midpoint above consensus of $528.3 million.

Varian Medical Systems (VAR +2.02%) jumped over 12% in after-hours trading after it reported Q1 adjusted EPS of $1.06, higher than consensus of 88 cents, and then raised guidance on full-year adjusted EPS to $4.24 to $4.36 from a prior view of $4.05 to $4.17.

Xilinx (XLNX -2.73%) rose almost 5% in after-hours trading after it said it sees Q4 sales of $635 million to $665 million, the midpoint above consensus of $642.2 million.

Legg Mason (LM +0.73%) gained over 2% in after-hours trading after it reported Q3 operating revenue of $793.1 million, better than consensus of $768.5 million.

Dolby Laboratories (DLB -0.40%) climbed over 8% in after-hours trading after it reported Q1 adjusted EPS of 79 cents, well above consensus of 60 cents, and then said it sees Q2 adjusted EPS of 74 cents to 80 cents, higher than consensus of 71 cents.

Spark Therapeutics (ONCE -2.10%) rallied almost 4% in after-hours trading after it entered into a pact with Novartis to commercialize Voretigene Neparvovec and will receive $105 million in an upfront fee.

Ethan Allen Interiors (ETH -0.37%) fell 3% in after-hours trading after it said it will begin a "major marketing campaign" and will boost advertising by 33% in Q3 and by 15% in Q4.

Ford Motor (F +0.75%) lost almost 1% in after-hours trading after it said it sees fiscal 2018 pre-tax profit lower than last year.

Celestia (CLS -0.54%) tumbled almost 9% in after-hours trading after it reported Q3 adjusted EPS of 27 cents, below consensus of 31 cents.

ShotSpottter (SSTI +1.19%) jumped over 10% in after-hours trading after it announced an agreement with Verizon to expand its gunshot detection services to more cities by leveraging Verizon's Light Sensory Network.

Iovance Biotherapeutics (IOVA -4.96%) climbed over 3% in after-hours trading after it reported three of eight evaluable patients with Metastatic Squamous Cell Carcinoma of the head and neck treated with its LN-145 experienced a confirmed partial response.

Ocular Therapeutix (OCUL -0.80%) dropped 12% in after-hours trading after it announced that it had commenced an underwritten public offering of $25 million of its common stock.

MARKET COMMENTS

Mar S&P 500 E-mini stock futures (ESH18 +0.30%) this morning are up +6.00 points (+0.21%). Wednesday's closes: S&P 500 -0.06%, Dow Jones +0.16%, Nasdaq -0.63%. The S&P 500 on Wednesday posted a new record high but then fell back and closed lower. Stocks were undercut by trade concerns after U.S. Commerce Secretary Ross said the U.S. may enact further tariffs in addition to the tariffs on imports of solar panels and washing machines enacted on Monday, which fueled long liquidation in stocks on fears the Trump administration may start a trade war. In addition, U.S. Dec existing home sales fell -3.6% to 5.57 million, weaker than expectations of -1.9% to 5.70 million. Stocks were supported by ongoing earnings optimism and strength in energy stocks after crude oil prices climbed +1.77% to a new 3-year high.

Mar 10-year T-note prices (ZNH18 +0.13%) this morning are up +4 ticks. Wednesday's closes: TYH8 -7.00, FVH8 -3.25. Mar 10-year T-notes on Wednesday closed lower on negative carry-over from a slide in German bund prices to a 1-week low and on a rally in crude oil to a 3-year high, which boosts inflation expectations.

The dollar index (DXY00 -0.10%) this morning is down -0.025 (-0.03%) at a new 3-year low. EUR/USD (^EURUSD) is down -0.0009 (-0.07%) and USD/JPY (^USDJPY) is down -0.20 (-0.18%) at a 4-1/2 month low. Wednesday's closes: Dollar Index -0.918 (-1.02%), EUR/USD +0.0109 (+0.89%), USD/JPY -1.09 (-0.99%). The dollar index on Wednesday tumbled to a new 3-year low and closed lower on comments from U.S. Treasury Secretary Mnuchin who endorsed a weaker dollar when he said, "obviously a weaker dollar is good for us as it relates to trade and opportunities." Meanwhile, EUR/USD climbed to a 3-year high after the Eurozone Jan Markit composite PMI unexpectedly rose +0.5 to an 11-1/2 year high of 58.6, which is hawkish for ECB monetary policy.

Mar crude oil (CLH18 +1.01%) this morning is up +47 cents (+0.72%) at a new 3-year high and Mar gasoline (RBH18 +0.30%) is +0.0015 (+0.08%). Wednesday's closes: Mar WTI crude +1.14 (+1.77%), Mar gasoline +0.0274 (+1.46%). Mar crude oil and gasoline on Wednesday closed higher with Mar crude at a 3-year nearest-futures high. Crude oil prices were boosted by the sell-off in the dollar index to a 3-year low, the -1.07 million bbl decline in EIA crude inventories to a 2-3/4 year low (a record tenth straight weekly decline), and the -3.15 million bbl drop in crude supplies at Cushing to a near 3-year low.

Metals prices this morning are higher with Feb gold (GCG18 +0.14%) +2.2 (+0.16%) at a 4-1/2 month high, Mar silver (SIH18 +0.23%) +0.031 (+0.18%) at a 4-1/2 month high, and Mar copper (HGH18 +0.22%) +0.005 (+0.15%) at a 1-week high. Wednesday's closes: Feb gold +19.6 (+1.47%), Mar silver +0.576 (+3.41%), Mar copper +0.1175 (+3.78%). Metals on Wednesday closed higher with Feb gold at a 4-1/2 month high and Mar silver at a 1-week high. Metals prices were boosted by the fall in the dollar index to a 3-year low and by signs of strength in the global economy that is supportive for industrial metals demand after the U.S. Jan Markit manufacturing PMI unexpectedly rose +0.4 to a 2-3/4 year high and the Eurozone Jan Markit composite PMI unexpectedly rose +0.5 to an 11-1/2 year high of 58.6.

(Click on image to enlarge)

Disclosure: None.