Morning Call For Thursday, August 10

OVERNIGHT MARKETS AND NEWS

Sep E-mini S&Ps (ESU17 -0.38%) this morning are down -0.42% and European stocks are down -0.60% as tensions between the U.S. and North Korea continue to weigh on global equity markets. South Korea and Japan both warned North Korea that it would face a strong response if it carried through with a threat to launch missiles toward the U.S. territory of Guam. The slide in global stock markets has boosted the safe-haven demand for precious metals with Dec COMEX gold (GCZ17 +0.57%) up +0.55% at a 1-3/4 month high. Asian stocks settled mostly lower: Japan -0.05%, Hong Kong -1.13%, China -0.42%, Taiwan -1.34%, Australia -0.08%, Singapore +0.16%, South Korea -0.37%, India -0.84%. The Chinese yuan rallied to a 23-month high against the dollar after the PBOC raised its daily reference rate for the yuan and as some investors are buying the yuan as a safe-haven currency due to the North Korean tensions.

The dollar index (DXY00 +0.16%) is up +0.14%. EUR/USD (^EURUSD) is down -0.31%. USD/JPY (^USDJPY) is down -0.30%.

Sep 10-year T-note prices (ZNU17 +0.01%) are up +1.5 ticks.

Japan Jul PPI rose +0.3% m/m and +2.6% y/y, stronger than expectations of +0.2% m/m and +2.3% y/y with the +2.6% y/y gain the largest year-on-year increase in 2-3/4 years.

UK Jun industrial production rose +0.5% m/m, stronger than expectations of +0.1% m/m and the largest increase in 5 months.

UK Jun manufacturing production was unch m/m, right on expectations.

U.S. STOCK PREVIEW

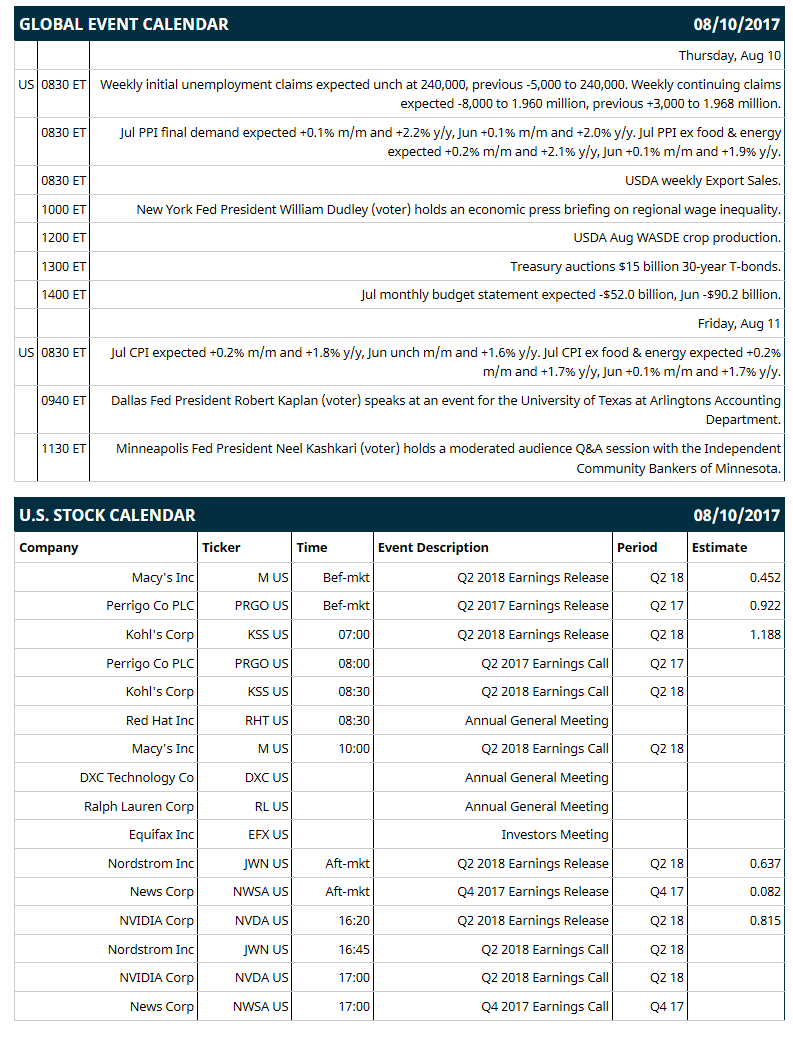

Key U.S. news today includes: (1) weekly initial unemployment claims (expected -5.000 at 240,000, previous -5,000 to 240,000) and continuing claims (expected -8,000 to 1.960 million, previous +3,000 to 1.968 million), (2) Jul PPI final demand (expected +0.1% m/m and +2.2% y/y, Jun +0.1% m/m and +2.0% y/y) and Jul PPI ex food & energy (expected +0.2% m/m and +2.1% y/y, Jun +0.1% m/m and +1.9% y/y), (3) New York Fed President William Dudley (voter) holds an economic press briefing on regional wage inequality, (4) Treasury auctions $15 billion 30-year T-bonds, (5) Jul monthly budget statement expected -$54.0 billion, Jun -$90.2 billion, (6) USDA weekly Export Sales, (7) USDA Aug WASDE crop production.

Notable S&P 500 earnings reports today include: Macy's (consensus $0.45), Perrigo (0.92), Kohl's (1.19), Nordstrom (0.64), News Corp (0.08), NVIDIA (0.82).

U.S. IPO's scheduled to price today: Ranger Energy Services (RNGR).

Equity conferences this week: Canaccord Genuity Growth Conference on Wed-Thu, Goldman Sachs Power, Utilities MLP and Pipeline Conference on Thu.

OVERNIGHT U.S. STOCK MOVERS

Esterline (ESL +2.64%) was downgraded to 'Sell' from 'Neutral' at Goldman Sachs.

Diamondback Energy (FANG -0.42%) slid almost 2% in pre-market trading after it reported an underwritten secondary offering of 3 million shares of its common stock by holders.

Jack in the Box (JACK -0.17%) gained almost 2% in after-hours trading after it reported Q3 sales at its Qdoba brand unexpectedly rose +0.5%, better than estimates of -0.5%.

Pegasystems (PEGA +0.69%) lost 3% in after-hours trading after it reported Q2 adjusted EPS of 15 cents, below consensus of 17 cents.

Ambac Financial Group (AMBC +1.11%) rose nearly 5% in after-hours trading after it reported Q2 adjusted EPS of $1.54, well above consensus of $1.25.

Masonite International (DOOR -0.34%) tumbled almost 15% in after-hours trading after it reported Q2 adjusted EPS of 89 cents, weaker than consensus of $1.11.

Live Nation Entertainment (LYV -0.95%) rose over 4% in after-hours trading after it reported Q2 revenue of $2.82 billion, better than consensus of $2.37 billion

Chicago Bridge & Iron (CBI -0.49%) slumped 20% in after-hours trading after it reported Q2 revenue of $1.28 billion, much weaker than consensus of $2.45 billion, and then said it will suspend its dividend.

Planet Fitness (PLNT -0.73%) climbed almost 3% in after-hours trading after it reported Q2 adjusted EPS of 22 cents, better than consensus of 19 cents.

Amtech Systems (ASYS +2.12%) jumped 13% in after-hours trading after it reported Q3 revenue of $47.8 million, above estimates of $40.9 million.

Quantum (QTM -2.37%) sank over 20% in after-hours trading after it reported Q1 revenue of $116.9 million, below consensus of $119.3 million, and then said it sees fiscal 2018 revenue of $51 million-$515 million, weaker than consensus of $528 million.

Babcock & Wilcox Enterprises (BW -0.71%) plunged 30% in after-hours trading after it reported Q2 revenue of $349.8 million, well below consensus of $424.7 million.

Hudson Technologies (HDSN -0.87%) surged 20% in after-hours trading after it reported Q2 revenue of $52.2 million, better than consensus of $46.3 million, and then announced an agreement to purchase Airgas-Refrigerants for about $220 million.

Goldfield (GV -1.90%) tumbled almost 7% in after-hours trading after it reported Q2 Ebitda of $5.9 million versus $7.8 million y/y and said Q2 revenue decreased -9.8% y/y to $29.1 million.

MARKET COMMENTS

Sep S&P 500 E-mini stock futures (ESU17 -0.38%) this morning are down -10.50 points (-0.42%). Wednesday's closes: S&P 500 -0.04%, Dow Jones -0.17%, Nasdaq -0.12%. The S&P 500 on Wednesday fell to a 1-1/2 week low but recovered most of its losses and closed only slightly lower. The main bearish factor continued to be US-North Korea tensions that pushed up the VIX volatility index to a 1-month high and spurred long liquidation in stocks. Stocks found support on the +0.9% increase in U.S. Q1 non-farm productivity (stronger than expectations of +0.7%) and the +0.6% gain in U.S. Q2 unit labor costs (weaker than expectations of +1.1%).

Sep 10-year T-note prices (ZNU17 +0.01%) this morning are up +1.5 ticks. Wednesday's closes: TYU7 +10.5, FVU7 +5.50. Sep 10-year T-notes on Wednesday rallied to a 6-week high and closed higher on increased safe-haven demand for T-notes from escalating geopolitical tensions between the U.S. and North Korea that slammed global equity markets. T-notes were also boosted by the stronger-than-expected +0.9% increase in U.S. Q2 non-farm productivity and smaller-than-expected +0.6% increase in Q2 unit labor costs.

The dollar index (DXY00 +0.16%) this morning is up +0.131 (+0.14%). EUR/USD (^EURUSD) is down -0.0037 (-0.31%) and USD/JPY (^USDJPY) is down -0.33 (-0.30%). Wednesday's closes: Dollar Index -0.099 (-0.11%), EUR/USD +0.0007 (+0.06%), USD/JPY -0.25 (-0.23%). The dollar index on Wednesday closed lower on the slide in USD/JPY to a 1-3/4 month low as the decline in global stock markets boosted the safe-haven demand for the yen, and on the fall in the 10-year T-note yield to a 6-week low, which reduced the dollar's interest rate differentials.

Sep crude oil (CLU17 +0.77%) this morning is up +31 cents (+0.63%) at a 1-week high. Sep gasoline (RBU17 +1.14%) is +0.0141 (+0.87%). Wednesday's closes: Sep WTI crude +0.39 (+0.79%), Sep gasoline -0.0008 (-0.05%). Sep crude and gasoline on Wednesday settled mixed. Crude oil prices were boosted by a weaker dollar and by the -6.45 million bbl decline in EIA crude inventories to a 9-1/2 month low, a bigger draw than expectations of -2.0 million bbl. Crude oil prices were undercut by the unexpected +3.42 million bbl increase in EIA gasoline inventories, more than expectations for a -1.5 million bbl decline, and by the fall in the crack spread to a 1-1/2 week low, which reduces the incentive for refiners to purchase crude to refine into gasoline.

(Click on image to enlarge)

Disclosure: None.