Morning Call For September 17, 2015

OVERNIGHT MARKETS AND NEWS

December E-mini S&Ps (ESZ15 -0.18%) are down -0.15% and European stocks are up +0.35% ahead of today's widely anticipated Fed interest rate decision. The markets are pricing in a 32% chance of a Fed rate hike today according to fed fund futures, up slightly from 30% at the beginning of the week. Weakness in technology stocks is dragging the overall market lower with Oracle down -1.2% in pre-market trading after reporting Q1 revenue of $8.45 billion, below consensus of $8.53 billion. Peabody Energy, the largest U.S. coal miner, plunged 15% in pre-market trading after it authorized a reverse stock split. Emerging markets closed higher and Asian stocks closed mixed: Japan +1.43%, Hong Kong -0.51%, China -2.10%, Taiwan +1.35%, Australia +0.94%, Singapore +0.94%, South Korea +0.21%, India closed for holiday. Japan's Nikkei Stock Index climbed to a 1-week high on speculation the BOJ may need to expand stimulus to revive economic growth after Japanese trade data showed Aug imports fell more than expected.

The dollar index (DXY00 -0.24%) is down -0.21%. EUR/USD (^EURUSD) is up +0.26%. USD/JPY (^USDJPY) is up +0.33%.

Dec T-note prices (ZNZ15 +0.12%) are up +5 ticks.

The ECB lowered Greece's Emergency Liquidity Assistance (ELA) to 88.9 billion euros from 89.1 billion euros and said the reduction of ceiling requested by the Bank of Greece "reflects an improvement of the liquidity situation of Greek banks, amid a reduction of uncertainty and the stabilization of private sector deposit flows."

The Japan Aug trade balance was in deficit by -569.7 billion yen, wider than expectations of -540.0 billion yen and the largest deficit in 7 months. Aug exports rose +3.1% y/y, weaker than expectations of +4.3% y/y. Aug imports fell -3.1% y/y, more than expectations of -2.5% y/y.

U.S. STOCK PREVIEW

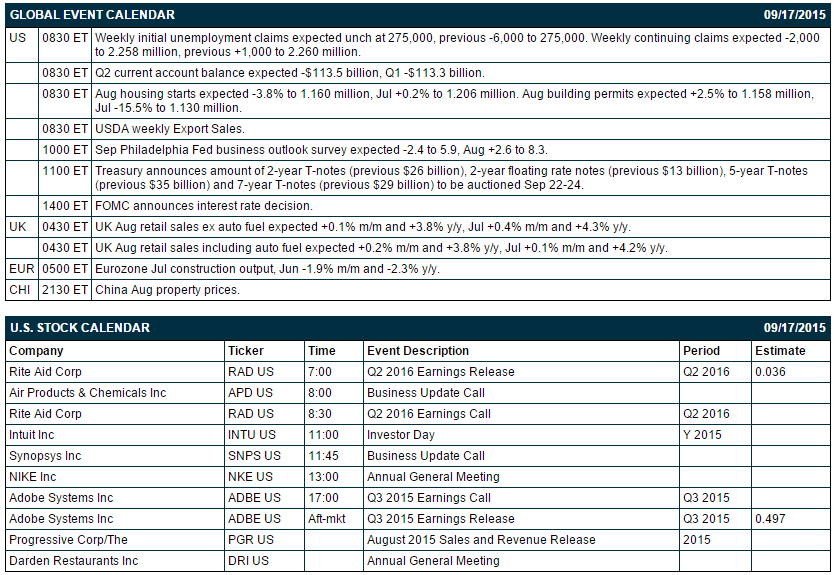

Key U.S. news today includes: (1) weekly initial unemployment claims (expected unch at 275,000, previous -6,000 to 275,000) and continuing claims (expected -2,000 to 2.258 million, previous +1,000 to 2.260 million), (2) Q2 current account deficit (expected -$113.5 billion, Q1 -$113.3 billion), (3) Aug housing starts (expected -3.8% to 1.160 million, Jul +0.2% to 1.206 million), (4) Sep Philadelphia Fed business outlook survey (expected -2.4 to 5.9, Aug +2.6 to 8.3), (5) the FOMC's policy announcement after its 2-day meeting and a press conference by Fed Chair Yellen.

There are 2 of the Russell 1000 companies reports earnings today: Adobe Systems (consensus $0.50), Rite Aid (0.04).

U.S. IPO's scheduled to price today include: Penumbra (PEN), Nabriva Therapeutics (NBRV).

Equity conferences during the remainder of this week include: Bank of America Merrill Lynch Power & Gas Leaders Conference on Wed-Thu, Citi 2015 Industrials Conference on Wed-Thu, Deutsche Bank Technology Conference on Wed-Thu, Morgan Stanley Industrials Conference on Wed-Thu, Barclays Capital Global Financial Services Conference on Wed-Fri, Credit Suisse Basic Materials Conference on Wed-Fri, Goldman Sachs Communacopia Conference on Wed-Fri, Morgan Stanley Global Healthcare Conference on Wed-Fri, Bank of America Merrill Lynch Global Health Care Conference on Thu, Imperial Capital Global Opportunities Conference on Thu, and AACR CRI-CIMT-EATI Immunotherapy Conference on Thu-Fri.

OVERNIGHT U.S. STOCK MOVERS

Oracle (ORCL +0.74%) slid over 1% in pre-market trading after it reported Q1 EPS of 53 cents, better than consensus of 52 cents, although Q1 revenue of $8.45 billion was below consensus of $8.53 billion.

Raytheon (RTN +0.04%) was upgraded to 'Top Pick' from 'Outperform' at RBC Capital.

Hasbro (HAS +1.48%) was downgraded to 'Neutral' from 'Buy' at Goldman Sachs.

NVIDIA (NVDA +0.70%) was upgraded to 'Buy' from 'Hold' at Jefferies with a $30 price target.

Stanley Black & Decker (SWK +0.44%) was initiated with a 'Buy' at UBS with a price target of $120.

Hanesbrands (HBI +1.17%) was upgraded to 'Buy' from 'Neutral' at Goldman Sachs.

Cablevision (CVC unch) jumped over 16% in pre-market trading after after Altice announced that it will acquire Cablevision for $34.90 per share in cash.

Clarcor (CLC +0.58%) reported Q3 non-GAAP EPS of 66 cents, weaker than consensus of 84 cents, and then lowered guidance on fiscal 2015 EPS view to $2.70-$2.80 from $3.00-$3.15, below consensus of $3.05.

Northrop Grumman Corporation (NOC +0.37%) announced that its board has authorized an additional $4 billion for the repurchase of the company's common stock.

Aetna (AET +0.01%) backs its fiscal 2015 EPS view of at least $7.40, below consensus of $7.51.

Envision Healthcare (EVHC -0.09%) was initiated with a 'Buy' at Canaccord with a price target of $51.

Allscripts (MDRX +0.59%) was initiated with a 'Buy' at Canaccord with a price target of $18.

Herman Miller (MLHR +1.24%) climbed 4% in after-hours trading after it reported Q1 EPS of 56 cents, well above consensus of 46 cents.

MARKET COMMENTS

Dec E-mini S&Ps (ESZ15 -0.18%) this morning are down -3.00 points (-0.15%). Wednesday's closes: S&P 500 +0.87%, Dow Jones +0.84%, Nasdaq +0.54%. The S&P 500 Wednesday rose to a 3-week high and closed higher on (1) the +1.8% y/y increase in U.S. Aug CPI, less than expectations of +1.9% y/y, which reduces the pressure on the Fed to raise interest rates, and (2) the unexpected +1 point increase in the Sep NAHB housing market index to a 9-3/4 year high of 62. Energy producers rallied after crude oil climbed to a 1-1/2 week high.

Dec 10-year T-notes (ZNZ15 +0.12%) this morning are up +5 ticks. Wednesday's closes: TYZ5 -6.00, FVZ5 -1.50. Dec T-notes Wednesday fell to a 4-week low and closed lower on the unexpected increase in the Sep NAHB housing market index to a 9-3/4 year high, which bolsters the case for a Fed interest rate increase, and on reduced safe-haven demand as the S&P 500 rallied to a 3-week high.

The dollar index (DXY00 -0.24%) this morning is down -0.204 (-0.21%). EUR/USD (^EURUSD) is up +0.0029 (+0.26%). USD/JPY (^USDJPY) is up +0.40 (+0.33%). Wednesday's closes: Dollar Index -0.191 (-0.20%), EUR/USD +0.0021 (+0.19%), USD/JPY +0.15 (+0.12%). The dollar index on Wednesday closed lower on reduced pressure for the Fed to raise interest rates after the U.S. Aug CPI rose +1.8% y/y, less than expectations of +1.9% y/y. EUR/USD was undercut by ECB Vice President Constancio's comment that the ECB has the scope to expand QE if needed.

Oct crude oil (CLV15 -0.98%) this morning is down -68 cents (-1.44%) and Oct gasoline (RBV15 -0.48%) is down -0.0118 (-0.85%). Wednesday's closes: CLV5 +2.54 (+5.70%), RBV5 +0.0491 (+3.68%). Oct crude oil and gasoline on Wednesday closed sharply higher with Oct crude at a 1-1/2 week high on (1) the unexpected -2.1 million bbl decline in weekly EIA crude inventories, (2) the -1.9 million bbl draw in crude supplies at Cushing to a 5-3/4 month low, and (3) the -0.2% decline in U.S crude production in the week ended Sep 11 to a 9-month low of 9.117 million bpd.

Disclosure: I have no positions in ...

more

Thanks for great news.