Morning Call For September 10, 2015

OVERNIGHT MARKETS AND NEWS

September E-mini S&Ps (ESU15 +0.08%) are up +0.31% as strength in technology stocks leads U.S. equities higher. Energy producers are higher as well as crude oil (CLV15 +0.79%) rose. European stocks are down -0.75% after French Jul industrial production unexpectedly fell -0.8% m/m, weaker than expectations of +0.2% m/m. A decline in Chinese and emerging market stocks also undercut European equities. Weakness in commodity producers pressured emerging market stocks after S&P cut Brazil's credit rating to junk with a negative outlook. Asian stocks closed mostly lower: Japan -2.51%, Hong Kong -2.57%, China -1.39%, Taiwan -0.22%, Australia -2.42%, Singapore -1.37%, South Korea +1.19%, India -0.38%. Chinese stocks closed lower on concern the economic slowdown is deeper than expected after China Aug producer prices fell by the most in nearly 6 years. Deflation concerns hurt Japanese stocks as well after Japan Aug PPI fell at the fastest pace in 5-1/2 years.

The dollar index (DXY00 +0.07%) is up +0.07%. EUR/USD (^EURUSD) is down -0.14%. USD/JPY (^USDJPY) is up +0.63% at a 1-week high on speculation that Japan will increase stimulus to thwart falling prices after Japan Aug PPI fell more than expected and after Prime Minister Abe said that October would be a "good opportunity" for the BOJ to boost stimulus.

Dec T-note prices (ZNZ15 -0.20%) are down -9.5 ticks.

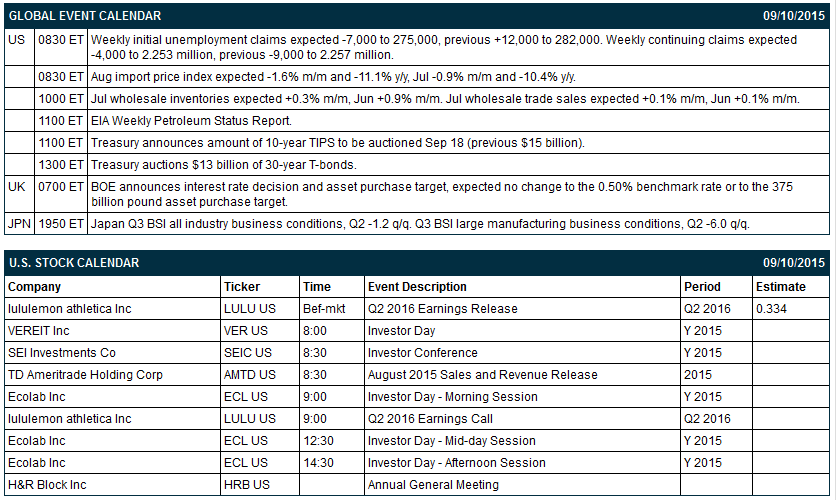

As expected, the BOE maintained its benchmark interest rate at 0.50% and kept its asset purchase target unchanged at 375 billion pounds following today's policy meeting.

ECB Governing Council member Liikanen said "the economic recovery in the Eurozone is proceeding, albeit at a slower pace than expected," and we "will continue are asset purchases until the end of Sep 2016, or beyond, if necessary."

China Aug CPI rose +2.0% y/y, higher than expectations of +1.8% y/y and the biggest increase in a year. Aug PPI fell -5.9% y/y, weaker than expectations of -5.6% y/y and the steepest pace of decline in 5-3/4 years.

Japan Aug PPI fell -0.6% m/m m/m and -3.6% y/y, weaker than expectations of -0.4% m/m and -3.3% y/y with the -3.6% y/y drop the steepest pace of decline in 5-1/2 years.

U.S. STOCK PREVIEW

Key U.S. news today includes: (1) weekly initial unemployment claims (expected -7,000 to 275,000, previous +12,000 to 282,000) and continuing claims (expected -4,000 to 2.253 million, previous -9,000 to 2.257 million), (2) Aug import price index (expected -1.6% m/m and -11.1% y/y, Jul -0.9% m/m and -10.4% y/y), (3) July wholesale inventories (expected +0.3% m/m, Jun +0.9% m/m), and (4) the Treasury's auction of $13 billion of 30-year T-bonds.

There is one of the Russell 1000 companies that reports earnings today: lululemon athletica (consensus $0.33).

U.S. IPO's scheduled to price today include: Pace Holdings (PACEU), USA Compression Partners (USAC), La Jolla Pharmaceutical (LJPC), American Midstream Partners (AMID).

Equity conferences during the remainder of this week include: Barclays CEO Energy Power Conference on Tue-Thu, Barclays Global Consumer Staples Conference on Tue-Thu, Citi Global Technology Conference on Tue-Thu, RBC Global Industrials Conference on Wed-Thu, Bank of America Merrill Lynch Media, Communications & Entertainment Conference on Wed-Thu, Goldman Sachs Global Retailing Conference on Wed-Thu, Baird Health Care Conference on Wed-Thu, Vertical Research Industrial Conference on Wed-Thu, Wells Fargo Healthcare Conference on Wed-Thu, Eurofi Financial Forum 2015 - Luxembourg on Wed-Fri, Bank of America Merrill Lynch Australian Investment Conference on Thu, Barclays Back-to-School Consumer Conference on Thu, D.A. Davidson Engineering and Construction Investor Conference on Thu, Goldman Sachs European Medtech & Health Care Conference on Thu, Mizuho Securities Investment Conference on Thu, UBS Best of Americas Conference on Thu, UBS Global Paper and Forest Products Conference on Thu, United Business Media Virtual Investor Conference on Thu.

OVERNIGHT U.S. STOCK MOVERS

CBS (CBS -0.37%) was upgraded to 'Buy' from 'Hold' at Deutsche Bank.

Principal Financial Group (PFG -2.11%) was downgraded to 'Sell' from 'Neutral' at Goldman Sachs.

eBay (EBAY -0.61%) was downgraded to 'Hold' from 'Buy' at Cantor.

Waters (WAT -1.51%) was upgraded to 'Buy' from 'Neutral' at BofA/Merrill Lynch.

Williams (WMB -2.25%) was downgraded to 'Market Perform' from 'Outperform' at Wells Fargo.

Warren Buffett disclosed that Berkshire Hathaway acquired an additional 3.51 million shares of Phillips 66 (PSX +0.96%) between September 4 and September 9.

lululemon (LULU -2.79%) reported Q2 EPS of 34 cents, higher than consensus of 33 cents.

Western Digital (WDC -1.80%) was initiated with a 'Sell' at UBS with a price target of $71 and Seagate (STX +0.99%) was initiated with a 'Sell' with a price target of $38.

Standard & Poor's Ratings Services lowered Brazil's long-term foreign currency sovereign credit rating to 'BB+' from 'BBB-' with a negative outlook.

Signet Jewelers (SIG -1.51%) was initiated with an 'Outperform' at RBC Capital with a price target of $160.

Coach (COH -3.62%) was initiated with an 'Outperform' at RBC Capital with a price target of $36.

First Solar (FSLR -2.81%) was initiated with a 'Buy' at Janney Capital.

Syntel (SYNT -2.13%) was initiated with a 'Buy' at SunTrust with a price target of $52.

Con-way (CNW -1.80%) surged 30% in after-hours trading after XPO Logistics (XPO -2.38%) said they will buy the company for $3 billion.

SunEdison (SUNE -7.57%) was initiated with a 'Buy' at Janney Capital with a price target of $23.

Palo Alto (PANW -0.78%) jumped over 5% in after-hours trading after it reported Q4 EPS of 28 cents, higher than consensus of 25 cents.

MARKET COMMENTS

Sep E-mini S&Ps (ESU15 +0.08%) this morning are up +6.00 points (+0.31%). Wednesday's closes: S&P 500 -1.39%, Dow Jones -1.45%, Nasdaq -1.16%. The S&P 500 on Wednesday fell back from a 1-week high and closed lower on the huge +430,000 increase in U.S. Jul JOLTS job openings to a record 5.753 million, more than expectations of +51,000 to 5.300 million, which may prompt the Fed to raise interest rates this year. In addition, energy producers saw weakness after crude oil fell sharply by -3.90%. The main bullish factor for stocks was carryover support from a sharp rally in Asian stocks markets after China's finance ministry pledged to accelerate construction of some major projects and reduce companies' tax burden and after Japanese Prime Minister Abe pledged to lower the corporate tax rate.

Dec 10-year T-notes (ZNZ15 -0.20%) this morning are down -9.5 ticks. Wednesday's closes: TYZ5 +5.00, FVZ5 +1.75. Dec T-notes on Wednesday recovered from a 1-week low and closed higher on the lower close in U.S. stocks and on decent demand for the Treasury's $21 billion 10-year T-note auction with a bid-to-cover ratio of 2.70, higher than the 12-auction average of 2.65. T-notes also found support after the S&P 500 fell back from a 1-week high and closed lower.

The dollar index (DXY00 +0.07%) this morning is up +0.072 (+0.07%). EUR/USD (^EURUSD) is down -0.0016 (-0.14%). USD/JPY (^USDJPY) is up +0.76 (+0.63%) at a 1-week high. Wednesday's closes: Dollar Index +0.027 (+0.03%), EUR/USD +0.00047 (+0.04%), USD/JPY +0.709 (+0.59%). The dollar index on Wednesday closed higher on the sharp increase in the U.S. July JOLTS job openings report and on yen weakness as the Asian stock markets rallied.

Oct crude oil (CLV15 +0.79%) this morning is up +58 cents (+1.31%) and Oct gasoline (RBV15 +1.31%) is up +0.0204 (+1.50%). Wednesday's closes: CLV5 -1.79 (-3.90%), RBV5 -0.0432 (-3.08%). Oct crude oil and gasoline prices on Wednesday closed sharply lower on the stronger dollar, the slide in stock prices, and expectations for Thursday's weekly EIA data to show that U.S. crude inventories rose +500,000 bbl.

Click on picture to enlarge

Disclosure: I have no positions in ...

more