Morning Call For Sept. 11, 2014

OVERNIGHT MARKETS AND NEWS

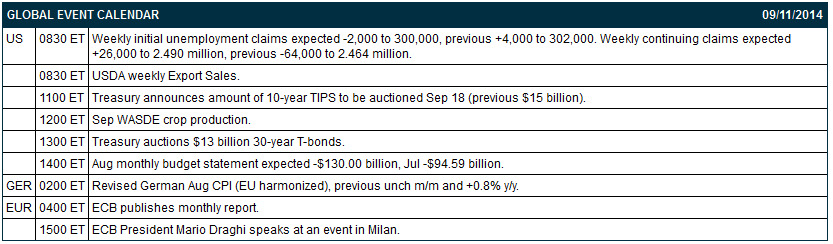

September E-mini S&Ps (ESU14 -0.25%) this morning are down -0.26% and European stocks are down -0.24% after the EU said that additional sanctions on Russia will enter into force on Friday. Also, signs of weaker economic conditions in China that may undercut global growth hurt stocks after Chinese consumer inflation reached a 4-month low last month. Asian stocks closed mostly lower: Japan +0.76%, Hong Kong -0.17%, China-0.37%, Taiwan -0.37%, Australia -0.51%, Singapore +0.26%, South Korea -0.87%, India -0.23%. Weakness in the yen propelled Japanese exporters and pushed the Nikkei Stock Index up to a 7-1/2 month high. Commodity prices are mostly lower. Oct crude oil (CLV14 -1.17%) is down -1.10% at a fresh 16-month low after the IEA cut its 2015 global oil demand forecast to 93.8 million bpd, -165,000 bpd less than predicted last month. Oct gasoline (RBV14 -0.80%) is down -0.73% at a 10-month low. Dec gold (GCZ14 -0.29%) is down -0.37%. Dec copper (HGZ14 -1.17%) is down -1.32% at a 2-3/4 month low on dollar strength and signs of a slowing Chinese economy. Agriculture and livestock prices are lower ahead of today's Sep WASDE report from the USDA. The dollar index (DXY00 -0.03%) is up +0.01%. EUR/USD (^EURUSD) is up +0.02%. USD/JPY (^USDJPY) is up +0.25% at a new 5-3/4 year high as the yen weakened further on speculation of additional BOJ monetary stimulus after BOJ Governor Kuroda told Japanese Prime Minister Abe that the BOJ will do its "utmost" to achieve its inflation target. Dec T-note prices (ZNZ14 +0.03%) are up +1.5 ticks.

ECB Governing Council member and Bank of Italy Governor Visco said that "In the Eurozone, recent data indicates that growth perspectives remain subdued and economic weakness is no longer confined to countries under stress." He added that "averting the risk that a too-prolonged period of low inflation would eventually lead to a dis-anchoring of medium-term inflation expectations is paramount" and "if needed, further monetary-policy actions can be undertaken."

The IfW Kiel economic institute cut its 2014 German GDP estimate to +1.4% from a Jun forecast of +.0% and cut its 2015 German GDP estimate to +1.9% from +2.5%, citing geopolitical risks damping exports

China Aug CPI rose +2.0% y/y, less than expectations of +2.2% y/y and the slowest pace of increase in 4 months. Aug PPI fell -1.2% y/y, a bigger decline than expectations of -1.1% y/y.

Japan Q3 BSI large all-industry business conditions rose to 11.1 from -14.6 in Q2. Q3 BSI large manufacturing business conditions rose to 12.7 from-13.9 in Q2.

U.S. STOCK PREVIEW

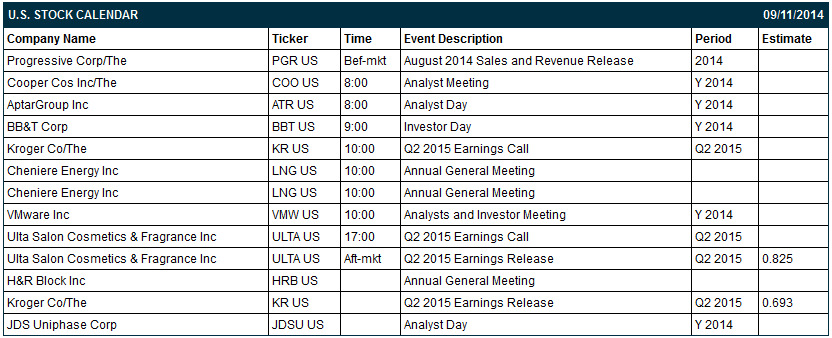

The market is expecting today’s initial unemployment claims report to show a small -2,000 decline to 300,000 following last week’s +4,000 increase to 302,000. The Treasury today will sell $13 billion of 30-year T-bonds, concluding this week’s $61 billion coupon package. There are two Russell 1000 companies that report earnings today: Ulta Salons (consensus: $0.83), Kroger ((0.69).

Equity conferences the rest of this week include: UBS Best of Americas Conference on Tue-Thu, Goldman Sachs Communacopia Conference on Wed-Fri, UBS Global Paper & Forest Products Conference on Thu, BIO Latin America Conference on Thu, and Credit Suisse Asian Technology Conference on Thu.

OVERNIGHT U.S. STOCK MOVERS

Macy's (M -0.86%) was downgraded to 'Neutral' from 'Buy' at Sterne Agee.

lululemon (LULU -0.75%) reported Q2 EPS of 33 cents, higher than consensus of 29 cents.

BofA/Merrill kept its 'Buy' rating on Signet Jewelers (SIG +0.42%) and raised its price target on the stock to $140 from $125.

Men's Wearhouse (MW -0.35%) reported Q2 adjusted EPS of $1.10, better than consensus of $1.06.

JDSU (JDSU +3.33%) jumped over 12% in after-hours trading after it said it will separate into two publicly traded companies.

CBOE Holdings (CBOE +1.08%) was initiated with a 'Buy' at Deutsche Bank with a pric target of $63.

CME Group (CME +0.44%) was initiated with a 'Buy' at Deutsche Bank with a price target of $85.

Edwards Lifesciences (EW +1.46%) was initiated with a 'Buy' at Sterne Agee with a price target of $110.

Restoration Hardware (RH +0.05%) reported Q2 adjusted EPS of 67 cents, higher than consensus of 64 cents.

Intel (INTC +0.32%) announced that it has signed a definitive agreement to buy over 1,400 patents and patent applications from an affiliate of The Gores Group, which obtained the patents in the Chapter 11 bankruptcy of Powerwave Technologies.

MARKET COMMENTS

Sep E-mini S&Ps (ESU14 -0.25%) this morning are down -5.25 points (-0.26%). The S&P 500 Index on Wednesday recovered from a 3-week low and closed higher: S&P 500 +0.36%, Dow Jones +0.32%, Nasdaq +0.81%. Bullish factors included (1) the prospects for a sustained peace in Ukraine after Ukrainian President Poroshenko said that Russia has withdrawn more than 70% of its troops from his country, and (2) a rally in shares of Apple that lifted technology stocks. The S&P 500 had fallen to a 3-week low on concern over higher interest rates after the yield on the 10-year T-note climbed to a 5-week high.

Dec 10-year T-notes (ZNZ14 +0.03%) this morning are up +1.5 ticks. Dec 10-year T-note futures prices on Wednesday fell to a 5-week low and closed lower. Bearish factors included (1) supply pressures ahead of today's $13 billion auction of 30-year T-bonds, and (2) carry-over selling from Tuesday after a research paper from the San Francisco Fed said investors may be underestimating how quickly the Fed could raise interest rates. Closes: TYZ4-5.50, FVZ4 -2.75.

The dollar index (DXY00 -0.03%) this morning is up +0.007 (+0.01%). EUR/USD (^EURUSD) is up +0.0003 (+0.02%) and USD/JPY (^USDJPY) is up +0.27 (+0.25%) at a new 5-3/4 year high. The dollar index on Wednesday closed slightly lower as prices consolidated below Tuesday's 14-month high. USD/JPY surged to a 5-3/4 year high as the yen plunged on speculation the BOJ may expand stimulus to combat deflation risks after Japan Aug PPI unexpectedly fell -0.2% m/m, less than expectations of unch m/m and the biggest drop in 22 months. Closes: Dollar index -0.039 (-0.05%), EUR/USD-0.00205 (-0.16%), USD/JPY +0.645 (+0.61%).

Oct WTI crude oil (CLV14 -1.17%) this morning is down -$1.01 a barreal (-1.10%) at a fresh 16-month low and Oct gasoline (RBV14 -0.80%) is down-0.0184 (-0.73%) at a new 10-month low. Oct crude and gasoline prices on Wednesday slumped with Oct crude at a 16-month low and Oct gasoline at a 10-month low: CLV4 -1.08 (-1.16%), RBV4 -0.0219 (-0.86%). Bearish factors included (1) the action by OPEC to lower its 2014 global demand forecast for its crude by -200,000 bpd to 29.5 million bpd, (2) the +78,000 bbl increase in crude supplies at Cushing, OK, the fifth increase in six weeks, and (3) the unexpected +2.38 million bbl increase in weekly EIA gasoline supplies, more than expectations of no change.

Disclosure: None