Morning Call For Sept. 10, 2014

OVERNIGHT MARKETS AND NEWS

September E-mini S&Ps (ESU14 -0.04%) this morning are up +0.08% and European stocks are up +0.03% on the prospects for a sustained peace in Ukraine after Ukrainian President Poroshenko said that Russia has withdrawn more than 70% of its troops from his country. Global stocks also found support on comments from Chinese Premier Li Keqiang who said that his country will accelerate policy changes to promote growth. Li Keqiang added that the Chinese economy will avoid a hard-landing and that his government will ensure a medium to high growth rate as it deepens policy changes to promote business, attract foreign investment and protect intellectual property. Asian stocks closed mostly lower: Japan +0.25%, Hong Kong -1.93%, China -0.52%, Taiwan -0.82%, Australia -0.60%, Singapore -0.13%, South Korea closed for holiday, India -0.76%. Japanese stocks bucked the trend of lower Asian markets and closed higher as exporter stocks rallied on the prospects for improved earnings after the yen slumped to a fresh 5-3/4 year low against the dollar. Commodity prices are mixed. Oct crude oil (CLV14 -0.42%) is up +0.09%. Oct gasoline (RBV14 -0.14%) is up +0.18%. Dec gold (GCZ14 +0.36%) is up +0.50%. Dec copper (HGZ14 +0.24%) is down -0.18%. Agriculture and livestock prices are mixed although Oct live cattle prices are up +1.00% at a new all-time high. The dollar index (DXY00 -0.08%) is down -0.17%. EUR/USD (^EURUSD) is up +0.10%. USD/JPY (^USDJPY) is up +0.37% at a 5-3/4 year high after an unexpected decline in Japanese producer prices last month bolstered expectations for the BOJ to expand stimulus. Dec T-note prices (ZNZ14 -0.14%) are down -4 ticks at a 1-month low.

Japan Aug PPI unexpectedly fell -0.2% m/m, less than expectations of unch m/m and the biggest drop in 22 months. On an annual basis, Aug PPI rose +3.9% y/y, less than expectations of +4.1% y/y.

Japan Jul machine orders rose +3.5% m/m, less than expectations of +4.0% m/m. On an annual basis, Jul machine orders rose +1.1% y/y, double expectations of +0.5% y/y.

U.S. STOCK PREVIEW

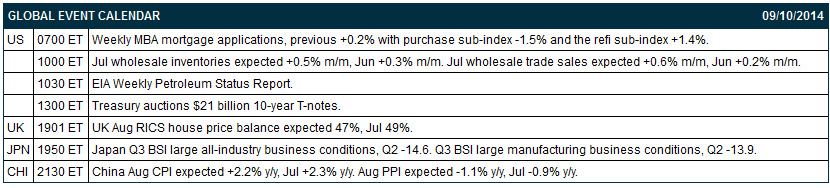

Mortgage activity should get a small boost from low U.S. mortgage rates. The Treasury today will sell $21 billion of 10-year T-notes. There are no Russell 1000 companies that report earnings today: (consensus: n/a).

Equity conferences the rest of this week include: Morgan Stanley Healthcare Conference on Mon-Wed, Barclays Global Financial Services Conference on Mon-Wed, Deutsche Bank dbAccess Technology Conference on Tue-Wed, RBC Capital Market Global Industrials Conference on Tue-Wed, UBS Best of Americas Conference on Tue-Thu, Latin Markets Mexico Energy Summit on Wed, Pareto Oil & Offshore Conference on Wed, Longbow Research - Industrial Manufacturing & Technology Investor Conference on Wed, Goldman Sachs Communacopia Conference on Wed-Fri, UBS Global Paper & Forest Products Conference on Thu, BIO Latin America Conference on Thu, and Credit Suisse Asian Technology Conference on Thu.

OVERNIGHT U.S. STOCK MOVERS

Huntsman (HUN -1.43%) was upgraded to 'Buy' from 'Neutral' at Citigroup.

eBay (EBAY -2.77%) was downgraded to 'Neutral' from 'Overweight' at Piper Jaffray.

L Brands (LB -0.72%) was upgraded to 'Outperform' from 'Neutral' at Credit Suisse.

Tiffany (TIF -0.92%) was downgraded to 'Neutral' from 'Outperform' at Credit Suisse.

Hartford Financial (HIG -0.49%) was upgraded to 'Outperform' from 'Market Perform' at FBR Capital.

Twitter (TWTR -2.67%) was upgraded to 'Buy' from 'Neutral' at UBS.

Billionaire activist investor Carl Icahn raised his stake in Gannett (GCI -3.11%) to 8.48% from 6.63%.

Urban Outfitters (URBN -0.46%) fell nearly 3% in after-hour trading after the company said that Q3 Same-Store-Ssales thus far are low single-digit negative.

Lazard Asset Management reported a 7.05% passive stake in Orbitz (OWW -1.21%) .

SAIC (SAIC -0.50%) reported Q2 EPS of 70 cents, better than consensus of 68 cents.

Piper Jaffray believes Apple's (AAPL -0.38%) new product launches met expectations and keeps its 'Overweight' rating on Apple with a $120 price target.

Pershing Square Capital Management reported a 9.7% stake in Allergan (AGN -0.49%) and sent a letter to Allergan's Board of Directors.

MARKET COMMENTS

Sep E-mini S&Ps (ESU14 -0.04%) this morning are up +1.50 points (+0.08%). The S&P 500 Index on Tuesday fell to a 2-week low and closed lower: S&P 500 -0.65%, Dow Jones -0.57%, Nasdaq -0.82%. Bearish factors included (1) the unexpected -2,000 decline in Jul JOLTS job openings, less than expectations for a +29,000 increase, and (2) long liquidation spurred on by interest rate concerns after a San Francisco Fed research paper stated that investors may be underestimating how quickly the Fed could raise interest rates.

Dec 10-year T-notes (ZNZ14 -0.14%) this morning are down -4 ticks at a fresh 1-month low. Dec 10-year T-note futures prices on Tuesday fell to a 1-month low and closed lower. Bearish factors included (1) a San Francisco Fed research paper that stated investors are underestimating how quickly the Fed may hike interest rates, and (2) supply pressures ahead of today's $21 billion auction of 10-year T-notes and tomorrow's $13 billion auction of 30-year T-bonds. Closes: TYZ4 -9.50, FVZ4 -7.00.

The dollar index (DXY00 -0.08%) this morning is down -0.147 (-0.17%). EUR/USD (^EURUSD) is up +0.0013 (+0.10%) and USD/JPY (^USDJPY) is up +0.39 (+0.37%) at a new 5-3/4 year high. The dollar index on Tuesday climbed to a 14-month high and closed higher. Bullish factors included (1) a San Francisco Fed research paper that stated the markets may be underestimating the pace of Fed rate increases, and (2) weakness in the yen as USD/JPY surged to a 5-3/4 year high on divergent monetary policies between the Fed, which is cutting stimulus and may soon raise interest rates and the BOJ, which is seen expanding stimulus to boost Japanese growth and combat deflation risks. Closes: Dollar index +0.046 (+0.05%), EUR/USD +0.0043 (+0.33%), USD/JPY +0.173 (+0.16%).

Oct WTI crude oil (CLV14 -0.42%) this morning is up +8 cents (+0.09%) and Oct gasoline (RBV14 -0.14%) is up +0.0045 (+0.18%). Oct crude and gasoline prices on Tuesday settled mixed: CLV4 +0.09 (+0.10%), RBV4 -0.0169 (-0.66%). Crude found support on expectations that Wednesday's weekly EIA inventory data will show crude supplies fell -1.5 million bbl, the fourth consecutive decline. Negative factors included (1) the rally in the dollar index to a 14-month high, and (2) increased oil output in Libya after Libya's state-run National Oil Corp. said Libyan oil production rose to 747,000 bpd on Sep 8 from 700,000 bpd on Sep 1.

Disclosure: None