Morning Call For Oct. 29, 2014

OVERNIGHT MARKETS AND NEWS

December E-mini S&Ps (ESZ14 -0.08%) this morning are down -0.16% ahead of the FOMC decision later today and European stocks are up +0.16% on better-than-expected earnings results from Total SA an Schneider Electric SE. Asian stocks closed mostly higher: Japan +1.46%, Hong Kong +1.27%, China +1.44%, Taiwan +1.48%, Australia -0.09%, Singapore +0.39%, South Korea +2.19%, India +0.81%. Japanese stocks rallied as the Nikkei Stock Index rose to a 1-1/2 week high after Japan's industrial output last month rose more than expected by the most in 8 months. The Shanghai Stock Index climbed to a 1-1/2 week high after Hong Kong's securities regulator said the preparatory work for a planned trade link with Shanghai had been completed, which boosted optimism that the link between the two exchanges will be launched sooner than expected. Commodity prices are mixed. Dec crude oil (CLZ14 +1.44%) is up +0.98%. Dec gasoline (RBZ14 +1.94%) is up +1.23%. Dec gold (GCZ14 -0.37%) is down -0.15%. Dec copper (HGZ14-0.03%) is up +0.26% at a 2-week high. Agriculture and livestock prices are higher. The dollar index (DXY00 -0.03%) is unch. EUR/USD (^EURUSD) is up +0.02%. USD/JPY (^USDJPY) is down -0.06%. Dec T-note prices (ZNZ14 -0.04%) are down -2.5 ticks.

Japan Sep industrial production rose +2.7% m/m and +0.6% y/y, stronger than expectations of +2.2% m/m and -0.1% y/y with the +2.7% m/m gain the biggest monthly increase in 8 months.

UK Sep net consumer credit rose +0.9 billion pounds, more than expectations of +0.8 billion pounds.

UK Sep mortgage approvals increased by 61,300, less than expectations of 62,000.

UK Sep M4 money supply fell -0.7% m/m, the biggest decline in 6 months. On a year-over-year basis Sep M4 money supply fell -2.5% y/y, the sixth straight y/y decline and the largest annual decrease in 22 months.

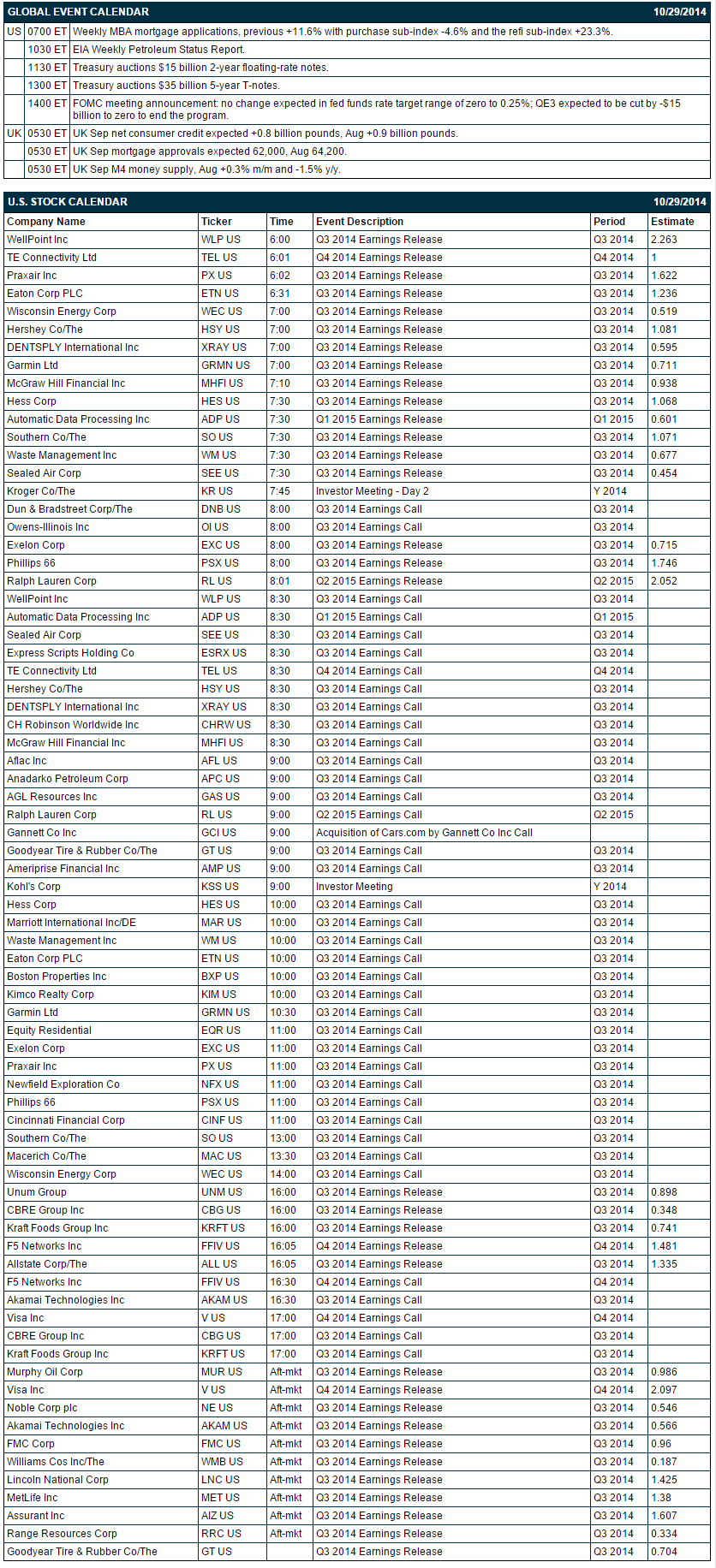

U.S. STOCK PREVIEW

The markets are unanimously expecting the FOMC at its 2-day meeting that ends today to end QE3 with a final $15 billion cut. The Treasury today will sell $15 billion of 2-year floating rate notes and $35 billion of 5-year T-notes. Equity conferences during the remainder of this week include: GTEC (Government Technology Exhibition & Conference) 2014 on Tue-Thu.

OVERNIGHT U.S. STOCK MOVERS

U.S. Steel (X +5.10%) rallied over 5% in after-hours trading after it reported Q3 adjusted EPS of $2.16, well ahead of consensus of $1.17.

Marriott (MAR +2.41%) reported Q3 EPS of 65 cents, higher than consensus of 62 cents.

McKesson (MCK -0.74%) reported Q2 adjusted EPS of $2.79, stronger than consensus of $2.73.

Ameriprise (AMP +1.52%) reported Q3 EPS ex-items of $2.24, well above consensus of $1.96.

Western Digital (WDC +0.14%) reported Q1 adjusted EPS of $2.10, higher than consensus of $2.03.

Wynn Resorts (WYNN +0.86%) reported Q3 adjusted EPS of $1.95, stronger than consensus of $1.84.

Owens-Illinois (OI +4.55%) reported Q3 adjusted EPS of 75 cents, better than consensus of 74 cents.

Edison International (EIX +1.46%) reported Q3 core EPS of $1.52, well ahead of consensus of $1.33.

Anadarko (APC +2.30%) reported Q3 adjusted EPS of $1.16, below consensus of $1.27.

Aflac (AFL +1.34%) rose 3% in after-hours trading after it reported Q3 EPS of $1.51, stronger than consensus of $1.43.

Fiserv (FISV +1.72%) reported Q3 adjusted EPS of 86 cents, higher than consensus of 84 cents.

Total System (TSS +1.53%) reported Q3 adjusted EPS of 56 cents, better than consensus of 52 cents.

Gilead (GILD +0.76%) reported Q3 EPS of $1.84, weaker than consensus of $1.92.

AMC Entertainment (AMC +3.43%) reported Q3 EPS of 8 cents, right on consensus, although Q3 revenue of $633.9 million ws below consensus of $639.89 million.

Facebook (FB +0.61%) reported Q3 EPS of 43 cents, higher than consensus of 40 cents.

Electronic Arts (EA +1.65%) jumped over 6% in after-hours trading after it reported Q2 adjusted EPS of 73 cents, well above consensus of 53 cents, and raised guidance on fiscal 2015 EPS view to $2.05 from $1.85, well ahead of consensus of $1.92.

PriceSmart (PSMT +4.37%) reported Q4 EPS of 73 cents, less than consensus of 74 cents.

MARKET COMMENTS

Dec E-mini S&Ps (ESZ14 -0.08%) this morning are down -3.25 points (-0.16%). The S&P 500 index on Tuesday rose to a 1-month high and closed higher: S&P 500 +1.19%, Dow Jones +1.12%, Nasdaq +1.50%. Bullish factors included (1) the +5.5 point increase in U.S. Oct consumer confidence (Conference Board) to 94.5, stronger than expectations of +1.0 to 87.0 and the highest in 7 years, (2) the unexpected +6 point increase in the Oct Richmond Fed manufacturing index to 20, better than expectations of -3 to 11 and the highest in 3-3/4 years, and (3) strong Q3 stock earnings results with about 79% of reporting S&P 500 companies having beaten earnings estimates.

Dec 10-year T-notes (ZNZ14 -0.04%) this morning are down -2.5 ticks. Dec 10-year T-note futures prices on Tuesday closed lower: TYZ4 -6.00, FVZ4-3.00. Bearish factors included (1) the larger-than-expected increase in U.S. Oct consumer confidence to a 7-year high, and (2) supply pressures as the Treasury auctions $108 billion of T-notes this week. Losses were contained after Sep durable goods orders and Aug S&P CaseShiller home prices both unexpectedly declined.

The dollar index (DXY00 -0.03%) this morning is unchanged. EUR/USD (^EURUSD) is up +0.0002 (+0.02%). USD/JPY (^USDJPY) is down -0.06(-0.06%). The dollar index on Tuesday closed lower. Closes: Dollar index -0.087 (-0.10%), EUR/USD +0.00359 (+0.28%), USD/JPY +0.339 (+0.31%). Bearish factors included (1) the unexpected declines in U.S. Sep durable goods orders and Aug S&P CaseShiller home prices, which may prod the Fed into delaying an interest rate hike, and (2) long liquidation pressures in the dollar ahead of the conclusion of the FOMC meeting on Wednesday.

Dec WTI crude oil (CLZ14 +1.44%) this morning is up +80 cents (+0.98%) and Dec gasoline (RBZ14 +1.94%) is up +0.0265 (+1.23%). Dec crude and Dec gasoline on Tuesday closed higher. Closes: CLZ4 +0.42 (+0.52%), RBZ4 +0.0251 (+1.18%). Supportive factors included (1) a weaker dollar, and (2) the increase in Oct U.S. consumer confidence to a 7-year high. Gains were limited on expectations that Wednesday’s weekly EIA report will show a +3.8 million bbl jump in crude oil inventories.

Disclosure: None