Morning Call For Oct. 28, 2014

OVERNIGHT MARKETS AND NEWS

December E-mini S&Ps (ESZ14 +0.54%) this morning are up +0.51% and European stocks are up +0.95% ahead of the start of the 2-day FOMC meeting where the Fed is expected to announce an end to its QE3 bond purchase program. Sweden's Riksbank unexpectedly cut its main interest rate to zero and said it won't raise interest rates until "inflation clearly picks up" in mid-2016 in an attempt to jolt the Swedish economy out of a deflationary spiral. The Russian ruble dropped to a record low of 42.597 per dollar on concern the Russian central bank will move to a free float after more than $20 billion of currency interventions this month failed to stem the ruble's decline. Asian stocks closed mixed: Japan -0.38%, Hong Kong +1.63%, China +2.02%, Taiwan +1.69%, Australia -0.12%, Singapore -0.45%, South Korea -0.24%, India +0.48%. Japanese stocks closed lower after stronger-than-expected Japan Sep retail sales dampened speculation the BOJ will expand stimulus measures when it meets for a 2-day meeting on Thursday. Chinese stocks closed higher after China Sep industrial profits rose from the prior month. Commodity prices are mostly higher. Dec crude oil (CLZ14 +0.60%) is up +0.17%. Dec gasoline (RBZ14 +0.62%) is up +0.24%. Dec gold (GCZ14 -0.12%) is down -0.11%. Dec copper (HGZ14 +0.47%) is up +0.44% at a 1-1/2 week high on the threat of a strike by workers at Freeport-McMoRan's Grasberg copper mine in Indonesia, the third-largest in the world. Agriculture and livestock prices are mostly higher with Dec corn up +1,86% at a 2-month high and Nov soybeans up +1.69% at a 1-3/4 month high on carry-over support from a rally in soybean meal prices to a 4-month high as near-record beef and pork prices boost demand for animal feed to fatten hogs and cattle. The dollar index (DXY00 +0.10%) is up +0.15%. EUR/USD (^EURUSD) is down -0.02%. USD/JPY (^USDJPY) is up +0.25%. Dec T-note prices (ZNZ14 -0.15%) are down-5 ticks.

German Sep import prices unexpectedly rose +0.3% m/m, higher than expectations of a -0.1% m/m decline and the first increase in 3 months. On an annual basis Sep import prices fell -1.6% y/y, a smaller decline than expectations of -1.9% y/y, but still the twenty-first consecutive month that import prices have fallen year-over-year.

Japan Sep retail sales rose +2.7% m/m and +2.3% y/y, stronger than expectations of +0.9% m/m and +0.8% y/y and the largest increase in 6 months.

China Sep industrial profits rose +0.4% y/y, an improvement from the -0.6% y/y decline in Aug.

U.S. STOCK PREVIEW

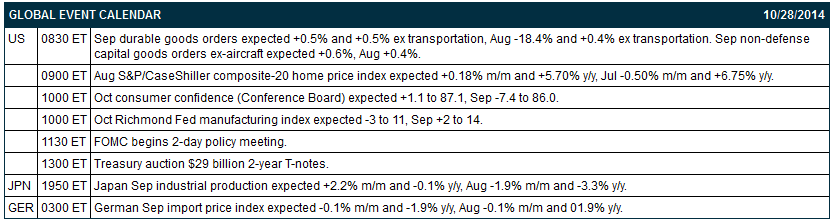

The markets are unanimously expecting the FOMC at its 2-day meeting that begins today to end QE3 with a final $15 billion cut. Today's Aug S&P/CaseShiller Composite-20 home price index is expected to show a small increase of +0.18% m/m, recovering a bit after the -0.50% decline seen in July. Today's Oct U.S. consumer confidence index ifrom the Conference Board is expected to show a +1.1 point increase to 87.1, recovering a bit after the sharp -7.4 point decline to 86.0 seen in September. Today’s Sep durable goods orders report is expected to show an overall increase of +0.5% and an +0.5% increase ex-transportation. The Treasury today will sell $29 billion of 2-year T-notes.

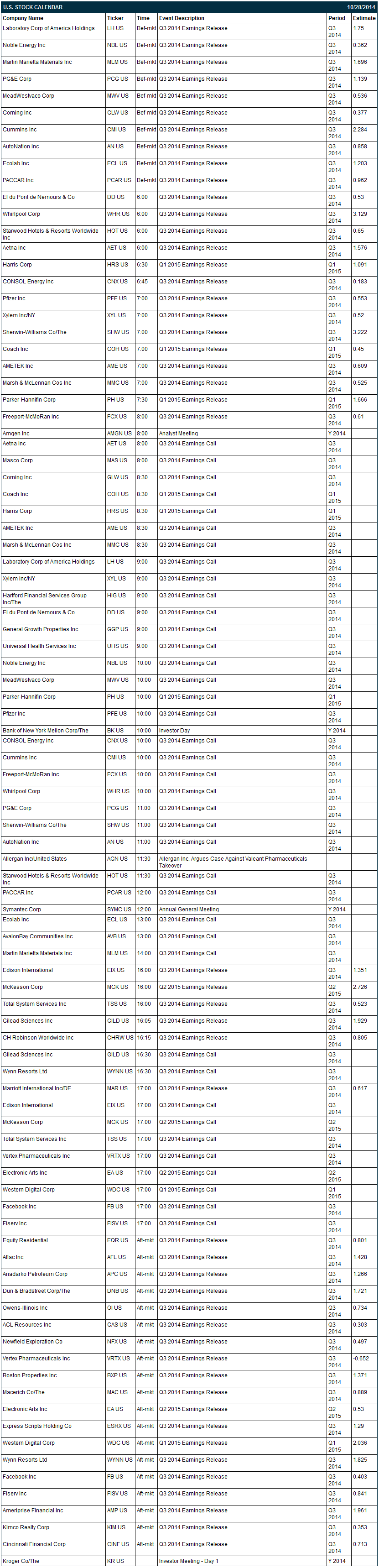

There are 49 of the S&P 500 companies that report earnings today with notable reports including: Facebook (consensus $0.40), Pfizer (0.55), PG&E (1.14), Cummings (2.28), du Pont (0.53), Aetna (1.58), Freeport-McMoRan (0.61), Electronic Arts (0.53), Wynn Resorts (1.83), Ameriprise (1.96). Equity conferences this week include: RMA Annual Risk Management Conference 2014 on Mon-Tue, and GTEC (Government Technology Exhibition & Conference) 2014 on Tue-Thu.

OVERNIGHT U.S. STOCK MOVERS

Aetna (AET +0.62%) reported Q3 EPS of $1.79, higher than consensus of $1.58.

Pfizer (PFE -0.27%) reported Q3 EPS of 57 cents, better than consensus of 55 cents.

Manitowoc (MTW -0.94%) slipped over 7% in after-hours trading after it reported Q3 EPS of 36 cents, below consensus of 42 cents.

Crane (CR -0.10%) reported Q3 EPS ex-items of $1.12, weaker than consensus of $1.17, and then lowered guidance on fiscal 2014 EPS view to $4.40-$4.50 from $4.55-$4.75, below consensus of $4.62.

Masco (MAS -0.48%) reported Q3 adjusted EPS of 31 cents, less than consensus of 32 cents.

Davidson Kempner Partners reported a 11.47% passive stake in Eagle Bulk Shipping (EGLE -1.49%) .

Kohl's (KSS -0.91%) dropped nearly 5% in after-hours trading after it said it sees Q3 same-store sales down -1.4% and that fiscal 2014 EPS will be at the low end of $4.05-$4.45, weaker than consensus of $4.30.

HealthSouth (HLS +0.27%) reported Q3 EPS of 53 cents, better than consensus of 49 cents.

Reinsurance Group (RGA +0.81%) reported Q3 EPS of $2.28, stronger than consensus of $2.07.

Hartford Financial (HIG +0.37%) reported Q3 EPS of 86 cents, higher than consensus of 83 cents.

Symetra Financial (SYA +0.13%) reported Q3 EPS of 39 cents, weaker than consensus of 44 cents.

AvalonBay (AVB +0.81%) reported Q3 FFO of $2.14, higher than consensus of $2.00.

Allison Transmission (ALSN +0.10%) reported Q3 EPS of 38 cents, stronger than consensus of 30 cents.

Buffalo Wild Wings (BWLD -1.17%) rose over 3% in after-hours trading after it reported Q3 EPS of $1.14, better than consensus of $1.07.

Amgen (AMGN +0.64%) reported Q3 EPS of $2.30, well above consensus of $2.11, and then raised guidance on fiscal 2014 EPS view to $8.45-$8.55 from $8.20-$8.40, higher than consensus of $8.42.

General Growth Properties (GGP +0.97%) reported Q3 FFO of 33 cents, higher than consensus of 31 cents.

MARKET COMMENTS

Dec E-mini S&Ps (ESZ14 +0.54%) this morning are up +10.00 points (+0.51%). The S&P 500 index on Monday closed lower: S&P 500 -0.15%, Dow Jones +0.07%, Nasdaq +0.10%. Negative factors included (1) carry-over selling from a slide in European stocks after the German Oct IFO business confidence fell for a sixth month to a 1-3/4 year low, (2) the +0.3% m/m increase in U.S. Sep pending home sales, weaker than expectations of +1.0% m/m, and (3) the -1.6 point decline in the U.S. Oct Markit composite PMI to 57.4, the slowest pace of expansion in 6 months.

Dec 10-year T-notes (ZNZ14 -0.15%) this morning are down -5 ticks. Dec 10-year T-note futures prices on Monday recovered from a 2-week low and closed higher. Closes: TYZ4 +3.50, FVZ4 +2.75. Bullish factors included (1) carry-over support from a rally in German bund prices after the German Oct IFO business climate fell more than expected to a 1-3/4 year low, (2) the smaller-than-expected increase in U.S. Sep pending home sales, which bolstered optimism the Fed will maintain record-low interest rates even as it ends QE3, and (3) increased safe-haven demand for T-notes as stocks fell.

The dollar index (DXY00 +0.10%) this morning isup +0.131 (+0.15%) . EUR/USD (^EURUSD) is down -0.0003 (-0.02%). USD/JPY (^USDJPY) is up +0.27 (+0.25%). The dollar index on Monday closed lower. Closes: Dollar index -0.237 (-0.28%), EUR/USD +0.00286 (+0.23%), USD/JPY -0.322 (-0.30%). Bearish factors included (1) the smaller-than-expected increase in U.S. Sep pending home sales, which boosted speculation that the weak data will prompt the Fed to delay raising interest rates, and (2) the positive results of the ECB’s bank stress tests, which eased concern about the health of European banks.

Dec WTI crude oil (CLZ14 +0.60%) this morning is up +14 cents (+0.17%) and Dec gasoline (RBZ14 +0.62%) is up +0.0051 (+0.24%). Dec crude and Dec gasoline on Monday closed lower with Dec crude falling to a 2-1/3 year low. Closes: CLZ4 -0.01 (-0.01%), RBZ4 -0.0178 (-0.83%). Bearish factors included (1) Goldman Sachs’ cut in its Q1 2015 WTI crude oil price estimate to $75 a barrel from $90 a barrel, citing a rise in global supplies, and (2) demand concerns in Europe after the German Oct IFO business climate fell more than expected to a 1-3/4 year low. Crude rebounded from its worst losses after the dollar fell.

Disclosure: None