Morning Call For November 2, 2015

OVERNIGHT MARKETS AND NEWS

December E-mini S&Ps (ESZ15 +0.02%) are up +0.05% and European stocks are up +0.50% at a 1-week high on signs of strength in European manufacturing activity after the Eurozone Oct Markit manufacturing PMI was revised higher. Stocks prices recovered from earlier losses made on China economic concerns after data showed China Oct manufacturing activity contracted for a third month. Increased M&A activity also lifted European equities after Dyax Corp. surged 27% after Shire Plc agreed to buy the company for $5.9 billion. Asian stocks settled mostly lower: Japan -2.10%, Hong Kong -1.19%, China -1.70%, Taiwan +0.71%, Australia -1.41%, Singapore -0.80%, South Korea +0.48%, India -0.37%. China's Shanghai Composite and Japan's Nikkei Stock Index both fell to 1-week lows on concerns over global growth after Chinese manufacturing activity contracted for a third month.

The dollar index (DXY00 -0.13%) is down -0.09%. EUR/USD (^EURUSD) is up +0.07%. USD/JPY (^USDJPY)is up +0.02%.

Dec T-note prices (ZNZ15 -0.21%) are down -5.5 ticks at a 1-1/4 month low and German bunds are down -0.41 at a 1-week low after ECB President Draghi curbed speculation the ECB will said further monetary stimulus is still an "open question."

The Eurozone Oct Markit manufacturing PMI was revised upward by +0.3 to 52.3.

ECB President Draghi said further stimulus is still as "open question" and it is "too early" to a judgement on lowering the deposit rate.

The China Oct manufacturing PMI was unchanged at 49.8, weaker than expectations of -0.2 to 50.0 and the third straight month of contraction. The Oct non-manufacturing PMI fell -0.3 to 53.1, the slowest pace of expansion in 6-3/4 years.

U.S. STOCK PREVIEW

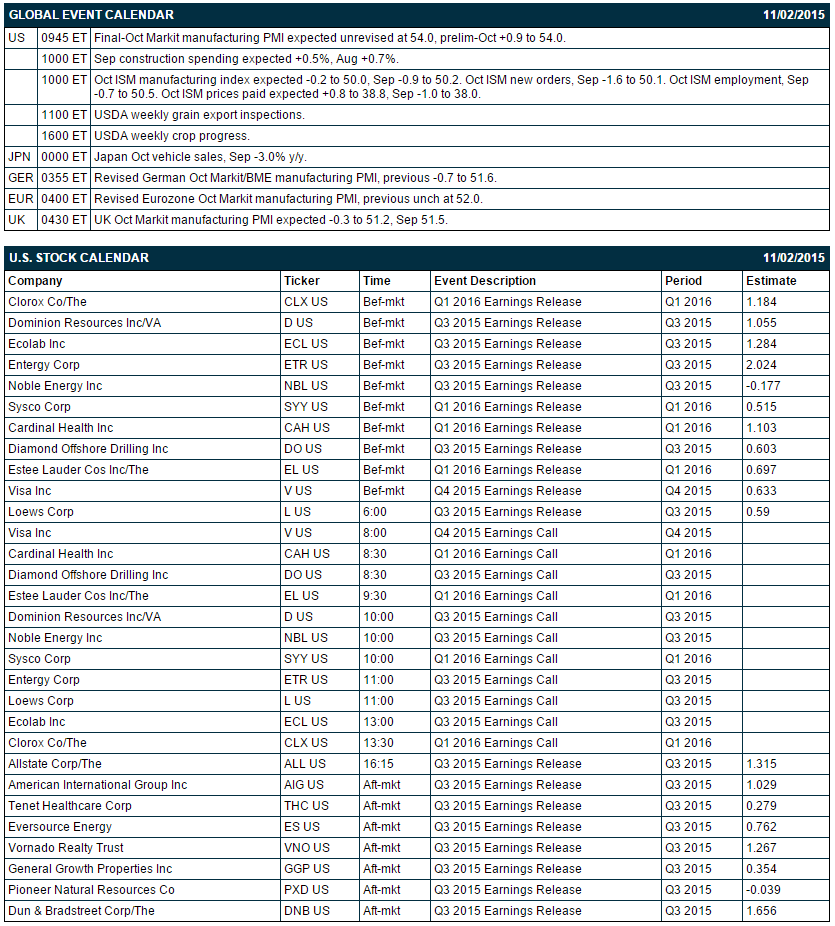

Key U.S. news today includes: (1) final-Oct Markit manufacturing PMI (expected unrevised at 54.0, prelim-Oct +0.9 to 54.0), (2) Sep construction spending (expected +0.5%, Aug +0.7%), and (3) Oct ISM manufacturing index (expected -0.2 to 50.0, Sep -0.9 to 50.2).

There are 19 of the S&P 500 companies that report earnings today with notable reports including: Visa (consensus $0.63), Allstate (1.32), General Growth Properties (0.35), AIG (1.03),

U.S. IPO's scheduled to price today: Xtera Communications (XCOM).

Equity conferences this week include: Gabelli & Company Automotive Aftermarket Symposium on Tue, Goldman Sachs Industrials Conference on Tue-Wed, Citi China Investor Conference on Wed, Citi Industrials Conference on Wed, Citi Global Health Care Conference on Thu, Needham Next Generation Storage Networking Conference on Thu, Bernstein Technology Innovation Summit on Thu-Fri, BancAnalysts Association of Boston Conference on Thu-Fri.

OVERNIGHT U.S. STOCK MOVERS

AbbVie Inc. (ABBV +10.07%) rose climbed 4% in pre-market trading after Goldman Sachs Group added the stock to its 'Conviction Buy' list.

Las Vegas Sands (LVS +1.35%) and Wynn Resorts (WYNN +0.07%) both rose nearly 3% in pre-market trading after a report signaled the slump in Macau's gaming revenue may be easing.

Loews (L -0.92%) reported Q3 EPS of 50 cents, below consensus of 56 cents.

Visa (V -1.18%) reported Q4 EPS of 62 cents, weaker than consensus of 63 cents.

Cardinal Health (CAH -0.98%) reported Q1 EPS of $1.38, higher than consensus of $1.10.

Diamond Offshore Drilling (DO +1.84%) reported Q3 EPS of $1.02, well above consensus of 60 cents.

Chipolte Mexican Grill (CMG -1.23%) slipped 6% in pre-market trading after it said it will close 43 restaurants as health officials investigate an E. coli outbreak linked to the food chain.

Mylan NV (MYL -3.69%) said it received a subpoena from the U.S. Securities and Exchange Commission seeking documents about "certain related party matters."

Hewlett Packard Enterprise ({=HPE-W=}) climbed over 1% in after-hours trading after the company was inserted into the S&P 500 as of Friday's close.

Vertex Pharmaceuticals (VRTX -1.13%) dropped over 1% in after-hours trading after the company received a subpoena from the U.S. Justice Department on its laboratory practices.

Eros International Plc (EROS -13.14%) slipped 1% in after-hours trading after the Rosen Law Firm said it was investigating potential securities claims on behalf of shareholders of Eros resulting from allegations that Eros may have issued materially misleading business information to the public.

Valeant Pharmaceuticals (VRX -15.90%) fell over 1% in after-hours trading after Standard & Poor's Ratings Services downgraded the company's credit rating to 'B+' from 'BB-' with a negative outlook.

MARKET COMMENTS

Dec E-mini S&Ps (ESZ15 +0.02%) this morning are up +1.00 point (+0.05%). Friday's closes: S&P 500 -0.48%, Dow Jones -0.52%, Nasdaq -0.47%. The S&P 500 on Friday closed lower on concerns about consumer spending after Sep personal income and spending reports each rose by only +0.1%, weaker than expectations of +0.2%. In addition, the final-Oct U.S. consumer sentiment index from the University of Michigan fell by -2.1 points, weaker than expectations of +0.4 to 92.5. On the supportive side, the Oct Chicago PMI rose by +7.5 points to 56.2, much stronger than expectations of +1.8 to 49.5 and the fastest pace of expansion in 9 months.

Dec 10-year T-notes (ZNZ15 -0.21%) this morning are down -5.5 ticks at a 1-1/4 month low. Friday's closes: TYZ5 +2.50, FVZ5 -0.25. Dec T-notes on Friday recovered from a 1-month low and closed higher on the smaller-than-expected +0.1% increases in U.S. Sep personal income and spending, the smaller-than-expected increase in the U.S. Sep core PCE deflator, and the unexpected decline in U.S. Oct University of Michigan consumer sentiment index.

The dollar index (DXY00 -0.13%) this morning is down -0.090 (-0.09%). EUR/USD (^EURUSD) is up +0.0008 (+0.07%). USD/JPY (^USDJPY) is up +0.02 (+0.02%). Friday's closes: Dollar Index -0.336 (-0.35%), EUR/USD +0.0029 (+0.26%), USD/JPY -0.51 (-0.42%). The dollar index on Friday closed lower on the smaller-than-expected increase in the Sep core PCE deflator, which may keep the Fed from raising interest rates, and strength in EUR/USD after Eurozone Oct core CPI rose more than expected and the Eurozone unemployment rate unexpectedly fell to a 3-1/2 year low, which reduces the chances that the ECB will boost QE.

Dec crude oil (CLZ15 -1.61%) this morning is down -78 cents (-1.67%) and Dec gasoline (RBZ15 -1.98%) is down -0.0278 (-2.03%). Friday's closes: CLZ5 +0.33 (+0.72%), RBZ5 +0.0250 (+1.87%). Dec crude oil and gasoline on Friday closed higher with Dec gasoline at a 2-1/2 week high. Bullish factors included a weaker dollar, the outlook for future U.S. oil production to decline after active U.S. oil rigs fell by 16 to 578 in the week ended Oct 30, the fewest in 5-1/3 years, and strength in gasoline after the crack spread widened to a 3-1/2 week high. Gains were limited due to the ongoing supply glut with U.S. crude inventories over 100 million bbls above the 5-year seasonal average.

Disclosure:None.