Morning Call For Nov. 12, 2014

OVERNIGHT MARKETS AND NEWS

December E-mini S&Ps (ESZ14 -0.41%) this morning are down -0.37% and European stocks are down -1.05% led by a slide in bank stocks with Citigroup down over 1% in pre-market trading after regulators from the U.S., U.K. and Switzerland fined five lenders a total of $3.3 billion to settle a probe into the rigging of foreign-exchange rates. Another negative for stocks is the action by the BOE to cut their U.K. GDP and inflation forecasts as a renewed slump in the Eurozone weighs on the U.K. economy. Asian stocks closed mixed: Japan +0.43%, Hong Kong +0.55%, China +1.40%, Taiwan-1.28%, Australia -0.98%, Singapore -0.26%, South Korea +0.32%, India +0.35%. Japan's Nikkei Stock Index pushed up to a 7-year high as retail stocks surged on speculation the government will delay another increase to the national sales tax. Commodity prices are mixed. Dec crude oil (CLZ14 -0.96%) is down -0.76%. Dec gasoline (RBZ14 -0.35%) is down -0.07%. Dec gold (GCZ14 -0.06%) is up +0.03%. Dec copper (HGZ14 -0.05%) is up +0.25%. Agriculture prices are higher with Jan soybeans up +1.20% at a 3-month high. The dollar index (DXY00 +0.07%) is up +0.07%. EUR/USD (^EURUSD) is down -0.14%. USD/JPY (^USDJPY) is down -0.39%. Dec T-note prices (ZNZ14 +0.28%) are up +11 ticks.

Philadelphia Fed President Plosser said it is "risky strategy" for the Fed to wait for labor markets to completely heal before lifting rates and that "we are at least a year ahead of where we thought we would be when we started to taper." He added that the Fed should raise rates "sooner rather than later" as that would enable them to move more gradually as data improves.

Eurozone Sep industrial production rose +0.6% m/m, less than expectations of +0.7% m/m, although Aug was revised upward to -1.4% m/m from the originally reported -1.8% m/m. On an annual basis, Sep industrial production unexpectedly rose +0.6 y/y, better than expectations of -0.2% y/y, and Aug was revised upward to -0.5% y/y from the previously reported -1.9% y/y.

The German Oct wholesale price index fell -0.6% m/m, the steepest decline a year. On an annual basis the Oct wholesale price index fell -0.7% y/y, the sixteenth consecutive month that wholesale prices have fallen year-over-year.

UK Oct jobless claims fell -20,400, more than expectations of -20,000. The Oct claimant count rate remained unchanged at 2.8%, when expectations were for a -0.1 point decline to 2.7%.

The UK Sep ILO unemployment rate remained unchanged at 6.0% for the 3-months through Sep, when expectations were for a -0.1 point decline to 5.9%. Sep avg weekly earnings rose +1.0% 3-month avg, stronger than expectations of +0.8% 3-month avg. Sep avg weekly earnings ex-bonus rose +1.3% 3-month avg, stronger than expectations of +1.1% 3-month avg.

The Japan Sep tertiary industry index rose +1.0% m/m, more than expectations of +0.8% y/y and the largest increase in 6 months.

U.S. STOCK PREVIEW

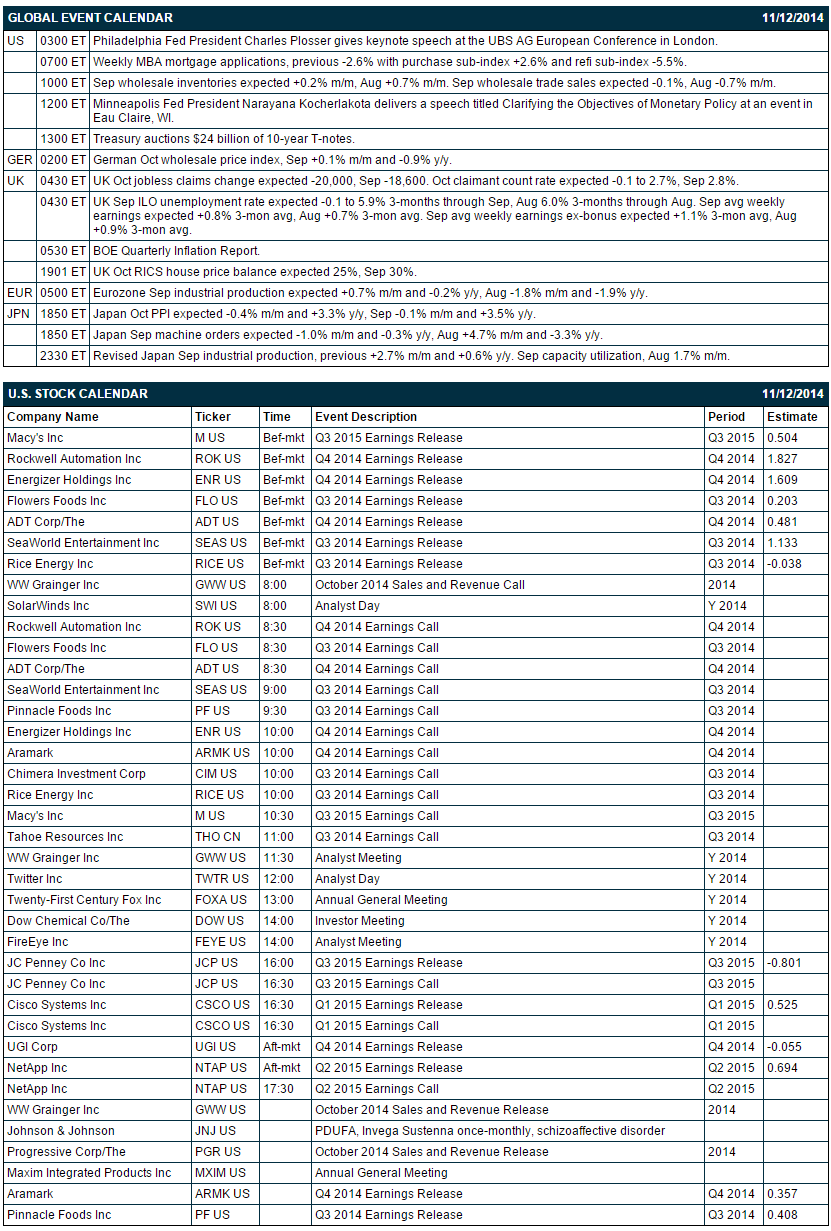

The Treasury today will sell $24 billion of 10-year T-notes. The U.S. government is closed today for the Veterans Day holiday. There are 5 of the S&P 500 companies that report earnings today: Cisco Systems (consensus $0.53), Rockwell Automation (1.83), ADT (0.48), Macy's (0.50), NetApp (0.69).

Equity conferences today include: Morgan Stanley Global Chemicals & Agriculture Conference on Tue-Wed, Stephens Inc Fall Investment Conference on Tue-Wed, Jefferies Global Energy Conference on Tue-Wed, Credit Suisse Health Care Conference on Tue-Thu, J.P. Morgan Ultimate Services Investor Conference on Wed, Mexico Investors Forum 2014 on Wed, Pacific Crest Consumer Innovations Technology Investor Forum on Wed, Bank of America Merrill Lynch Banking & Financial Services Conference on Wed-Thu, Wells Fargo Securities Technology, Media & Telecom Conference on Wed-Thu, Goldman Sachs Global Industrials Conference on Wed-Thu, Bank of America Merrill Lynch Global Energy Conference on Wed-Fri, Edison Electric Institute Financial Conference on Thu, UBS Building & Building Products CEO Conference on Thu, SunTrust Robinson Humphrey Financial Technology, Business & Government Services on Thu, NOAH Conference 2014 on Thu, Goldman Sachs Technology and Internet Conference on Fri.

OVERNIGHT U.S. STOCK MOVERS

Citigroup (C -0.15%) fell 1% in pre-market trading after the bank, along with four others, was fined $668 million to settle a probe into the rigging of foreign-exchange rates.

BB&T (BBT -0.29%) to acquire Susquehanna Bancshares (SUSQ -0.80%) for approximately $2.5 billion.

Beazer Homes (BZH +1.37%) reported Q4 EPS of $1.88, well above consensus of $1.08.

Flowers Foods (FLO -2.34%) reported Q3 adjusted EPS of 21 cents, better than consensus of 20 cents, but then lowered guidance on fiscal 2014 EPS view to 86 cents-90 cents from 92 cents-98 cents, below consensus of 93 cents.

JetBlue (JBLU -1.07%) was downgraded to 'Neutral' from 'Overweight' at JPMorgan Chase.

CBOE Holdings (CBOE +0.82%) were downgraded to 'Sell' from 'Hold' at Evercore ISI.

Goldman Sachs reported a 13% passive stake in PBF Logistics (PBFX -0.59%) .

JPMorgan Chase (JPM -0.90%) was downgraded to 'Market Perform' from 'Outperform' at Bernstein.

Rockwell Automation (ROK +0.10%) reported Q4 EPS of $1.86, higher than consensus of $1.83.

ADT Corp. (ADT -3.23%) reported Q4 EPS of 55 cents, better than consensus of 48 cents.

Discovery (DISCA -0.84%) and Viacom (VIAB -0.80%) were both downgraded to 'Market Perform' from 'Outperform' at Bernstein.

VeriFone (PAY -0.11%) was initiated with a 'Buy' at Topeka with a price target of $43.

Fossil (FOSL +0.51%) surged over 8% in after-hours trading after it reported Q3 EPS of $1.96, higher than consensus of $1.82

MARKET COMMENTS

Dec E-mini S&Ps (ESZ14 -0.41%) this morning are down -7.50 points (-0.37%). The S&P 500 index on Tuesday posted a new record high and closed higher: S&P 500 +0.07%, Dow Jones +0.01%, Nasdaq +0.27%. Bullish factors included (1) a rally in homebuilders after D.R Horton, the largest U.S. homebuilder by revenue, said orders in Q3 jumped by +38%, and (2) carry-over support from a rally in European stocks after Vodafone Group Plc climbed by over 5% and led telecommunications companies higher on better-than-expected quarterly earnings results.

Dec 10-year T-notes (ZNZ14 +0.28%) this morning are up +11 ticks. Dec 10-year T-note futures prices on Tuesday closed lower in uninspired trade with U.S. cash Treasury trading closed for Veterans Day: TYZ4 -5.00, FVZ4 -2.50. Bearish factors included (1) reduced safe-haven demand for T-notes after the S&P 500 climbed to a new all-time high, and (2) supply pressures due to the Nov quarterly refunding as the Treasury auctions $66 billion of T-notes and T-bonds this week.

The dollar index (DXY00 +0.07%) this morning is up +0.057 (+0.07%). EUR/USD (^EURUSD) is down -0.0018 (-0.14%). USD/JPY (^USDJPY) is down-0.45 (-0.39%). The dollar index on Tuesday closed lower. Closes: Dollar index -0.279 (-0.32%), EUR/USD +0.00543 (+0.44%), USD/JPY +0.914 (+0.80%). A rally in the S&P 500 to a new record high undercut the dollar on reduced safe-haven demand, although dollar losses were limited after USD/JPY soared to a new 7-year high on speculation Japanese Prime Minister Abe is considering postponing a planned sales-tax increase and preparing to call early elections next month.

Dec WTI crude oil (CLZ14 -0.96%) this morning is down -59 cents (-0.76%) and Dec gasoline (RBZ14 -0.35%) is down -0.0015 (-0.07%). Dec crude and Dec gasoline on Tuesday closed higher. Closes: CLZ4 +0.54 (+0.70%), RBZ4 +0.0029 (+0.14%). Bullish factors included (1) a weak dollar, and (2) a rally in the S&P 500 to a record high, which bolsters optimism in the economic outlook and the prospects for increased energy demand. Bearish factors included (1) comments from UAE Energy Minister Suhail Al Mazrouei that the global oil market is oversupplied, partly because of rising U.S. output, and (2) expectations for Thursday’s EIA inventory data to show crude supplies rose +1.1 million bbl and gasoline stockpiles rose +350,000 bbl.

Disclosure: None