Morning Call For Monday, July 17

OVERNIGHT MARKETS AND NEWS

Sep E-mini S&Ps (ESU17 +0.07%) this morning are up +0.05% as stronger-than-expected China Q2 GDP bolstered optimism in the global economic outlook. Strength in China Jun industrial production along with a faster-than-expected pace of growth in Q2 lifted commodities with Aug WTI crude (CLQ17 -0.19%) up +0.04% at a 1-week high and Sep COMEX copper (HGU17 +0.98%) up +0.89% at a 3-1/4 month high. The strength in oil and metals boosted energy and mining stocks, although gains were tempered as BlackRock fell -0.3% in pre-market trading after it reported weaker-than-expected Q2 earnings results. European stocks are down -0.10% as Brexit negotiations resumed in Brussels. Asian stocks settled mixed: Japan closed for holiday, Hong Kong +0.31%, China -1.43%, Taiwan +0.13%, Australia -0.17%, Singapore +0.33%, South Korea +0.37%, India +0.17%. Despite the strength in Chinese economic data, China's Shanghai Composite tumbled to a 3-week low on concerns about tougher regulations proposed by Chinese President Xi Jinping at a high-level weekend conference. President Xi said the PBOC will play a stronger role in defending against risks and he called for more work on safeguarding the financial system and modernizing its regulatory framework.

The dollar index (DXY00 +0.03%) is up +0.05%. EUR/USD (^EURUSD) is down -0.04%. USD/JPY (^USDJPY) is down -0.04%.

Sep 10-year T-note prices (ZNU17 +0.06%) are up +3.5 ticks.

China Jun industrial production rose +7.6% y/y, stronger than expectations of +6.5% y/y.

China Q2 GDP rose +6.9% y/y, stronger than expectations of +6.8% y/y.

U.S. STOCK PREVIEW

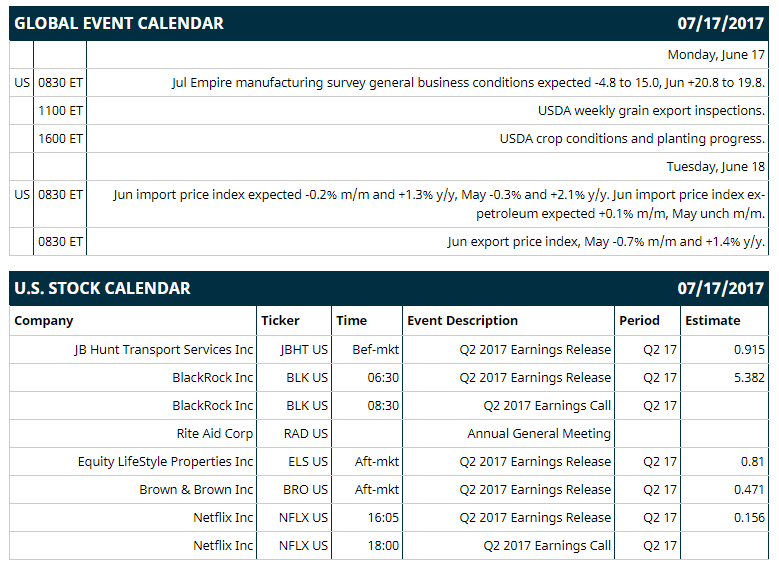

Key U.S. news today includes: (1) Jul Empire manufacturing index (expected -4.8 to 15.0, Jun +20.8 to 19.8), (2) USDA weekly grain export inspections, (3) USDA crop conditions and planting progress.

Notable Russell 1000 earnings reports today include: Blackrock (consensus $5.38), Netflix (0.16), JB Hunt Transport (0.92), Equity LifeStyle Products (0.81), Brown & Brown (0.47).

U.S. IPO's scheduled to price today: none.

Equity conferences this week: none.

OVERNIGHT U.S. STOCK MOVERS

BlackRock (BLK +0.11%) fell -0.3% in pre-market trading after it reported Q2 adjusted EPS of $5.24, below consensus of $5.38.

Fiserv (FISV +0.28%) was upgraded to 'Buy' from 'Neutral' at Guggenheim with a price target of $136.

CIT Group (CIT -0.04%) was upgraded to 'Overweight' from 'Equal-Weight' at Stephens with a price target of $60.

Greenbrier (GBX -0.83%) was upgraded to 'Buy' from 'Hold' at Stifel with a price target of $51.

Booz Allen Hamilton Holding (BAH -0.06%) was downgraded to 'Hold' from 'Buy' at Jeffries.

NuStar Energy LP (NS +2.08%) was downgraded to 'Market Perform' from 'Outperform' at Wells Fargo Securities.

United Rentals (URI +2.15%) was upgraded to 'Outperform' from 'Sector Perform' at RBC Capital Markets.

Science Applications International (SAIC +0.18%) was downgraded to 'Hold' from 'Buy' at Jeffries.

Targa Resources (TRGP +1.51%) was upgraded to 'Outperform' from 'Market Perform' with a price target of $54 at Wells Fargo Securities.

Sprint (S +4.27%) rose nearly 1% in after-hours trading and added to its 4% gain during Friday's session, after Chairman Masayoshi Son was said to have held talks with billionaire investors Warren Buffet and John Malone about investing in the company.

NetApp (NTAP +5.46%) gained over 1% in after-hours trading, and added to the 5.5% increase during Friday's session to a 3-year high, after the stock was added to the 'Conviction Buy' list at Goldman Sachs.

Peregrine Pharmaceuticals (PPHM +3.14%) sank nearly 15% in after-hours trading after it reported Q4 revenue of $17.9 million versus $18.8 million y/y, and said fiscal 2018 revenue should be similar to fiscal 2017 due to recent changes in the forecast of a large customer and a delayed regulatory filing for another customer.

MARKET COMMENTS

Sep E-mini S&Ps (ESU17 +0.07%) this morning are up +1.25 points (+0.05%). Friday's closes: S&P 500 +0.47%, Dow Jones +0.39%, Nasdaq +0.77%. The S&P 500 on Friday rose to a new all-time high and closed higher on the slightly weaker-than-expected U.S. Jun core CPI report of +0.1% m/m and +1.7% y/y, which was dovish for Fed policy, and on the +0.4% increase in U.S. Jun industrial production, stronger than expectations of +0.3%. Energy stocks received a lift from the +1.0% rally in crude oil prices to a 1-week high. Stocks were undercut by the U.S. Jun retail sales report of -0.2% and -0.2% ex autos, weaker than expectations of +0.1% and +0.2% ex autos.

Sep 10-year T-notes (ZNU17 +0.06%) this morning are up +3.5 ticks. Friday's closes: TYU7 +8.50, FVU7 +4.75. The Sep 10-year T-note on Friday rallied to a 2-week high and closed higher on the weaker than expected U.S. Jun retail sales and CPI report and the fall in Jul University of Michigan U.S. consumer sentiment to a 9-month low. T-notes were also boosted by comments from Dallas Fed President Kaplan who said he wants evidence of inflation progress towards 2% before hiking interest rates again.

The dollar index (DXY00 +0.03%) this morning is up +0.046 (+0.05%). EUR/USD (^EURUSD) is down -0.0005 (-0.04%) and USD/JPY (^USDJPY) down -0.04 (-0.04%). Friday's closes: Dollar index -0.575 (-0.60%), EUR/USD +0.0072 (+0.63%), USD/JPY -0.75 (-0.66%). The dollar index on Friday slumped to a 9-1/2 month low and closed lower on the weaker-than-expected U.S. Jun CPI and retail sales report, which were dovish for Fed policy. The dollar was also undercut by dovish comments from Dallas Fed President Kaplan who said that he wants evidence of inflation progress towards 2% before hiking interest rates again.

Aug WTI crude oil prices (CLQ17 -0.19%) this morning are up +2 cent (+0.04%) and Aug gasoline (RBQ17 -0.12%) is +0.0004 (+0.03%). Friday's closes: Aug crude +0.46 (+1.00%), Aug gasoline +0.0344 (+2.25%). Aug crude oil and gasoline on Friday closed higher with Aug crude at a 1-week high and Aug gasoline at a 5-week high. Metals prices were undercut by the sell-off in the dollar index to a 9-1/2 month low and by optimism in the energy demand outlook after the S&P 500 rose to a new record high.

Disclosure: None.