Morning Call For Monday, August 21

OVERNIGHT MARKETS AND NEWS

Sep E-mini S&Ps (ESU17 -0.01%) this morning are down -0.04% and European stocks are down -0.21% ahead of the gathering of world central bankers later this week in Jackson Hole, Wyoming. Losses were limited as energy stocks rose with Sep WTI crude oil (CLU17 +0.27%) up +0.29% at a 1-week high after Libya declared force majeure on supplies of crude from its Sharara oil field after it was blocked on Sunday by armed rebels. An upbeat report from the Bundesbank limited losses in European stocks after the German central bank said the German economy "may grow more strongly than was expected in June forecasts." Asian stocks settled mixed: Japan -0.40%, Hong Kong +0.40%, China +0.56%, Taiwan +0.05%, Australia -0.37%, Singapore -0.15%, South Korea -0.08%, India -0.84%. China's Shanghai Composite climbed to a 2-week high as a rally in copper prices (HGU17 +0.99%) to a 2-3/4 year high boosted mining and commodity producing stocks. Japan's Nikkei Stock Index fell to a fresh 3-1/2 month low as exporter stocks declined as the yen held gains from safe-haven demand amid lingering concerns over U.S. politics. USD/JPY is down -0.11%% and just above Friday's 4-month low, which weighed on exporter stocks as the stronger yen reduces exporters' earnings prospects.

The dollar index (DXY00 -0.05%) is down -0.02%. EUR/USD (^EURUSD) is up +0.05%. USD/JPY (^USDJPY) is down -0.11%.

Sep 10-year T-note prices (ZNU17 +0.06%) are up +1.5 ticks.

In its monthly report the Bundesbank said, "record-high sentiment in manufacturing, robust orders, and the large portion of not yet completed orders point to industrial production picking up anew in the current quarter. The German economy may therefore grow more strongly this year than was expected in June forecasts."

U.S. STOCK PREVIEW

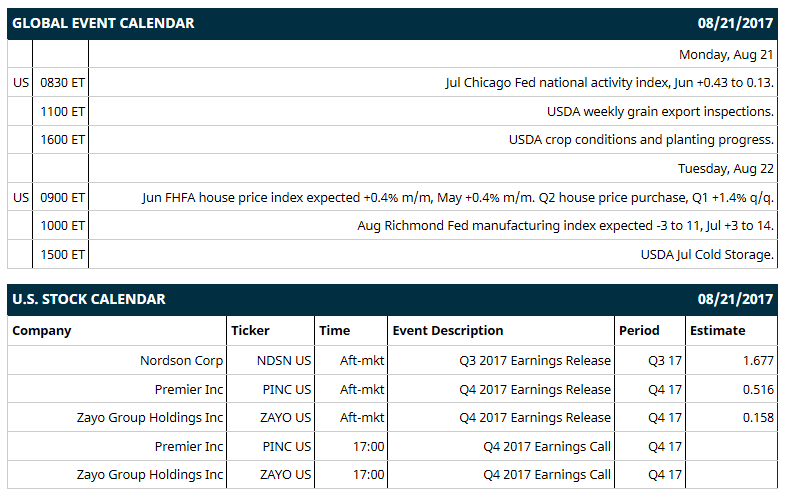

Key U.S. news today includes: (1) Jul Chicago Fed national activity index, (Jun +0.43 to 0.13), (2) USDA weekly grain export inspections, (3) USDA crop conditions and planting progress.

Notable Russell 1000 earnings reports today include: Nordson (consensus $1.68), Premier Inc. ($0.52), Zayo Group Holdings ($0.16).

U.S. IPO's scheduled to price today: None.

Equity conferences this week: None.

OVERNIGHT U.S. STOCK MOVERS

Foot Locker (FL -27.92%) fell 1% in pre-market trading after it was downgraded to 'Neutral' from 'Buy' at UBS.

Finish Line (FINL -8.17%) was downgraded to 'Sell' from 'Neutral' at UBS with a price target of $9.

Nike (NKE -4.37%) was downgraded to 'Hold' from 'Buy' at Jeffries.

Advanced Auto Parts (AAP +0.44%) was upgraded to 'Equal-Weight' from 'Underweight' at Barclays.

Lululemon (LULU -1.41%) was upgraded to 'Buy' from 'Underperform' at Bank of America/Merrill Lynch with a price target of $70.

Snap-On (SNA -0.58%) was downgraded to 'Neutral' from 'Buy' at Longbow Research.

Sturm Ruger (RGR +1.13%) was initiated a new 'Buy' at Aegis with a price target of $67.

Calpine (CPN +10.52%) was downgraded to 'Neutral' from 'Buy' at Guggenheim Securities.

Flex Ltd (FLEX -1.83%) gained over 1% in after-hours trading after the company received shareholder approval to purchase up to 20% of its outstanding shares.

LendingClub (LC +2.23%) rose almost 2% in after-hours trading after Director Ciporin disclosed a 10,000-share purchase of LendingClub's stock.

MARKET COMMENTS

Sep S&P 500 E-mini stock futures (ESU17 -0.01%) this morning are down -1.00 point (-0.04%). Friday's closes: S&P 500 -0.18, Dow Jones -0.35%, Nasdaq -0.09%. The S&P 500 on Friday fell to a 1-1/4 month low and closed lower on carry-over weakness from losses in European stocks after terrorist attacks in Spain and on concern that the political turmoil in Washington will keep the Trump administration from enacting its pro-growth economic agenda. Stocks rallied briefly in the early afternoon before turning lower again after President Trump removed his chief strategist, Steve Bannon, who had clashed with President Trump's inner circle and his removal may stop further defections from President Trump's economic team.

Sep 10-year T-note prices (ZNU17 +0.06%) this morning are up +1.5 ticks. Friday's closes: TYU7 +1.00, FVU7 unch. Sep 10-year T-notes on Friday rose to a 2-month high and closed higher on increased safe-haven demand for T-notes from the terrorist attacks in Spain and on the slump in the S&P 500 to a 1-1/4 month low. T-notes fell back from their best levels after the U.S. Aug University of Michigan consumer sentiment rose +4.2 to 97.6, stronger than expectations of +0.6 to 94.0 and a 7-month high.

The dollar index (DXY00 -0.05%) this morning is down -0.017 (-0.02%). EUR/USD (^EURUSD) is up +0.0006 (+0.05%) and USD/JPY (^USDJPY) is down -0.12 (-0.11%). Friday's closes: Dollar Index -0.188 (-0.20%), EUR/USD +0.0038 (+0.32%), USD/JPY -0.39 (-0.36%). The dollar index on Friday closed lower due to the terrorist attacks in Spain, which boosted safe-haven demand for the yen as USD/JPY tumbled to a 4-month low, and on the stronger than expected German Jul PPI, which was positive for EUR/USD.

Sep crude oil (CLU17 +0.27%) this morning is up +14 cents (+0.29%) at a 1-week high and Sep gasoline (RBU17 -0.60%) is -0.0127 (-0.78%). Friday's closes: Sep WTI crude +1.42 (+3.02%), Sep gasoline +0.0371 (+2.34%). Sep crude oil and gasoline on Friday closed higher with Sep gasoline at a 1-week high due to a weaker dollar, and on the increase in the crack spread to a 2-week high, which gives incentive for refiners to purchase crude oil to refine into gasoline.

Metals prices this morning are mostly higher with Dec gold (GCZ17 +0.19%) +1.4 (+0.11%), Sep silver (SIU17 +0.32%) unch and Sep copper (HGU17 +0.99%) +0.032 (+1.09%) at a new 2-3/4 year nearest-futures high. Friday's closes: Dec gold -0.8 (-0.06%), Sep silver -0.053 (-0.31%), Sep copper +0.0015 (+0.05%). Metals on Friday settled mixed. Metals price found support on a weaker dollar, and on the -4,450 MT decline in LME copper inventories to a 1-1/2 month low of 271,350 MT, a sign of tighter copper supplies. A negative factor for metals was the recovery in U.S. stocks from their worst levels, which curbed safe-haven demand for precious metals.

(Click on image to enlarge)

Disclosure: None.