Morning Call For May 8, 2015

OVERNIGHT MARKETS AND NEWS

June E-mini S&Ps (ESM15 +0.20%) this morning are up +0.17% before the release of U.S. Apr non-farm payrolls and European stocks are up +0.67%, led by a +1.84% rally in UK stocks after election results showed UK Prime Minister Cameron will return at the head of a majority Conservative government. Gains in European stocks were limited after German Mar industrial production unexpectedly declined. Asian stocks closed mixed: Japan +0.45%, Hong Kong +1.05%, China +2.28%, Taiwan -0.12%, Australia -0.20%, Singapore +0.56%, South Korea -0.63%, India +1.90%. China's Shanghai Composite Index rebounded from a 3-week low and closed higher after weak Apr trade data spurred speculation the government will boost stimulus.

Commodity prices are mostly higher. Jun crude oil (CLM15 +0.76%) is up +0.36% and Jun gasoline (RBM15 +0.65%) is up +0.14%. Metals prices are stronger. Jun gold (GCM15 +0.16%) is up +0.19%. Jul copper (HGN15 +0.05%) is up +0.05% on signs of stronger Chinese demand after China Apr copper imports were 430,000 MT, up +5.5% m/m and the most in a year. Agriculture prices are mixed.

The dollar index (DXY00 +0.16%) is up +0.17%. EUR/USD (^EURUSD) is down -0.39%. USD/JPY (^USDJPY) is up +0.28%. GBP/USD climbed +1.19% to a 2-1/2 month high after election results showed that the UK Conservative party was one seat away from an overall majority in the 650-seat UK Parliament after Thursday's general election.

Jun T-note prices (ZNM15 +0.01%) are up +2 ticks.

German Mar industrial production unexpectedly fell -0.5% m/m, weaker than expectations of +0.4% m/m.

The China Apr trade balance widened to a surplus of +$34.13 billion, less than expectations of +$39.60 billion. Apr exports unexpectedly fell for a second month as they dropped -6.4% y/y, weaker than expectations of +1.6%, and Apr imports fell for a sixth month as they slumped -16.2% y/y, weaker than expectations of -12.2% y/y.

U.S. STOCK PREVIEW

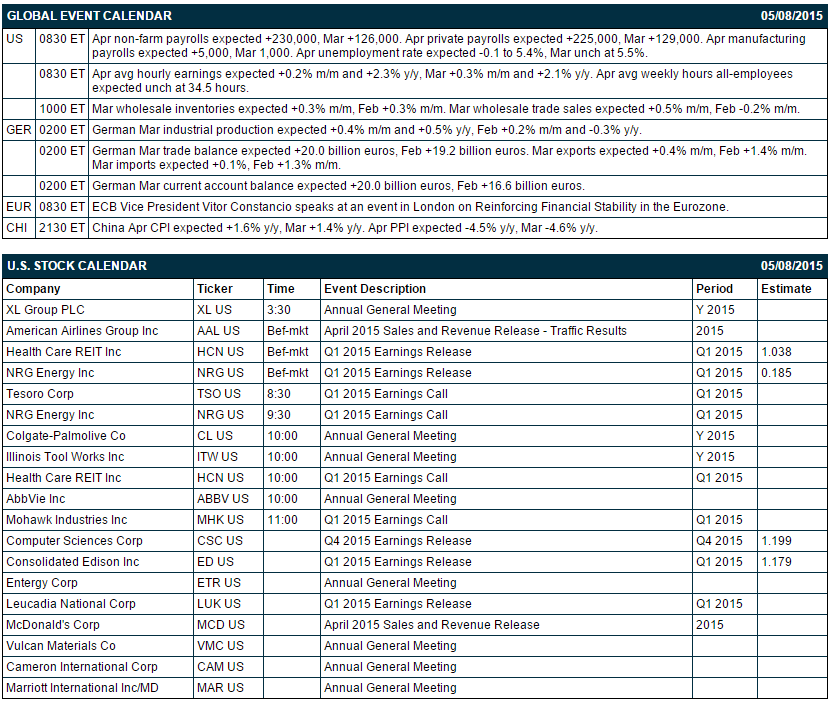

Key U.S. reports today include: (1) April non-farm payrolls (expected +230,000 after March's +126,000) and the April unemployment rate (expected -0.1to 5.4% after March's unchanged at 5.5%), and (2) Mar wholesale inventories (expected +0.3% m/m after Feb's +0.3% m/m).

There are 5 of the S&P 500 companies that report earnings today: Consolidated Edison (consensus $1.18), Health Care REIT (1.04), NRG Energy (0.19), Computer Sciences (1.20), Leucadia National.

U.S. IPO's scheduled to price today include: Multivir (MVIR), QCR Holdings (QCRH).

Equity conferences today include: none.

OVERNIGHT U.S. STOCK MOVERS

Ericsson (ERIC +1.56%) was upgraded to 'Buy' from 'Neutral' at BofA/Merrill Lynch and at UBS.

Biogen (BIIB -0.07%) announced a $5 billion share repurchase program of the company’s common stock.

Sucampo (SCMP -19.71%) rose 3% in after-hours trading after it announced that the FDA has granted Fast Track Designation for its drug cobiprostone that helps in the prevention of oral mucositis.

CST Brands (CST +0.24%) reported Q1 EPS of 20 cents ex-items, weaker than consensus of 23 cents.

Molina Healthcare (MOH -0.19%) reported Q1 adjusted EPS of 71 cents, well above consensus of 49 cents.

NVIDIA (NVDA +1.76%) reported Q1 EPS of 33 cents, better than consensus of 26 cents.

Cerner (CERN +0.56%) reported Q1 EPS of 45 cents, right on consensus, although Q1 revenue of $996.1 million was less than consensus of $1.09 billion.

Sprouts Farmers Markets (SFM -2.74%) reported Q1 adjusted EPS of 25 cents, below consensus of 26 cents, and then lowered guidance on fiscal 2015 adjusted EPS to 84 cents-87 cents, below consensus of 88 cents.

Mohawk (MHK +2.12%) reported Q1 adjusted EPS of $1.70, higher than consensus of $1.60.

Scientific Games (SGMS +4.93%) reported a Q1 EPS loss of -$1.01, a smaller loss than consensus of -$1.26.

Mettler-Toledo ({=MTD reported Q1 adjusted EPS of $2.25, above consensus of $2.17.

Nuance (NUAN -0.26%) reported Q2 non-GAAP EPS of 30 cents, higher than consensus of 24 cents.

Kemper (KMPR -0.47%) repored Q1 EPS of 42 cents, well below consensus of 57 cents.

CA Technologies (CA -0.16%) lowered guidance on fiscal 2016 EPS to $2.38-$2.45, below consensus of $2.47, and said it sees fiscal 2016 revenue of $3.95 billion-$3.99 billion, below consensus of $4.18 billion.

CBS (CBS +0.16%) reported Q1 EPS of 78 cents, better than consensus of 75 cents.

MARKET COMMENTS

June E-mini S&Ps (ESM15 +0.20%) this morning are up +3.50 points (+0.17%). Thursday's closes: S&P 500 +0.38%, Dow Jones +0.46%, Nasdaq +0.50%. The S&P 500 on Thursday closed moderately higher on the smaller-than-expected +3,000 increase in U.S weekly initial unemployment claims to 265,000 (vs expectations of +16,000 to 278,000) and on a rally in tech stocks led Microsoft and Yahoo.

Jun 10-year T-notes (ZNM15 +0.01%) this morning are up +2 ticks. Thursday's closes: TYM5 +9.50, FVM5 +2.50. Jun 10-year T-notes on Thursday recovered from a 4-1/4 month nearest-futures low and closed higher on the decline in the 10-year T-note breakeven inflation rate to a 2-week low on sharply lower oil prices. Jun T-notes posted a 4-1/4 month low overnight due to the continued plunge in German bund prices to a 4-3/4 month low.

The dollar index (DXY00 +0.16%) this morning is up +0.157 (+0.17%). EUR/USD (^EURUSD) is down -0.0044 (-0.39%). USD/JPY (^USDJPY) is up +0.33 (+0.28%). Thursday's closes: Dollar Index +0.548 (+0.58%), EUR/USD -0.0805 (-0.71%), USD/JPY +0.27 (+0.23%). The dollar index on Thursday closed higher on the smaller-than-expected +3,000 increase in U.S. weekly unemployment claims. Meanwhile, EUR/USD retreated from a 2-1/2 month high and closed lower as German Mar factory orders rose by only +0.9% m/m vs expectations of +1.5%.

Jun WTI crude oil (CLM15 +0.76%) this morning is up +21 cents (+0.36%) and Jun gasoline (RBM15 +0.65%) is up +0.0028 (+0.14%). Thursday's closes: CLM5 -1.99 (-3.27%), RBM5 -0.0444 (-2.18%). Jun crude oil and gasoline on Thursday closed sharply lower on long liquidation pressure driven in part by indications of weak U.S. gasoline demand after Wednesday’s EIA data showed that U.S. fuel consumption fell to an 11-month low of 18.196 million bpd.

Disclosure: None.