Morning Call For May 6, 2015

OVERNIGHT MARKETS AND NEWS

June E-mini S&Ps (ESM15 +0.24%) this morning are up +0.18% and European stocks are up +0.74% ahead of this morning’s U.S. Apr ADP employment change that may gauge whether the U.S. economy recovered from a winter slowdown. European stocks also received a boost after the Eurozone Apr Markit composite PMI was revised higher by +0.4 to 53.9 from the originally reported 53.5. The 10-year Greek bond yield rose to a 3-session high of 11.25% after Greek President Tsipras blamed international creditors for a failure to end an impasse in his country's bailout talks. The next meeting of European finance ministers is on Monday, May 11 to discuss Greece's debt situation and a breakdown of talks then may prompt the ECB to tighten collateral rules on Greek debt. Asian stocks closed lower: Japan closed for holiday, Hong Kong -0.41%, China -1.62%, Taiwan -0.02%, Australia -2.31%, Singapore -0.33%, South Korea -1.23%, India -2.63%.

Commodity prices are mixed. Jun crude oil (CLM15 +2.33%) is up +2.37% at a 4-3/4 month high and Jun gasoline (RBM15 +1.19%) is up +1.11% at a 5-3/4 month high on expectations that today's EIA data will show crude supplies at Cushing, OK, the delivery point of WTI futures, fell -580,000 bbl. Metals prices are lower. Jun gold (GCM15 -0.28%)is down -0.42%. Jul copper (HGN15 -0.72%) is down -0.73%. Agriculture prices are higher.

The dollar index (DXY00 -0.27%) is down -0.29%. EUR/USD (^EURUSD) is up +0.43%. USD/JPY (^USDJPY) is down -0.07%.

Jun T-note prices (ZNM15 -0.15%) are down -3.5 ticks at a 1-1/2 month low on carry-over weakness from the plunge in German bund prices to a 4-month low.

According to two people familiar with the matter, the ECB will discuss today whether to raise discounts on the collateral Greek banks pledge in exchange for emergency funding as well as how much more Emergency Liquidity Assistance to offer Greek banks.

Minneapolis Fed President Kocherlakota said "softening" of the U.S. economy in Q1 "is a matter for some concern" and underscores his view that the Fed should not raise rates until 2016.

U.S. STOCK PREVIEW

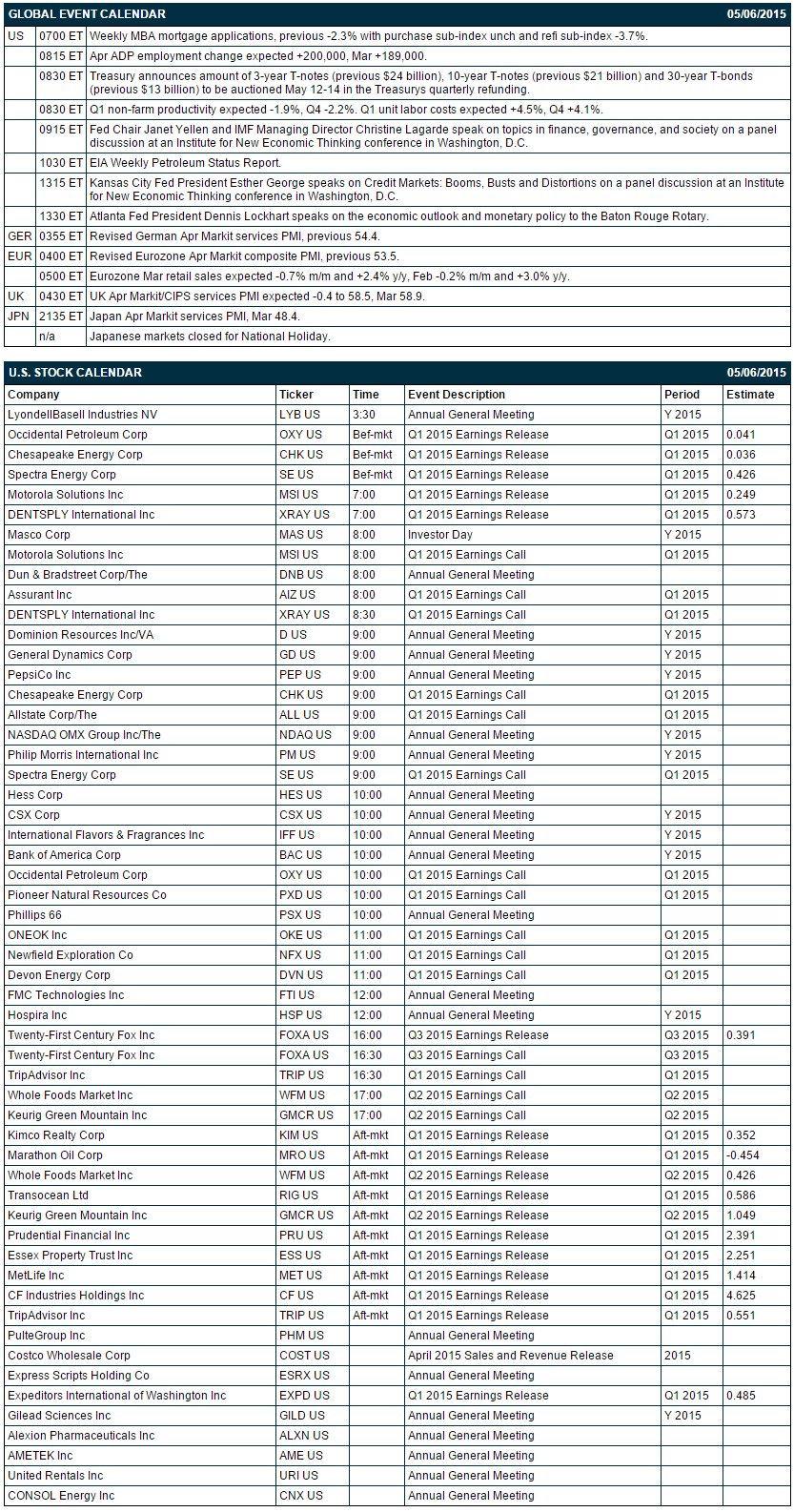

Key U.S. reports today include: (1) weekly MBA mortgage applications (previous -2.3% with purchase sub-index unch and refi sub-index -3.7%), (2) Apr ADP employment (expected +200,000 after March's +189,000), (3) Q1 non-farm productivity (expected -1.9% after Q4's -2.2%) and Q1 unit labor costs (expected +4.5% after Q4's +4.1%), (4) comments by Fed Chair Janet Yellen and IMF Managing Director Christine Lagarde on topics in finance, governance, and society on a panel discussion at an Institute for New Economic Thinking conference in Washington, D.C., (5) Kansas City Fed President Esther George's speech on “Credit Markets: Booms, Busts and Distortions” on a panel discussion at an Institute for New Economic Thinking conference in Washington, D.C., (6) Atlanta Fed President Dennis Lockhart's speech on the economic outlook and monetary policy to the Baton Rouge Rotary, and (7) the Treasury's announcement of the May 12-14 sale of 3-year, 10-year and 30-year securities.

There are 17 of the S&P 500 companies that report earnings today with notable reports including: Marathon Oil (consensus $-0.45), Whole Foods (0.43), MetLife (1.41), TripAdvisor (0.55), Transocean (0.59).

U.S. IPO's scheduled to price today include: Tallgrass Energy (TEGP), Commercial Credit (CCR), Collegium Pharmaceutical (COLL), aTyr Pharma (LIFE), Klox Technologies (KLOX), HTG Molecular Diagnostics (HTGM), Forest City Enterprises (FCE/A).

Equity conferences during the remainder of this week include: Internet & Television Expo on Tue-Wed, Wells Fargo Industrial and Construction Conference on Tue-Wed, Baird Growth Stock Conference on Tue-Thu, Power & Electricity World Asia 2015 on Wed, Sanford C. Bernstein & Co. Energy Conference on Wed, Deutsche Bank Health Care Conference on Wed-Thu, ICI General Membership Meeting on Wed-Thu, Citi Car of the Future Conference on Thu, Mitsubishi UFJ Securities Oil & Gas Conference on Thu, and RBC Capital Markets Mobile & Cloud Networking Investor Day on Thu.

OVERNIGHT U.S. STOCK MOVERS

Convergys (CVG -0.74%) reported Q1 adjusted EPS of 47 cents, better than consensus of 40 cents

News Corp. (NWSA -0.93%) reported Q3 adjusted EPS of 5 cents, less than consensus of 7 cents.

CenturyLink (CTL -1.42%) reported Q1 adjusted EPS of 67 cents, above consensus of 59 cents.

Trinseo (TSE -2.02%) reported Q1 adjusted EPS of 80 cents, below consensus of 81 cents.

Team Health (TMH -1.67%) reported Q1 adjusted EPS of 68 cents, better than consensus of 60 cents.

Community Health (CYH -3.63%) reported Q1 EPS of 79 cents, above consensus of 66 cents, but Q1 revenue of $4.911 billion was below consensus of $5.010 billion

Frontier Communications (FTR -1.89%) reported Q1 adjusted EPS of 2 cents, half as much as consensus of 4 cents.

Andersons (ANDE -0.83%) reported Q1 adjusted EPS of 42 cents, higher than consensus of 34 cents, but Q1 revenue of $950 million was less than consensus of $962.05 million.

Allstate (ALL +0.26%) reported Q1 EPS of $1.46, above consensus of $1.44.

Herbalife (HLF -4.71%) jumped 13% in after-hours trading after it reported Q1 adjusted EPS of $1.29, higher than consensus of $1.01, and then raised guidance on fiscal 2015 adjusted EPS outlook to $4.30-$4.60, better than consensus of $4.22.

Groupon (GRPN -2.84%) fell over 4% in after-hours trading after it reported Q1 EPS of 3 cents, better than consensus of 1 cent, although Q1 revenue of $750.4 million was less than consensus of $812.19 million.

Electronic Arts (EA -0.25%) climbed nearly 5% in after-hours trading after it reported Q4 adjusted EPS of 39 cents, well above consensus of 25 cents, and then raised guidance on fiscal 2016 adjusted EPS to $2.75, better than consensus of $2.64.

Mylan (MYL -0.22%) reported Q1 adjusted EPS of 70 cents, above consensus of 69 cents, but Q1 revenue of $1.87 billion was below consensus of $2.06 billion.

AmSurg (AMSG -2.42%) reported Q1 adjusted EPS of 62 cents, higher than consensus of 57 cents, and then raised guidance on fiscal 2015 EPS outlook to $3.31-$3.39 from $3.24-$3.32, above consensus of $3.26.

Fiserv (FISV -1.45%) reported Q1 adjusted EPS of 89 cents, better than consensus of 86 cents, although Q1 revenue of $1.28 billion was below consensus of $1.29 billion.

MARKET COMMENTS

June E-mini S&Ps (ESM15 +0.24%) this morning are up +3.75 points (+0.18%). Tuesday's closes: S&P 500 -1.18%, Dow Jones -0.79%, Nasdaq-1.63%. The S&P 500 on Tuesday closed lower on expectations for a downward revision in Q1 GDP due to the much wider-than-expected U.S. March trade deficit report of -$51.4 billion. In addition, the broad market was dragged down by weakness in semiconductor and biotechnology stocks.

Jun 10-year T-notes (ZNM15 -0.15%) this morning are down -3.5 ticks at a fresh 1-1/2 month low. Tuesday's closes: TYM5 -11.00, FVM5 -7.00. June T-bonds on Tuesday slid to a new 1-1/2 month low due to the unexpected increase in the Apr ISM non-manufacturing index to a 5-month high and carry-over weakness from a slump in German bund prices to a 3-1/4 month low.

The dollar index (DXY00 -0.27%) this morning is down -0.271 (-0.29%). EUR/USD (^EURUSD) is up +0.0048 (+0.43%). USD/JPY (^USDJPY) is down-0.08 (-0.07%). Tuesday's closes: Dollar Index -0.404 (-0.42%), EUR/USD +0.00385 (+0.35%), USD/JPY -0.26 (-0.22%). The dollar index on Tuesday closed lower on expectations that an expected downward revision in Q1 GDP from the much wider-than-expected U.S. Mar trade deficit report of -$51.4 billion could delay a Fed rate hike. EUR/USD saw strength after the European Commission raised its Eurozone 2015 GDP forecast to 1.5% from Feb's estimate of 1.3%.

Jun WTI crude oil (CLM15 +2.33%) this morning is up +$1.43 a barrel (+2.37%) at a 4-3/4 month high and Jun gasoline (RBM15 +1.19%) is up +0.0230 (+1.11%) at a 5-3/4 month high. Tuesday's closes: CLM5 +1.47 (+2.49%), RBM5 +0.0345 (+1.70%). Jun crude oil and gasoline closed higher on Monday with Jun crude at a 4-3/4 month high and Jun gasoline at a 5-1/4 month high as the market is hoping for Wednesday's EIA report to show the second weekly decline in Cushing crude oil inventories and on ideas that U.S. oil production may drop as well.

Disclosure: None.