Morning Call For May 25, 2016

OVERNIGHT MARKETS AND NEWS

Jun E-mini S&Ps (ESM16 +0.39%) are up +0.37% and European stocks are up +1.35%, both at 3-week highs, on speculation a stronger U.S. economy can handle higher interest rates. A +1.09% rally in July WTI crude oil (CLN16 +1.07%) to a 7-1/4 month high is fueling gains in energy producing stocks and M&A activity is giving equities a lift as well with Hewlett Packard Enterprise up 11% in pre-market trading after it said it will merge its enterprise-services division with Computer Sciences Corp. in a deal valued at $8.5 billion for HP Enterprise shareholders. European stocks also found support on an increase in German business confidence after the German May IFO business climate rose to a 5-month high. Asian stocks settled mostly higher: Japan +1.57%, Hong Kong+2.71%, China -0.23%, Taiwan +1.15%, Australia +1.45%, Singapore +0.60%, South Korea +1.37%, India +2.28%.

The dollar index (DXY00 -0.03%) is up +0.02% at a 1-3/4 month high. EUR/USD (^EURUSD) is up +0.02%. USD/JPY (^USDJPY) is up +0.19%.

Jun T-note prices (ZNM16 -0.06%) are down -3 ticks.

The German May IFO business climate rose +1.0 to 107.7, stronger than expectations of +0.2 to 106.8 and a 5-month high.

The Chinese yuan tumbled to a 3-1/2 month low against the dollar after the PBOC weakened its reference rate by -0.3% to 6.5693 per dollar, the lowest in 5 years. The PBOC is attempting to guide the yuan lower and avoid panic selling as it deals with the prospects of a Fed rate hike that has boosted the dollar.

U.S. STOCK PREVIEW

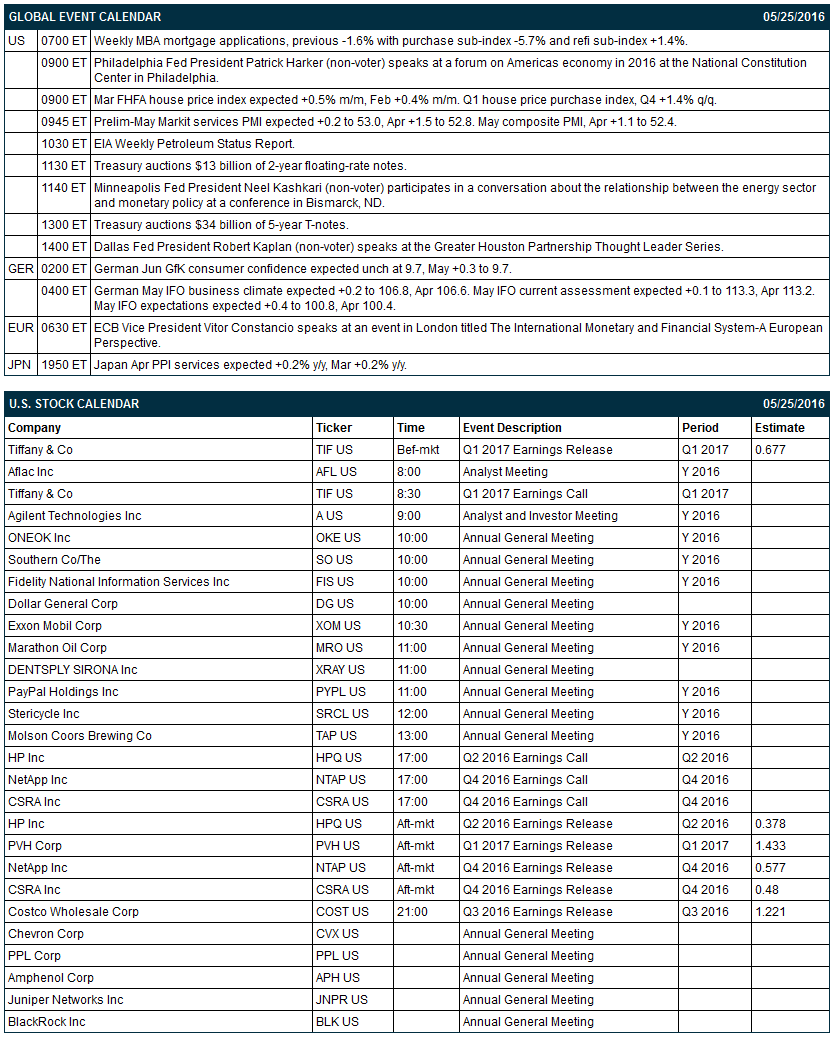

Key U.S. news today includes: (1) weekly MBA mortgage applications (previous -1.6% with purchase sub-index -5.7% and refi sub-index +1.4%), (2) Philadelphia Fed President Patrick Harker (non-voter) speaks at a forum on America’s economy in 2016 at the National Constitution Center in Philadelphia, (3) Mar FHFA house price index (expected +0.5% m/m, Feb +0.4% m/m), (4) prelim-May Markit U.S. services PMI (expected +0.2 to 53.0, Apr +1.5 to 52.8), (5) Minneapolis Fed President Neel Kashkari (non-voter) participates in a conversation about the relationship between the energy sector and monetary policy at a conference in Bismarck, ND, (6) Dallas Fed President Robert Kaplan (non-voter) speaks at the Greater Houston Partnership Thought Leader Series, (7) the Treasury auctions $34 billion of 5-year T-notes and $13 billion of 2-year floating-rate notes, and (8) EIA Weekly Petroleum Status Report.

There are 6 of the S&P 500 companies that report earnings today: Tiffany (consensus $0.68), HP (0.38), PVH Corp (1.43), NetApp (0.58), SCRA (0.48), Costco (1.22).

U.S. IPO's scheduled to price today: GMS Inc (GMS), Reata Pharmaceuticals (RETA), US Foods Holding Co (USFD), Landcadia Holdings (LCAHU).

Equity conferences during the remainder of this week include: UBS Global Health Care Conference on Mon-Wed, J.P. Morgan Global Technology, Media and Telecom Conference on Mon-Wed, UBS Global Oil & Gas Conference on Tue-Wed, Wolfe Research Global Transportation & Industrials Conference on Tue-Wed.

OVERNIGHT U.S. STOCK MOVERS

Intuit (INTU +2.57%) rose 1% in after-hours trading after it reported Q3 adjusted EPS of $3.43, better than consensus of $3.21, and then raised guidance on full-year adjusted EPS to $3.63-$3.65 from a February 25 estimate of $3.45-$3.50.

Arthur J Gallagher (AJG +1.11%) rose nearly 1% in after-hours trading after it announced that it will replace Coca-Cola Enterprises in the S&P 500 after the close of trading Friday, May 27.

Dycom Industries (DY +1.30%) jumped over 8% in pre-market trading after it reported Q3 adjusted EPS of $1.08, well above consensus of 74 cents, and then said it sees Q4 adjusted EPS of $1.45-$1.60, higher than consensus of $1.36.

Noble Energy (NBL -1.04%) was upgraded to 'Buy' from 'Neutral' at Sterne Agee CRT.

Best Buy (BBY -7.42%) was downgraded to 'Hold' from 'Buy' at Deutsche Bank.

Pilgrim's Pride (PPC +0.20%) was downgraded to 'Hold' from 'Buy' at BB&T Capital Markets.

ON Semiconductor (ON +2.18%) gained 2% in after-hours trading after it was rated a new 'Outperform' at CLSA.

Axalta Coating Systems (AXTA +1.41%) fell nearly 1% in after-hours trading after it announced a sale of 25 million common shares by affiliates of the Carlyle Group.

Computer Sciences (CSC +1.86%) surged over 20% and Hewlett Packard Enterprises (HPE +1.12%) jumped 11% in pre-market trading after CSC announced that it will merge with HP Enterprise's Services Unit.

Sportsman's Warehouse Holdings (SPWH -2.10%) dropped 4% in after-hours trading after it said it sees fiscal-year 2017 adjusted EPS of 65 cents-73 cents, below consensus of 73 cents.

Chesapeake Energy (CHK +10.35%) rose over 2% in after-hours trading after it announced, for the second time in a month, a debt for equity swap as it attempts to strategically reduce its debt load.

American Axle & Manufacturing Holdings (AXL +2.68%) gained over 4% in after-hours trading after it announced that it will replace Education Realty in the Smallcap 600 after the close of trading Friday, May 27.

Nimble Storage (NMBL +2.08%) jumped over 10% in after-hours trading after it reported a Q1 adjusted EPS loss of -24 cents, a smaller loss than consensus of -26 cents, and then said it sees Q2 revenue of $93 million-$96 million, above consensus of $92.7 million.

MARKET COMMENTS

June E-mini S&Ps (ESM16 +0.39%) this morning are up +7.75 points (+0.37%) at a 3-week high. Tuesday's closes: S&P 500 +1.37%, Dow Jones +1.22%, Nasdaq +2.05%. The S&P 500 on Tuesday rose to a 1-1/2 week high and closed sharply higher on carryover support from a rally in European stocks to a 3-week high after German Q1 capital investment rose +1.8% q/q (stronger than expectations of +1.4% q/q and the biggest increase in 2 years) and on the +16.6% surge in U.S. Apr new home sales to 619,000 (stronger than expectations of +2.4% to 523,000 and the most in 8-1/4 years). Stocks were also boosted by a rally in technology stocks led by a +2% gain in Alphabet and Microsoft.

June 10-year T-note prices (ZNM16 -0.06%) this morning are down -3 ticks. Tuesday's closes: TYM6 -6.00, FVM6 -3.50. Jun T-notes on Tuesday closed lower on the surge in U.S. Apr new home sales to their highest in 8-1/4 years and reduced safe-haven demand with the the rally in the S&P 500 to a 1-1/2 week high.

The dollar index (DXY00 -0.03%) this morning is up +0.019 (+0.02%) at a fresh 1-3/4 month high. EUR/USD (^EURUSD) is up +0.0002 (+0.02%). USD/JPY (^USDJPY) is up +0.21 (+0.19%). Tuesday's closes: Dollar Index +0.340 (+0.36%), EUR/USD -0.0004 (-0.04%), USD/JPY -0.91 (-0.83%). The dollar index on Tuesday rose to a 1-3/4 month high and closed higher on the stronger-than-expected U.S. Apr new home sales of +16.6%, which bolsters the case for the Fed to raise interest rates. The dollar was also boosted by weakness in EUR/USD which fell to a 1-3/4 month low after an unexpected decline in the German May ZEW survey expectations of economic growth.

July WTI crude oil (CLN16 +1.07%) is up +53 cents (+1.09%) at a 7-1/4 month high. July gasoline (RBN16 -0.70%) is down -0.0132 (-0.80%). Tuesday's closes: CLN6 +0.54 (+1.12%), RBN6 +0.0084 (+0.51%). July crude oil and gasoline on Tuesday closed higher with July gasoline at a 9-1/2 month high on expectations for Wednesday's EIA crude inventories to fall -2.25 million bbl and by the rally in the S&P 500 to a 1-1/2 week high. Crude oil prices were undercut by the rally in the dollar index to a 1-3/4 month high.

(Click on image to enlarge)

Disclosure: None.