Morning Call For May 21, 2015

OVERNIGHT MARKETS AND NEWS

June E-mini S&Ps (ESM15 -0.12%) this morning are down -0.21% ahead of economic data on U.S. Apr existing home sales and weekly jobless claims to gauge the timing of a Fed interest rate increase after Wednesday afternoon's Apr 28-29 FOMC minutes reinforced the message that rates could rise at any Fed meeting. European stocks are down -0.52 % after the Eurozone May composite PMI unexpectedly weakened. Asian stocks closed mixed: Japan +0.03%, Hong Kong -0.22%, China +1.87%, Taiwan -1.10%, Australia +0.93%, Singapore +0.01%, South Korea -1.02%, India -0.10%. Japan's Nikkei Stock Index climbed to a new 15-year high on expectations that the weak yen will continue to give Japan's economy a boost after Wednesday's economic data showed Japan Q1 GDP rose +2.4% q/q annualized, the fastest pace of growth in a year. China's Shanghai Composite Stock Index rose to a 3-week high on speculation China will expand stimulus after a gauge of Chinese manufacturing activity contracted for a third month.

Commodity prices are mostly higher. Jul crude oil (CLN15 +1.03%) is up +1.38% and Jul gasoline (RBN15 +0.59%) is up +0.99% after Wednesday’s weekly EIA data showed U.S. crude stockpiles declined, indicating the supply glut may be easing. Metals prices are higher with a weaker dollar. Jun gold (GCM15 +0.02%) is up +0.05%. Jul copper (HGN15 +0.49%) is up +0.46%. Agricultural prices are higher.

The dollar index (DXY00 -0.28%) is down -0.37%. EUR/USD (^EURUSD) is up +0.59%. USD/JPY (^USDJPY) is down -0.28%.

Jun T-note prices (ZNM15 +0.01%) are up +3 ticks.

The May Eurozone composite PMI fell -0.5 to 53.4, weaker than expectations of unch at 53.9. The May Markit manufacturing PMI unexpectedly rose +0.3 to 52.3, stronger than expectations of -0.2 to 51.8 and the fastest pace of expansion in 13 months.

The China May HSBC flash manufacturing PMI rose +0.2 to 49.1, weaker than expectations of +0.4 to 49.3 and the third month the index has remained below the contraction/expansion level of 50.0.

U.S. STOCK PREVIEW

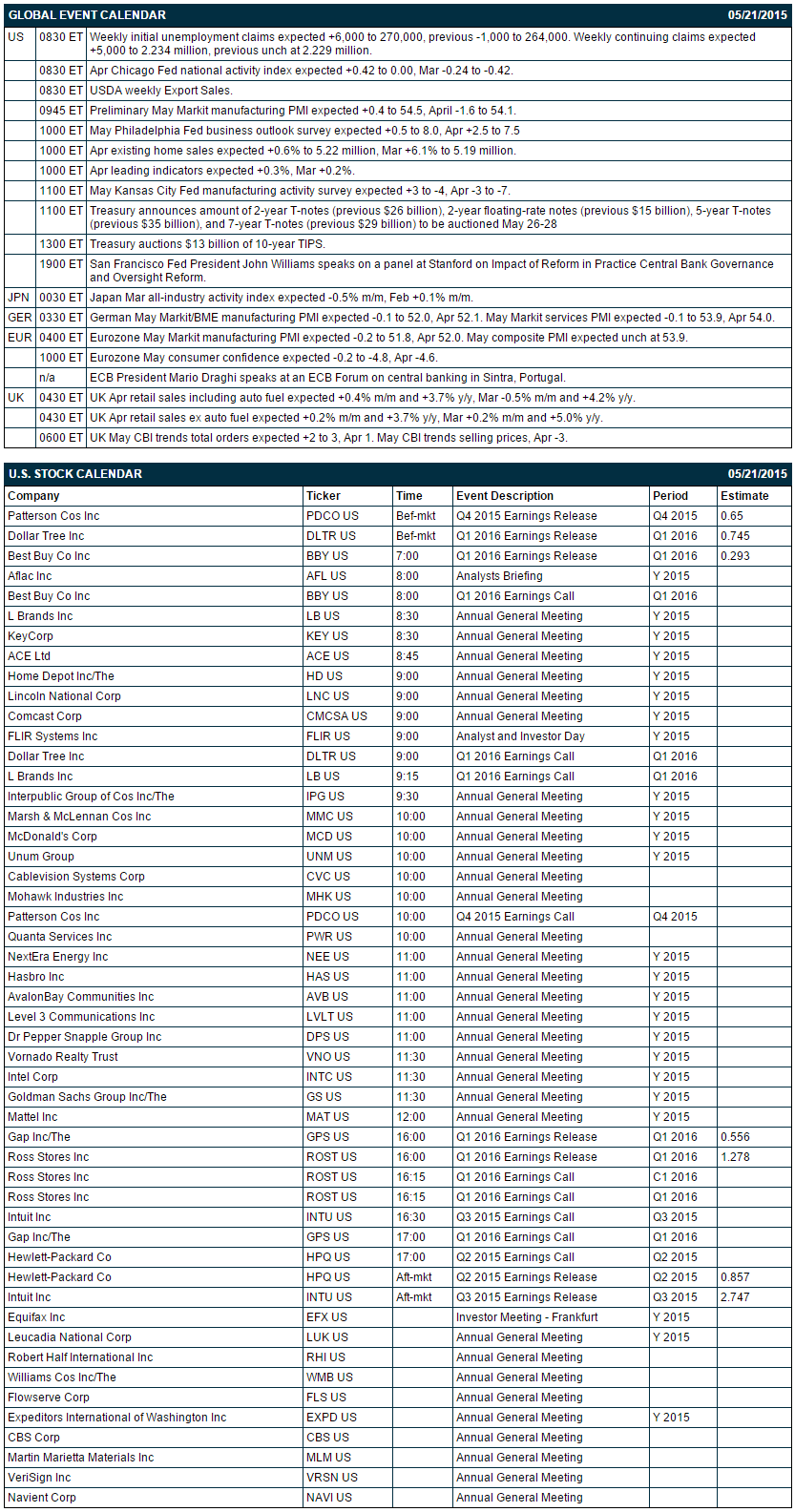

Key U.S. reports today include: (1) weekly initial unemployment claims (expected +6,000 to 270,000 after last week's -1,000 to 264,000) and continuing claims (expected +5,000 to 2.234 million after unchanged at 2.229 million), (2) preliminary May Markit manufacturing PMI (expected +0.4 to 54.5 after April's -1.6 to 54.1), (3) regional confidence surveys including the Apr Chicago Fed national activity index (expected +0.42 to 0.00 after March's -0.24 to-0.42), May Philadelphia Fed business outlook survey (expected +0.5 to 8.0 after April's +2.5 to 7.5), and May Kansas City Fed manufacturing activity survey (expected +3 to -4 after April's -3 to -7), (4) Apr existing home sales (expected +0.6% to 5.22 million after March's +6.1% to 5.19 million), (5) Apr leading indicators (expected +0.3% after March's +0.2%), and (6) the Treasury's auction of $13 billion of 10-year TIPS.

There are 7 of the S&P 500 companies report earnings today: HP (consensus $0.86), Best Buy (0.29), GAP (0.56), Ross Stores (1.28), Intuit (2.75), Dollar Tree (0.75), Patterson Cos (0.65).

U.S. IPO's scheduled to price today include: Emerald Oil (EOX), Manhattan Bridge Capital (LOAN).

Equity conferences during the remainder of this week include: BMO Farm to Market Conference on Wed-Thu, Janney Montgomery Scott-Company Marketing: Biotechnology-Southeast on Fri.

OVERNIGHT U.S. STOCK MOVERS

Dollar Tree (DLTR -1.66%) lowered guidance on Q2 EPS ex-acquisition costs to 63 cents-68 cents, below consensus of 70 cents.

Bon-Ton Stores (BONT -1.49%) reported a Q1 EPS loss of -$1.74, a larger loss than consensus of -$1.56.

Omnicare (OCR +2.48%) was downgraded to 'Market Perform' from 'Outperform' at Cowen.

Citigroup maintains a 'Buy' rating on Netflix (NFLX +0.82%) and raised its price target on the stock to $722 from $584.

Vodafone (VOD +2.60%) was upgraded to 'Neutral' from 'Reduce' at Nomura.

Nike (NKE -0.03%) was initiated with a 'Buy' at Jefferies with a price target of $120.

Best Buy (BBY -3.43%) jumped over 9% in pre-market trading after reported Q1 EPS of 37 cents, better than consensus of 29 cents.

CVS Health (CVS -1.03%) agreed to acquire Omnicare (OCR) for $98 a share.

Salesforce.com (CRM -1.85%) rallied more than 6% in after-hours trading on positive earnings.

Williams-Sonoma (WSM -0.43%) rallied 4% in after-hours trading on positive earnings.

NetApp (NTAP -0.06%) fell 8% in after-hours trading on disappointing earnings and then was downgraded to 'Underweight' from 'Neutral' at JPMorgan Chase.

MARKET COMMENTS

June E-mini S&Ps (ESM15 -0.12%) this morning are down -4.50 points (-0.21%). Wednesday's closes: S&P 500 -0.09%, Dow Jones -0.15%, Nasdaq +.03%. The S&P 500 on Wednesday closed slightly lower as some long liquidation pressure emerged. However, stocks saw support from the FOMC minutes, which said that many members believed that rates would not be raised at the June meeting. In addition, there was some carry-over support from the +0.35% rally in the Euro Stoxx on relief that the ECB did not raise the haircut on Greek bank collateral and only needed to raise the Greek ELA by 200 million euros.

June 10-year T-notes (ZNM15 +0.01%) this morning are up +3 ticks. Wednesday's closes: TYM5 +7.50, FVM5 +6. Jun T-notes on Wednesday closed higher on some relief that the April 28-29 FOMC minutes downplayed the chances for a rate hike in June. The main bearish factor was the -0.22 point sell-off in June German bund prices.

The dollar index (DXY00 -0.28%) this morning is down -0.355 (-0.37%). EUR/USD (^EURUSD) is up +0.0065 (+0.59%). USD/JPY (^USDJPY) is down-0.34 (-0.28%). Wednesday's closes: Dollar Index +0.359 (+0.38%), EUR/USD -0.0056 (-0.50%), USD/JPY +0.66 (+0.55%). The dollar index on Wednesday closed higher on technical buying with the new 2-week high. EUR continued to see weakness from the ECB's statement earlier this week about boosting the size of QE in May-June to offset reduced liquidity during the summer.

July WTI crude oil (CLN15 +1.03%) is up +82 cents (+1.39%). July gasoline (RBN15 +0.59%) is up +0.0201 (+0.99%). Wednesday's closes: CLN5 +0.99 (+1.71%), RBN5 +0.0438 (+2.21%). Jul crude oil and gasoline prices on Wednesday closed sharply higher on a bullish weekly EIA report. The EIA report showed a (1) -2.67 million bbl decline in U.S. crude oil inventories (vs expectations of -2 million bbls), (2) a -2.77 million bbl drop in gasoline inventories, and (3) a sharp -1.2% drop in U.S. crude oil production.

Disclosure: None.