Morning Call For May 20, 2015

OVERNIGHT MARKETS AND NEWS

June E-mini S&Ps (ESM15 +0.05%) this morning are little changed as the market awaits today's FOMC meeting minutes. The Euro Stoxx 50 index this morning is mildly lower by -0.20%. Asian stocks today closed mixed: Japan +0.85%, Hong Kong -0.39%, China +0.65%, Taiwan -0.32%, Australia-0.09%, Singapore -0.42%, South Korea +0.93%, India +0.69%, Turkey -1.07%.

The dollar index (DXY00 +0.30%) this morning is up +0.21%. EUR/USD is seeing continued weakness and is down -0.0046 (-0.41%) this morning on yesterday's news that the ECB will slightly expand QE in May-June to account for lower liquidity over the summer. USD/JPY is up +0.24 (+0.20%). June 10-year T-notes (ZNM15 +0.04%) are unchanged this morning. June bunds are up +0.26 points.

Commodity prices are unchanged on net this morning. July WTI crude oil is up +0.56 (+0.97%) on some short-covering after yesterday's plunge. July gasoline is up +0.0243 (+1.23%). July natural gas is up +0.027 (+0.90%).

Precious metals prices are trading slightly higher this morning on some short-covering after Tuesday's sharp sell-off. Jun gold this morning is up +2.0 (+0.17%) and July silver is up +0.064 (+0.37%). July copper is down -0.013 (-0.44%). Grain and softs prices are trading moderately lower this morning.

The Japan Q1 GDP report of +2.4% (q/q annualized) was stronger than market expectations of +1.6%, although Q4 was revised lower to +1.1% from +1.5%.

The Bank of England policy minutes were a bit hawkish as they said that slack in the UK economy will probably be eroded within a year, which signals that potential future inflation pressures may then require a rate hike. For now, the Monetary Policy Committee voted 9-0 to keep its base rate unchanged at 0.50%.

The ECB later today will likely raise the Greek Emergency Lending Assistance (ELA) facility from the current 80 billion euros, adding to last week's hike of 2.0 billion euros.

U.S. STOCK PREVIEW

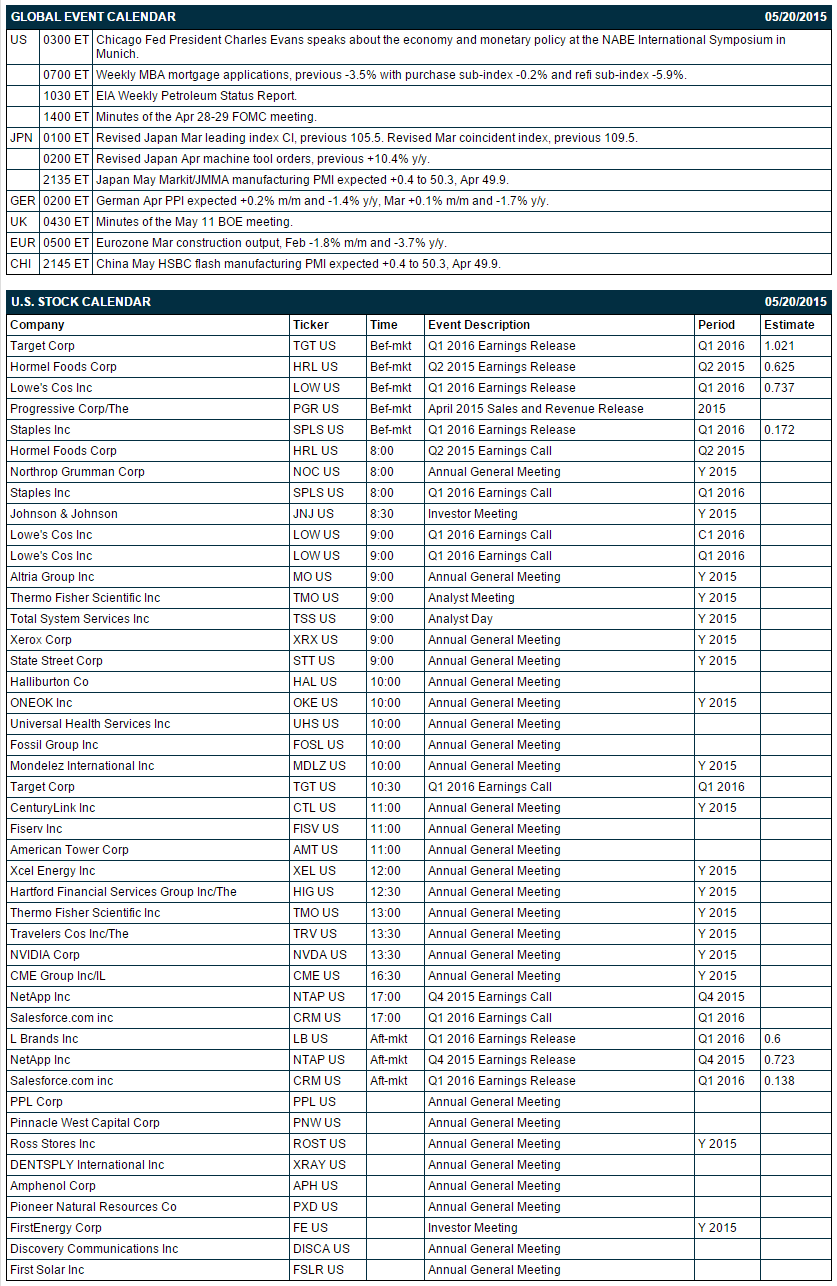

Key U.S. reports today include: (1) the weekly MBA mortgage applications report (last week was -3.5% with purchase sub-index -0.2% and refi sub-index -5.9%), (2) the minutes from the Apr 28-29 FOMC meeting, and (3) a speech by Chicago Fed President Charles Evans about the economy and monetary policy at the NABE International Symposium in Munich.

There are 7 of the S&P 500 companies report earnings today: Target (consensus $1.02), Hormel Foods (0.63), Lowe's (0.74), Staples (0.17), L Brands (0.60), NetApp (0.72), Salesforce.com (0.14).

U.S. IPO's scheduled to price today include: Press Ganey Holdings (PGND), Baozun (BZUN), Community Healthcare Trust (CHCT), Shopify (SHOP), Dicerna Pharmaceuticals (DRNA), Malibu Boats (MBUU).

Equity conferences this week include: JPMorgan Global Technology, Media and Telecom Conference on Mon-Wed, UBS Global Health Care Conference on Mon-Wed, Electrical Products Group Spring Conference on Mon-Wed, EPG Conference on Mon-Wed, Goldman Sachs Basic Materials Conference on Tue-Wed, Barclays America Select Conference on Tue-Wed, Wolfe Research Global Transportation Conference on Tue-Wed, LME Week Asia 2015 on Wed, BMO Farm to Market Conference on Wed-Thu, Janney Montgomery Scott-Company Marketing: Biotechnology-Southeast on Fri.

June E-mini S&Ps this morning are little changed as the market awaits today's FOMC meeting minutes. Tuesday's closes: S&P 500 -0.06%, Dow Jones +0.07%, Nasdaq -0.17%. The S&P 500 on Tuesday closed little changed on offsetting factors. Stocks were supported by the sharp +20.2% increase in April U.S. housing starts to a 7-1/3 year high, although that also meant the Fed might tighten sooner rather than later. U.S. stocks also received a boost from a rally in European stocks on the ECB’s statement that it will boost the size of its QE program in May-June to offset lower liquidity during the summer. Stocks were undercut by a -4.4% slump in Wal-Mart on a disappointing earnings report and by weakness in energy producers after the sharp-3.74% sell-off in crude oil prices.

OVERNIGHT U.S. STOCK MOVERS

- Hormel Foods (HRL +0.13%) reported Q2 EPS of 67 cents, mildly above the consensus of 63 cents. Q2 revenue of $2.3 billion was slightly below the consensus of $2.40 billion.

- Lowe's (LOW -1.68%) reported Q1 EPS of 70 cents, mildly below the consensus of 74 cents. Q1 revenue of $14.13 billion was slightly below the consensus of $14.28 billion.

- Staples (SPLS -0.42%) reported Q1 non-GAAP EPS of 17 cents, matching the consensus. Q1 revenue of $5.26 billion was below the consensus of $5.47 billion.

- Northrop Grumman (NOC +0.58%) increased its quarterly dividend by 14% to 80 cents/share.

- Yahoo (YHOO -7.62%) said this morning that the IRS statement on spin-offs will not affect its previously filed requests.

- LendingClub (LC +1.50%) rallied nearly 3% in after-hours trading after Morgan Stanley upgraded the stock to Overweight from Equal Weight.

- Autodesk (ADSK -1.51%) fell 2% in after-hours trading due to a disappointing earnings report.

- Norwegian Cruise Line (NCLH +3.26%) fell -2.5% in after-hours trading after filing to sell 20 million of ordinary shares.

MARKET COMMENTS

June 10-year T-notes are unchanged this morning, awaiting today's FOMC meeting minutes. Tuesday's closes: TYM5 -11.00, FVM5 -8.50. Jun T-notes on Tuesday closed lower on the +20.2% surge in U.S. April housing starts and increased concern about a Fed rate hike. However, T-notes found support from the sharp sell-off in oil prices that undercut inflation expectations and from carry-over support from the +0.38 point rally in June Bund prices.

The dollar index this morning is up +0.21%. EUR/USD is seeing continued weakness and is down -0.0046 (-0.41%) this morning on yesterday's news that the ECB will slightly expand QE in May-June to account for lower liquidity over the summer. USD/JPY is up +0.24 (+0.20%). Tuesday's closes: Dollar Index +1.083 (+1.15%), EUR/USD -0.0165 (-1.46%), USD/JPY +0.70 (+0.58%). The dollar index on Tuesday closed sharply higher for the second straight day on the sharp +20.2% increase in U.S. April housing starts and on EUR weakness sparked by the news that the ECB is boosting the size of QE in May-June to offset reduced liquidity during the summer.

July WTI crude oil is up +0.56 (+0.97%) on some short-covering after yesterday's plunge. July gasoline is up +0.0243 (+1.23%). Tuesday's closes: CLN5-2.25 (-3.74%), RBN5 -0.0376 (-1.85%). Jul crude oil and gasoline prices on Tuesday closed sharply lower on the sharp rally in the dollar index and on expectations for the U.S. and world oil supply glut to continue.

Disclosure: None.