Morning Call For May 14, 2015

OVERNIGHT MARKETS AND NEWS

June E-mini S&Ps (ESM15 +0.50%) this morning are up +0.45% on speculation that Wednesday’s weaker-than-expected U.S. Apr retail sales may keep the Fed from raising interest rates. European stocks are down -0.01% amid a stronger euro as EUR/USD climbed to a 2-3/4 month high. Another negative for European stocks is an increase in the 10-year German bund yield to a 1-week high of 0.755%. Greece's ASE Stock Index is up +1.19% after Greek Finance Minister Varoufakis said his government agrees with its creditors on most issues. Asian stocks closed mostly lower: Japan -0.98%, Hong Kong +0.14%, China +0.06%, Taiwan -1.16%, Australia -0.33%, Singapore +0.08%, South Korea +0.17%, India -0.17%. Most Asian bourses weakened as exporters declined after a weak U.S. retail sales report raised concern about U.S. economic growth and demand for Asian goods.

Commodity prices are mostly higher due to a weaker dollar. Jun crude oil (CLM15 +0.13%) is up +0.12% and Jun gasoline (RBM15 +0.95%) is up +0.72%. Metals prices are mixed. Jun gold (GCM15 -0.14%) is up +0.07% at a 1-1/4 month high. Jul copper (HGN15 -0.24%) is down -0.19%. Agriculture prices are higher.

The dollar index (DXY00 -0.30%) is down -0.51% at a new 3-1/2 month low. EUR/USD (^EURUSD) is up +0.67% at a 2-3/4 month high. USD/JPY (^USDJPY) is up +0.07% and GBP/USD is up +0.31% at a 5-1/2 month high.

Jun T-note prices (ZNM15 +0.06%) are up +4 ticks.

Greek Finance Minister Varoufakis said that Greece agrees with its creditors on most issues and that Greece "will sink" without reforms. He added that Greece needs a debt "redesigning" that will substantially extend repayment deadlines, with possible solutions including bond swaps. Varoufakis insists that he will reject any deal with international bailout creditors that does not help his country exit its economic crisis. According to an official familiar with the matter, Greece has to raise at least 3 billion euros to meet minimum budget targets acceptable by creditors.

U.S. STOCK PREVIEW

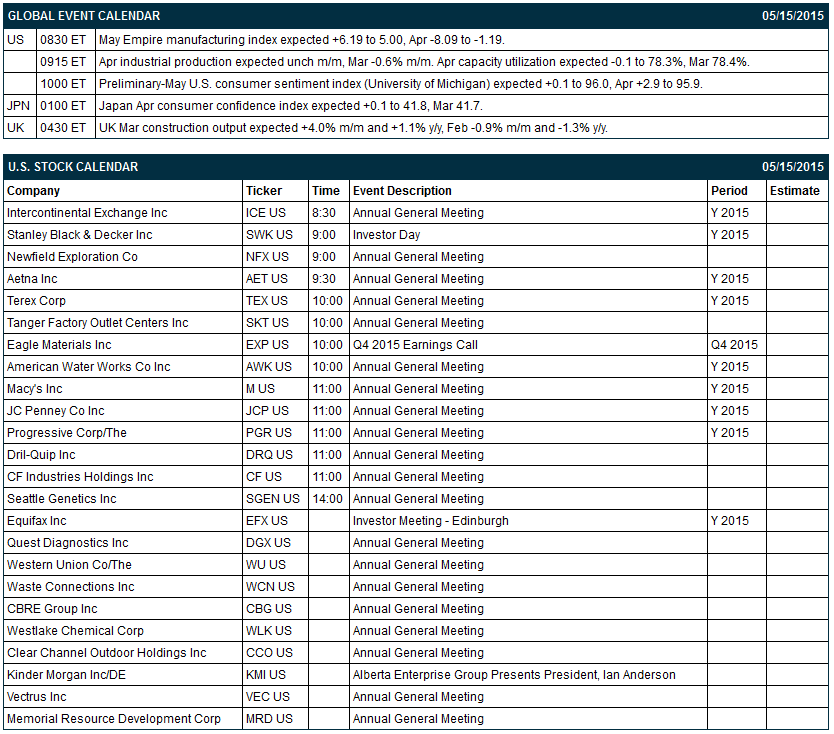

Key U.S. reports today include: (1) weekly initial unemployment claims (expected +8,000 to 273,000 after last week's +3,000 to 265,000) and continuing claims (expected +4,000 to 2.232 million after last week's -28,000 to 2.228 million), (2) April final-demand PPI (expected +0.1% m/m and -0.8% y/y after March's +0.2% m/m and -0.8% y/y) and Apr PPI ex-food & energy (expected +0.1% m/m and +1.1% y/y after March's +0.2% m/m and +0.9% y/y), and (3) the Treasury's auction of $16 billion of 30-year T-bonds.

There are 10 of the Russell 100 companies that report earnings today with notable reports including: Applied Materials (consensus 0.28), Nordstrom (0.71), Kohl's (0.55), Dillard;s (2.78), Symantec (0.44).

U.S. IPO's scheduled to price today include: Landmark Infrastructure (LMRK), Code Rebel (CDRB).

Equity conferences during the remainder of this week include: Bank of America Merrill Lynch Health Care Conference on Tue-Thu, Jefferies Global Technology, Media and Telecom Conference on Tue-Thu, Morgan Stanley E&P and Oil Services Conference on Tue-Thu, MoffettNathanson Media & Communications Summit on Wed-Thu, Bank of America Merrill Lynch Transportation Conference on Thu, Barclays Biotech CEO/CFO Conference on Thu, Royal Bank of Canada Aerospace & Defense Investor Day on Thu.

OVERNIGHT U.S. STOCK MOVERS

Kohl's (KSS +0.28%) reported Q1 EPS of 63 cents, better than consensus of 55 cents.

Urban Outfitters (URBN -0.27%) was upgraded to 'Outperform' from 'Market Perform' at Telsey Advisory.

DuPont (DD -7.37%) was upgraded to 'Neutral' from 'Underperform' at BofA/Merrill Lynch.

J.B. Hunt (JBHT -0.61%) and Ingersoll-Rand (IR +0.89%) were both upgraded to 'Overweight' from 'Sector Weight' at KeyBanc.

Citigroup keeps a 'Buy' rating on Global Payments (GPN +1.23%) and raises its price target on the stock to $118.50 from $110.

CarMax (KMX -0.22%) was initiated with a 'Buy' at Sterne Agee CRT with a price target of $87.

Teekay (TK -0.62%) reported Q1 adjusted EPS of 22 cents, below consensus of 29 cents.

AOL (AOL +0.49%) was downgraded to 'Neutral' from 'Buy' at UBS.

Superior Energy (SPN -0.37%) was upgraded to 'Outperform' from 'Perform' at Oppenheimer.

Duke Energy (DUK -2.44%) was downgraded to 'Neutral' from 'Outperform' at Credit Suisse.

J.C. Penney (JCP -1.91%) reported a Q1 EPS loss of -57 cents, a smaller loss than consensus of -77 cents.

Vipshop (VIPS +3.41%) reported Q1 adjusted EPS of 13 cents, above consensus of 10 cents.

Cisco (CSCO +0.41%) reported Q3 EPS of 54 cents, higher than consensus of 53 cents.

Jack in the Box (JACK -0.05%) reported Q2 operating EPS of 69 cents, better than consensus of 67 cents.

Roundy's (RNDY -1.51%) reported a Q1 EPS loss of -1 cent, a smaller loss than consensus of -3 cents.

MARKET COMMENTS

June E-mini S&Ps (ESM15 +0.50%) this morning are up +9.50 points (+0.45%). Wednesday's closes: S&P 500 -0.03%, Dow Jones -0.04%, Nasdaq +0.13%. The S&P 500 on Wednesday closed little changed. Stocks were undercut by the weaker-than-expected U.S. Apr retail sales report of unchanged and +0.1% ex-autos (vs expectations of +0.2% and +0.5% ex-autos) and by carry-over weakness from European stocks that were hurt by a lower close in German bund prices. Stocks received some support from continued M&A activity as Owens-Illinois offered to buy Vitro SAB for $2.15 billion and Danaher announced the acquisition of Pall Corp. for $13.8 billion. There was also some strength in the technology sector after Microsoft rallied on Deutsche Bank's update to "Buy" from "Hold."

Jun 10-year T-notes (ZNM15 +0.06%) this morning are up +4 ticks. Wednesday's closes: TYM5 -2.00, FVM5 +3.00. Jun 10-year T-notes on Wednesday closed lower on carry-over weakness from a lower close in German bund prices. Supportive factors included the weaker-than-expected U.S. April retail sales report of unchanged and +0.1% ex-autos and strong demand for the 10-year T-note auction with foreign buyers taking 60.2% of the auction.

The dollar index (DXY00 -0.30%) this morning is down -0.481 (-0.51%) at a 3-1/2 month low. EUR/USD (^EURUSD) is up +0.0076 (+0.67%) at a 2-3/4 month high. USD/JPY (^USDJPY) is up +0.08 (+0.07%). Wednesday's closes: Dollar Index -0.917 (-0.97%), EUR/USD +0.0141 (+1.26%), USD/JPY -0.714 (-0.60%). The dollar index on Wednesday fell to a 3-1/4 month low on the weaker-than-expected U.S. April retail sales report and on the as-expected increase in Eurozone Q1 GDP, which was supportive for EUR/USD.

Jun WTI crude oil (CLM15 +0.13%) this morning is up +7 cents (+0.12%) and Jun gasoline (RBM15 +0.95%) is up +0.0147 (+0.72%). Wednesday's closes: CLM5 -0.25 (-0.41%), RBM5 -0.0052 (-0.25%). Jun crude oil and gasoline prices on Wednesday closed lower on the EIA report showing that U.S. crude production rose +5,000 bpd and that the U.S. refinery utilization rate fell sharply by -1.8 points to 91.2%, which will reduce crude oil demand and boost inventories. Supportive factors included the decline in the dollar index to a 3-1/4 month low and the -2.19 million bbl decline in EIA crude inventories (vs expectations of -500,000 bbl).

Click on picture to enlarge

Disclosure: None.