Morning Call For March 2, 2015

OVERNIGHT MARKETS AND NEWS

March E-mini S&Ps (ESH15 +0.02%) this morning are up +0.05% and European stocks are down -0.25%. Stocks found support after China cut interest rates on Saturday for the second time in three months. Gains were limited as energy stocks declined after the price of crude oil fell. The yield on Portugal's 10-year bond fell to a record low 1.74% and Italy's 10-year yield dropped to a record low 1.294% before the start of the ECB's bond-buying program. Asian stocks closed mostly higher: Japan +0.15%, Hong Kong +0.26%, China +0.80%, Taiwan -0.22%, Australia +0.51%, Singapore +0.03%, South Korea +0.87%, India +0.33%. China's Shanghai Stock Index rose to a 1-month high and the Chinese yuan fell to a 2-1/3 year low against the dollar after China cut interest rates. The PBOC on Saturday cut the 1-year deposit and lending rates by -25 bp each to 2.50% and 5.35% respectively effective Mar 1. Japan's Nikkei Stock index climbed to a 14-3/4 year high as exporter stocks rallied after the yen fell to a 2-week low against the dollar, which boosts exporters' earnings prospects. Commodity prices are mixed. Apr crude oil (CLJ15 -1.81%) is down -1.73% and Apr gasoline (RBJ15-1.52%) is down -1.56%. Apr gold (GCJ15 +0.26%) is up +0.26% at a 1-1/2 week high. May copper (HGK15 -0.33%) is down -0.17%. Agriculture prices are mixed. The dollar index (DXY00 -0.21%) is down -0.16%. EUR/USD (^EURUSD) is up +0.26% after Eurozone Feb CPI rose less than expected. USD/JPY (^USDJPY) is up +0.13% at a 2-week high. Jun T-note prices (ZNM15 +0.01%) are down -2.5 ticks.

The China Feb manufacturing PMI unexpectedly rose +0.1 to 49.9, stronger than expectations of -0.1 to 49.7. The Feb non-manufacturing PMI climbed +0.2 to 53.9.

The China Feb HSBC flash manufacturing PMI was revised lower to 50.7 from the previously reported 51.1.

The Eurozone Feb CPI estimate fell -0.3% y/y, a slower pace of decline than expectations of -0.4% y/y. The Feb core CPI rose +0.6% y/y, right on expectations and matched Jan's gain as the slowest pace of increase since the data series began in 1997.

The Eurozone Jan unemployment rate unexpectedly fell -0.1 to 11.2% from a downward revised 11.3% in Dec, stronger than expectations of no change at 11.4% and the lowest in 2-3/4 years.

The German Feb Markit/BME manufacturing PMI was revised higher by +0.2 to 51.1 from the originally reported 50.9.

The UK Feb Markit manufacturing PMI rose +1.0 to 54.1, stronger than expectations of +0.3 to 53.3 and the fastest pace of expansion in 7 months.

Japan Q4 capital spending ex-software rose +3.9% y/y, less than expectations of +5.0% y/y. Q4 capital spending rose +2.8% y/y, less than expectations of +4.0% y/y.

U.S. STOCK PREVIEW

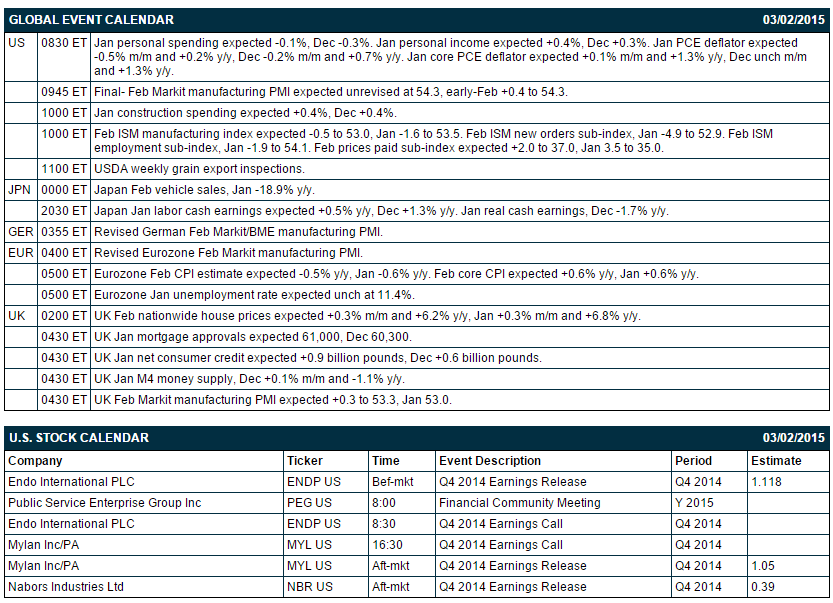

Today’s Feb ISM manufacturing index is expected to show a -0.5 point decline to 53.0, which would be the fourth consecutive monthly decline. Today’s Jan PCE deflator is expected to fall to +0.2% y/y from +0.7% in Dec, remaining just above the deflationary level of zero. There are 3 of the S&P 500 companies that report earnings today: Nabors Industries (consensus $0.39), Mylan (1.05), Endo International (1.12).

Equity conferences this week include: Cowen & Co. Health Care Conference on Mon-Wed, 10th LNG Supplies for Asian Markets on Mon-Tue, Association of Insurance and Financial Analysts Conference on Mon-Tue, Citigroup Global Property CEO Conference on Mon-Wed, Raymond James & Associates Institutional Investors Conference on Mon-Wed, Morgan Stanley Technology Media & Telecom Conference on Mon-Thu, JMP Securities Technology Conference on Tue, SpeedNews 5th Annual Aerospace Raw Materials & Manufacturers Supply Chain Conference on Tue, ISI Industrial Conference on Tue, Bank of America Merrill Lynch Consumer & Retail Conference on Tue-Wed, J.P. Morgan Aviation, Transportation and Industrials Conference on Tue-Thu, Mitsubishi UFJ Securities 3rd Annual Seattle Consumer Conference on Wed, Morgan Stanley European MedTech & Services Conference on Wed,

Simmons Energy Conference on Wed, UBS Natural Gas, Electric Power and MLP Conference on Wed, UBS Utilities and Natural Gas Conference on Wed, UBS Global Consumer Conference on Wed-Thu, Bank of America Merrill Lynch Refining Conference on Thu, Barclays Investment Grade Energy & Pipeline Conference on Thu, Pacific Crest Emerging Technology Summit on Thu, Morgan Stanley MLP/Diversified Natural Gas, Utilities Clean Tech Conference on Thu.

OVERNIGHT U.S. STOCK MOVERS

MasterCard (MA -1.24%) jumped nearly 10% in pre-market trading after it joined with Samsung Electronics to introduce mobile payments on phones.

Cardinal Health (CAH -0.20%) will buy Cordis from Johnson & Johnson (JNJ -0.28%) in a $1.99 billion deal.

Warrem Buffett said he sold his entire Exxon Mobil (XOM -0.12%) stake in Q4.

International Business Machines (IBM +0.67%) was downgraded to 'Underweight' from 'Neutral' at Atlantic Equities.

BlackRock (BLK -0.96%) was downgraded to 'Neutral' from 'Buy' at Citigroup.

Lumber Liquidators (LL +5.34%) was downgraded to 'Equal Weight' from 'Overweight' at Morgan Stanley.

United Rentals (URI -1.27%) was upgraded to 'Overweight' from 'Equal Weight' at Morgan Stanley.

Northern Oil and Gas (NOG +5.64%) was downgraded to 'Neutral' from 'Buy' at SunTrust.

Crane (CR -2.21%) was downgraded to 'Underperform' from 'Neutral' at BofA/Merrill Lynch.

Endo International PLC (ENDP +0.42%) reported Q4 EPS of 54 cents, less than half the consensus of $1.12.

Lockheed Martin (LMT -0.64%) and United Technologies (UTX -0.62%) were awarded a joint venture $2 billion government contract for 1,710 weapon replaceable assemblies and replaceable assemblies’ components in support of the H-60 aircraft.

Barron's reports that Icahn Enterprises (IEP -1.85%) appears pricey at almost $100 per unit as the company's indicative net asset value at year-end 2014 was approximately $69 per unit.

Dresser-Rand (DRC -0.10%) reported Q4 adjusted EPS of $1.52, higher than consensus of $1.30, and then announced a planned reduction in its workforce of approximately 8%.

MARKET COMMENTS

Mar E-mini S&Ps (ESH15 +0.02%) this morning are up +1.00 point (+0.05%). The S&P 500 index on Friday closed lower: S&P 500 -0.30%, Dow Jones-0.45%, Nasdaq -0.48%. Bearish factors included (1) the +1.7% m/m increase in U.S. Jan pending home sales, weaker than expectations of +2.0%, and (2) the -13.6 point plunge in the Feb Chicago PMI to 45.8, weaker than expectations of -1.4 to 58.0 and the steepest pace of contraction in 5-1/2 years. A bullish factor was the downward revision to U.S. Q4 GDP to 2.2% (q/q annualized), which was stronger than expectations of 2.0%.

Jun 10-year T-notes (ZNM15 +0.01%) this morning are down -2.5 ticks. Jun 10-year T-note futures prices on Friday closed higher. Closes: TYM5 +5.00, FVM5 +4.00. Bullish factors included (1) the plunge in the Feb Chicago PMI to a 5-1/2 year low, and (2) comments from New York Fed President Dudley who said raising interest rates too soon poses greater risks to the economy than lifting them too late.

The dollar index (DXY00 -0.21%) this morning is down -0.149 (-0.16%). EUR/USD (^EURUSD) is up +0.0029 (+0.26%). USD/JPY (^USDJPY) is up +0.15 (+0.13%) at a 2-week high. The dollar index on Friday rallied to a 1-month high but fell back and closed little changed: Dollar index unch, EUR/USD -0.00039 (-0.03%), USD/JPY +0.140 (+0.12%). Bullish factors included (1) the smaller-than-expected downward revision to U.S. Q4 GDP, and (2) the stronger-than-expected U.S. Feb University of Michigan consumer confidence index. The dollar fell back from its best levels after New York Fed President Dudley said he sees reason for caution on how soon to raise interest rates.

Apr WTI crude oil (CLJ15 -1.81%) this morning is down -86 cents (-1.73%) and Apr gasoline (RBJ15 -1.52%) is down -0.0308 (-1.56%). Apr crude and Apr gasoline prices on Friday closed higher with Apr gasoline at a 2-1/2 month high: CLJ5 +1.59 (+3.30%), RBJ5 +0.0751 (+3.95%). Bullish factors included (1) the smaller-than-expected downward revision to U.S. Q4 GDP, and (2) strength in gasoline due to supply concerns about shutdowns at several U.S. refineries including Motiva Enterprise LLC’s Port Arthur, Texas, refinery, the largest in the U.S.

Disclosure: None.