Morning Call For June 9, 2016

OVERNIGHT MARKETS AND NEWS

Jun E-mini S&Ps (ESM16 -0.33%) are down -0.33% and European stocks are down -0.89% as weakness in commodity prices drags down global equity markets. A sell-off in mining stocks and energy and raw-material producers are leading stocks lower after they rallied sharply earlier this week. The slide in world equity markets has fueled rallies in government bond markets as the German 10-year bund yield matched its record low of 0.033% set Wednesday and the UK 10-year gilt yield dropped to a record low of 1.24%. Asian stocks settled mostly lower: Japan -0.97%, Hong Kong, China and Taiwan closed for holiday, Australia -0.15%, Singapore -0.65%, South Korea +0.06%, India -0.95%. Japanese stocks were undercut by strength in the yen as USD/JPY fell to a 1-month low, which reduces the profitability of exporters. Japanese industrial stocks also fell after the -11.0% plunge in Japan Apr machine orders, the biggest monthly decline in 23 months.

The dollar index (DXY00 +0.32%) is up +0.25%. EUR/USD (^EURUSD) is down -0.47%. USD/JPY (^USDJPY) is down -0.44% at a 1-month low.

Sep T-note prices (ZNU16 +0.19%) are up +6.5 ticks at a contract high due to weakness in global stocks and carryover from rallies in European government bonds to record highs.

The German Apr trade balance shrank to a surplus of 25.6 billion euros, a larger surplus than expectations of 22.8 billion euros. Apr exports were unchanged m/m, stronger than expectations of -0.8% m/m. Apr imports unexpectedly fell -0.2% m/m, weaker than expectations of +1.3% m/m.

Japan Apr machine orders fell -11.0% m/m and -8.2% y/y, weaker than expectations of -3.0% m/m and -1.8% y/y with the -11.0% m/m fall the biggest monthly decline in 23 months.

U.S. STOCK PREVIEW

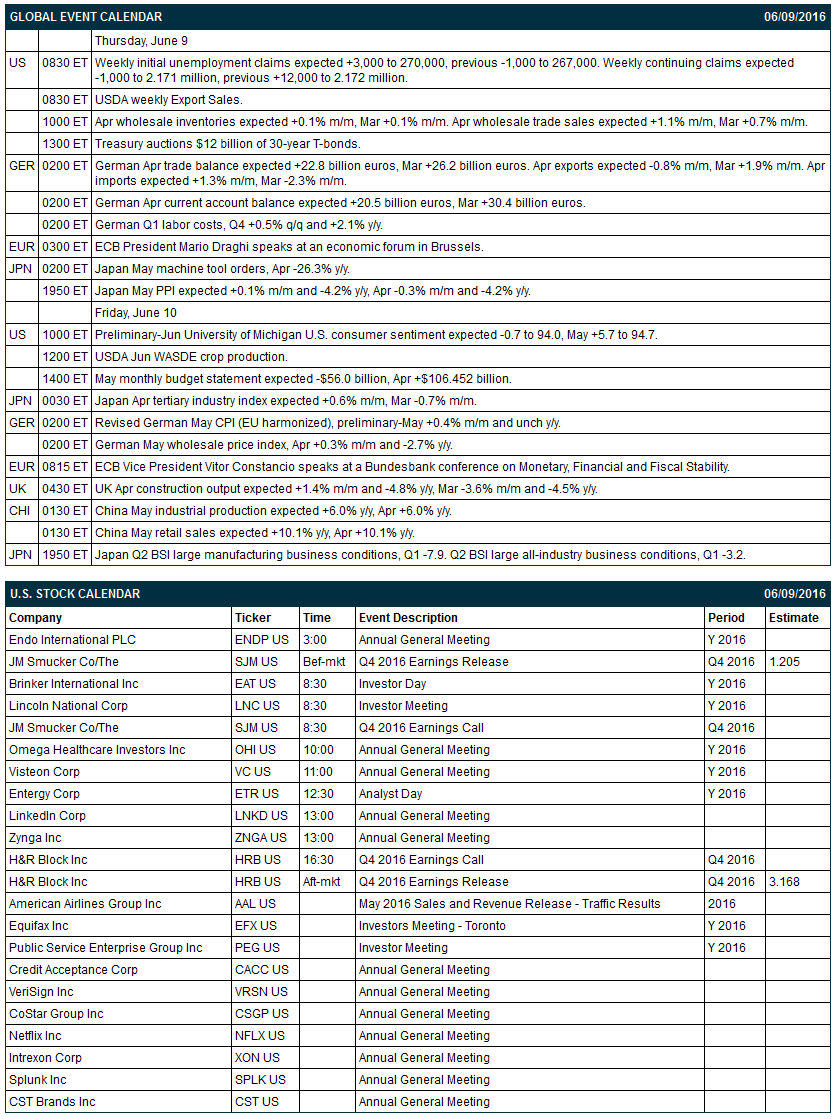

Key U.S. news today includes: (1) weekly initial unemployment claims (expected +3,000 to 270,000, previous -1,000 to 267,000) and continuing claims (expected -1,000 to 2.171 million, previous +12,000 to 2.172 million), (2) Apr wholesale inventories (expected +0.1% m/m, Mar +0.1% m/m), (3) the Treasury's auction of $12 billion of 30-year T-bonds, and (4) USDA weekly Export Sales.

There are 2 of the Russell 1000 companies that report earnings today: JM Smucker (consensus $1.21), H&R Block (3.17).

U.S. IPO's scheduled to price today: Atkore International Group (ATKR), China Online Education Group (COE),

Equity conferences during the remainder of this week include: American Society of Clinical Oncology Annual Meeting on Mon-Thu, Goldman Sachs Global Health Care Conference on Tue-Thu, Jefferies Global Health Care Conference on Tue-Thu, Baird Global Consumer, Technology and Services Conference on Tue-Thu, Deutsche Bank Global Industrials and Materials Summit on Wed-Thu, Sandler O'Neill Global Exchange and Brokerage Conference on Wed-Thu, Gabelli & Company Movie & Entertainment Conference on Thu, Susquehanna Financial Group Energy and Industrials Conference on Thu.

OVERNIGHT U.S. STOCK MOVERS

Comtech Telecommunications (CMTL -1.36%) lowered guidance on fiscal 2016 revenue to $425 million-$435 million from a March 10 estimate of $435 million-$445 million.

US Concrete (USCR +2.47%) was rated a new 'Buy' at DA Davidson with an 18-month target price of $80.

SolarCity (SCTY -0.94%) rose over 3% in pre-market trading after it was upgraded to 'Outperform' from 'Neutral' at Baird.

Boston Scientific (BSX +0.75%) was rated a new 'Buy' at Guggenheim Securities with a 12-month price target of $26.

Chesapeake Energy (CHK +6.42%) tumbled over 4% in pre-market trading after it was downgraded to 'Underperform' from 'Sector Perform' at RBC Capital Markets.

Fitbit (FIT -1.47%) was rated a new 'Outperform' at Wedbush with a 12-month price target of $18.

Stryker (SYK +1.51%) was rated a new 'Buy' at Guggenheim Securities with a 12-month price target of $134.

LinkedIn (LNKD +0.11%) climbed nearly 2% in pre-market trading after it was upgraded to 'Outperform' from 'Sector Perform' at RBC Capital Markets with a target price of $160.

Restoration Hardware Holdings (RH +1.95%) plunged over 20% in pre-market trading after it reported an unexpected Q1 adjusted EPS loss of -5 cents, weaker than consensus of a 5 cent gain, and then cut its full-year adjusted EPS forecast to $1.60-$1.80, well below consensus of $2.66,

ABM Industries (ABM +1.52%) gained over 3% in after-hours trading after it reported Q2 adjusted EPS continuing operations of 31 cents, higher than consensus of 27 cents.

Tesco (TESO +2.33%) slid over 3% in after-hours trading after it announced a public offering of 7 million shares of common stock.

Envision Healthcare (EVHC +1.66%) rose over 3% in after-hours trading after Dow Jones reported that the company was in merger talks with Amsung.

Team Health Holdings (TMH -0.10%) tumbled over 9% in after-hours trading after Dow Jones reported that a deal between AmSung, who was rumored to merge with Team Health, was said to be close to a deal to merge with Envision Healthcare.

Brinker International (EAT +1.58%) jumped 6% in after-hours trading after it said it sees fiscal 2017 comparable sales up +0.5% to +2.0%.

MARKET COMMENTS

June E-mini S&Ps (ESM16 -0.33%) this morning are down -7.00 points (-0.33%). Wednesday's closes: S&P 500 +0.33%, Dow Jones +0.37%, Nasdaq +0.17%. The S&P 500 index on Wednesday climbed to a 10-1/2 month high and closed higher on the unexpected +118,000 increase in U.S. Apr JOLTS job openings to 5.788 million, more than expectations for a decline of -82,000 to 5.675 million and matching the July 2015 record high. Stocks were also boosted by strength in energy and raw-material producers as commodity prices rallied with crude oil at a 10-1/2 month high and gold and silver at 3-week highs.

September 10-year T-note prices (ZNU16 +0.19%) this morning are up +6.5 ticks at a contract high. Wednesday's closes: TYU6 +2.50, FVU6 +2.00. Sep T-notes on Wednesday fell back from a 1-month high and closed lower on the rally in the S&P 500 to a 10-1/2 month high and on the unexpected increase in Apr JOLTS job openings to a record high. T-notes gained support from a rally in German bunds as the 10-year bund yield fell to a record low of 0.033% and from economic growth concerns after the World Bank cut its global 2016 GDP forecast.

The dollar index (DXY00 +0.32%) this morning is up +0.238 (+0.25%). EUR/USD (^EURUSD) is down -0.0053 (-0.47%). USD/JPY (^USDJPY) is down -0.47 (-0.44%) at a 1-month low. Wednesday's closes: Dollar Index -0.238 (-0.25%), EUR/USD +0.0037 (+0.33%), USD/JPY -0.38 (-0.35%). The dollar index on Wednesday fell to a 1-month low and closed lower on the World Bank's cut in its U.S. 2016 GDP forecast to 2.4% from 2.7% and on continued dollar bearishness after Fed Chair Yellen on Monday expressed concern about last Friday's payroll report and backed off her previous comment that a rate hike would be appropriate in "coming months."

July WTI crude oil (CLN16 -0.82%) this morning is down -40 cents (-0.78%). July gasoline (RBN16 -1.27%) is down -0.0201 (-1.24%). Wednesday's closes: CLN6 +0.87 (+1.73%), RBN6 +0.0327 (+2.06%). July crude oil and gasoline prices on Wednesday closed higher with July crude at a 10-1/2 month high. Crude oil prices were boosted by the slide in the dollar index to a 1-month low and by the -3.23 million bbl decline in EIA crude inventories, a bigger decline than expectations of -3.0 million bbl. Gasoline prices were undercut by the unexpected +1.01 million bbl increase in EIA gasoline stockpiles versus expectations for a -2.0 million bbl draw.

(Click on image to enlarge)

Disclosure: None.