Morning Call For June 29, 2015

OVERNIGHT MARKETS AND NEWS

September E-mini S&Ps (ESU15 -1.01%) are down sharply by -1.12% at a 1-1/2 month low and European stocks are down-3.75% at a 1-week low on concern Greece will be forced to leave the Eurozone. The 10-year German bund yield sank to a 3-1/2 week low of 0.705% on increased safe-haven demand for government bonds from the Greek turmoil. Greece closed banks until at least July 6 and imposed capital controls in an attempt to avert a run on its banks. Trading on the Athens Stock Exchange will be closed as well until Jul 6. The move follows a breakdown of talks Friday between Greece and its creditors and Greek Prime Minister Tsipras's surprise announcement that he will put creditors’ demands up for a referendum to the Greek people to vote on July 5. The ECB on Sunday froze the level of emergency funds available to Greek banks at Friday's level of 89 billion euros. Asian stocks closed sharply lower: Japan -2.88%, Hong Kong -2.61%, China -3.34%, Taiwan -6.73%, Australia -2.23%, Singapore -1.23%, South Korea -1.27%, India -0.60%. China's Shanghai Composite dropped % to a 2-3/4 month low, despite the cut in interest rates by the PBOC on Saturday for the fourth time since Nov.

Commodity prices are mixed. Aug crude oil (CLQ15 -2.23%) is down -2.38% at a 3-week low, Aug gasoline (RBQ15 -1.31%) is down -1.66%. Metals prices are mixed. Aug gold (GCQ15 +0.40%) is up +0.31%. Jul copper (HGN15 -0.55%) is down -0.81. Agricultural prices are higher with Jul wheat up +0.53% at a 5-3/4 month high.

The dollar index (DXY00 +0.16%) is up +0.10% at a 3-week high. EUR/USD (^EURUSD) is down -0.46% at a 3-1/2 week low. USD/JPY (^USDJPY) is down -0.82% at a 1-month low as the plunge in global equity markets boosts safe-haven demand for the yen.

Sep T-note prices (ZNU15 +0.75%) are up +1-05/32 points at a 3-1/2 week high.

The PBOC cut interest rates for the fourth time since Nov on Saturday when they lowered the 1-year lending rate by -25 bp to 4.85% and the 1-year deposit rate by 25 bp to 2.00%, and said reserve ratios for some lenders including city commercial and rural commercial banks will be cut by 50 bp.

U.S. STOCK PREVIEW

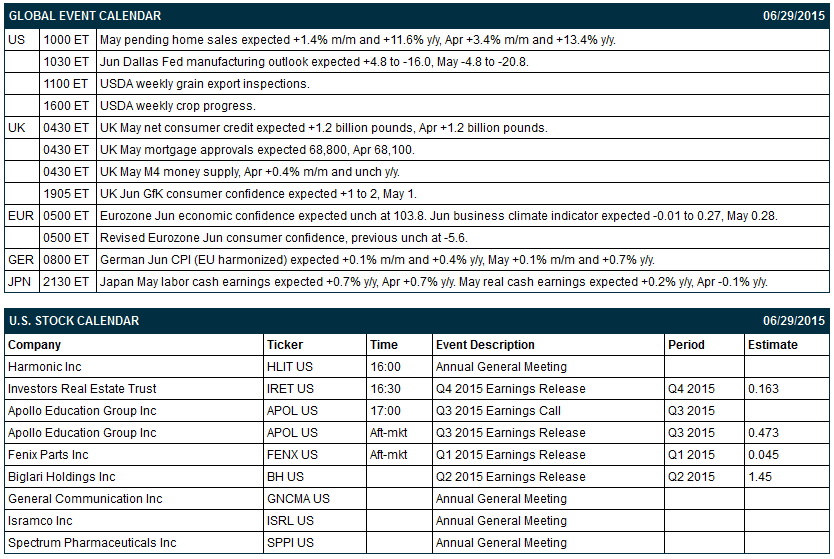

Key U.S. news today includes: (1) May pending home sales (expected +1.4% m/m and +11.6% y/y after April's +3.4% m/m and +13.4% y/y), and (2) Jun Dallas Fed manufacturing outlook (expected +4.8 to -16.0 after May's -4.8 to -20.8).

None of the Russell 1000 companies report earnings today.

U.S. IPO's scheduled to price today include: none.

Equity conferences this week include: Nasdaq Investor Program Conference on Tue

OVERNIGHT U.S. STOCK MOVERS

Qualcomm (QCOM -0.90%) was downgraded to 'Sell' from 'Hold' at Drexel Hamilton.

JPMorgan Chase (JPM +0.44%) downgraded to Perform from Outperform at Oppenheimer.

Ternium (TX -1.08%) was downgraded to 'Neutral' from 'Buy' at BofA/Merrill Lynch.

Tesla shares (TSLA -0.63%) have 'substantially' more upside, says Credit Suisse.

Synaptics (SYNA -3.90%) was upgraded to 'Outperform' from 'Perform' at Oppenheimer.

Chesapeake (CHK +0.45%) was upgraded to 'Buy' from 'Underperform' at Sterne Agee CRT.

Ryder (R -0.67%) and Old Dominion (ODFL -0.23%) were both upgraded to 'Buy' from 'Hold' at Stifel.

Macy's(M +0.98%) was downgraded to 'Sell' from 'Buy' at Deutsche Bank.

LifePoint (LPNT +0.59%) was upgraded to 'Buy' from 'Neutral' at Mizuho.

LinkedIn (LNKD -0.90%) filed to sell 3.57 million shares of Class A common stock for holders.

First Light Asset reported a 5.16% passive stake in Streamline Health (STRM +6.93%) .

J.B. Hunt (JBHT -0.12%) will replace Integrys Energy (TEG +0.70%) in the S&P 500 as of the close of trading on Tuesday, June 30.

MARKET COMMENTS

September E-mini S&Ps (ESU15 -1.01%) this morning are down -23.50 points (-1.12%) at a 1-1/2 month low. Friday's closes: S&P 500 -0.04%, Dow Jones +0.31%, Nasdaq -0.66%. The S&P 500 on Friday rebounded from a 1-week low and closed little changed. The main supportive factor was the +1.5 point increase in the final-June U.S. consumer sentiment index, better than expectations of unchanged at 94.6 and the highest level in 5 months. The main negative factor was the decline in tech stocks sparked by an -18% plunge in shares of Micron after it reported weaker-than-expected sales and earnings.

Sep 10-year T-notes (ZNU15 +0.75%) this morning are up +1-05/32 points at a 3-1/2 week high. Friday's closes: TYU5 -18.00, FVU5 -8.50. Sep 10-year T-note futures prices on Friday fell to a 9-month nearest-futures low and closed lower. The main bearish factor was the stronger-than-expected Jun University of Michigan U.S. consumer sentiment report, which bolstered the case for a Fed interest rate increase sooner rather than later.

The dollar index (DXY00 +0.16%) this morning is up +0.100 (+0.10%) at a 3-week high. EUR/USD (^EURUSD) is down -0.0051 (-0.4%) at a 3-week low. USD/JPY (^USDJPY) is down -1.01 (-0.82%) at a 1-month low. Friday's closes: Dollar Index +0.285 (+0.30%), EUR/USD -0.00413 (-0.37%), USD/JPY +0.204 (+0.17%). The dollar index on Friday rallied to a 2-week high and closed higher on (1) the larger-than-expected increase in the Jun U.S. consumer sentiment index to a 5-month high, and (2) weakness in EUR/USD which fell to a 2-week low as the unresolved Greek debt crisis increased the risk of a Greek default.

Aug WTI crude oil (CLQ15 -2.23%) this morning is down -$1.42 a brrrel (-2.38%) at a 3-week low. Aug gasoline (RBQ15 -1.31%) is down -0.0336 (-1.66%). Friday's closes: CLQ5 -0.07 (-0.12%), RBQ5 +0.0077 (+0.38%). Aug crude oil and gasoline settled mixed Friday with Aug crude at a 2-week low. Negative factors included the rally in the dollar index to a 2-week high and concern that the U.S. crude oil supply glut will persist with U.S. crude oil inventories 84 million bbl above the 5-year average for this time of year.

Click on picture to enlarge

Disclosure: None.