Morning Call For June 2, 2016

OVERNIGHT MARKETS AND NEWS

Jun E-mini S&Ps (ESM16 -0.11%) are down -0.07% and European stocks are up +0.30% ahead of today's ECB interest rate decision. No change in interest rates or additional stimulus is expected, although ECB President Draghi will unveil the ECB's latest economic and price-growth forecasts at a press conference following today's meeting. The markets are also focused on today's OPEC meeting in Vienna and tomorrow's monthly U.S. payrolls data. Asian stocks settled mixed: Japan -2.32%, Hong Kong +0.47%, China +0.40%, Taiwan -0.48%, Australia -0.83%, Singapore +0.16%, South Korea +0.25%, India +0.48%. Japan's Nikkei Stock Index dropped to a 1-week low as exporter stocks declined and led the overall market lower after USD/JPY tumbled to a 2-week low, which reduces the prospects for exporters' earnings.

The dollar index (DXY00 -0.16%) is down -0.16%. EUR/USD (^EURUSD) is up +0.10% at a 1-week high on expectations that the ECB will refrain from additional stimulus at today's policy meeting. USD/JPY (^USDJPY) is down -0.54% at a 2-week low after Japanese Prime Minister Abe said that a sales-tax increase will be postponed until 2019 from April 2017.

Sep T-note prices (ZNU16 +0.12%) are up +3 ticks.

In today's OPEC meeting in Vienna, Saudi Arabia proposed that OPEC restore a production target scrapped at the cartel's last meeting in December, although Iran opposes a production target as it wants to boost its oil production to pre-sanction levels. The odds of any cut in OPEC production are small after Iranian Oil Minister Bijan Namdar Zanganeh said "a general quota for OPEC with no country quota has no meaning."

U.S. STOCK PREVIEW

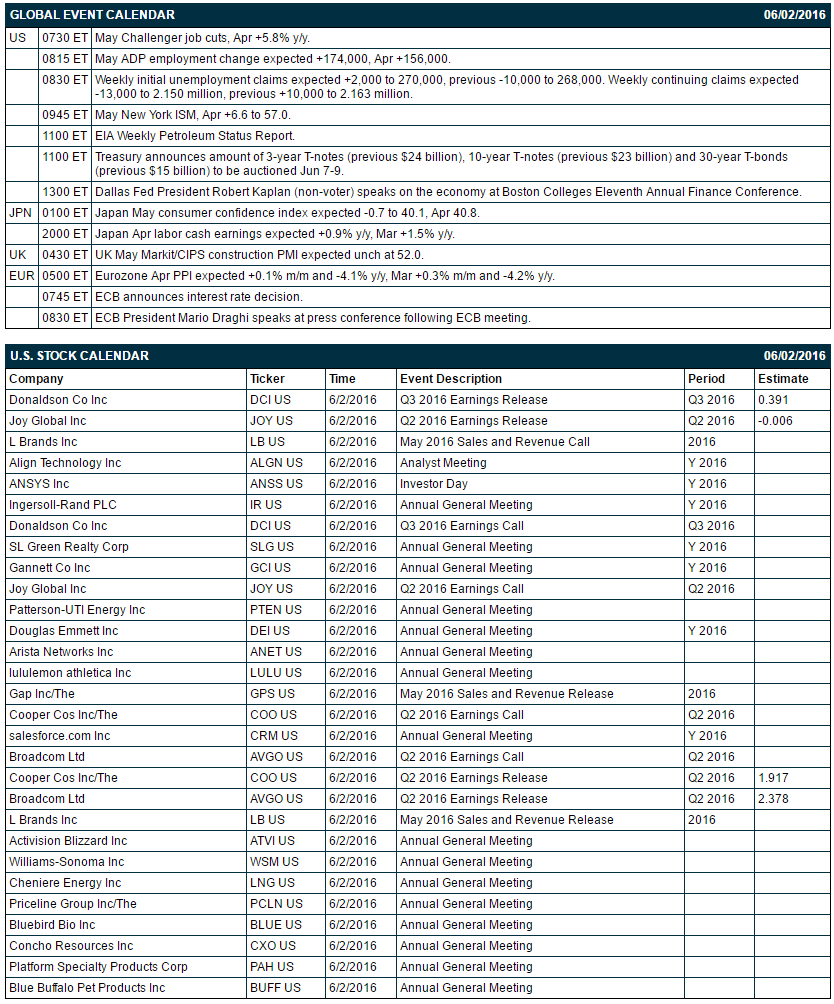

Key U.S. news today includes: (1) weekly MBA mortgage applications (previous +2.3% with purchase sub-index +4.8% and refi sub-index +0.4%), (2) revised-May Markit U.S. manufacturing PMI (expected unrevised at 50.5, preliminary-May -0.3 to 50.5), (3) May ISM manufacturing index (expected -0.5to 50.3, Apr -1.0 to 50.8), (4) Apr construction spending (expected +0.6%, Mar +0.3%), (5) Fed Beige Book, (6) May total vehicle sales (expected 17.30 million, Apr 17.32 million).

There are 4 of the Russell 1000 companies that report earnings today: Donaldson (consensus $0.39), Joy Global (-0.01), Cooper Cos (1.92), Broadcom (2.38).

U.S. IPO's scheduled to price today: Sensus Healthcare (SRTSU).

Equity conferences during the remainder of this week include: Bank of America Merrill Lynch Global Technology Conference on Wed-Thu, Cowen and Company Technology, Media & Telecom Conference on Wed-Thu, RBC Capital Markets Consumer & Retail Conference on Wed-Thu, Bernstein Strategic Decisions Conference on Wed-Fri, Credit Suisse Engineering & Construction Conference on Thu, Keefe, Bruyette & Woods Asset Management Conference on Thu, American Society of Clinical Oncology (ASCO) Meeting on Fri.

OVERNIGHT U.S. STOCK MOVERS

Oracle (ORCL +0.15%) is down over 2% in pre-market trading after a former senior finance manager said in a whistleblower lawsuit that she was instructed to add millions of dollars in accruals to cloud-service reports.

Exxon Mobile (XOM +0.25%) was downgraded to 'Neutral' from 'Buy' at Bank of America/Merrill Lynch.

Sally Beauty Holdings (SBH +2.40%) was upgraded to 'Market Perform' from 'Underperform' at Wells Fargo Securities.

Lending Tree (TREE +0.85%) was rated a new 'Buy' at Compass Point Research & Trading LLC with a 12-month price target of $100

Semtech (SMTC +3.53%) reported Q1 adjusted EPS of 30 cents, better than consensus of 28 cents.

Analogic (ALOG -0.61%) reported Q3 non-GAAP EPS of 80 cents, below consensus of 88 cents, although Q3 revenue of $128 million was better than consensus of $127.7 million.

Guidewire Software (GWRE +3.03%) gained over 3% in after-hours trading after it reported Q3 adjusted EPS of 14 cents, higher than consensus of 6 cents.

Box (BOX +1.99%) sank over 10% in pre-market trading after it reported Q1 billings up +9% y/y to $75.9 million, weaker than consensus of +20% y/y growth.

Ollie's Bargain Outlet Holdings (OLLI +4.55%) reported Q1 adjusted EPS of 29 cents, higher than consensus of 16 cents, and then raised its full-year EPS estimate to 85 cents-87 cents from an April 6 view of 83 cents-85 cents.

Weatherford International PLC (WFT -1.43%) slumped over 9% in after-hours trading after it said it plans a $1 billion bond offering to refinance its debt.

Fidelity & Guaranty Life (FGL -3.83%) slid over 3% in after-hours trading after China's Anbang Insurance Group pulled its offer to buy Fidelity.

Keryx Biopharmaceuticals (KERX -0.50%) rose over 4% in after-hours trading after Baupost Group reported a 42.5% stake in the company.

Dermira (DERM +0.82%) climbed nearly 5% in after-hours trading after it said it met 3 of 4 primary endpoints in two studies that showed its DRM04 drug for excessive underarm sweating showed statistically significant improvements.

MARKET COMMENTS

June E-mini S&Ps (ESM16 -0.11%) this morning are down -1.50 points (-0.07%). Wednesday's closes: S&P 500 +0.11%, Dow Jones +0.01%, Nasdaq-0.08%. The S&P 500 on Wednesday closed higher on the unexpected +0.5 point increase in the U.S. May ISM manufacturing index to 51.3 (stronger than expectations of -0.5 to 50.3) and the mostly upbeat Fed Beige Book that said the U.S. economy expanded at a "modest pace" across most of the country since mid-April. Stocks were undercut by the OECD's cut its U.S. 2016 GDP estimate to +1.8% from its Feb estimate of +2.0%. Stocks were also undercut by global growth concerns after the German May Markit/BME manufacturing PMI was revised lower to 52.1 from 52.4 and the China May manufacturing PMI was unchanged at 50.1.

September 10-year T-note prices (ZNU16 +0.12%) this morning are up +3 ticks. Wednesday's closes: TYU6 -4.50, FVU6 -4.75. Sep T-notes on Wednesday rallied to a 1-1/2 week high but fell back and closed lower. T-notes were undercut by the unexpected +0.5 point increase in the May ISM manufacturing index and by increased inflation concerns after the May ISM prices-paid sub-index rose +4.5 to a 4-3/4 year high of 63.5. T-notes were supported by the OECD's cut in its U.S. 2016 GDP forecast to +1.8% from +2.0% and by carryover support from a rally in German bunds to a 2-week high.

The dollar index (DXY00 -0.16%) this morning is down -0.156 (-0.16%). EUR/USD (^EURUSD) is up +0.0011 (+0.10%) at a 1-week high. USD/JPY (^USDJPY) is down -0.59 (-0.54%) at a 2-week low. Wednesday's closes: Dollar Index -0.436 (-0.45%), EUR/USD +0.0056 (+0.50%), USD/JPY -1.19(-1.07%). The dollar index on Wednesday closed lower on the tumble in USD/JPY to a 1-1/2 week low after Japanese Prime Minister Abe said he will postpone an increase in Japan’s sales tax, which fueled speculation the BOJ will delay expanding stimulus. In addition, there was strength in EUR/USD after the OECD raised its Eurozone 2016 GDP forecast to +1.6% from +1.4%.

July WTI crude oil (CLN16 -0.24%) this morning is up +5 cents (+0.10%). July gasoline (RBN16 +0.98%) is up +0.0194 (+1.20%). Wednesday's closes: CLN6 -0.09 (-0.18%), RBN6 +0.0019 (+0.12%). July crude oil and gasoline on Wednesday settled mixed. Crude oil prices were undercut by demand concerns after the OECD cut its U.S. 2016 GDP estimate to +1.8% from +2.0% and by expectations that OPEC members will be unable to agree on production cuts when the cartel meets on Thursday in Vienna. Crude oil prices found support on a weaker dollar and on expectations that Thursday's weekly EIA data will show that U.S. crude oil inventories fell by -2.5 million bbl.

Disclosure: None.