Morning Call For January 21, 2015

OVERNIGHT MARKETS AND NEWS

March E-mini S&Ps (ESH15 -0.38%) this morning are down -0.17% and European stocks are down -0.21% on reduced expectations that the ECB will announce a large-scale bond-buying program when it meets tomorrow after ECB Governing Council member Nowotny said "one should not get overexcited" about one policy meeting. Asian stocks closed mostly higher: Japan -0.49%, Hong Kong +1.68%, China +4.50%, Taiwan +0.74%, Australia +1.61%, Singapore +0.61%, South Korea +0.55%, India +0.36%. Commodity prices are mixed. Mar crude oil (CLH15 +0.52%) is up +0.45%. Mar gasoline (RBH15 +0.84%) is up +0.85%. Feb gold (GCG15 +0.43%) is up +0.22% at a 5-1/4 month high on speculation slowing global growth will prompt central banks to boost stimulus. Mar copper (HGH15 -2.35%) is down -1.83%. Agriculture prices are higher. The dollar index (DXY00 -0.36%) is down -0.34%. EUR/USD (^EURUSD) is up +0.23% on hawkish comments from ECB Governing Council member Nowotny. USD/JPY (^USDJPY) is down -1.06% after the BOJ failed to boost stimulus and retained its plan to increase the monetary base at an annual pace of 80 trillion yen. The BOJ, however, did cut its inflation forecast for the fiscal year starting in April to 1.0% from 1.7% previously. Mar T-note prices (ZNH15 +0.05%) are down -1tick.

The minutes of the Jan 7-8 BOE policy meeting showed that the two BOE policy makers who pushed for an interest rate increase dropped their call for rate hikes this month on the risk of "inflation persisting below the target for longer than previously expected."

UK Dec jobless claims fell -29,700, a larger decline than expectations of -25,000 and the biggest drop in 4 months. The Dec claimant count rate fell -0.1to 2.6%, right on expectations and the lowest in 6-1/2 years.

UK Nov avg weekly earnings rose +1.7% 3-mo avg, right on expectations. Nov avg weekly earnings ex-bonus rose +1.8% 3-mo avg, less than expectations of +1.9% 3-mo avg.

The UK Nov ILO unemployment rate fell -0.2 to 5.8% for the 3-months through Nov, a bigger decline than expectations of -0.1 to 5.9% and the lowest in 6-1/4 years.

The Japan Nov all-industry activity index unexpectedly rose for a third month as it gained +0.1% m/m, better than expectations of unch, while Oct was revised upward to +0.1% m/m from the originally reported -0.1% m/m.

U.S. STOCK PREVIEW

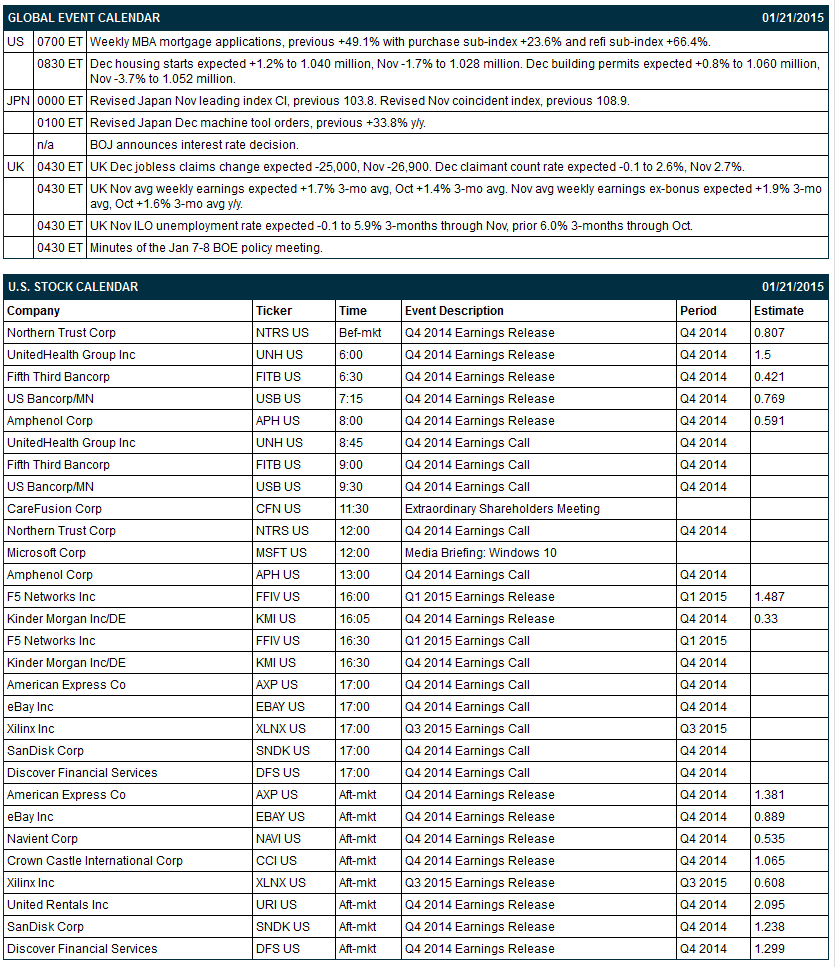

Today’s Dec housing starts report is expected to show a +1.2% increase to 1.040 million, reversing most of November’s -1.7% decline to 1.028 million. There are 15 the S&P 500 companies that report earnings today with notable reports including: American Express (consensus $1.38), Northern Trust (0.81), US Bancorp (0.77), eBay (0.89), Discover Financial (1.30). Equity conferences during the remainder of this week include: World Future Energy Summit 2015 Abu Dhabi Tue-Wed, CIBC Whistler Institutional Investor Conference on Wed.

OVERNIGHT U.S. STOCK MOVERS

Wal-Mart (WMT -0.09%) was downgraded to 'Equal Weight' from 'Overweight' at Morgan Stanley.

Whole Foods Market (WFM -0.29%) was upgraded to 'Buy' from 'Neutral' at Sterne Agee.

Lowe's (LOW -2.16%) was upgraded to 'Overweight' from 'Equal Weight' at Morgan Stanley.

Colgate-Palmolive (CL -0.30%) and McDermott (MDR -5.49%) were both downgraded to 'Neutral' from 'Buy' at UBS.

Exxon Mobil (XOM -0.03%) was upgraded to 'Outperform' from 'Market Perform' at Wells Fargo.

Fifth Third Bancorp (FITB -1.20%) reported Q4 EPS of 42 cents, right on consensus.

US Bancorp (USB -0.75%) reported Q4 EPS of 78 cents, higher than consensus of 77 cents.

UnitedHealth Group (UNH -0.14%) reported Q4 EPS of $1.55, better than consensus of $1.50

ING Group reported an 18.9% passive stake in Voya Financial (VOYA -0.87%) .

Advanced Micro Devices (AMD -6.28%) reported Q4 adjusted EPS of 0 cents, weaker than consensus of 1 cent.

Woodward (WWD +0.57%) reported Q1 EPS of 66 cents, well above consensus of 46 cents.

Celestica (CLS -0.88%) reported Q4 adjusted EPS of 23 cents, less than consensus of 24 cents.

International Business Machines (IBM -0.12%) fell over 2% in after-hours trading after it reported Q4 EPS of $5.81, higher than consensus of $5.41, but then lowered guidance on fiscal 2015 EPS to $15.75-$16.50, below consensus of $16.53.

Netflix (NFLX +3.40%) jumped over 15% in after-hours trading after it reported Q4 EPS of 72 cents, well above consensus of 45 cents.

Cree (CREE +4.66%) climbed nearly 4% in after-hours trading after it reported Q2 EPS of 33 cents, much better than consensus of 22 cents.

MARKET COMMENTS

Mar E-mini S&Ps (ESH15 -0.38%) this morning are down -3.50 points (-0.17%). The S&P 500 index on Tuesday closed slightly higher: S&P 500 +0.15%, Dow Jones +0.02%, Nasdaq +0.70%. Bullish factors included (1) reduced Chinese growth concerns after the Chinese Q4 GDP report of +7.3% y/y was slightly stronger than expectations of +7.2% y/y, and (2) a rally in technology stocks. Bearish factors included (1) global economic concerns after the IMF cut its 2015 global GDP forecast to +3.5% from an Oct estimate of +3.8%, and (2) weakness in homebuilder stocks after the U.S. Jan NAHB housing market index fell -1 from Dec to 57, weaker than expectations of +1 to 58.

Mar 10-year T-notes (ZNH15 +0.05%) this morning are down -1 tick. Mar 10-year T-note futures prices on Tuesday closed little changed. Closes: TYH5 unch, FVH5 -1.50. Bullish factors included (1) global growth concerns after the IMF cut its 2015 global GDP forecast, and (2) carry-over support from rallies in European government bonds on expectations for the ECB to announce sovereign debt purchases on Thursday. T-notes fell back from their best levels after stocks recovered from early losses and closed higher.

The dollar index (DXY00 -0.36%) this morning is down -0.319 (-0.34%). EUR/USD (^EURUSD) is up +0.0026 (+0.23%). USD/JPY (^USDJPY) is down-1.26 (-1.06%). The dollar index on Tuesday closed higher: Dollar index +0.526 (+0.57%), EUR/USD -0.00221 (-0.19%), USD/JPY +1.2629 (+1.07%). Bullish factors included (1) weakness in EUR/USD on the prospects for the ECB to announce QE when it meets Thursday, and (2) strength in USD/JPY after China Q4 GDP expanded more than forecast, which reduced safe-haven demand for the yen.

Mar WTI crude oil (CLH15 +0.52%) this morning is up +21 cents (+0.45%) and Mar gasoline (RBH15 +0.84%) is up +0.0114 (+0.85%). Mar crude oil and Mar gasoline on Tuesday closed sharply lower: CLH5 -2.66 (-5.41%), RBH5 -0.0460 (-3.31%). Negative factors included (1) a stronger dollar, (2) the IMF’s cut in its 2015 global GDP estimate, which signals reduced energy demand, and (3) global oversupply concerns after Iraqi Oil Minister Adel Abdul Mahdi said Iraq is pumping a record 4 million barrels of crude a day.

Click on picture to enlarge

Disclosure: None.