Morning Call For January 16, 2015

OVERNIGHT MARKETS AND NEWS

March E-mini S&Ps (ESH15 -0.54%) this morning are down -0.15% at a 4-week low and European stocks shed losses and are up +0.55% after comments from ECB Executive Board member Coeure bolstered speculation the ECB will embark on a program of buying sovereign debt at its meeting next Thursday. The fallout from Thursday's surprise move by the Swiss National Bank (SNB) to abandon its currency cap led to huge losses in the forex market with New Zealand's Global Brokers NZ Ltd. saying that losses from the franc's surge are forcing it to shut down and British broker Alpari Ltd. said it "entered into insolvency." Also, FXCM Inc., the largest U.S. retail foreign-exchange broker, said clients owe $225 million on their accounts and threaten the firm's compliance with capital rules. Asian stocks closed mostly lower: Japan -1.43%, Hong Kong -1.02%, China +0.86%, Taiwan -0.29%, Australia -0.60%, Singapore -1.14%, South Korea -1.44%, India +0.17%. Japan's Nikkei Stock Index dropped to a 2-1/2 month low after the SNB's unexpected scrapping of its currency cap prompted investors to avert risk and dump stocks. Chinese stocks bucked the trend and rallied on speculation the PBOC will soon cut reserve-requirement ratios. Commodity prices are mixed. Feb crude oil (CLG15 +2.21%) is up +2.72%. Feb gasoline (RBG15+1.47%) is up +2.20%. Feb gold (GCG15 -0.17%) is down -0.37%. Mar copper (HGH15 -0.23%) is unch. Agriculture prices are higher. The dollar index (DXY00 +0.16%) is up +0.13%. EUR/USD (^EURUSD) is down -0.40%. USD/JPY (^USDJPY) is up +0.46%. Mar T-note prices (ZNH15 +0.28%) are up +8 ticks.

In a sign that the ECB will implement quantitative easing at next Thursday's policy meeting, ECB Executive Board member Coeure said that for QE to be efficient "it would have to be big" and that "we will take into account the American and British experiences to determine the amounts of bonds to buy."

Eurozone Dec CPI fell -0.1% m/m, right on expectations and the third consecutive month of declines. Dec CPI of -0.2% y/y was left unrevised, although Dec core CPI was revised lower to +0.7% y/y from the originally reported +0.8% y/y and matched the slowest pace of increase since data began in 1997.

Eurozone Dec new car registrations rose +4.7% y/y to 951,000, the sixteenth consecutive month registrations have increased.

The Japan Nov tertiary industry index rose +0.2% m/m, right on expectations, although Oct was revised upward to -0.1% m/m from the originally reported -0.2% m/m.

U.S. STOCK PREVIEW

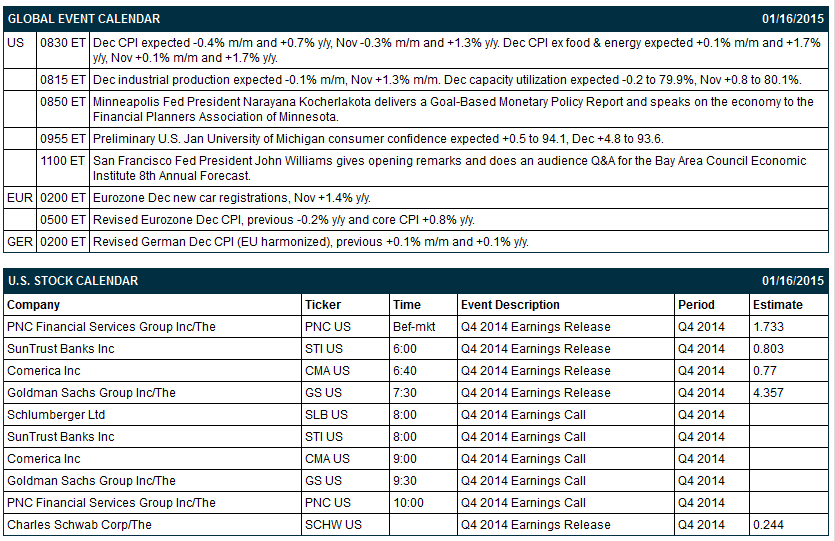

Today’s early-Jan U.S. consumer confidence index from the University of Michigan is expected to show a +0.5 point increase to 94.1, adding to December’s +4.8 point rise to an 8-year high of 93.6. Today’s Dec CPI is expected to drop to +0.7% y/y from Nov’s +1.3% due to the plunge in oil and gasoline prices. Today’s Dec core CPI is expected to be unchanged from November at +1.7% y/y. Today’s Dec industrial production report is expected to show a small decline of -0.1% m/m, stalling after November’s sharp increase of +1.3% m/m. There are 5 the S&P 500 companies that report earnings today: Goldman Sachs (consensus $4.36), Schwab (0.24), Comerica (0.77), SunTrust Banks (0.80), PNC Financial (1.73). Equity conferences today include: Biomarkers from Research to Clinic Conference on Fri.

OVERNIGHT U.S. STOCK MOVERS

Starwood (HOT -1.00%) was downgraded to 'Neutral' from 'Buy' at BofA/Merrill Lynch.

Gap (GPS -2.37%) was downgraded to 'Neutral' from 'Overweight' at Atlantic Equities.

CSX (CSX +1.37%) was upgraded to 'Positive' from 'Neutral' at Susquehanna.

PNC Financial Services Group (PNC -0.70%) reported Q4 EPS of $1.84, stronger than consensus of $1.73.

Family Dollar (FDO -1.52%) was downgraded to 'Hold' from 'Buy' at Jefferies.

Comerica (CMA -1.09%) reported Q4 EPS of 82 cents, better than consensus of 77 cents.

SunTrust Banks (STI -1.77%) reported Q4 EPS of 88 cents, higher than consensus of 80 cents.

The WSJ reported that British Petroleum (BP +0.17%) may pay up to $13.7 billion in fines for the 2010 Deepwater Horizon Gulf spill case.

Time Warner (TWX +0.04%) was downgraded to 'Hold' from 'Buy' at Stifel.

Viacom (VIAB -1.95%) was initiated with a 'Buy' at Stifel with a price target of $89.

21st Century Fox (FOXA -0.77%) was initiated with a 'Buy' at Stifel with a price target of $41.

GrubHub (GRUB -1.98%) was initiated with a 'Buy' at Stifel with a price target of $46.

Target (TGT +1.80%) was upgraded to 'Neutral' from 'Underperform' at BofA/Merrill Lynch.

Schlumberger (SLB -2.25%) reported Q4 adjusted EPS of $1.50, higher than consensus of $1.46, although Q4 revenue of $12.6 billion was less than consensus of $12.72 billion. Schlumberger then said it plans to cut 9,000 jobs in 2015.

Roundy's (RNDY -5.29%) lowered guidance on Q1 EPS to -5 cents to zero, weaker than consensus of 3 cents, and then cut guidance on full-year fiscal 2015 EPS to a loss of -18 cents to -7 cents, well below consensus of 6 cents.

Intel (INTC -0.44%) reported Q4 EPS of 74 cents, better than consensus of 66 cents, but then said Q1 revenue would be $13.7 billion, plus or minus $500 million, which is less than consensus of $13.77 billion.

MARKET COMMENTS

Mar E-mini S&Ps (ESH15 -0.54%) this morning are down -3.00 points (-0.15%) and posted a 4-week low. The S&P 500 index on Thursday closed lower: S&P 500 -0.92%, Dow Jones -0.61%, Nasdaq -1.36%. Bearish factors included (1) the unexpected +19,000 increase in U.S. weekly unemployment claims to a 4-month high of 316,000, more than expectations for a -4,000 decline to 290,000, (2) the -18.0 point plunge in the Jan Philadelphia Fed business outlook survey to 6.3, weaker than expectations of -5.8 to 18.7 and the lowest in 11 months, and (3) a slide in U.S. bank stocks after Citigroup, Bank of America and JPMorgan Chase reported the worst combined quarterly trading revenue since 2011.

Mar 10-year T-notes (ZNH15 +0.28%) this morning are up +8 ticks. Mar 10-year T-note futures prices on Thursday posted a new contract high and closed higher. Closes: TYH5 +18.50, FVH5 +12.50. Bullish factors included (1) the end of the Swiss National Bank’s exchange-rate cap against the euro, which roiled global stock and currency markets and boosted safe-haven demand for T-notes, (2) the unexpected increase in U.S. weekly jobless claims to a 4-month high, and (3) the larger-than-expected decline in the Jan Philadelphia Fed business outlook survey to an 11-month low.

The dollar index (DXY00 +0.16%) this morning is up +0.119 (+0.13%). EUR/USD (^EURUSD) is down -0.0046 (-0.40%). USD/JPY (^USDJPY) is up +0.53 (+0.46%). The dollar index on Thursday surged to an 11-year high and closed higher: Dollar index +0.191 (+0.21%), EUR/USD -0.01586(-1.35%), USD/JPY -1.17 (-1.00%). Bullish factors included (1) the plunge in EUR/USD to an 11-year low after the Swiss National Bank ended its 3-year minimum exchange rate of 1.20 franc per euro, and (2) improved dollar interest rate differentials versus the euro on expectations for the ECB to announce QE when it meets next Thursday.

Feb WTI crude oil (CLG15 +2.21%) this morning is up +$1.26 a barrel (+2.72%) and Feb gasoline (RBG15 +1.47%) is up +0.0286 (+2.20%). Feb crude oil and Feb gasoline on Thursday climbed to 1-week highs but relinquished their gains and closed lower: CLG5 -2.23 (-4.60%), RBG5 -0.0512 (-3.79%). Bearish factors included (1) the rally in the dollar index to an 11-year high, (2) OPEC’s cut in its 2015 global demand forecast for its crude to 28.8 million bpd, -100,000 bpd less than last month’s forecast.

Disclosure: None.