Morning Call For January 12, 2015

OVERNIGHT MARKETS AND NEWS

March E-mini S&Ps (ESH15 +0.55%) this morning are up +0.57% and European stocks are up +1.62% as health-care companies rallied on increased M&A activity and promising drug-test results from Bristol-Myers Squibb. Also, Greek sovereign debt concerns eased and pushed the Greek 10-year bond yield down to a 1-week low and gave a boost to European stocks after Syriza leader Tsipras said that a government led by his party would repay Greek debt maturing in March and keep Greece in the Eurozone. Asian stocks closed mixed: Japan closed for holiday, Hong Kong +1.45%, China-0.93%, Taiwan -0.40%, Australia -0.78%, Singapore +0.19%, South Korea -0.14%, India +0.46%. China's Shanghai Stock Index slipped to a 1-week low amid concern the recent rally in Chinese equities to a 5-1/3 year high has been excessive relative to the outlook for the economy. Commodity prices are mixed. Feb crude oil (CLG15 -2.52%) is down -2.40%. Feb gasoline (RBG15 -1.56%) is down -1.36%. Feb gold (GCG15 +0.30%) is up % at a 1-month high on speculation that Friday's weaker-than-expected wage growth will prompt the Fed to go slow in raising interest rates. Mar copper (HGH15-0.44%) is down -0.31%. Agriculture prices are mixed ahead of this morning's USDA monthly WASDE crop production report. The dollar index (DXY00+0.38%) is up +0.32%. EUR/USD (^EURUSD) is down -0.34%. USD/JPY (^USDJPY) is up +0.57%. Mar T-note prices (ZNH15 -0.01%) are up +2 ticks.

A couple of ECB members expressed differing views over the weekend on whether the ECB should begin quantitative easing after ECB Executive Board member Lautenschlage said in an interview with Der Spiegel that conditions were not yet grave enough to warrant government bond purchases, while Bank of Italy Governor and fellow ECB member Visco said in an interview with Welt am Sonntag that there was a threat of deflation and that government bond purchases would be the most effective tool to combat it.

The UK Dec Lloyds employment confidence fell -3 to -2 and matched the lowest level in 9 months.

U.S. STOCK PREVIEW

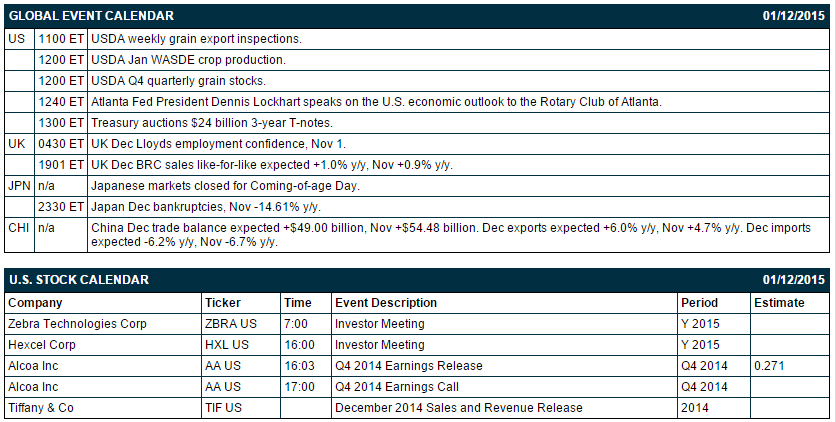

The Treasury today will sell $24 billion of 3-year T-notes. There is one of the Russell 1000 companies that reports earnings today: Alcoa (consensus $0.27). Equity conferences this week include: JP Morgan Health Care Conference on Mon-Wed, Needham Growth Conference on Tue, Deutsche Bank Global Auto Industry Conference on Tue-Wed, and Biomarkers from Research to Clinic Conference on Fri.

OVERNIGHT U.S. STOCK MOVERS

Alcoa (AA +1.32%) was upgraded to Buy from Neutral at Nomura.

Bristol-Myers Squibb (BMY -0.66%) climbed nearly 6% in pre-market trading after it said its Opdivo treatment showed better overall survival rates compared with docetaxel, a form of chemotherapy, in a study of patients with a type of lung cancer.

NPS Pharmaceuticals (NPSP -2.35%) jumped nearly 9% in pre-market trading after Shire Plc agreed to buy the drug maker for about $5.2 billion.

D.R. Horton (DHI +0.50%) was downgraded to 'Neutral' from 'Overweight' at JPMorgan Chase.

Barron's says that Regeneron (REGN +1.93%) has 25% upside potential.

Select Medical (SEM +7.65%) fell 4% in after-hours trading after it lowered guidance on fiscal 2015 diluted EPS to 84 cents-90 cents, well below consensus of 98 cents.

BlackRock reported a 12.3% passive stake in Symmetry Surgical (SSRG -2.45%) .

BlackRock reported a 10.2% passive stake in Orbitz (OWW +0.92%) .

Brown Brothers Harriman reported a 5.05% passive stake in Southwestern Energy (SWN -1.56%) .

Baupost Group reported a 10.01% passive stake in Cheniere Energy (LNG +1.49%) .

Fitch Ratings downgraded Russia's long-term foreign and local currency Issuer Default Ratings to 'BBB-' from 'BBB' with a negative outlook.

Ameriprise Financial reported a 10.6% passive stake in Mattson (MTSN unch) .

Burlington Stores (BURL -1.52%) rose 4% in after-hours trading after it raised guidance on Q4 adjusted EPS to $1.30-$1.32 from $1.25-$1.28, higher than consensus of $1.28, and also raised guidance on full year fiscal 2014 EPS view to $1.70-$1.72 from $1.65-$1.67, better than consensus of $1.68.

MARKET COMMENTS

Mar E-mini S&Ps (ESH15 +0.55%) this morning are up +11.50 points (+0.57%). The S&P 500 index on Friday closed lower: S&P 500 -0.84%, Dow Jones -0.95%, Nasdaq -0.64%. Bearish factors included (1) concern about the sustainability of the U.S. recovery after Dec avg hourly earnings unexpectedly fell -0.2% m/m, weaker than expectations of +0.2% m/m and the biggest decline since comparable records began in 2006, and (2) negative carry-over from a slide in European stocks on concern the ECB won’t be aggressive in expanding stimulus.

Mar 10-year T-notes (ZNH15 -0.01%) this morning are up +2 ticks. Mar 10-year T-note futures prices on Friday closed higher. Closes: TYH5 +15.00, FVH5 +9.00. Supportive factors included (1) speculation the Fed may delay any interest rate increase after U.S. Dec avg hourly earnings unexpectedly declined, and (2) increased safe-haven demand for Treasuries as stocks sold off.

The dollar index (DXY00 +0.38%) this morning is up +0.294 (+0.32%). EUR/USD (^EURUSD) is down -0.0040 (-0.34%). USD/JPY (^USDJPY) is up +0.68 (+0.57%). The dollar index on Friday closed lower: Dollar index -0.43 (-0.47%), EUR/USD +0.00496 (+0.42%), USD/JPY -1.126 (-0.94%). Bearish factors for the dollar included (1) the unexpected decline in U.S. Dec avg hourly earnings, which bolstered speculation the Fed will be in no hurry to raise interest rates, and (2) strength in EUR/USD on speculation the ECB may not expand stimulus at the Jan 22 policy meeting after ECB Governing Council member Hansson said current stimulus measures haven’t had time to work.

Feb WTI crude oil (CLG15 -2.52%) this morning is down -$1.16 a barrel (-2.40%) and Feb gasoline (RBG15 -1.56%) is down -0.0180 (-1.36%). Feb crude oil and Feb gasoline on Friday closed lower with Feb gasoline at a 5-3/4 year low: CLG5 -0.43 (-0.88%), RBG5 -0.0149 (-1.11%). Bearish factors included (1) speculation that OPEC will refrain from cutting oil production after the U.A.E ambassador to the U.S. said that the U.A.E. has no plans to reduce output no matter how low oil prices drop, and (2) the unexpected declines in German and UK Nov industrial production, a sign of weaker energy demand.

Disclosure: None.