Morning Call For February 5, 2015

OVERNIGHT MARKETS AND NEWS

March E-mini S&Ps (ESH15 +0.69%) this morning are up +0.44% on favorable stock earnings results, while European stocks are down -0.86%, led by a plunge in Greek bank stocks, after the ECB late yesterday restricted direct access to funding lines for Greek lenders. The ECB said it will no longer accept junk-rated collateral from Greece, citing doubt over the new government's commitment to previous reform pledges. Greek government bonds sank and Greece's ASE Stock Index tumbled over 5% as the ECB's decision will raise financing costs for Greek banks and adds pressure to the newly elected government to moderate its policies or risk sterner measures that may jeopardize its membership within the Eurozone. As expected, the BOE today kept its benchmark interest rate unchanged at 0.50% and maintained its asset purchase target at 375 billion pounds. Asian stocks closed mostly lower: Japan -0.98%, Hong Kong +0.35%, China -1.02%, Taiwan -0.02%, Australia +0.58%, Singapore -0.32%, South Korea -0.72%, India -0.11%. Commodity prices are mixed. Mar crude oil (CLH15 +1.53%) is up +0.39% and Mar gasoline (RBH15 +1.13%) is up +0.71%. Apr gold (GCJ15 -0.20%) is down -0.31%. Mar copper (HGH15 -2.03%) is down -1.95%. Agriculture prices are higher. The dollar index (DXY00 -0.07%) is down -0.07%. EUR/USD (^EURUSD) is up +0.68%. USD/JPY (^USDJPY) is up +0.08%. Mar T-note prices (ZNH15 +0.07%) are up +4 ticks.

The European Commission raised its Eurozone 2015 GDP estimate to 1.3% from a +1.1% projection in Nov, and lowered its 2015 CPI forecast to -0.1%from a Nov estimate of +0.8%, marking the first annual decline in consumer prices since the introduction of the euro in 1999.

German Dec factory orders jumped +4.2% m/m and +3.4% y/y, much better than expectations of +1.5% m/m and +0.7% y/y and the biggest increase in 5 months.

Boston Fed President Rosengren, speaking at an event in Germany, said "There is insufficient evidence that U.S. inflation is clearly trending toward the 2% goal" and that "a policy of patience in the U.S. continues to be appropriate."

UK Jan Halifax house prices rose +2.0% m/m, better than expectations of unch m/m and the biggest increase in 8 months.

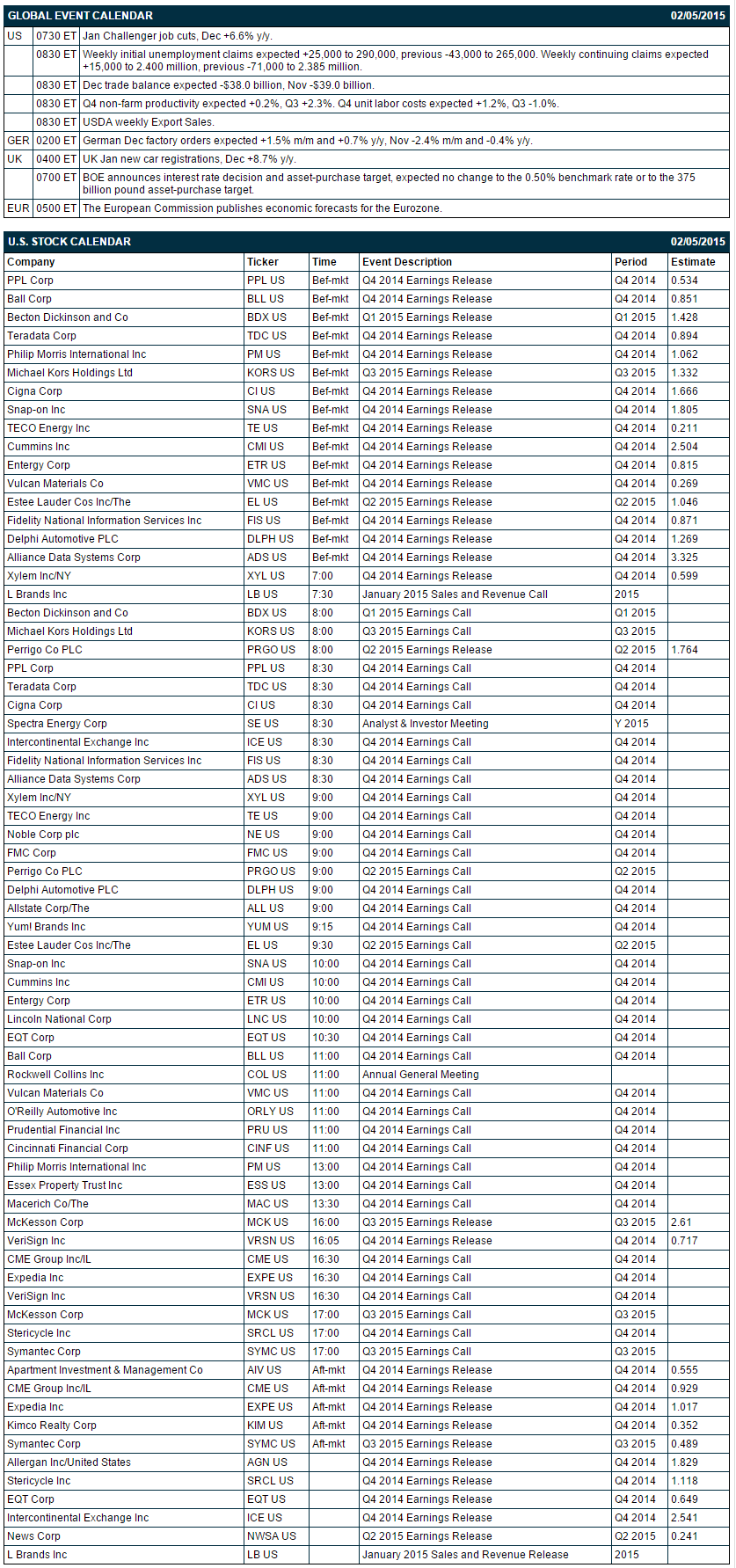

U.S. STOCK PREVIEW

Today’s initial claims report is expected to show a +25,000 increase to 290,000 and the continuing claims report is expected to show an increase of +15,000 to 2.400 million. Today’s Dec U.S. trade deficit is expected to narrow mildly to -$38.0 billion from -$39.0 billion in November. Today’s Q4 non-farm productivity report is expected to show an increase of +0.2%, down from +2.3% in Q3. Q4 unit labor costs are expected to rise to +1.2% from -1.0%in Q3.

There are 70 of the S&P 500 companies that report earnings today: PPL Corp. (consensus $0.53), Ball Corp. (0.85), Becton Dickinson (1.43), Teradata (0.89), Philip Morris International (1.06), Michael Kors Holdings Ltd. (1.33), Cigna (1.67), Snap-on (1.81), TECO Energy (0.21), Cummins (2.50). Equity conferences this week include: Media Insights & Engagement Conference on Tue-Thu, Cowen and Company Aerospace/Defense Conference & Transport Forum on Wed-Thu.

OVERNIGHT U.S. STOCK MOVERS

Cigna (CI +1.29%) reported Q4 EPS of $1.69, more than consensus of $1.67.

O'Reilly Automotive (ORLY -0.29%) reported Q4 EPS of $1.76, better than consensus of $1.68.

Ralph Lauren (RL -18.22%) was downgraded to 'Neutral' from 'Buy' at Citigroup.

Lincoln National (LNC -0.02%) reported Q4 operating EPS of $1.67, above consensus of $1.48.

Under Armour (UA +1.02%) reported Q4 EPS of 40 cents, more than consensus of 39 cents.

Con-way (CNW -1.58%) reported Q4 adjusted EPS of 41 cents, less than consensus of 45 cents.

Hub Group (HUBG -1.05%) reported Q4 EPS ex-items of 41 cents, better than consensus of 38 cents.

Yum! Brands (YUM +0.05%) reported Q4 EPS ex-items of 61 cents, weaker than consensus of 66 cents.

Genpact (G unch) reported Q4 EPS of 26 cents, more than consensus of 24 cents.

Cincinnati Financial (CINF +0.71%) reported Q4 EPS of $1.02, higher than consensus of 85 cents.

Prudential (PRU -0.25%) fell 3% in after-hours trading after it reported Q4 adjusted EPS of $2.12, below consensus of $2.38.

Allstate (ALL +0.76%) reported Q4 EPS of $1.72, more than consensus of $1.68, and then announced a $3 billion stock buyback program.

21st Century Fox (FOXA +0.17%) reported Q2 EPS ex-items of 53 cents, higher than consensus of 42 cents.

Fortune Brands (FBHS +0.19%) reported Q4 EPS of 44 cents, below consensus of 51 cents, and then lowered guidance on fiscal 2015 EPS to $2.00-$2.10, well below consensus of $2.32.

Spectrum Brands (SPB +0.89%) reported Q1 EPS of $1.07, less than consensus of $1.08.

Keurig Green Mountain (GMCR -3.88%) fell 7% in after-hours trading after it reported Q1 EPS of 88 cents, below consensus of 89 cents, and then loweed guidance on Q2 EPS to $1.00-$1.05, weaker than consensus of $1.18.

MARKET COMMENTS

Mar E-mini S&Ps (ESH15 +0.69%) this morning are up +9.00 points (+0.44%). The S&P 500 index on Wednesday retreated from a 1-week high and closed lower: S&P 500 -0.42%, Dow Jones +0.04%, Nasdaq -0.19%. Bearish factors included (1) a slide in energy producers after the price of crude declined, and (2) the action by the ECB to lift a waiver on Greek government debt as collateral, which may lead to a cash crunch in Greece and its exit from the Eurozone. Bullish factors included (1) the action by the PBOC to cut the reserve requirement ratio of Chinese banks by 50 bp, which may boost liquidity and stimulate Chinese economic growth, and (2) the +0.2 point increase in the Jan ISM non-manufacturing index to 56.7, higher than expectations of 56.4.

Mar 10-year T-notes (ZNH15 +0.07%) this morning are up +4 ticks. Mar 10-year T-note futures prices on Wednesday closed lower. Closes: TYH5 -2.00, FVH5 -1.50. Bearish factors included (1) the stronger-than-expected Jan ISM non-manufacturing index, and (2) a rally in the S&P 500 to a 1-week high, which reduced safe-haven demand for T-notes. T-notes recovered from their worst levels on increased safe-haven demand after stocks plunge when the ECB dropped a waiver that allowed Greece to use government debt as collateral.

The dollar index (DXY00 -0.07%) this morning is down -0.062 (-0.07%). EUR/USD (^EURUSD) is up +0.0077 (+0.68%). USD/JPY (^USDJPY) is up +0.09 (+0.08%). The dollar index on Wednesday closed higher: Dollar index +0.386 (+0.41%), EUR/USD -0.0135 (-1.18%), USD/JPY -0.258 (-0.25%). Bullish factors included (1) the stronger-than-expected Jan ISM non-manufacturing index, which may keep the Fed on a path to raising interest rates, and (2) weakness in in EUR/USD on Greek sovereign debt concerns after the ECB dropped a waiver that allowed Greece to use government debt as collateral.

Mar WTI crude oil (CLH15 +1.53%) this morning is up +19 cents (+0.39%) and Mar gasoline (RBH15 +1.13%) is up +0.0105 (+0.71%). Mar crude oil and Mar gasoline on Wednesday closed sharply lower: CLH5 -4.60 (-8.67%), RBH5 -0.1196 (-7.47%). Bearish factors included (1) the +6.33 million bbl increase in weekly EIA crude inventories to a record 413.06 million bbl, more than double expectations of a +3.0 million bbl build, (2) the unexpected +2.34 million bbl increase in EIA gasoline stockpiles, more than expectations of a -1.0 million bbl draw, and (3) the +2.5 million bbl increase in crude supplies at Cushing, OK, delivery point of WTI futures, to a 1-year high of 41.38 million bbl.

Disclosure: None.