Morning Call For February 4, 2016

OVERNIGHT MARKETS AND NEWS

March E-mini S&Ps (ESH16 +0.01%) are up +0.14% and European stocks are up 0.63% as a selloff in the dollar index to a 3-month low underpins crude oil and metal prices and fuels a rally in energy and commodity producer stocks. Gains in European stocks were limited as automakers retreated, led by a nearly 4% decline in Daimler AG, after the automaker said growth will slow down in 2016 with only "slight' gains in revenue and earnings. As expected, the BOE kept its benchmark rate unchanged at 0.50% and maintained its asset purchase target at 375 billion pounds. Asian stocks settled mostly higher: Japan -0.85%, Hong Kong +1.01%, China +1.53%, Taiwan closed for holiday, Australia +2.12%, Singapore +0.30%, South Korea +1.72%, India +0.48%. Japan's Nikkei index closed lower as export stocks sold off after a rally in the yen to a 2-week high against the dollar reduced the earnings prospects of exporters.

The dollar index (DXY00 -0.60%) is down -0.54% at a 3-month low. EUR/USD (^EURUSD) is up +0.64% at a 3-1/4 month high. USD/JPY (^USDJPY) is down -0.23%.

Mar T-note prices (ZNH16 -0.07%) are down -3 ticks.

The European Commission cut its Eurozone 2016 GDP forecast to 1.7% from a Nov projection of 1.8% and slashed its Eurozone 2016 CPI estimate to 0.5% from a Nov forecast of 1.0%.

U.S. STOCK PREVIEW

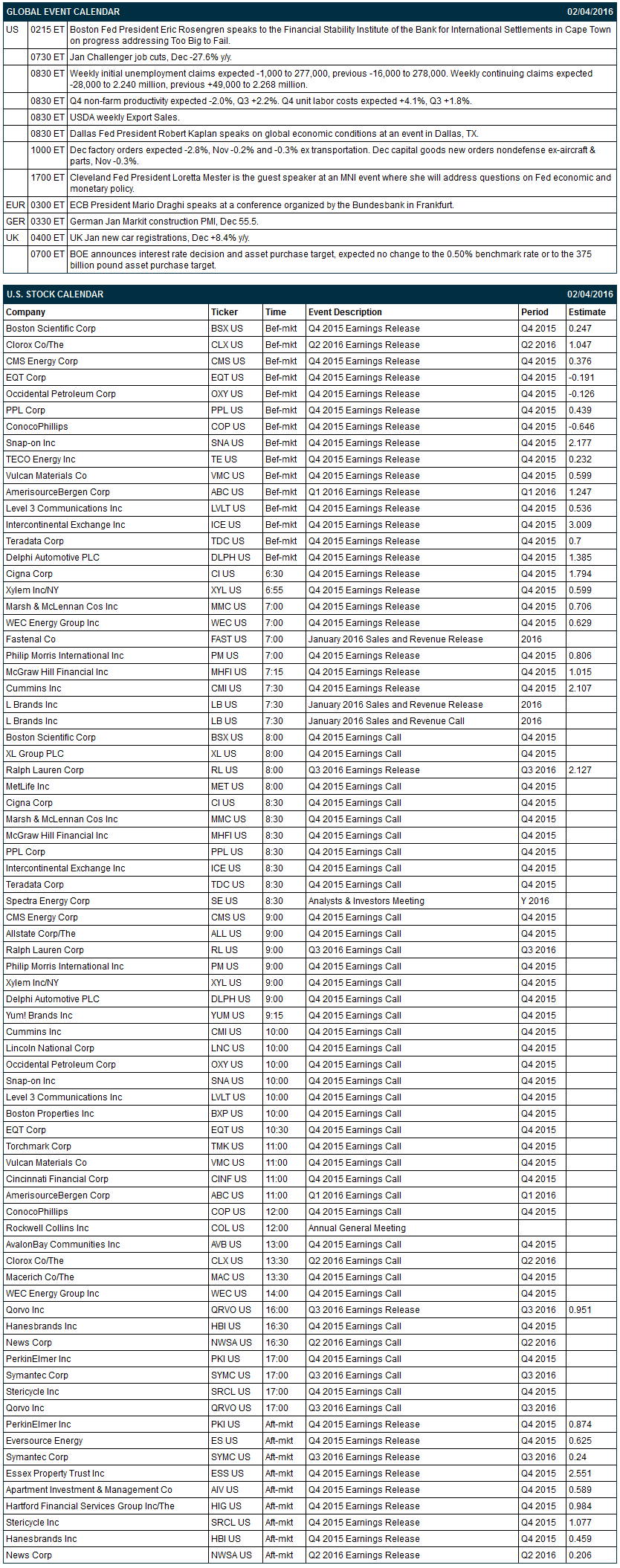

Key U.S. news today includes: (1) Boston Fed President Eric Rosengren's speech to the Financial Stability Institute of the Bank for International Settlements in Cape Town on progress addressing “Too Big to Fail,” (2) Jan Challenger job cuts (Dec -27.6% y/y), (3) weekly initial unemployment claims (expected -1,000 to 277,000, previous -16,000 to 278,000) and continuing claims (expected -28,000 to 2.240 million, previous +49,000 to 2.268 million), (4) Q4 non-farm productivity (expected -2.0%, Q3 +2.2%. Q4 unit labor costs expected +4.1%, Q3 +1.8%), (5) Dallas Fed President Robert Kaplan's speech on global economic conditions at an event in Dallas, TX, (6) Dec factory orders (expected -2.8%, Nov -0.2% and -0.3% ex transportation), and (7) Cleveland Fed President Loretta Mester's speech at an MNI event where she will address questions on Fed economic and monetary policy.

There are 33 of the S&P 500 companies that report earnings today with notable reports including: News Corp (0.21), Symantec (0.24), Cummins (2.11), McGraw Hill Financial (1.02), Conoco Phillips (-0.65), ICE Exchange (3.01), Occidental Petroleum (-0.13).

U.S. IPO's scheduled to price today: Advanced Inhalation Theraphies (AITP).

Equity conferences this week include: Cowen and Company Aerospace/Defense Conference & Transport Forum on Wed-Thu

OVERNIGHT U.S. STOCK MOVERS

Viacom (VIAB +2.10%) surged over 7% in pre-market trading after a person familiar witt the matter said the board will meet today to name a successor to Chairma Summer Restone.

CBS Corp. (CBS +3.50%) rose 4% in pre-market trading after Summer Redstone resigned as chairman of CBS and will be replaced by CEO Les Moonves.

Yum! Brands (YUM +0.18%) fell over 1% in after-hours trading after it reported Q4 revenue of $3.95 billion, less than consensus of $4.03 billion.

Cisco (CSCO +1.18%) slid nearly 1% in after-hours trading after it said it will acquire Jasper Technologies for $1.4 billion in cash and assumed equity awards.

Allstate (ALL -0.55%) gained nearly 1% in after-hours trading after it reported Q4 adjusted EPS of $1.60, higher than consensus of $1.35.

MetLife (MET -1.89%) fell over 2% in after-hours trading after it reported Q4 operating EPS of $1.23, below consensus of $1.36.

Noble Corp. Plc (NE +4.13%) dropped 7% in after-hours trading after it reported Q4 adjusted EPS of 52 cents, weaker than consensus of 55 cents, and said it faces a "challenging outlook" in 2016.

Take-Two Interactive Software (TTWO -1.82%) climbed 8% in after-hours trading after it reported Q3 adjusted EPS of 89 cents, well above consensus of 50 cents, and raised guidance on fiscal 2016 adjusted EPS to $1.65-$1.75 from a prior view of $1.00-$1.15, better than consensus of $1.15.

GoPro (GPRO +4.59%) slumped over 8% in pre-market trading after it lowered guidance on fiscal 2016 revenue to $1.35 billion-$1.50 billion, below consensus of $1.59 billion, and said Brian McGee will succeed Jack Lazar as CFO effective March 11.

VirnetX Holding (VHC +29.81%) soared over 80% in after-hours trading after a jury in Texas awarded the company $625.6 million in a patent trial against Apple.

Cadence Design Systems (CDNS unch) climbed 4% in after-hours trading after it reported Q4 non-gaap EPS of 31 cents, higher than consensus of 29 cents.

DHT Holdings (DHT +3.86%) slid over 10% in after-hours trading after it reported Q4 EPS of 31 cents, below consensus of 33 cents.

Glu Mobile (GLUU -2.90%) surged over 20% in after-hours trading after it reported an unexpected Q4 EPS profit of 2 cents, better than consensus of a -3 cent loss.

SolarEdge Technologies (SEDG +2.73%) jumped over 11% in after-hours trading after it reported Q2 adjusted EPS of 44 cents, better than consensus of 35 cents.

Imperva (IMPV -0.76%) tumbled over 10% in after-hours trading after it said it sees a Q1 adjusted EPS loss of -26 cents to -32 cents, weaker than consensus of an -11 cent loss.

MARKET COMMENTS

Mar E-mini S&Ps (ESH16 +0.01%) this morning are up +2.75 points (+0.14%). Wednesday's closes: S&P 500 +0.50%, Dow Jones +1.13%, Nasdaq -2.18%. The S&P 500 on Wednesday closed higher on the +205,000 increase in the Jan ADP employment report (stronger than expectations of +193,000) and a rally in energy producers after crude oil prices recovered from a 1-week low and closed sharply higher. Stocks were undercut by the -2.3 point decline in the Jan ISM non-manufacturing PMI to 53.5, weaker than expectations of -0.2 to 55.1 and the slowest pace of expansion in nearly 2 years.

Mar 10-year T-notes (ZNH16 -0.07%) this morning are down -3 ticks. Wednesday's closes: TYH6 -2.50, FVH6 +1.50. Mar T-notes on Wednesday rallied to a 1-year nearest-futures high but fell back and closed lower. T-note prices were undercut by the larger than expected increase in the Jan ADP employment change and reduced safe-haven demand after stocks recovered to close higher. T-note prices were supported by the weaker-than-expected Jan ISM non-manufacturing PMI report.

The dollar index (DXY00 -0.60%) this morning is down -0.522 (-0.54%) at a 3-month low. EUR/USD (^EURUSD) is up +0.0071 (+0.64%) at a 3-1/4 month high. USD/JPY (^USDJPY) is down -0.27 (-0.23%). Wednesday's closes: Dollar Index -1.584 (-1.60%), EUR/USD +0.0186 (+1.70%), USD/JPY -2.07 (-1.73%). The dollar index on Wednesday slumped to a 3-month low and closed lower on U.S. growth concerns that may keep the Fed from further raising interest rates after the Jan non-manufacturing PMI expanded at the slowest pace in nearly 2 years. The dollar index was also undercut by strength in EUR/USD which rallied to a 3-month high after the Eurozone Jan composite PMI was revised upward by +0.1 to 53.6.

Mar crude oil (CLH16 +0.46%) this morning is up +7 cents (+0.22%) and Mar gasoline (RBH16 +2.42%) is up +0.0192 (+1.89%). Wednesday's closes: CLH6 +2.87 (+9.61%), RBH6 +0.0273 (+2.73%). Mar crude oil and gasoline closed sharply higher on Wednesday as Mar crude rebounded from a 1-week low and Mar gasoline recovered from a 7-year low. Crude oil prices were boosted by short-covering after the dollar index tumbled to a 3-month low and by the -0.1% decline in U.S. crude production in the week of Jan 29 to a 1-month low of 9.214 million bpd. Crude oil prices were undercut by the +7.79 million bbl surge in EIA crude inventories to a record high of 502.7 million bbl and by the +5.94 million bbl increase in EIA gasoline stockpiles to a record 254.4 million bbl.

(Click on image to enlarge)

Disclosure: None.