Morning Call For February 3, 2015

OVERNIGHT MARKETS AND NEWS

March E-mini S&Ps (ESH15 +0.37%) this morning are up +0.43% and European stocks are up +1.41% at a 6-1/3 year high after Greece's government backed down from its call for a debt write down. Greek bank stocks surged and Greece's ASE Stock Index jumped nearly 9% after Greek Finance Minister Varoufakis outlined plans to swap some Greek debt owned by the ECB and the European Financial Stability Facility for new securities that would allow Greece to avoid imposing a haircut on creditors. Asian stocks closed mixed: Japan -1.27%, Hong Kong +0.29%, China +2.49%, Taiwan +0.66%, Australia +1.46%, Singapore -0.45%, South Korea -0.09%, India -0.42%. Chinese stocks rose on speculation the PBOC may soon lower banks' reserve requirements in an attempt to revive economic growth after the China Jan manufacturing PMI contracted by the most in 28 months. Australia's S&P 200 Stock Index surged to a 6-1/2 year high after the RBA unexpectedly cut interest rates. Commodity prices are mostly higher. Mar crude oil (CLH15 +2.52%) is up +3.41% at a 2-week high and Mar gasoline (RBH15 +2.34%) is up +2.86% at a 1-1/4 month high as a strike by the United Steelworkers union, which represents employees at more than 200 refineries, enters its third day. Feb gold (GCG15 +0.10%) is up +0.32%. Mar copper (HGH15 +3.11%) is up +3.59% at a 1-week high. Agriculture prices are stronger. The dollar index (DXY00 -0.05%) is unchanged. EUR/USD (^EURUSD) is up +0.04%. USD/JPY (^USDJPY) is down -0.18%. Mar T-note prices (ZNH15 -0.25%) are down -13 ticks.

The Eurozone Dec PPI fell -1.0% m/m, more than expectations of -0.7% m/m and the largest monthly decline in 5-3/4 years. On an annual basis, Dec PPI fell -2.7% y/y, more than expectations of -2.5% y/y and the fastest pace of decline in 5 years.

The UK Jan Markit/CIPS construction PMI unexpectedly rose +1.5 to 59.1, better than expectations of -0.6 to 57.0.

The Reserve Bank of Australia (RBA) unexpectedly cut its benchmark interest rate by -25 bp to a record low 2.25% and RBA Governor Stevens said the Australian dollar "remains above most estimates of its fundamental value." He added that "output growth will probably remain a little below trend for somewhat longer, and the rate of unemployment peak a little higher, than earlier expected."

U.S. STOCK PREVIEW

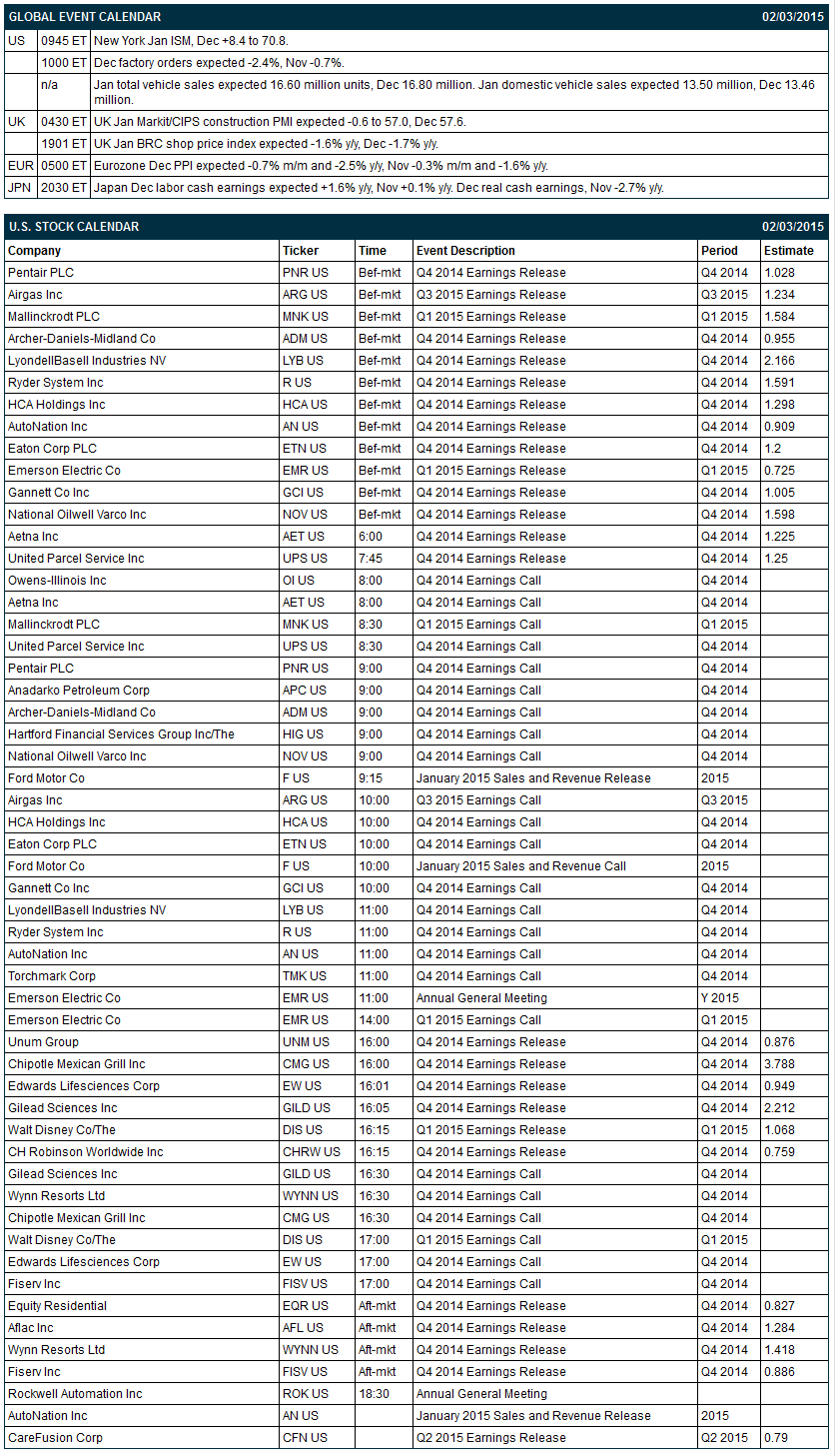

Today’s Dec factory orders report is expected to show a decline of -2.4%, adding to November’s decline of -0.7%. Today’s Jan total vehicle sales report is expected to show a small decline to 16.60 million units from 16.80 million units in December.

There are 54 of the S&P 500 companies that report earnings today: Pentair (consensus $1.03), Airgas (1.23), Archer-Daniels Midland (0.96), LyondellBasell Industries NV (2.80), Ryder Systems (1.59), HCA Holdings (1.30), AutoNation ((0.91), Eaton Corp PLC (1.20), Emerson Electric (0.73), Gannett (1.01). Equity conferences this week include: ANS Conference on Nuclear Training and Education on Mon-Tue, In-Pharma Osaka 2015 on Tue, Media Insights & Engagement Conference on Tue-Thu, Cowen and Company Aerospace/Defense Conference & Transport Forum on Wed-Thu.

OVERNIGHT U.S. STOCK MOVERS

Archer-Daniels Midland (ADM +3.30%) reported Q4 EPS of $1.00, better than consensus of 96 cents.

AutoNation (AN -0.47%) reported Q4 EPS of $1.03, stronger than consensus of 91 cents.

Office Depot (ODP +0.39%) surged 13% in pre-market trading after the WSJ reported that the company is in advanced merger talks with Staples (SPLS+0.53%) .

Dow Jones reported that the NYSE said it will suspend trading in RadioShack (RSH -14.29%) immediately and begin the delisting proceedings.

MDU Resources (MDU +0.84%) reported Q4 adjusted EPS of 35 cents, weaker than consensus of 39 cents, and then lowered guidance on fiscal 2015 adjusted EPS to $1.05-$1.20, below consensus of $1.42.

Neil Dana reported a 9.3% passive stake in GoPro (GPRO +4.80%) .

Advent Software (ADVS -1.10%) rose over 6% in after-hours tradng after SS&C (SSNC -1.41%) announeced it will acquire the company for $44.25 per share, or $2.7 billion.

Cliffs Natural Resources (CLF +8.57%) jumped 11% in after-hours trading after it reported Q4 EPS of $1.00, more than seven times consensus of 13 cents.

Rent-A-Center (RCII +2.19%) slumped over 13% in after-hours trading after it reported Q4 adjusted EPS of 50 cents, below consensus of 63 cents, and then lowered guidance on fiscal 2015 EPS to $2.05-$2.30, less than consensus o $2.48.

Reinsurance Group (RGA +1.62%) reported Q4 adjusted EPS of $2.99, well above consensus of $2.11.

OppenheimerFunds reported a 6.11% passive stake in Targa Resources Partners (NGLS +4.59%) .

Anadarko (APC +1.25%) reported adjusted Q4 EPS of 37 cents, well below consensus of 85 cents.

Hartford Financial (HIG +1.70%) reported Q4 EPS of 96 cents, beter than consensus of 93 cents.

Owens-Illinois (OI +3.73%) reported Q4 EPS of 46 cents, right on consensus, although Q4 revenue of $1.60 billion was slightly below consensus of $1.65 billion.

Torchmark (TMK +1.98%) reported Q4 net operating EPS of $1.00, right on consensus.

MARKET COMMENTS

Mar E-mini S&Ps (ESH15 +0.37%) this morning are up +8.75 points (+0.43%). The S&P 500 index on Monday closed higher: S&P 500 +1.30%, Dow Jones +1.14%, Nasdaq +0.97%. Bullish factors included (1) the +0.3% increase in U.S. Dec personal income, better than expectations of +0.2%, and (2) strength in energy producers after crude oil climbed to a 2-week high. Bearish factors included (1) the -0.3% decline in U.S. Dec personal spending, a bigger decline than expectations of -0.2% and the largest drop in 5-1/4 years, (2) concern the U.S. economy may be slowing after the U.S. Jan ISM manufacturing PMI fell -1.6 to 53.5, more than expectations of -1.0 to 54.5 and the slowest pace of expansion in a year.

Mar 10-year T-notes (ZNH15 -0.25%) this morning are down -13 ticks. Mar 10-year T-note futures prices on Monday closed higher. Closes: TYH5 +1.50, FVH5 +0.25. Bullish factors included (1) concern about a slowdown in the U.S. economy after the Jan ISM manufacturing PMI fell more than expected and expanded at the slowest pace in a year, (2) the bigger-than-expected -0.3% m/m decline in U.S. Dec personal spending, the most in 5-1/4 years, and (3) deflation concerns after the Dec core PCE deflator rose +1.3% y/y, the slowest pace of increase in 9 months.

The dollar index (DXY00 -0.05%) this morning is unchanged. EUR/USD (^EURUSD) is up +0.0004 (+0.04%). USD/JPY (^USDJPY) is down -0.21(-0.18%). The dollar index on Monday closed lower: Dollar index +0.022 (+0.02%), EUR/USD +0.00675 (+0.60%), USD/JPY +0.107 (+0.09%). Bearish factors included (1) concern that U.S. growth is slowing which may prompt the Fed to delay interest rate hikes after the Jan ISM manufacturing PMI expanded at the slowest pace in a year and (2) strength in EUR/USD after Greece's newly elected leaders gave assurances that Greece will abide by its financial obligations, which reduced concern that Greece will default on its debt and leave the Eurozone.

Mar WTI crude oil (CLH15 +2.52%) this morning is up +$1.69 (+3.41%) at a 2-week high and Mar gasoline (RBH15 +2.34%) is up +0.0441 (+2.86%) at a 1-1/4 month high. Mar crude oil and Mar gasoline on Monday closed higher with Mar crude at a 2-week high and Mar gasoline at a 5-week high: CLH5 +1.59 (+3.30%), RBH5 +0.0736 (+4.98%). Bullish factors included (1) a weaker dollar, (2) concern that gasoline production will decline as a strike by U.S. oil refinery workers that account for 10% of U.S. refining capacity entered its second day.

Click on picture to enlarge

Disclosure: None.