Morning Call For February 26, 2015

OVERNIGHT MARKETS AND NEWS

March E-mini S&Ps (ESH15 +0.13%) this morning are up +0.19% and European stocks are up +0.39% as global stock and bond markets continue their rallies to record highs after Fed Chair Yellen this week dampened concern of an imminent interest rate increase and ahead of the ECB's QE program that begins next month. 10-year government bond yields of 9 Eurozone nations fell to record lows today, including Germany where the 10-year bund yield fell to an all-time low of 0.288%. Asian stocks closed mixed: Japan +1.08%, Hong Kong +0.50%, China +2.52%, Taiwan -0.80%, Australia -0.61%, Singapore -0.43%, South Korea -0.01%, India -0.90%. Japan's Nikkei Stock Index posted a 14-3/4 year high and China's Shanghai Stock Index rose to a 4-week high on speculation the government will boost stimulus to spur economic growth. Chinese Premier Li Keqiang called for more active fiscal policy while a government publication said the PBOC should cut bank's required reserve ratios further to deal with deflation risks. Commodity prices are mixed. Apr crude oil (CLJ15 -1.20%) is down -1.51% and Apr gasoline (RBJ15 +0.31%) is up +0.05%. Apr gold (GCJ15 +1.35%) is up +1.26%. Mar copper (HGH15 +2.14%) is up +2.50% at a 1-1/2 month high on speculation China may boost stimulus to revive growth, which would spur copper demand. Agriculture prices are mixed. The dollar index (DXY00 +0.13%) is up +0.03%. EUR/USD (^EURUSD) is down -0.10%. USD/JPY (^USDJPY) is down -0.08%. Mar T-note prices (ZNH15 +0.15%) are up +5.5 ticks at a 2-week high.

Eurozone Feb economic confidence rose +0.7 to 102.1, stronger than expectations of +0.8 to 102.0 and the highest in 7 months. The Feb business climate indicator unexpectedly fell -0.05 to 0.07, weaker than expectations of +0.07 to 0.23.

Eurozone Jan M3 money supply rose +4.1% y/y, stronger than expectations of +3.7% y/y and the fastest pace of growth in 5-3/4 years. The Jan M3 money supply 3-month average was +3.6%, stronger than expectations of +3.4%.

The German Mar GfK consumer confidence rose +0.4 to 9.7, stronger than expectations of +0.2 to 9.5 and the highest since the data series began in 2005.

German Feb unemployment fell -20,000, double expectations of -10,000. The Feb unemployment rate remained unchanged at 6.5%, right on expectations and the lowest since employment data for a unified Germany began in 1991.

U.S. STOCK PREVIEW

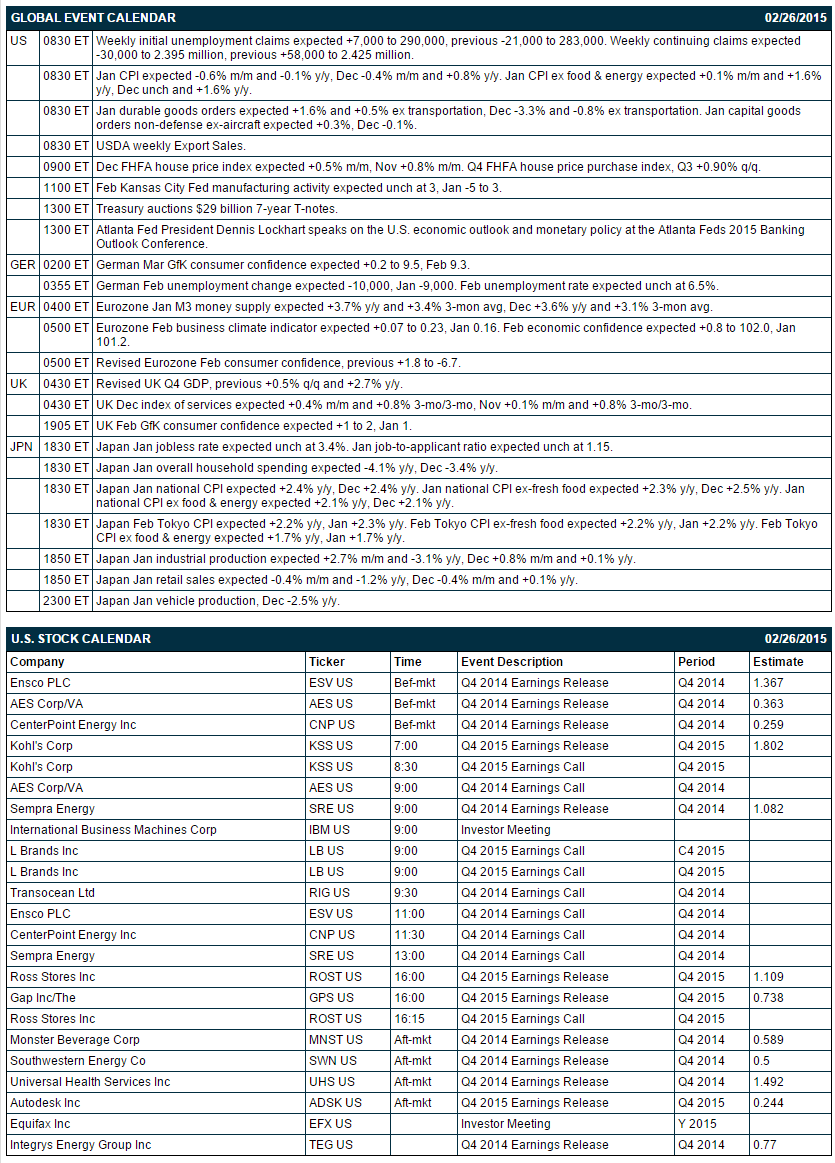

Today’s initial claims report is expected to show an increase of +7,000 to 290,000 following last week’s decline of -21,000 to 283,000. Meanwhile, today’s continuing claims report is expected to show a -30,000 drop to 2.395 million following last week’s +58,000 increase to 2.425 million. Today’s Jan CPI report is expected to fall to -0.1% y/y from +0.8% y/y in December, thus falling into deflationary territory. Excluding food and energy, today’s Jan core CPI is expected to be unchanged from Dec at +1.6% y/y, which is only mildly below the Fed’s inflation target of +2.0%. Today’s Jan durable goods orders report is expected to show an increase of +1.6% and +0.5% ex-transportation, recovering from the weak December report of -3.3% and -0.8% ex-transportation. Today’s Dec Federal Home Financing Agency (FHFA) house price index is expected to show a solid increase of +0.5% m/m, adding to the +0.8% increase seen in November. The Treasury today will conclude this week’s $103 billion T-note package by selling $29 billion of 7-year T-notes.

There are 12 of the S&P 500 companies that report earnings today with notable reports including: GAP (consensus $0.74), Kohl's (1.80), Ross Stores (1.11), Sempra Energy (1.08), Autodesk (0.24). Equity conferences during the remainder of this week include: Bank of America Merrill Lynch Global Agriculture Conference on Wed-Thu, Auerbach Grayson & Morgan Stanley's Inaugural Frontier Markets Conference on Thu, Gabelli & Company Pump, Valve & Water Systems Symposium on Thu, Gabelli & Company Inaugural Waste & Environmental Services Symposium on Fri.

OVERNIGHT U.S. STOCK MOVERS

Kohl's (KSS +1.33%) reported Q4 EPS of $1.83, better than consensus of $1.80.

Carter's (CRI +1.34%) reported Q4 adjusted EPS of $1.32, stronger than consensus of $1.27.

State Street (STT -1.66%) was downgraded to 'Neutral' from 'Outperform' at Credit Suisse.

Southwest Gas (SWX -0.90%) reported Q4 EPS of $1.26, higher than consensus of $1.24.

Chemtura (CHMT -1.06%) reported Q4 adjusted EPS of 10 cents, better than consensus of 7 cents.

Babcock & Wilcox (BWC -1.70%) reported Q4 adjusted EPS of 64 cents, well above consensus of 44 cents.

DryShips (DRYS +4.08%) reported Q4 EPS of 2 cents, well below consensus of 4 cents.

Yelp (YELP -0.30%) gained 2% in after-hours trading after it was initiated with an 'Overweight' at Morgan Stanley with a price target of $62.

LinkedIn (LNKD +1.79%) was initiated with an 'Overweight' at Morgan Stanley with a price target of $310.

Sprouts Farmers Markets (SFM +1.23%) reported Q4 adjusted EPS of 12 cents, above consensus of 9 cents.

Avago (AVGO -0.44%) rose over 5% in after-hours trading after it reported Q1 EPS of $2.09, higher than consensus of $1.94, and then said it will acquire Emulex ELX for $8 per share in an all-cash transaction valued at approximately $606 million.

L Brands (LB +1.03%) fell nearly 2% in after-hours trading after it reported Q4 EPS of $1.89, better than consensus of $1.80, but then lowered guidance on fiscal 2015 EPS to $3.45-$3.65, below consensus of $3.83.

Salesforce.com (CRM +1.52%) reported Q4 EPS of 14 cents, right on consensus.

Whiting Petroleum (WLL +0.57%) reported Q4 adjusted EPS of 44 cents, weaker than consensus of 49 cents.

AmSurg (AMSG -0.42%) reported Q4 adjusted EPS of 77 cents, above consensus of 73 cents, and then raised guidance on fiscal 2015 revenue to $2.44 billion-$2.47 billion, higher than consensus of $2.39 billion.

MARKET COMMENTS

Mar E-mini S&Ps (ESH15 +0.13%) this morning are up +4.00 points (+0.19%). The S&P 500 index on Wednesday posted a record high, but fell back on profit-taking and closed lower: S&P 500 -0.08%, Dow Jones +0.08%, Nasdaq -0.23%. Bullish factors included (1) reduced Chinese growth concerns after the China Feb HSBC flash manufacturing PMI unexpectedly rose +0.4 to 50.1, stronger than expectations of -0.2 to 49.5, and (2) the -0.2% decline in U.S. Jan new home sales to 481,000, stronger than expectations of -2.3% to 470,000.

Mar 10-year T-notes (ZNH15 +0.15%) this morning are up +5.5 ticks at a 2-week high. Mar 10-year T-note futures prices on Wednesday rose to a 2-week high and closed higher. Closes: TYH5 +1.00, FVH5 -0.75. Bullish factors included (1) carry-over support from Tuesday's comments from Fed Chair Yellen who said the Fed will be “patient” on when to raise interest rates and that an increase is unlikely for “at least the next couple” of FOMC meetings, and (2) strong foreign demand for the Treasury's $35 billion auction of 5-year T-notes in which indirect bidders, a proxy for foreign buying, purchased 60.1% of the auction, well above the 12-auction average of 52.9%.

The dollar index (DXY00 +0.13%) this morning is up +0.029 (+0.03%). EUR/USD (^EURUSD) is down -0.0011 (-0.10%). USD/JPY (^USDJPY) is down-0.09 (-0.08%). The dollar index on Wednesday closed lower: Dollar index -0.280 (-0.30%), EUR/USD +0.00214 (+0.19%), USD/JPY -0.108 (-0.09%). Bearish factors included (1) negative carry-over from Tuesday's comments by Fed Chair Yellen that signaled the Fed is in no hurry to raise interest rates, and (2) strength in GBP/USD which climbed to a 1-3/4 month high after BOE policy maker Weale said interest rate may need to rise earlier than markets expect.

Apr WTI crude oil (CLJ15 -1.20%) this morning is down -77 cents (-1.51%) and Apr gasoline (RBJ15 +0.31%) is up +0.0010 (+0.05%). Apr crude and Apr gasoline prices on Wednesday closed higher: CLJ5 +1.71 (+3.47%), RBJ5 +0.1026 (+5.63%). Apr crude recovered from a 3-week low and Apr gasoline posted a 2-1/2 month high on bullish factors that included (1) the weaker dollar, (2) the -3.1 million bbl decline in weekly EIA gasoline supplies, more than expectations of a -2.0 million bbl draw, and (3) the -2.7 million bbl drop in weekly EIA distillate inventories to a 2-month low of 124.7 million bbl. Bearish factors included (1) the +8.4 million bbl increase in weekly EIA crude inventories to a record 434.1 million bbl (EIA data since 1982), more than double expectations of a +4.0 million bbl build, and (2) the +2.4 million bbl increase in crude supplies at Cushing, OK, the delivery point of WTI futures, to a 1-1/2 year high of 48.68 million bbl.

Disclosure: None.