Morning Call For February 19, 2016

OVERNIGHT MARKETS AND NEWS

March E-mini S&Ps (ESH16 -0.46%) are down -0.47% and European stocks are down -1.33% as they track crude oil prices lower. Mar WTI crude oil is down -1.92% on concern that oversupply of crude will persist after EIA data yesterday showed U.S. crude stockpiles expanded to 504 million bbl, the highest since weekly data began in 1982 and in monthly data going back to 1930. Weakness in European insurance companies are leading European stocks lower, led by a -1.5% decline in Allianz SE, after it reported weaker-than-expected quarterly profits. Asian stocks settled mostly lower: Japan -1.42%, Hong Kong -0.40%, China -0.10%, Taiwan +0.12%, Australia -0.79%, Singapore -0.03%, South Korea +0.23%, India +0.25%.

The dollar index (DXY00 -0.13%) is down -0.06%. EUR/USD (^EURUSD) is up +0.05%. USD/JPY (^USDJPY) is down -0.37%.

Mar T-note prices (ZNH16 +0.26%) are up +10 ticks.

San Francisco Fed President John Williams said late yesterday that "the economy is actually done fine" and he sees a gradual U.S. rate hike path as the "best course." He added that while the Fed has tools to deal with an economic downturn including negative interest rates, he doesn't expect that it will have to use them.

U.S. STOCK PREVIEW

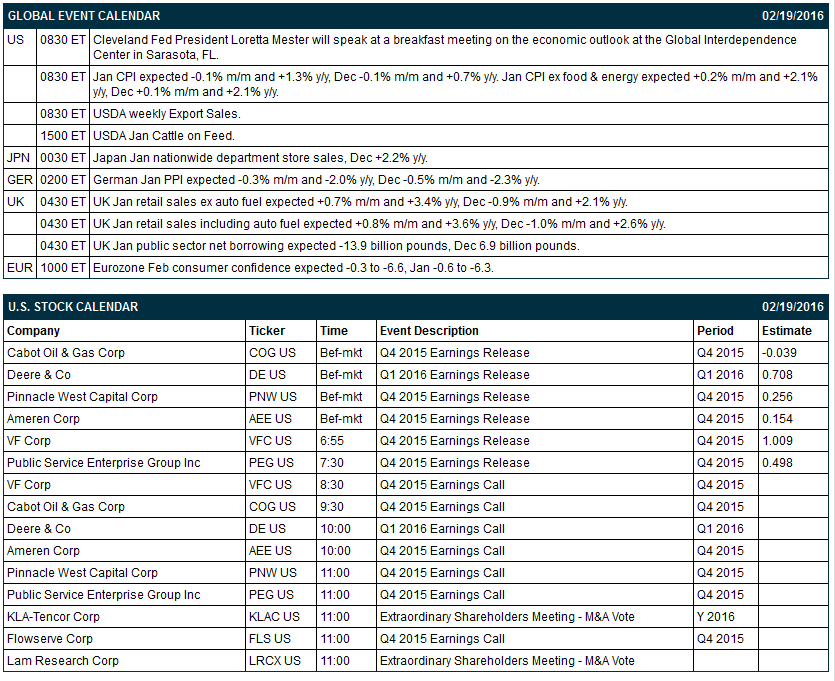

Key U.S. news today includes: (1) Cleveland Fed President Loretta Mester's speech at a breakfast meeting on the economic outlook at the Global Interdependence Center in Sarasota, FL, and (2) Jan CPI (expected -0.1% m/m and +1.3% y/y, Dec -0.1% m/m and +0.7% y/y) and Jan CPI ex food & energy (expected +0.2% m/m and +2.1% y/y, Dec +0.1% m/m and +2.1% y/y).

There are 6 of the S&P 500 companies that report earnings today: Deere (consensus $0.71), Cabot Oil (-0.04), Pinnacle West Capital (0.26), Ameren (0.15), VF Corp (1.01), PSEG (0.50).

U.S. IPO's scheduled to price today: none.

Equity conferences during the remainder of this week include: none.

OVERNIGHT U.S. STOCK MOVERS

Applied Materials (AMAT +0.18%) climbed 4% in pre-market trading after it reported Q1 net revenue of $2.26 billion, higher than consensus of $2.24 billion, and said it sees Q2 adjusted EPS of 30 cents-34 cents, above consensus of 27 cents.

Nordstrom (JWN +0.90%) tumbled over 8% in pre-market trading after it reported Q4 adjusted EPS ex-impairments of $1,17, weaker than consensus of $1.21, and then lowered guidance on fiscal 2017 adjusted EPS to $3.10-$3.35, below consensus of $3.55.

AMN Healthcare Services (AHS +0.20%) jumped over 7% in after-hours trading after it reported Q4 adjusted EPS of 47 cents, higher than consensus of 41 cents.

Flowserve (FLS -0.09%) lost over 3% in after-hours trading after it reported Q4 adjusted EPS of 89 cents, below consensus of 92 cents.

Allscripts Healthcare Solutions (MDRX -1.58%) dropped over 2% in after-hours trading after it reported Q4 adjusted EPS of 13 cents, right on consensus, but lowered guidance on fiscal 2016 revenue to $1.43 billion-$1.46 billion, below consensus of $1.48 billion.

Flour (FLR +0.06%) lost over 1% in after-hours trading after it reported Q4 continuing operations EPS of 68 cents, below consensus of 93 cents, and reported Q4 revenue of $4.12 billion, less than consensus of $4.54 billion.

Arista Networks (ANET -2.86%) gained almost 6% in after-hours trading after it reported Q4 adjusted EPS of 80 cents, higher than consensus of 61 cents.

Trinity Industries (TRN -4.17%) dropped over 13% in after-hours trading after it lowered guidance on fiscal 2016 EPS to $200-$2.40, well below consensus of $3.64.

WageWorks (WAGE -5.01%) rose 7% in after-hours trading after it reported Q4 adjusted EPS of 33 cents, better than consensus of 28 cents.

Equinix (EQIX -0.12%) slid over 4% in after-hours trading after it reported Q4 FFO of $2.14 a share, well below consensus of $3.07.

Ambac Financial Group (AMBC +2.58%) climbed 4% in after-hours trading after it reported a Q4 operating EPS of $10.64, higher than consensus of $1.15.

Century Aluminum (CENX -1.33%) gained over 1% in after-hours trading after it reported a Q4 adjusted EPS loss of -53 cents, narrower than consensus of a -61 cent loss.

TrueCar (TRUE -2.20%) slumped over 15% in after-hours trading after it reported a Q4 adjusted EPS loss of -6 cents, wider than consensus of a -4 cent loss.

Nivalis Therapeutics (NVLS unch) jumped 6% in after-hours trading after it received FDA Fast Track designation for its N91115 drug to treat Cystic Fibrosis.

MARKET COMMENTS

Mar E-mini S&Ps (ESH16 -0.46%) this morning are down -9.00 points (-0.47%). Thursday's closes: S&P 500 -0.47%, Dow Jones -0.25%, Nasdaq -1.13%. The S&P 500 on Thursday closed lower on the OECD's cut in its 2016 global GDP forecast to 3.0% from a Nov projection of 3.3% and on weakness in energy producers after crude oil prices fell back from a 2-week high. Stocks received some support from the unexpected -7,000 decline in U.S. weekly initial unemployment claims to a 2-1/2 month low of 262,000, better than expectations of +6,000 to 275,000.

Mar 10-year T-notes (ZNH16 +0.26%) this morning are up +10 ticks. Thursday's closes: TYH6 +15.50, FVH6 +7.50. Mar T-notes on Thursday closed higher on increase safe-haven demand with the sell-off in stocks and on global growth concerns after the OECD cut its 2016 global GDP estimate.

The dollar index (DXY00 -0.13%) this morning is down -0.059 (-0.06%). EUR/USD (^EURUSD) is up +0.0005 (+0.05%). USD/JPY (^USDJPY) is down -0.42 (-0.37%). Thursday's closes: Dollar Index +0.165 (+0.17%), EUR/USD -0.0021 (-0.19%), USD/JPY -0.86 (-0.75%). The dollar index on Thursday closed higher on signs of U.S. labor market strength after weekly initial jobless claims fell to a 2-1/2 month low and on weakness in EUR/USD which fell to a 2-week low on speculation the ECB may boost stimulus measures after the minutes of Jan 21 ECB meeting showed policy makers were concerned about global risks to the economic outlook.

Mar WTI crude (CLH16 -2.34%) this morning is down -59 cents (-1.92%) and Mar gasoline (RBH16 -1.18%) is down -0.0084 (-0.86%). Thursday's closes: CLH6 +0.11 (+0.36%), RBH6 -0.0310 (-3.09%). Mar crude oil and gasoline on Thursday settled mixed. Crude oil prices were undercut by the +2.147 million bbl increase in EIA crude inventories to a record high 504.1 million bbl and by the +36,000 bbl increase in crude supplies at Cushing, OK, delivery point of WTI futures, to a record high 64.7 million bbl. Crude oil prices were supported by the -0.6% decline in U.S. crude production in the week ended Feb 12 to 9.135 million bpd, a 3-1/2 month low, and by the unexpected fall in U.S. weekly jobless claims to a 2-1/2 month low, a sign of labor market strength that benefits economic growth and energy demand.

(Click on image to enlarge)

Disclosure: None.