Morning Call For December 9, 2014

OVERNIGHT MARKETS AND NEWS

December E-mini S&Ps (ESZ14 -0.46%) this morning are down -0.32 % at a 1-week low and European stocks are down -1.29% on carry-over from a fall in Chinese stocks that plunged over 4% after the government tightened collateral rules for short-term loans. China said it won't allow bonds rated below AAA or sold by issuers graded lower than AA to be used as collateral for short-term loans obtained through repurchase agreements, which sparked a selloff in riskier debt that spread to government notes and stocks. Asian stocks closed mostly lower: Japan -0.68%, Hong Kong -2.34%, China -4.49%, Taiwan -0.64%, Australia -1.68%, Singapore +0.67%, South Korea -0.20%, India -1.15%. China's Shanghai Stock Index retreated from a 3-1/2 year high and sold-off sharply, led by losses in banking and financial stocks, after the government tightened collateral rules for short-term loans as it takes steps to push local governments away from using opaque financing vehicles to raise funds. Commodity prices are mixed. Jan crude oil (CLF15 +1.02%) is up +1.17%. Jan gasoline (RBF15 +0.55%) is up +0.60%. Feb gold (GCG15 +1.40%) is up +0.89%. Mar copper (HGH15 -0.54%) is down -0.59%. Agriculture prices are lower. The dollar index (DXY00 -0.33%) is down 0.17%. EUR/USD (^EURUSD) is up +0.32%. USD/JPY (^USDJPY) is down-0.60%. The British pound held near a 15-month low against the dollar after UK Oct manufacturing activity unexpectedly fell for the first time in 5 months. Mar T-note prices (ZNH15 +0.21%) are up +2.5 ticks.

The German Oct trade balance shrank to a surplus of +21.9 billion euros from an upward revised +22.1 billion euro surplus in Sep, larger than expectations of +18.9 billion euros. Oct exports fell -0.5% m/m, a smaller decline than expectations of -1.7% m/m. Oct imports fell -3.1% m/m, more than expectations of -1.7% m/m and the biggest decline in 23 months.

UK Oct industrial production fell -0.1% m/m and rose +1.1% y/y, weaker than expectations of +0.2% m/m and +1.8% y/y. Oct manufacturing production fell -0.7% m/m and rose +1.7% y/y, less than expectations of +0.2% m/m and +3.2% y/y.

UK Nov BRC sales like-for-like rose +0.9% y/y, more than expectations of +0.6% y/y.

Japan Nov machine tool orders rose +36.6% y/y, the biggest increase in 4 months.

U.S. STOCK PREVIEW

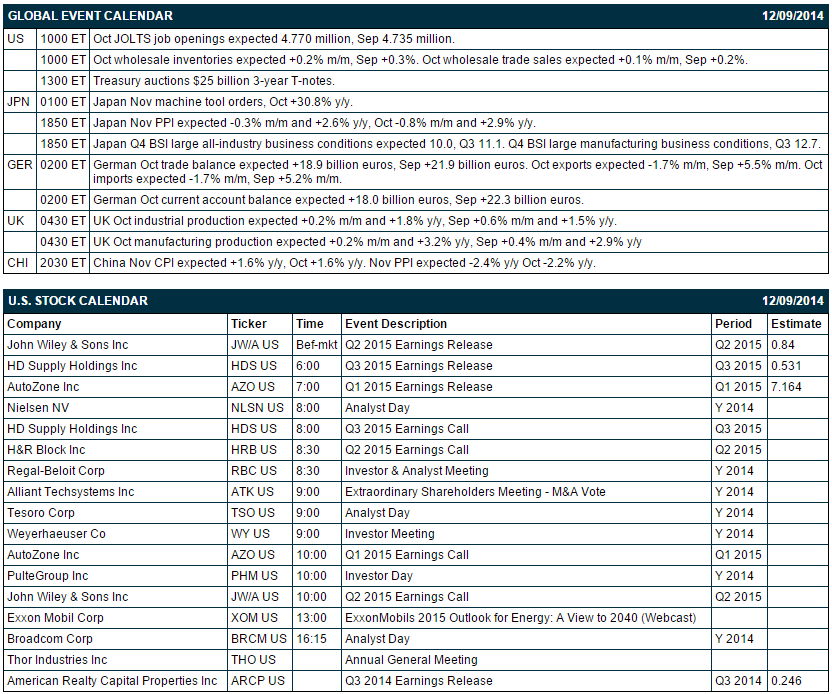

Today’s JOLTS U.S. job openings report is expected to show a +35,000 rise to 4.770 million jobs, reversing part of the -118,000 decline seen in September to 4.735 million jobs. The Treasury today will sell $25 billion of 3-year T-notes. There are 4 of the Russell 1000 companies that report earnings today: John Wiley (consensus $0.84), AutoZone (7.16), HD Supply (0.53), American Realty Capital Properties (0.25).

Equity conferences during the remainder of this week include: UBS Global Media and Communications Conference on Mon-Tue, Raymond James Systems, Semiconductors, Software and Supply Chain Conference on Mon, BMO Capital Markets Technology & Digital Media Conference on Tue, Leerink Devices & DNA Bus Tour 2014 Northern & Southern California on Tue, Goldman Sachs Financial Services Conference on Tue-Wed, Barclays Capital Global Technology Conference on Tue-Wed, Wells Fargo Energy Symposium on Tue-Wed, Barclays Real Estate Conference on Wed, BMO Technology Conference on Wed, Mitsubishi UFJ Securities Property REIT Conference on Wed, Wells Fargo Securities Research, Economics & Strategy Energy Symposium on Wed, Credit Lyonnais Securities Asia Ltd Americas Innovation Summit on Wed, Oppenheimer Healthcare Conference on Wed, Bank of America Merrill Lynch US Basic Materials Conference on Wed-Thu, Capital One Southcoast Energy Conference on Wed-Thu, Bank of America Merrill Lynch Animal & Dental Health Summit on Thu, and Desjardins Securities Materials Conference on Thu.

OVERNIGHT U.S. STOCK MOVERS

Walgreen (WAG -1.27%) was downgraded to 'Neutral' from 'Buy' at Mizuho.

SAIC (SAIC -1.07%) reported Q3 EPS of 77 cents, higher than consensus of 74 cents.

Burlington Stores (BURL -1.77%) raised guidance on fiscal 2014 adjusted EPS view to $1.65-$1.67, above consensus of $1.61.

HD Supply (HDS -1.39%) reported Q3 adjusted EPS of 55 cents, better than consensus of 53 cents.

Schlumberger (SLB -3.38%) and Oceaneeing (OII -5.10%) were both downgraded to 'Hold' from 'Buy' at Jefferies.

AutoZone (AZO -1.17%) reported Q1 EPS of $7.27, better than consensus of $7.16.

T-Mobile (TMUS +0.04%) fell over 3% in pre-market trading after the company said it will sell as much as 17.4 million new convertible shares.

Steadfast Capital reported a 6.6% passive stake in Wix.com (WIX -1.38%) .

ABM Industries (ABM -1.02%) reported Q4 adjusted EPS of 52 cents, less than consensus of 58 cents, and then lowered guidance on fiscal 2015 adjusted EPS $1.65-$1.75, below consensus of $1.80.

IDT Corp. (IDT unch) reported Q1 adjusted EPS of 46 cents, better than consensus of 42 cents.

Pinetree Capital reported a 13.0% passive stake in Sphere 3D (ANY -5.16%) .

Pep Boys (PBY -3.31%) reported a Q3 EPS loss of -3 cents with items, well below consensus of a 12 cent gain.

TRT Holdings reported a 9.98% stake in Northern Oil and Gas (NOG -11.78%) .

MARKET COMMENTS

Dec E-mini S&Ps (ESZ14 -0.46%) this morning are down -6.50 points (-0.32%) at a 1-week low. The S&P 500 index on Monday closed lower: S&P 500-0.73%, Dow Jones -0.59%, Nasdaq -0.77%. Bearish factors included (1) global growth concerns after Japan Q3 GDP was revised lower to -1.9% (q/q annualized) from -1.6% q/q and after China Nov exports rose +4.7% y/y, weaker than expectations of +8.0% y/y and the smallest increase in 7 months, and (2) weakness in energy producers after crude oil prices tumbled to a 5-1/3 year low.

Mar 10-year T-notes (ZNH15 +0.21%) this morning are up +2.5 ticks. Mar 10-year T-note futures prices on Monday recovered from a 2-week low and closed higher: TYH5 +10.00, FVH5 +3.00. Bullish factors included (1) reduced inflation expectations after the 10-year break-even rate fell to a 5-1/4 year low, and (2) global growth concerns after China Nov exports rose less than expected at the slowest pace in 7 months and after Japan Q3 GDP was revised lower.

The dollar index (DXY00 -0.33%) this morning is down -0.152 (-0.17%). EUR/USD (^EURUSD) is up +0.0039 (+0.32%). USD/JPY (^USDJPY) is down-0.72 (-0.60%). The dollar index on Monday retreated from a new 5-3/4 year high and closed lower. Closes: Dollar index -0.293 (-0.33%), EUR/USD +0.00348 (+0.28%), USD/JPY -0.803 (-0.66%). Negative factors included (1) a recovery in EUR/USD which rebounded from a 2-1/4 year low and closed higher after the Eurozone Dec Sentix investor confidence rose more than expected to the highest level in 4 months, and (2) strength in the yen after USD/JPY fell back from a 7-1/3 year high and closed lower after the Japan Oct current-account surplus was wider than expected.

Jan WTI crude oil (CLF15 +1.02%) this morning is up +74 cents (+1.17%) and Jan gasoline (RBF15 +0.55%) is up +0.0102 (+0.60%). Jan crude and Jan gasoline prices on Monday sold off with Jan crude at a 5-1/3 year low and Jan gasoline at a 5-year low. Closes: CLF5 -2.29 (-4.24%), RBF5 -0.0706(-3.98%). Bearish factors included (1) global growth concerns after China Nov exports rose at the slowest pace in 7 months and after Japan Q3 GDP was revised lower, and (2) concern that falling prices may prompt hedge funds to liquidate long positions after CFTC data showed net-long positions on crude oil jumped 14% in the week ended Dec 2.

Disclosure: None