Morning Call For December 5, 2014

OVERNIGHT MARKETS AND NEWS

December E-mini S&Ps (ESZ14 +0.10%) this morning are up +0.08% ahead of U.S. Nov payrolls data and European stocks are up +1.63% after German Oct factory orders exceeded expectations. Stocks also rose and European government bonds rallied, with Italy's 10-year bond yield falling to a record low 1.948%, on speculation the ECB was preparing a package of asset purchases. According to 2 central bank officials familiar with the deliberations, the ECB Governing Council expects to consider a proposal for broad-based asset purchases including sovereign debt at the next meeting on Jan 22. European stocks gained despite the action by the Bundesbank to cut its German GDP and inflation forecasts for this year and next. Asian stocks closed mixed: Japan +0.19%, Hong Kong +0.71%, China +0.66%, Taiwan -0.20%, Australia -0.62%, Singapore +0.59%, South Korea +0.07%, India -0.37%. Japan's Nikkei Stock Index advanced to a 7-1/3 year high as exporters rallied as the yen weakened past 120 yen per dollar for the first time in 7-1/3 years. China's Shanghai Stock Index climbed to a new 3-1/2 year high and is up +9.5% this week amid speculation the PBOC will cut reserve-requirement ratios for banks after lowering interest rate for the first time in 2 years in an attempt to revive economic growth. Commodity prices are mostly lower. Jan crude oil (CLF15 -0.72%) is down -0.99%. Jan gasoline (RBF15 -0.91%) is down -1.08%. Feb gold (GCG15 -0.60%) is down-0.46%. Mar copper (HGH15 +0.55%) is up +0.65%. Agriculture prices are weaker. The dollar index (DXY00 +0.19%) is up +0.20%. EUR/USD (^EURUSD) is down -0.23%. USD/JPY (^USDJPY) is up +0.73% at a fresh 7-1/3 year high. Mar T-note prices (ZNH15 -0.06%) are down -2.5 ticks.

In its biannual report, the Bundesbank cut its 2014 German GDP forecast to +1.4% from a Jun estimate of +1.9% and lowered its 2015 GDP forecast to +1.0% from +2.0%. The Bundesbank also lowered its German 2014 inflation forecast to +0.9% from a Jun projection of +1.1% and cut its 2015 inflation forecast to +1.1% from +1.5%.

German Oct factory orders rose +2.5% m/m and +2.4% y/y, much more than expectations of +0.5% m/m and unch y/y and the strongest in 3 months.

Eurozone Q3 GDP was left unrevised at +0.2% q/q and +0.8% y/y.

The Japan Oct leading index CI fell -1.6 to 104.0, a slightly bigger decline than expectations of -1.5 to 104.1 and the lowest in 1-3/4 years. The Oct coincident index rose +0.4 to 110.2, a larger increase than expectations of +0.2 to 110.0 and the highest in 5 months.

U.S. STOCK PREVIEW

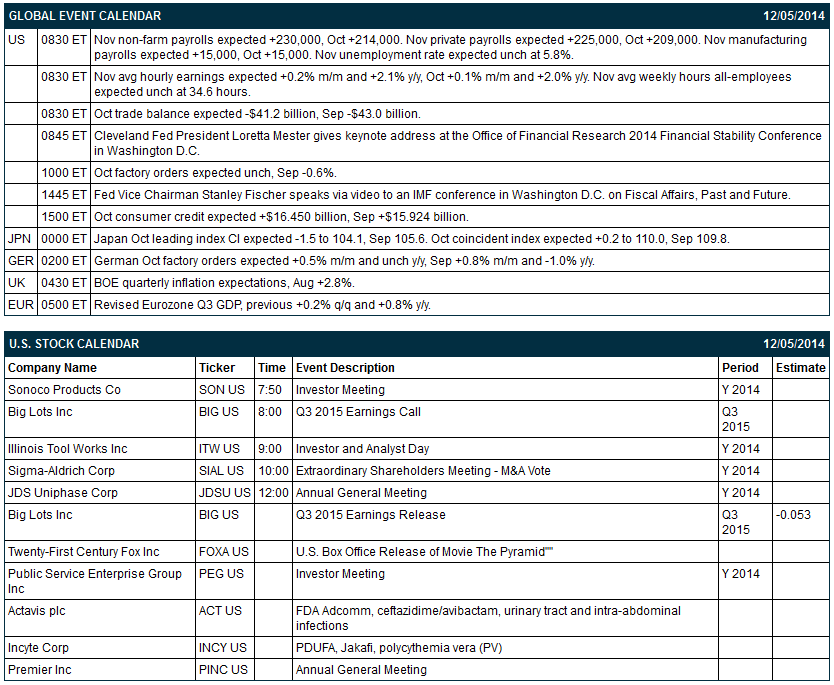

Today’s Nov payroll report is expected to show an increase of +230,000, which would be a bit better than October’s report of +214,000. Today’s Nov unemployment rate is expected to be unchanged from October’s 6-1/3 year low of 5.8%. Today’s Oct U.S. trade deficit is expected to narrow to -$41.2 billion from -$43.0 billion in September. Today’s Oct factory orders report is expected to show a decline of -0.2%, adding to the -0.6% decline seen in September. Today’s Oct consumer credit report is expected to show another strong increase of +$16.5 billion following the September increase of +$15.924 billion. There is only 1 of the Russell 1000 companies that reports earnings today: Big Lots (consensus $-0.05). There are no equity conferences today.

OVERNIGHT U.S. STOCK MOVERS

Tyson Foods (TSN -1.93%) was upgraded to 'Conviction Buy' from 'Buy' at Goldman Sachs.

AMC Entertainment (AMC +1.02%) was downgraded to 'Neutral' from 'Buy' at B. Riley.

IntercontinentalExchange (ICE +0.32%) was downgraded to 'Neutral' from 'Buy' at Citigroup.

Thor Industries (THO -5.68%) was downgraded to 'Neutral' from 'Buy' at SunTrust.

Big Lots (BIG -1.22%) reported a Q3 EPS loss of -6 cents, a bigger loss than consensus of -5 cents.

Vodafone (VOD -1.04%) was upgraded to 'Buy' from 'Neutral' at Goldman Sachs.

Cormorant Global Healthcare reported a 8.94% passive stake in Quotient (QTNT -0.17%) .

Fiat Chrysler (FCAU -2.51%) slid over 3% in after-hours trading after it filed to sell $2.5 billion of mandatory convertible securities due 2016.

Gabelli reported a 12.37% stake in Cincinnati Bell (CBB -0.88%) .

Synaptics (SYNA -1.15%) soared over 7% in after-hours trading after it raised guidance on Q2 revenue view to $440 million-$460 million from $415 million-$450 million, above consensus of $433.12 million.

Northrop Grumman (NOC -0.80%) announced a new $3 billion share repurchase authorization, and then the company was upgraded to 'Conviction Buy' from 'Buy' at Goldman Sachs.

Ulta Salon (ULTA +0.85%) climbed over 5% in after-hours trading after it reported Q3 EPS of 91 cents, higher than consensus of 84 cents.

Cooper Companies (COO -0.45%) dropped over 2% in after-hours trading after it reported Q4 EPS of $1.95, less than consensus of $2.03, and then lowered guidance on fiscal 2015 EPS view to $7.30-$7.70 from $8.20-$8.60, well below consensus of $8.24.

American Eagle (AEO -3.83%) reported Q3 adjusted EPS of 22 cents, right on consensus, although Q3 revenue of $854 million was above consensus of $845.95 million.

The Gap (GPS -0.10%) jumped over 2% in after-hours trading after it reported November same-store-sales of $1.72 billion, up 6% y/y.

MARKET COMMENTS

Dec E-mini S&Ps (ESZ14 +0.10%) this morning are up +1.75 points (+0.08%). The S&P 500 index on Thursday closed lower: S&P 500 -0.12%, Dow Jones -0.07%, Nasdaq -0.02%. Bearish factors included (1) disappointment the ECB didn’t expand stimulus after ECB President Draghi said the ECB will reassess the effects of existing monetary stimulus “early next year,” and (2) the ECB’s cut in its Eurozone 2014-2016 GDP forecasts. Stocks rebounded from their worst levels after two Eurozone central-bank officials familiar with the deliberations said the ECB was planning for a broad-based asset purchase program next month that includes purchases of sovereign debt.

Mar 10-year T-notes (ZNH15 -0.06%) this morning are down -2.5 ticks. Mar 10-year T-note futures prices on Thursday rebounded from a 1-week low and closed higher: TYH5 +7.00, FVH5 +3.25. Supportive factors included (1) European economic concerns after the ECB lowered its Eurozone GDP and inflation forecasts for 2014-2016, and (2) increased safe-haven demand for T-notes as stocks retreated.

The dollar index (DXY00 +0.19%) this morning is up +0.176 (+0.20%). EUR/USD (^EURUSD) is down -0.0028 (-0.23%). USD/JPY (^USDJPY) is up +0.87 (+0.73%) at a 7-1/3 year high. The dollar index on Thursday retreated from a 5-1/2 year high and closed lower. Closes: Dollar index -0.252(-0.28%), EUR/USD +0.00679 (+0.55%), USD/JPY unch. The main bearish factor was short-covering in EUR/USD which rebounded from a 2-1/4 year low after ECB President Draghi said policy makers will wait until next quarter to assess whether additional stimulus measures are required. USD/JPY soared to a 7-1/3 year high after the Nikkei and Yomiuri newspapers reported that Prime Minister Abe’s Liberal Democratic Party will boost its majority at the Dec 14 election, which will give Abe a mandate to continue his inflationary and yen-negative fiscal policies.

Jan WTI crude oil (CLF15 -0.72%) this morning is down -66 cents (-0.99%) and Jan gasoline (RBF15 -0.91%) is down -0.0193 (-1.08%). Jan crude and Jan gasoline on Thursday closed lower. Closes: CLF5 -0.57 (-0.85%), RBF5 -0.0112 (-0.68%). Bearish factors included (1) comments from an unnamed person from the Saudi Oil Ministry who said Saudi Arabia has no target for crude prices and will let the market decide at what level oil should trade for now, and (2) the ECB’s cut in its Eurozone 2014 and 2015 GDP forecasts, which signals reduced energy consumption and demand.

Click on picture to enlarge

Disclosure: None