Morning Call For December 22, 2014

OVERNIGHT MARKETS AND NEWS

March E-mini S&Ps (ESH15 +0.23%) this morning are up +0.28% and European stocks are up +0.84% as energy producers rose after the price of crude oil stabilized. The Russian ruble rallied up to a 1-week high against the dollar while yields on Spanish and Portuguese 10-year government bonds fell to record lows. Asian stocks closed higher: Japan +0.08%, Hong Kong +1.26%, China +0.33%, Taiwan +1.06%, Australia +1.94%, Singapore +1.57%, South Korea +0.70%, India +1.21%. China's Shanghai Composite Index climbed to a 4-3/4 year high on expectations for China to expand stimulus measures and Japan's Nikkei Stock Index rose to a 1-1/2 week high as exporter stocks rallied after the yen fell to a 1-week low against the dollar. Commodity prices are mixed. Feb crude oil (CLG15 -0.79%) is down -0.09%. Feb gasoline (RBG15 -0.19%) is up +0.49%. Feb gold (GCG15 +0.06%) is up +0.05%. Mar copper (HGH15 +0.23%) is up +0.54%. Agriculture prices are mixed. The dollar index (DXY00 -0.14%) is down -0.09%. EUR/USD (^EURUSD) is up +0.25%. USD/JPY (^USDJPY) is up +0.21% at a 1-week high. Mar T-note prices (ZNH15 -0.05%) are down -1 tick.

ECB Vice President Constancio said that he sees a negative inflation rate in coming months and that the ECB must use all monetary policy instruments to prevent a "dangerous vicious circle of declining prices, rising real wage costs, falling profits, shrinking demand and further declining prices."

The German Nov import price index fell -0.8% m/m, more than expectations of -0.7% m/m and the biggest monthly decline in 19 months. On an annual basis. Nov import prices fell -2.1%, a bigger drop than expectations of -1.9% and the fastest pace of decline in 7 months.

U.S. STOCK PREVIEW

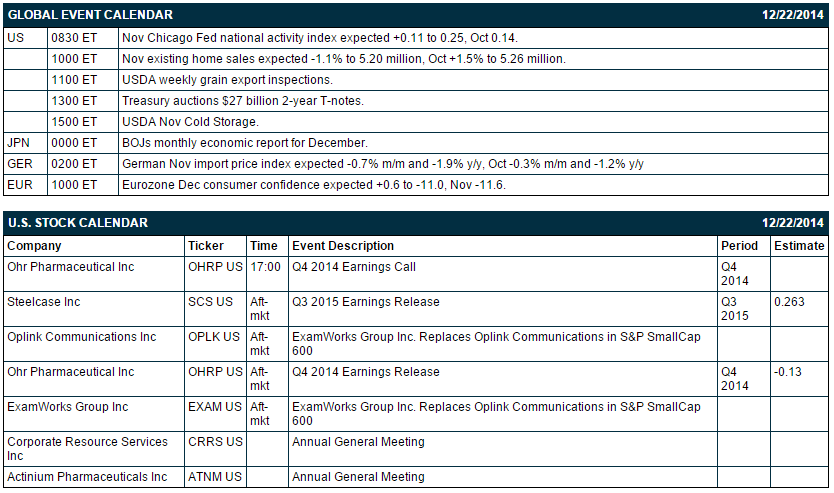

Today’s Nov existing home sales report is expected to show a -1.1% decline to 5.20 million, reversing most of October’s +1.5% increase to 5.26 million. The Treasury today will sell $27 billion of 2-year T-notes. There are 2 of the Russell 3000 companies that report earnings today: Steelcase (consensus $0.26), Ohr Pharma (-0.13). There are no equity conferences this week.

OVERNIGHT U.S. STOCK MOVERS

BlackBerry (BBRY -0.79%) was upgraded to 'Buy' from 'Hold' at TD Securities.

Tesco (TESO +4.78%) lowered guidance on Q4 EPS excluding items to 10 cents-15 cents, well below consensus of 32 cents.

Seagate (STX +1.17%) and Western Digital ({=WDC were both downgraded to 'Neutral' from 'Buy' at Longbow.

Time Warner (TWX +0.65%) was initiated with an 'Outperform' at Pacific Crest with a price target of $99.

Finish Line (FINL -19.20%) was downgraded to 'Neutral' from 'Buy' at Janney Capital.

Gilead (GILD +2.76%) dropped 4% in pre-market trading after Express Scripts said it will will offer AbbVie's just approved hepatitis C regimen Viekira Pak at a "significant discount" starting Jan. 1, while excluding competing drugs from Gilead and Johnson & Johnson,

ARAMARK (ARMK +0.95%) was upgraded to 'Top Pick' from 'Outperform' at RBC Capital.

Yahoo reported a 16.7% passive stake in Hortonworks (HDP +1.66%) .

Raytheon (RTN +0.76%) was awarded a $2.4 billion government contract for 10 PATRIOT fire units with spares for the State of Qatar.

Harvey Partners reported 5.0% passive stake in Oil-Dri Corporation of America (ODC -0.16%) .

Adage Capital Partners reported an 18.84% passive stake in Advaxis (ADXS +15.43%) .

MARKET COMMENTS

Mar E-mini S&Ps (ESH15 +0.23%) this morning are up +5.75 points (+0.28%). The S&P 500 index on Friday rallied to a 1-1/2 week high and closed higher: S&P 500 +0.46%, Dow Jones +0.15%, Nasdaq +0.33%. Bullish factors included (1) carry-over support from Wednesday’s FOMC meeting statement where the Fed said it will be “patient” in its approach to raising interest rates, and (2) strength in energy producers after crude oil prices rose.

Mar 10-year T-notes (ZNH15 -0.05%) this morning are down -1 tick. Mar 10-year T-note futures prices on Friday recovered from a 1-week low and closed higher: TYH5 +5.00, FVH5 +0.75. Bullish factors included (1) expectations that the Fed will take its time in raising interest rates after Wednesday’s post-FOMC statement said that policy makers will be “patient” on timing the first rate increase, and (2) dovish comments from Minneapolis Fed President Kocherlakota who said that a failure by policy makers “to respond to weak inflation runs the risk of creating a harmful downward slide in inflation and longer-term inflation expectations of the kind we have seen in Japan and Europe.”

The dollar index (DXY00 -0.14%) this morning is down -0.081 (-0.09%). EUR/USD (^EURUSD) is up +0.0030 (+0.25%). USD/JPY (^USDJPY) is up +0.25 (+0.21%) at a 1-week high. The dollar index on Friday rose to an 8-1/2 year high and closed higher. Closes: Dollar index +0.363 (+0.41%), EUR/USD -0.00578 (-0.47%), USD/JPY +0.673 (+0.57%). Bullish factors included (1) weakness in EUR/USD, which slumped to a 2-1/3 year low on the prospects for the ECB to implement quantitative easing at the next policy meeting on Jan 22, and (2) weakness in the yen after USD/JPY climbed to a 1-week high as the BOJ maintained record stimulus at its 2-day policy meeting that ended on Friday.

Feb WTI crude oil (CLG15 -0.79%) this morning is down -5 cents (-0.09%) and Feb gasoline (RBG15 -0.19%) is up +0.0077 (+0.49%). Feb crude and Feb gasoline prices Friday closed higher. Closes: CLG5 +2.77 (+5.10%), RBG5 +0.0578 (+3.75%). Bullish factors included (1) the rally in the S&P 500 to a 1-1/2 week high, which bolsters optimism in the economic outlook and energy demand, and (2) comments from Saudi Oil Minister Ali Al-Naimi who said that oil markets are experiencing “temporary” instability and that a steady global economic expansion will resume and spur oil demand.

Disclosure: None