Morning Call For Aug. 5, 2014

OVERNIGHT MARKETS AND NEWS

September E-mini S&Ps (ESU14 -0.25%) this morning are down -0.16%, while European stocks are up +0.51% after earnings results from Bayerische Motoren Werke AG, the world's biggest luxury automaker, and Credit Agricole SA beat estimates. Asian stocks closed mixed: Japan -1.00%, Hong Kong +0.20%, China -0.26%, Taiwan -2.02%, Australia -0.40%, Singapore +0.28%, South Korea -0.75%, India +0.72%. China's Shanghai Stock Index retreated from a 7-3/4 month high and closed lower after a gauge of China's services industries declined to a record low. Commodity prices are mixed. Sep crude oil (CLU14 +0.25%) is up +0.25%. Sep gasoline (RBU14 -0.23%) is down -0.33%. Dec gold (GCZ14 +0.27%) is up +0.25%. Sep copper (HGU14 -0.35%) is down -0.25%. Agriculture and livestock prices are mostly lower as grain prices fell after overnight rains in the Midwest reduced soil moisture concerns. The dollar index (DXY00 +0.18%) is up +0.15%. EUR/USD (^EURUSD) is down -0.25%. USD/JPY (^USDJPY) is up +0.15%. Sep T-note prices (ZNU14 -0.01%) are down -2.5 ticks.

Eurozone Jun retail sales were mixed as they rose +0.4% m/m, slightly less than expectations of +0.5% m/m, but rose +2.4% y/y, stronger than expectations of +1.4% y/y and the largest annual increase in 7-1/4 years.

The Eurozone Markit Jul composite PMI was revised lower to 53.8 from the originally reported 54.0.

The UK Markit/CIPS Jul composite PMI unexpectedly rose +0.9 to 58.8, higher than expectations of unch at 58.0.

The China HSBC Jul services PMI dropped -3.1 to 50.0, the lowest since the data series began in 2005.

U.S. STOCK PREVIEW

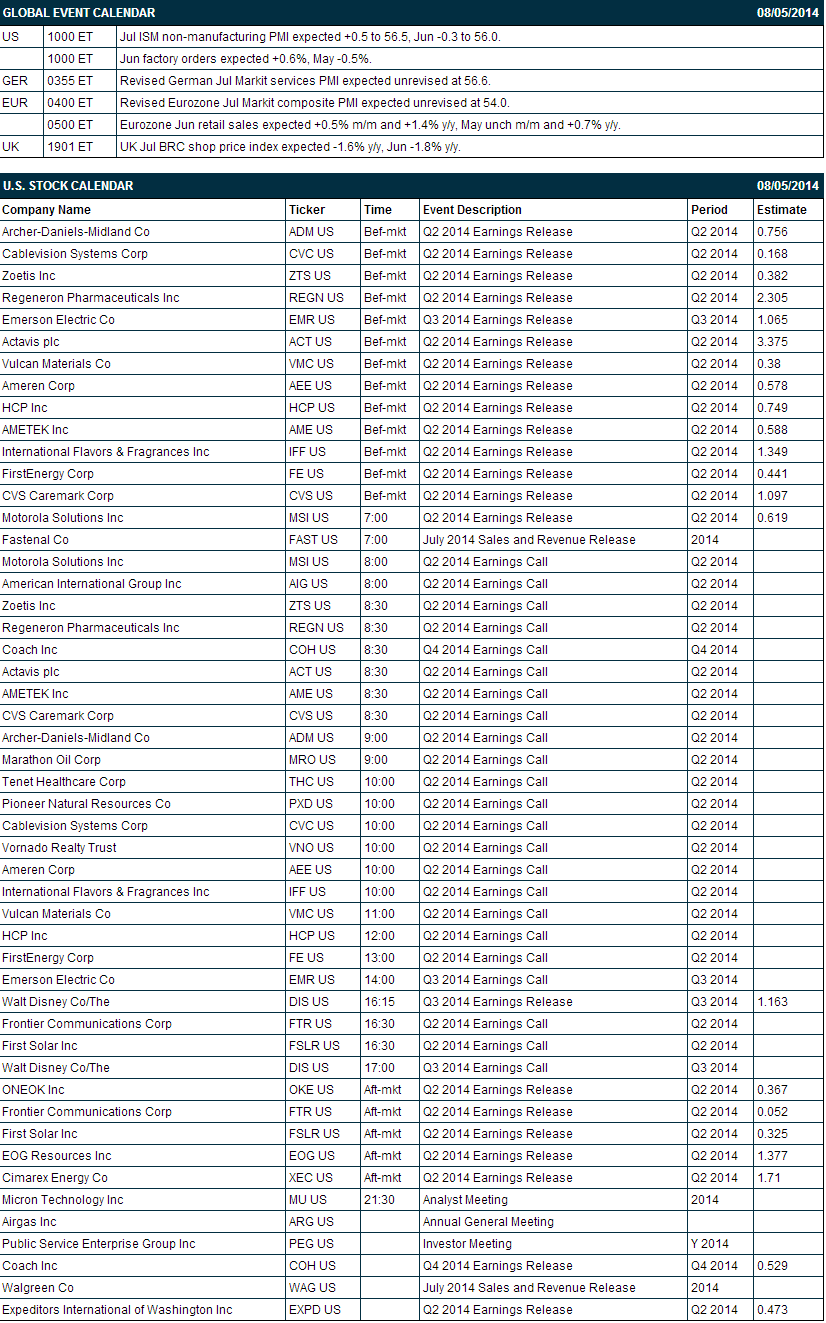

Today’s July ISM non-manufacturing PMI is expected to rise +0.5 points to 56.5, more than reversing the small -0.3 point decline to 56.0 seen in June. Today’s June factory orders report is expected to show a +0.6% increase, more than reversing May’s decline of -0.5%.

There are 15 of the S&P 500 companies that report earnings today with notable reports including: Archer-Daniels Midland (consensus $0.76), Cablevision Systems (0.17), Emerson Electric (1.07), CVS Caremark (1.10), Walt Disney (1.16). Equity conferences for the remainder of this week include: Needham Interconnect Conference on Tue, Piper Jaffray Global Agriculture & Animal Health Investor Day on Tue, AESP Conference - Evaluators & Implementers: Merging on the Energy Efficiency on Tue, CFA Society of Minnesota InvestMNt Conference on Wed, Black Hat USA 2014 on Wed-Thu, Needham Advanced Industrial Technologies Conference on Thu.

OVERNIGHT U.S. STOCK MOVERS

Emerson Electric (EMR +0.93%) reported Q3 EPS of $1.03, below consensus of $1.06.

Archer-Daniels Midland (ADM +0.82%) reported Q2 EPS of 77 cents, higher than consensus of 76 cents.

CVS Caremark (CVS +1.15%) reported Q2 EPS of $1.13, better than consensus of $1.10.

Bristow Group (BRS +1.48%) reported Q1 adjusted EPS of $1.32, better than consensus of $1.08.

Dresser-Rand (DRC +0.12%) reported Q2 EPS of 38 cents, weaker than consensus of 40 cents.

Avis Budget (CAR +1.98%) rose over 4% in after-hours trading after it reported Q2 EPS ex-items of 68 cents, higher than consensus of 61 cents.

Thor Industries (THO +1.54%) reported preliminary Q4 revenue of $1.04 billion, below consensus of $1.1 billion.

The Column Group reports 20.1% stake in Immune Design (IMDZ -1.17%) .

Cubic (CUB -0.75%) reported Q3 EPS of 45 cents, well below consensus of 75 cents.

McDermott (MDR +0.97%) reported a Q2 EPS loss of -5 cents, better than consensus of a -17 cent loss.

Tenet ({=THC reported Q2 continuing operations EPS of 17 cents, well above consensus of 1 cent.

Alleghany (Y +0.15%) reported Q2 EPS of $9.06, well ahead of consensus of $8.00.

Texas Roadhouse (TXRH -0.08%) reported Q2 EPS of 33 cents, right on consensus, although Q2 revenue of $395.4 million was slightly better than consensus of $394.29 million.

Pioneer Natural Resources (PXD +2.75%) reported Q2 EPS of $1.35, better than consensus of $1.28.

Kaman (KAMN +0.20%) reported Q2 EPS of 60 cents, right on consensus, although Q2 revenue of $459.1 million was below consensus of $471.25 million.

AIG (AIG +1.17%) gained over 2% in after-hours trading after it reported Q2 EPS of $1.25, well above consensus of $1.05, and then announced an additional share repurchase authorization of $2 billion.

MARKET COMMENTS

Sep E-mini S&Ps (ESU14 -0.25%) this morning are down -3.00 points (-0.16%). The S&P 500 index on Monday closed higher: S&P 500 +0.72%, Dow Jones +0.46%, Nasdaq +0.75%. Bullish factor included (1) reduced global banking concerns after the Bank of Portugal took control over Banco Espirito Santo, which eased concern that the crisis would spread, and (2) better-than-expected Q2 company earnings results as 76% of the S&P 500 companies that have reported earnings thus far have exceeded estimates. Gains in stocks were limited due to the ongoing geopolitical crisis in Iraq, Ukraine and the Middle East.

Sep 10-year T-notes (ZNU14 -0.01%) this morning are down -2.5 ticks. Sep 10-year T-note futures prices on Monday climbed to a 2-week high and closed higher. The main bullish factor was positive carry-over from Friday's payroll report that showed a smaller-than-expected increase in July non-farm payrolls and an unexpected uptick in the Jul unemployment rate. T-notes fell back from their best levels after stocks moved higher and maintained their gains. Closes: TYU4 +4.00, FVU4 +2.00.

The dollar index (DXY00 +0.18%) this morning is up +0.125 (+0.15%). EUR/USD (^EURUSD) is down -0.0034 (-0.25%) and USD/JPY (^USDJPY) is up +0.15 (+0.15%). The dollar index on Monday closed slightly higher on speculation the Fed will tighten monetary policy before the ECB and BOJ, which would boost the dollar's interest rate differentials versus the euro and yen. EUR/USD fell back after Eurozone Aug Sentix investor confidence fell a more-than-expected -7.4 to 2.7, a 1-year low. Closes: Dollar index +0.026 (+0.03%), EUR/USD -0.0006 (-0.05%), USD/JPY -0.041 (-0.04%).

Sep WTI crude oil (CLU14 +0.25%) this morning is up +25 cents (+0.25%) and Sep gasoline (RBU14 -0.23%) is down -0.0089 (-0.33%). Sep crude and gasoline prices on Monday settled mixed with Sep gasoline at a 6-month low: CLU4 +0.41 (+0.42%), RBU4 -0.0194 (-0.71%). Crude prices rose on rising tensions in Iraq after militants took control over two oil fields in northern Iraq. Gasoline prices fell on demand concerns after EIA gasoline inventories rose to a 4-month high last Wed despite summer being typically a strong time of year for gasoline demand.

Disclosure: None