Morning Call For Aug. 14, 2014

OVERNIGHT MARKETS AND NEWS

September E-mini S&Ps (ESU14 +0.10%) this morning are up +0.12% and European stocks are up +0.37% after ThyssenKrupp AG, Germany's largest steelmaker, reported better-than-expected quarterly earnings. European stocks shook off weaker-than-expected Q2 GDP reports from Germany and France which left Eurozone economic growth stagnating in Q2. The yield on the 10-year German bund fell to a record low 0.998% on speculation that the weaker-than-expected Eurozone Q2 GDP will prod the ECB into expanding stimulus. Asian stocks closed mixed: Japan +0.66%, Hong Kong-0.36%, China -0.97%, Taiwan -0.01%, Australia +0.61%, Singapore -0.20%, South Korea -0.01%, India +0.71%. Commodity prices are mostly lower. Sep crude oil (CLU14 -0.11%) is down -0.09%. Sep gasoline (RBU14 -0.51%) is down -0.38%. Dec gold (GCZ14 -0.25%) is down -0.17%. Sep copper (HGU14 -0.08%) is down -0.10% at a 1-3/4 month low as stagnation in the Eurozone economy fuels copper demand concerns. Agriculture and livestock prices are mostly lower with Oct hogs down -1.85% at a 4-3/4 month low. The dollar index (DXY00 -0.06%) is down -0.06%. EUR/USD (^EURUSD) is up +0.08%. USD/JPY (^USDJPY) is up +0.03%. Sep T-note prices (ZNU14 +0.02%) are unchanged.

Eurozone Q2 GDP was unchanged q/q and up +0.7% y/y, slightly less than expectations of +0.1% q/q and +0.7% y/y.

Eurozone Jul CPI fell -0.7% m/m, a bigger decline than expectations of -0.6% m/m, while the annual Jul CPI was left unrevised at +0.4% y/y. The Jul core CPI was also left unrevised at +0.8% y/y.

German Q2 GDP fell -0.2% q/q and rose +0.8% y/y (nsa), weaker than expectations of -0.1% q/q and +1.3% y/y (nsa).

Japan Jun machine orders rose +8.8% m/m and fell -3.0% y/y, weaker than expectations of +15.3% m/m and +3.0% y/y.

The Bank of Korea (BOK) unexpectedly cut its seven-day repurchase rate by 25 bp to 2.25% and BOK Governor Lee said the cut was aimed at preventing weak sentiment from harming growth and was possible because pressure from inflation isn't high. The BOK last month had lowered its South Korea 2014 GDP estimate to 3.8% from 4.0% due to weaker-than-expected domestic demand.

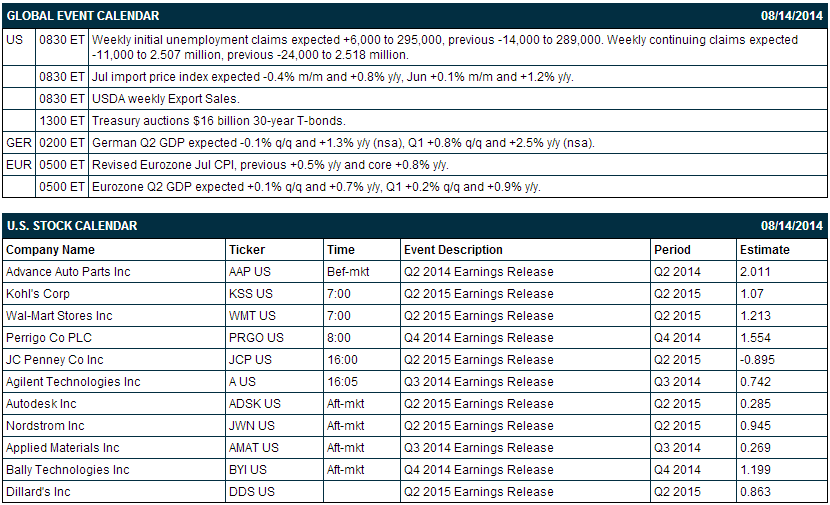

U.S. STOCK PREVIEW

Today’s weekly initial unemployment claims report is expected to show an increase of +6,000 to 295,000, reversing part of last week’s decline of-14,000 to 289,000. Meanwhile, continuing claims are expected to show a decline of -11,000 to 2.507 million, adding to last week’s decline of -24,000 to 2.518 million. The unemployment claims series are both in good shape and are showing a slow improvement in the layoff picture. Today’s July import price index is expected to weaken to -0.4% m/m and +0.8% y/y from the June report of +0.1% m/m and +1.2% y/y. The Treasury today will sell $16 billion of 30-year T-bonds, concluding this week’s $67 billion refunding operation.

There are 7 of the S&P 500 companies that report earnings today: Wal-Mart (consensus $1.21), Kohl's (1.07), Perrigo (1.55), Agilent (0.74), Applied Materials (0.27), Autodesk (0.29), Nordstrom (0.95). Equity conferences during the remainder of this week include: Jefferies Global Industrials Conference on Mon-Thu, Canaccord Genuity Growth Conference on Wed-Thu, and Barclays Summer Utilities Conference on Thu.

OVERNIGHT U.S. STOCK MOVERS

Kohl's (KSS -1.47%) reported Q2 EPS of $1.13, better than consensus of $1.07.

Wal-Mart (WMT -0.26%) reported Q2 EPS of $1.21, right on expectations, but then lowered guidance on fiscal 2015 EPS view to $4.90-$5.15 from $5.10-$5.45, at the lower end of consensus of $5.15.

Dresser-Rand (DRC -0.09%) was upgraded to 'Buy' from 'Neutral' at Guggenheim.

Molson Coors (TAP +0.42%) was initiated with an 'Outperform' at Credit Suisse with a price target of $84.

Freeport McMoRan (FCX -1.33%) was downgraded to 'Hold' from 'Buy' at Stifel.

Progressive (PGR +1.68%) was upgraded to 'Buy' from 'Neutral' at Citigroup.

Guess (GES -3.69%) was initiated with a 'Buy' at Wunderlich with a price target of $31.

Infineon (IFNNY +0.27%) was upgraded to 'Buy' from 'Neutral' at UBS.

Point72 Asset reported a 5.1% passive stake in Kindred Healthcare (KND +0.21%) .

Aegean Marine (ANW -0.84%) reported Q2 EPS of 20 cents, right on consensus, although Q2 revenue of $1.72 billion was higher than consensus of $1.71 million.

Cisco (CSCO +0.20%) reported Q4 EPS of 55 cents, better than consensus of 53 cents.

Infosys (INFY +0.86%) was downgraded to 'Hold' from 'Buy' at Jefferies.

Vipshop (VIPS +4.36%) reported Q2 EPS of 72 cents, higher than consensus of 64 cents, and then raised guidance on Q3 revenue to $850 million-$860 million, better than consensus of $824.85 million.

NetApp (NTAP +0.03%) reported Q1 EPS of 60 cents, better than consensus of 57 cents.

MARKET COMMENTS

Sep E-mini S&Ps (ESU14 +0.10%) this morning are up +2.25 points (+0.12%). The S&P 500 index on Wednesday rallied to a 1-1/2 week high and closed higher: S&P 500 +0.67%, Dow Jones +0.55%, Nasdaq +1.13%. Bullish factors included (1) speculation the Fed won’t be forced to raise interest rates sooner than expected after the weaker-than-expected U.S. Jul retail sales report, and (2) strong Q2 company earnings results as 75% of reporting S&P 500 companies have beaten profit estimates. On the negative side, U.S. Jul retail sales were unchanged and +0.1% ex autos, weaker than expectations of +0.2% and +0.4% ex autos.

Sep 10-year T-notes (ZNU14 +0.02%) this morning are unch. Sep 10-year T-note futures prices on Wednesday closed higher. Bullish factors included (1) the smaller-than-expected increase in U.S. Jul retail sales, and (2) global economic concerns after China Jul new yuan loans showed the smallest increase in 4-1/2 years and Eurozone Jun industrial production unexpectedly fell for a second month. Closes: TYU4 +10.00, FVU4 +6.25.

The dollar index (DXY00 -0.06%) this morning is down -0.050 (-0.06%). EUR/USD (^EURUSD) is up +0.0011 (+0.08%) and USD/JPY (^USDJPY) is up +0.03 (+0.03%). The dollar index on Wednesday closed higher. Supportive factors included (1) weakness in EUR/USD after Eurozone Jun industrial production unexpectedly fell -0.3% m/m, weaker than expectations of +0.4% m/m, and (2) weakness in the yen after Japan Q2 GDP fell -6.8% q/q annualized, the largest pace of contraction in 3-1/2 years. Strength in the dollar was limited after U.S. Jul retail sales rose less than expected. Closes: Dollar index +0.096 (+0.12%), EUR/USD -0.0004 (-0.03%), USD/JPY +0.157 (+0.15%).

Sep WTI crude oil (CLU14 -0.11%) this morning is down -9 cents (-0.09%) and Sep gasoline (RBU14 -0.51%) is down -0.0105 (-0.38%). Sep crude and gasoline prices on Wednesday closed higher on technical buying from early losses after last week’s lows held: CLU4 +0.22 (+0.23%), RBU4 +0.0160 (+0.59%). Prices had moved lower on bearish factors that included (1) the unexpected +1.4 million bbl increase in weekly EIA crude inventories, more than expectations for a -1.625 million bbl decline, and (2) the +418,000 bbl rise in crude supplies at Cushing, OK, the delivery point of WTI futures, for the second consecutive weekly rise.

Disclosure: None