Morning Call For April 7, 2015

OVERNIGHT MARKETS AND NEWS

June E-mini S&Ps (ESM15 +0.22%) this morning are little changed. The Euro Stoxx 50 index is up +1.21% as the European markets reopened after the Easter holiday and reacted positively to hopes for an easier Fed policy after last Friday's weaker-than-expected U.S. payroll report of +126,000. Asian stocks today settled mostly higher: Japan +1.25%, China +2.15%, Taiwan +0.43%, Australia +0.46%, Singapore +0.37%, South Korea -0.02%, India +0.04%, and Turkey -0.77%. The dollar index (DXY00 +0.71%) is sharply higher by +0.76% on higher U.S. inflation expectations after Monday's +5.8% surge in Brent crude oil prices. EUR/USD (^EURUSD) is down -0.0060 (-0.55%) and USD/JPY (^USDJPY) is up +0.36 (+0.30%). Jun T-note prices (ZNM15 -0.06%) are down -2 ticks.

Commodity prices are down -0.39% this morning as the energy and metals markets fell back after Monday's surge and as this morning's stronger dollar takes its toll. May crude oil (CLK15 -0.96%) is down -0.59 (-1.13%) and May gasoline (RBK15 -0.15%) is down -0.0069 (-0.37%). Jun gold (GCM15 -0.60%) is down -9.0 (-0.74%), May silver (SIK15 -1.43%) is down -0.300 (-1.75%), and May copper (HGK15 +1.31%) is up +0.021 (+0.75%). Grain and softs prices are trading mostly lower.

The Australian dollar saw some strength today after the Australian central bank today kept its key interest rate unchanged, which was more hawkish than market expectations of about a 50-50 chance of a rate cut. The markets are now expecting the Australian central bank to cut rates in May.

European bond yields fell today after last Friday's weak U.S. payroll report of +126,000 caused market participants to defer expectations of Fed tightening and after Greece indicated over the weekend that it will make its 500 million euro payment to the IMF this Thursday. 10-year bond yields fell by -5 bp to 1.25% for Italy, -7 bp to 1.64% for Portugal, and -22 bp to 11.84% for Greece.

U.S. STOCK PREVIEW

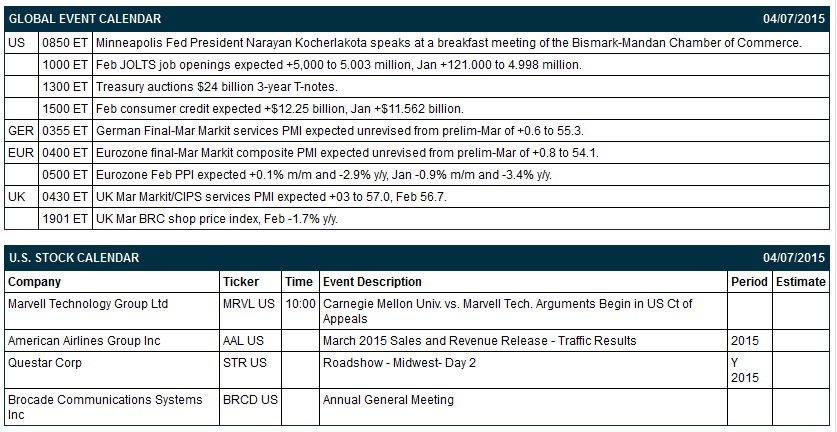

Key news today includes (1) the Feb JOLTS job openings report (expected +5,000 to 5.003 million after Jan's +121.000 to 4.998 million, (2) the Feb consumer credit report (expected +$12.25 billion after Jan's +$11.562 billion), (3) a speech by Minneapolis Fed President Narayan Kocherlakota at a breakfast meeting at the Bismark-Mandan Chamber of Commerce, and (4) the Treasury's auction of $24 billion of 3-year T-notes.

None of the Russell 1000 companies report earnings today.

There are no U.S. IPO's that scheduled to price or trade today.

Equity conferences this week include: Internet of Things (IoT) Asia 2015 on Wed-Thu, and JP Morgan Spring Fling Conference on Thu

June E-mini S&Ps this morning are little changed, consolidating after yesterday's gains. Monday's closes: S&P 500 +0.67%, Dow Jones +0.66%, Nasdaq +0.62%. The stock market rallied fairly sharply on Monday on hopes for a delayed Fed rate hike due to last Friday's poor March payroll report of +126,000. In addition, petroleum stocks rallied sharply on Monday on the +5.7% surge in May crude oil prices. The ISM non-manufacturing index was net positive for the stock market since the -0.4 decline to 56.5 was in line with market expectations while the new orders sub-index rose by +1.1 to 57.8 and the employment sub-index rose by +0.2 points to 56.6.

OVERNIGHT U.S. STOCK MOVERS

- International Speedway (ISCA +0.74%) reported Q1 non-GAAP EPS of 33 cents, which was better than the consensus of 29 cents.

- Starbucks' (SBUX +0.14%) losses on its European division have raised suspicions among European regulators, according to WSJ

- An affiliate of Berkshire Hathaway (BRK-A -0.10%) acquired 20 million shares of Axalta (AXTA +1.43%) worth $560 million from The Carlyle Group.

- Domino's Pizza (DPZ -0.18%) CEO said on CNBC that he believes a wage hike may be necessary.

- A. Schulman (SHLM +0.52%) reported fiscal Q2 adjusted EPS of 39 cents, just under the consensus of 40 cents.

MARKET COMMENTS

Jun 10-year T-notes this morning are down -2 ticks: Monday's closes: TYM5 -15.50, FVM5 -7.75. June 10-year T-note prices on Monday fell fairly sharply as the +5.70% surge in May crude oil prices boosted inflation expectations. T-note prices were also undercut by (1) reduced safe-haven demand with the higher close in the stock market, and (2) supply overhang as the Treasury on Tuesday will begin selling this week's $58 billion coupon package.

The dollar index this morning is sharply higher by +0.76% on higher U.S. inflation expectations after Monday's +5.8% surge in Brent crude oil prices. EUR/USD is down -0.0060 (-0.55%) and USD/JPY is up +0.36 (+0.30%). Monday's closes: Dollar index +0.494 (+0.51%), EUR/USD -0.0033 (-0.30%), USD/JPY +0.51 (+0.43%). The dollar index on Monday rallied moderately on some short-covering after last week's losses and on ideas that Monday's surge in oil prices may accelerate a Fed tightening due to higher inflation expectations.

May crude oil is down -0.59 (-1.13%) and May gasoline is down -0.0069 (-0.37%) on this morning's stronger dollar and on some long liquidation pressure after Monday's sharp gains. Monday's closes: CLK5 +2.80 (+5.70%), RBK5 +0.0795 (+4.51%). May crude oil and gasoline prices on Monday rallied very sharply after Saudi Arabia raised its May prices to Asian customers by 30 cents per barrel due to stronger demand and wider refining margins. In addition, pessimism about the Iran nuclear agreement grew after the Obama administration said that there is effectively no agreement with Iran yet about exactly how sanctions will be dropped and after Israeli PM Netanyahu made a full court press to try to scuttle the deal. May crude oil prices shook off expectations that Wednesday's EIA report will show a further +3.0 million bbl gain in U.S. crude oil inventories.

Disclosure: None.