Morning Call For April 30, 2015

OVERNIGHT MARKETS AND NEWS

June E-mini S&Ps (ESM15 -0.30%) this morning are down -0.23%, led by a 1% drop in Apple after a report that a component defect could force it to limit supply of its new watch. European stocks are down -0.14% at a 1-1/2 month low after German Mar retail sales unexpectedly fell -2.3% m/m, the biggest monthly drop in 15 months. Also, Nokia Oyj is down nearly 8% after it reported Q1 profits that were below estimates, and STMicroelectronics plunged 12% after it forecast weaker-than-expected revenue and profit margins amid a slowdown in demand. Asian stocks closed mostly lower: Japan -2.69%, Hong Kong -0.94%, China -0.78%, Taiwan -0.34%, Australia -0.83%, Singapore +0.01%, South Korea -0.60%, India -0.79%. Japan's Nikkei Stock Index fell to a 1-week low, led by a slide in exporters, after the yen climbed to a 1-month high against the dollar, which reduces the earnings prospects of exporters.

Commodity prices are mixed. Jun crude oil (CLM15 +1.02%) is up +0.89% at a new 4-1/2 month high as the dollar weakened and after Wednesday's EIA data showed a decline in crude supplies at Cushing for the first time since Nov. Jun gasoline (RBM15 +0.61%) is up +0.33%. Metals prices are mixed. Jun gold (GCM15 -0.62%) is down -0.63% after Wednesday's post-FOMC statement signaled the Fed is still open to raising interest rates. May copper (HGK15 +1.45%) is up +1.29% at a 1-month high after weekly Shanghai copper inventories fell for a fourth week as they slid -20,120 Mt TO 188,165 MT, a 2-1/2 month low. Agriculture prices are higher due to a weaker dollar.

The dollar index (DXY00 -0.39%) is down -0.44% at a fresh 2-month low on speculation the Fed is in no hurry to raise interest rates. EUR/USD (^EURUSD) is up +0.58% at a 2-month high after Eurozone Apr CPI was unch y/y and ended a 4-month streak of declines. USD/JPY (^USDJPY) is down -0.06% at a 1-month low.

Jun T-note prices (ZNM15 -0.04%) are down -0.5 of a tick on carry-over weakness from a slide in German bunds to a 1-1/2 month low.

In its Economic Bulletin for Apr, the ECB was upbeat in its economic prospects for the Eurozone when it said "the latest economic indicators and survey results are consistent with continued economic expansion in Q1 of 2015. Looking beyond the short term, the monetary measures taken by the Governing Council, the low oil price and the depreciation of the euro should help broaden and gradually strengthen the recovery."

U.S. STOCK PREVIEW

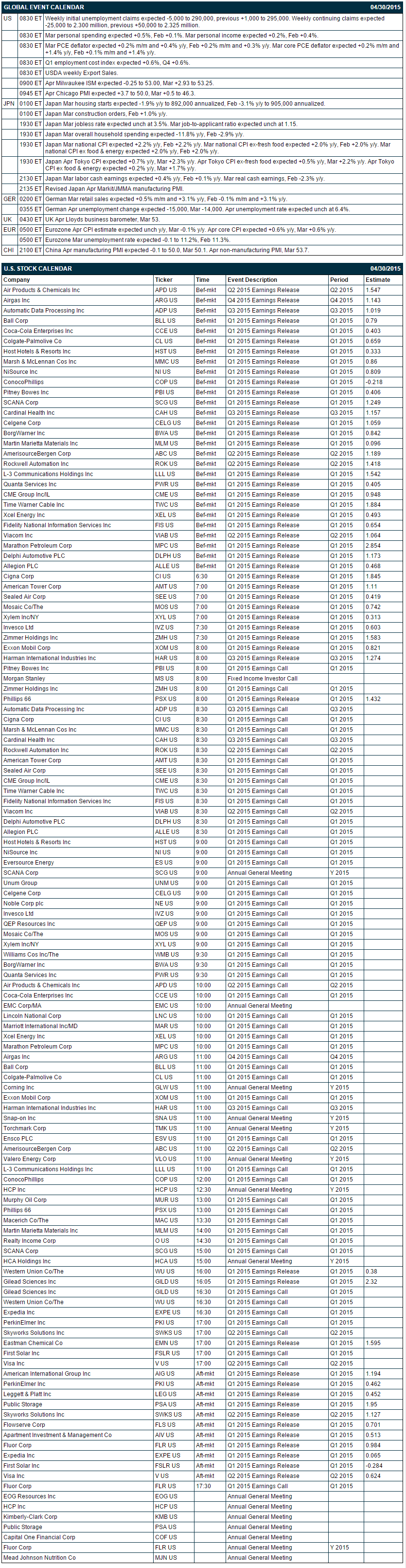

Key U.S. reports today include: (1) weekly unemployment claims (initial unemployment claims expected -5,000 to 290,000 after last week's +1,000 to 295,000; continuing claims expected -25,000 to 2.300 million after last week's +50,000 to 2.325 million), (2) Mar personal spending (expected +0.5% after Feb's +0.1%) and Mar personal income (expected +0.2% after Feb's +0.4%), (3) the Mar PCE deflator (expected +0.4% y/y after Feb's +0.3% y/y) and Mar core PCE deflator (expected unchanged from Feb's +1.4% y/y), (4) the Q1 employment cost index (expected +0.6% q/q after Q4's +0.6%), and (5) the April Chicago PMI (expected +3.7 to 50.0 after March's +0.5 to 46.3), and (6) the Apr Milwaukee ISM (expected -0.25 to 53.00 after March's +2.93 to 53.25).

There are 52 of the S&P 500 companies that report earnings today with notable reports including: Exxon Mobil (consensus $0.82), Visa (0.62), Time Warner Cable (1.88), Coca-Cola Enterprises (0.40), ConocoPhillips (-0.22), Marathon Petroleum (2.85), CME Group (0.95).

U.S. IPO's scheduled to price today include: Black Stone Minerals (BSM), Biondvax Pharmaceuticals (BVXV), Advaxis (ADXS), Inovio Pharmaceuticals (INO), Scorpio Tankers (STNG). IPOs that are scheduled to trade today include: Blueprint Medicines (BPMC).

Equity conferences during the remainder of this week include: none.

OVERNIGHT U.S. STOCK MOVERS

Time Warner Cable (TWC -0.02%) reported Q1 EPS of $1.65, below consensus of $1.88.

Manitowoc (MTW -0.96%) reported a Q1 adjusted EPS loss of -5 cents, a larger loss than consensus of -2 cents.

Baidu (BIDU -0.09%) reported Q1 adjusted EPS of $1.22, better than consensus of $1.16.

Marriott (MAR +3.14%) reported Q1 EPS of 73 cents, above consensus of 70 cents.

Flextronics (FLEX +0.41%) reported Q4 adjusted EPS of 27 cents, higher than consensus of 25 cents.

Apple (AAPL -1.47%) is down over 1% in pre-market trading after Dow Jones reported that the company found defects in the 'taptic engine' of the Apple Watch.

AMC Entertainment (AMC +0.37%) reported Q1 EPS of 6 cents, less than consensus of 8 cents.

Con-way (CNW -2.77%) reported Q1 EPS of 39 cents, better than consensus of 38 cents, but Q1 revenue of $1.37 billion was below consensus of $1.45 billion.

CACI (CACI -2.36%) reported Q3 EPS of $1.18, weaker than consensus of $1.27.

Williams (WMB +1.21%) reported Q1 adjusted EPS of 16 cents, above consensus of 15 cents.

Service Corp. (SCI -1.00%) reported Q1 adjusted EPS of 32 cents, higher than consensus of 28 cents. although Q1 revenue of $748.1 million was below consensus of $752.45 million.

Bob Evans Farms (BOBE -3.74%) announced that it will close 20 restaurants over the next 12 months.

Varian Medical (VAR +0.02%) reported Q2 EPS of $1.05, better than consensus of $1.00.

ARRIS (ARRS -0.89%) reported Q1 adjusted EPS of 44 cents, right on consensus

Hologic (HOLX -1.15%) reported Q2 EPS of 41 cents, above consensus of 39 cents, and then raised guidance on fiscal 2015 EPS view to $1.57-$1.59, above consensus of $1.57.

MARKET COMMENTS

June E-mini S&Ps (ESM15 -0.30%) this morning are down -4.75 points (-0.23%). Wednesday's closes: S&P 500 -0.37%, Dow Jones -0.41%, Nasdaq-0.60%. The S&P 500 index on Wednesday closed lower on the weak U.S. Q1 GDP report of +0.2% (q/q annualized) versus expectations of +1.0%. There was also weakness in health-care stocks after Humana plunged 6% on disappointing earnings news.

Jun 10-year T-notes (ZNM15 -0.04%) this morning are down -0.5 of a tick. Wednesday's closes: TYM5 -14.00, FVM5 -5.00. Jun 10-year T-notes on Wednesday fell sharply to post a new 1-1/4 month low as the 10-year T-note breakeven inflation rate climbed to a 5-1/2 month high. In addition, there was some negative carry-over from the decline in German bund prices to a 1-1/4 month low.

The dollar index (DXY00 -0.39%) this morning is down -0.423 (-0.44%) to a fresh 2-month low. EUR/USD (^EURUSD) is up +0.0065 (+0.58%) to a 2-month high. USD/JPY (^USDJPY) is down -0.07 (-0.06%) to a 1-month low. Wednesday's closes: Dollar Index -0.883 (-0.92%), EUR/USD +0.01467 (+1.34%), USD/JPY +0.159 (+0.13%). The dollar index on Wednesday fell to a 2-month low on the weaker-than-expected U.S. Q1 GDP report of +0.2% versus expectations of +1.0%. EUR/USD rallied to a 1-3/4 month high after the Eurozone Apr business climate indicator unexpectedly rose to an 11-month high.

Jun WTI crude oil (CLM15 +1.02%) this morning is up +52 cents (+0.89%) to a new 4-1/2 month high and Jun gasoline (RBM15 +0.61%) is up +0.0067 (+0.33%). Wednesday's closes: CLM5 +1.52 (+2.66%), RBM5 +0.0061 (+0.31%). Jun crude oil and gasoline prices on Wednesday climbed to 4-1/2 month highs on the plunge in the dollar index to a 2-month low and on the -514,000 bbl decline in crude supplies at Cushing, which was the first decline in 21 weeks.

Disclosure: None.