Morning Call For April 27, 2015

OVERNIGHT MARKETS AND NEWS

June E-mini S&Ps (ESM15 +0.19%) this morning are up +0.22% ahead of this week's 2-day FOMC meeting where the Fed may provide clues as to the timing on an expected interest rate increase. European stocks are up +0.09%, led by a +2.6% increase in HSBC after a report said that it's considering spinning off its UK retail bank for 20 billion pounds ($30 billion). Gains in European stocks were limited after Deutsche Bank fell 3% when it scrapped its profitability goal for next year and set a lower target for the medium term. The Greek debt situation is another concern for European markets as Greece has to pay pensioners and state workers this week and is counting on deposits of its local governments to meet end-of-month payments of over 1.5 billion euros. Eurozone finance ministers late Friday said they won't disburse more aid until bailout terms are met by Greece's government. Asian stocks closed mixed: Japan -0.18%, Hong Kong +1.33%, China +3.04%, Taiwan +0.60%, Australia +0.83%, Singapore +0.08%, South Korea -0.37%, India -0.95%. China's Shanghai Composite Index rose to a fresh 7-year high on speculation the government will expand stimulus to revive economic growth.

Commodity prices are mixed. Jun crude oil (CLM15 +0.03%) is down -0.26% Jun gasoline (RBM15 -0.02%) is down -0.24%. Losses were contained on concern that escalation of Saudi Arabia's military campaign in Yemen may disrupt Middle Eastern crude supplies after the Saudi Press Agency reported that Saudi Arabia deployed National Guard troops to its southern borders. Metals prices are higher. Jun gold (GCM15 +0.82%) is up +0.60% and May copper (HGK15 +0.20%) is up +0.29%. Agriculture prices are mixed.

The dollar index (DXY00 +0.29%) is up +0.20%. EUR/USD (^EURUSD) is down -0.25%. USD/JPY (^USDJPY) is up +0.28%.

Jun T-note prices (ZNM15 -0.01%) are little changed, down -0.5 of a tick.

Fitch Ratings cut Japan's sovereign-credit rating one notch to 'A' from 'A+' with a stable outlook, saying "the Japanese government did not include sufficient structural fiscal measures in its budget for the fiscal year" beginning this month to offset effects of the delay in the sales-tax increase.

U.S. STOCK PREVIEW

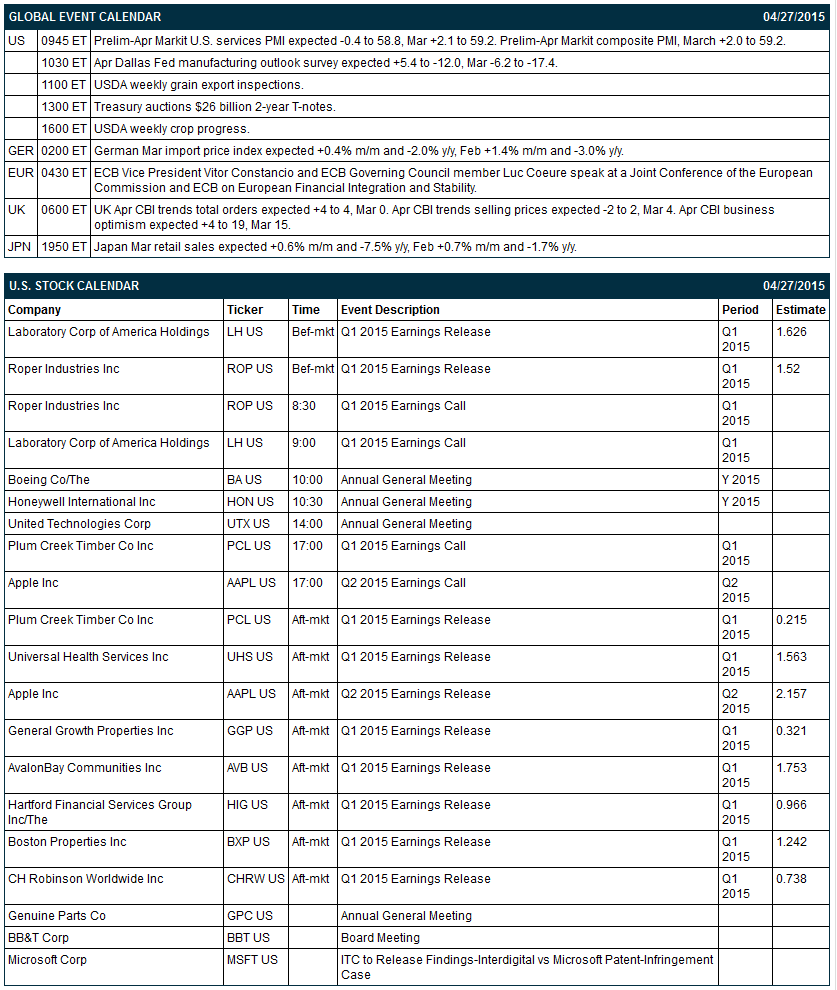

Key U.S. reports today include: (1) the preliminary-Apr Markit U.S. services PMI (expected -0.4 to 58.8 after March's +2.1 to 59.2), (2) the Apr Dallas Fed manufacturing outlook survey (expected +5.4 to -12.0 after March's -6.2 to -17.4), and (3) the Treasury's auction of $26 billion of 2-year T-notes.

There are 10 of the S&P 500 companies that report earnings today with notable reports including: Apple (consensus $2.16), General Growth Properties (0.32), Lab Corp (1.63), Roper Industries (1.52), Plum Creek Timber (0.22), Hartford Financial (0.97).

U.S. IPO's scheduled to price or trade today include: none

Equity conferences this week include: Milken Institute Global Conference on Mon-Wed.

OVERNIGHT U.S. STOCK MOVERS

Helmerich & Payne (HP -1.21%) was upgraded to 'Buy' from 'Neutral' at Goldman Sachs.

Citigroup raised its price target for Disney (DIS +0.49%) to $125 from $110 and keeps a 'Buy' rating on the stock.

Eaton Vance (EV -0.83%) was downgraded to 'Sell' from 'Neutral' at Citigroup.

Essex Property Trust (ESS -0.32%) was upgraded to 'Buy' from 'Hold' at Jefferies.

Perrigo (PRGO -4.33%) was downgraded to 'Neutral' from 'Buy' at UBS.

C.H. Robinson (CHRW +0.04%) was downgraded to 'Sell' from 'Neutral' at UBS.

Six Flags (SIX +2.41%) was downgraded to 'Neutral' from 'Buy' at Goldman Sachs.

SeaWorld (SEAS +1.66%) was upgraded to 'Buy' from 'Neutral' at Goldman Sachs.

Allscripts (MDRX -1.18%) was upgraded to 'Neutral' from 'Underweight' at Piper Jaffray.

Roper Industries (ROP -0.08%) reported Q1 EPS of $1.55, above consensus of $1.52.

Laboratory Corporation of America Holdings (LH +0.44%) reported Q1 EPS of $1.73, better than consensus of $1.63.

Applied Materials (AMAT -1.67%) slid nearly 7% in pre-market trading after the compnay scrapped its planned $9.39 billion takeover bid of rival Tokyo Electron Ltd. on opposition from the U.S. Department of Justice.

Marvell (MRVL -1.51%) dropped 5% in after-hours trading after it lowered its Q1 revenue guidance to $710 million-$740 million from $810 million-$830 million, well below consensus of $816.25 million.

Paulson & Co. reported an 11.7% passive stake in Synthesis Energy (SYMX -6.09%) .

MARKET COMMENTS

June E-mini S&Ps (ESM15 +0.19%) this morning are up +4.75 points (+0.22%). Friday's closes: S&P 500 +0.23%, Dow Jones +0.12%, Nasdaq +1.33%. The S&P 500 on Friday closed higher, supported mainly by a rally in tech stocks that pushed the Nasdaq Composite Index to a record high. Stocks also received a lift from European stocks after the German Apr IFO business confidence index rose +0.7 to a 10-month high of 108.6.

Jun 10-year T-notes (ZNM15 -0.01%) this morning are down -0.5 of a tick. Friday's closes: TYM5 +8.00, FVM5 +6.25. June T-notes on Friday closed higher on additional weak U.S. economic data as Mar core capital goods orders (ex-defense ex-aircraft), a proxy for capital spending fell -0.5% for the seventh straight monthly decline.

The dollar index (DXY00 +0.29%) this morning is up +0.194 (+0.20%). EUR/USD (^EURUSD) is down -0.0027 (-0.25%). USD/JPY (^USDJPY) is up +0.33 (+0.28%). Friday's closes: Dollar Index -0.356 (-0.37%), EUR/USD +0.00482 (+0.45%), USD/JPY -0.622 (-0.52%). The dollar index on Friday fell to a 2-1/2 week low and closed lower on the weak U.S. March core capital goods orders report and strength in EUR/USD on the rise in German Apr IFO business confidence index to a 10-month high.

Jun WTI crude oil (CLM15 +0.03%) this morning is down -15 cents (-0.26%) and Jun gasoline (RBM15 -0.02%) is down -0.0048 (-0.24%). Friday's closes: CLM5 -0.59 (-1.02%), RBM5 +0.0130 (+0.65%). Jun crude oil and gasoline prices on Friday settled mixed with crude oil continuing to see weakness on Wednesday's EIA report of a new record high in both U.S. and Cushing crude oil inventories. Supportive factors on Friday included the ongoing Saudi air strikes in Yemen and weakness in the dollar index.

Click on picture to enlarge

Disclosure: None.