Morning Call For April 23.2015

OVERNIGHT MARKETS AND NEWS

June E-mini S&Ps (ESM15 -0.24%) this morning are down -0.25% and European stocks are down -1.08% on weaker-than-expected global manufacturing reports. Gauges of Chinese and Japanese manufacturing activity contracted at the fastest pace in a year and Eurozone manufacturing activity unexpectedly declined. Also, U.S. technology stocks are lower led by a 3% loss in Qualcomm and a 5% drop in Texas Instruments after both companies reported less than expected quarterly profits. European technology stocks are also lower, led by a 9% drop in Ericsson AB after the company reported profits that were below consensus due to a slowdown in spending by its North American operators. Asian stocks closed mostly higher: Japan +0.27%, Hong Kong -0.38%, China +0.36%, Taiwan +1.92%, Australia +0.12%, Singapore +0.19%, South Korea +1.47%, India -0.56%. Japan's Nikkei stock index posted a fresh 15-year high as exporters rallied after the yen fell to a 1-week low against the dollar, which boosts the earnings prospects of exporters, while China's Shanghai Composite rose to a new 7-year high after weaker-than-expected manufacturing data spurred speculation the government will expand stimulus measures.

Commodity prices are mixed. Jun crude oil (CLM15 -0.37%) is down -0.28% and Jun gasoline (RBM15 +0.35%) is up +0.28%. Metals prices are higher. Jun gold (GCM15 +0.18%) is up +0.17% after data showed funds boosted their gold holdings for a fourth day as gold assets in ETFs rose to a 4-week high on Wednesday. May copper (HGK15 +0.71%) is up +0.34% and recovered from a 1-month low on speculation China will boost stimulus to spur economic growth that will lift copper demand. Agriculture prices are mixed.

The dollar index (DXY00 +0.09%) is up +0.03%. EUR/USD (^EURUSD) is up +0.14%. USD/JPY (^USDJPY) is up +0.07% at a 1-week high.

Jun T-note prices (ZNM15 +0.11%) are up +5 ticks on increased safe-haven demand as stocks falter.

The China Apr HSBC flash manufacturing PMI fell -0.4 to 49.2, weaker than expectations of -0.2 to 49.4 and the lowest in a year, which bolsters concern about China's economy.

The Eurozone Apr Markit manufacturing PMI unexpectedly fell -0.3 to 51.9, weaker than expectations of +0.4 to 52.6, and shows the ECB's QE program will take time to revive the economy.

U.S. STOCK PREVIEW

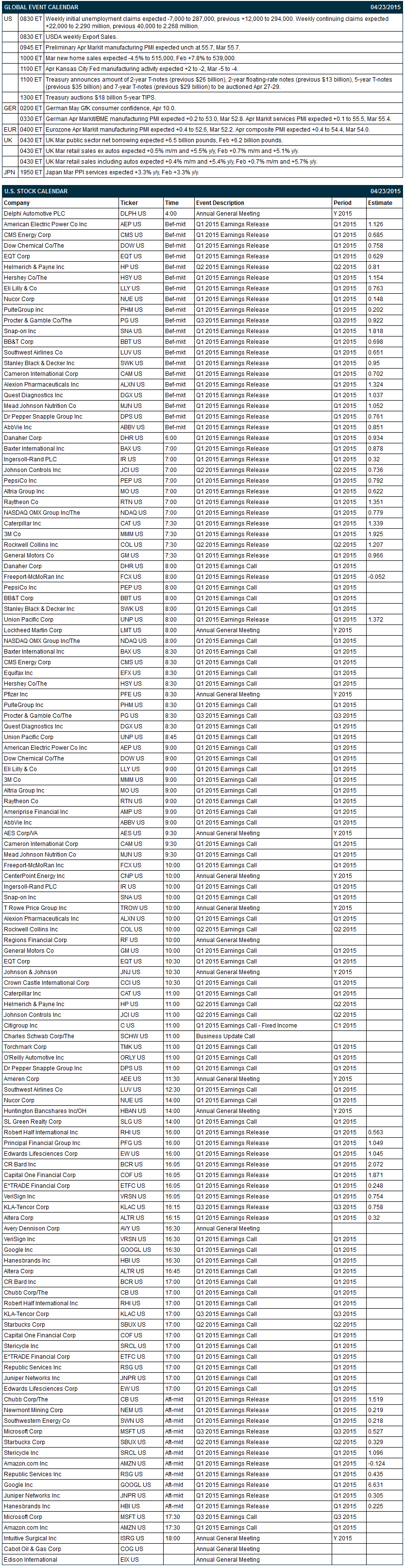

Key U.S. reports today include: (1) weekly unemployment claims (initial claims expected -7,000 to 287,000 after last week's +12,000 to 294,000; continuing claims expected +22,000 to 2.290 million after last week's -40,000 to 2.268 million), (2) preliminary-April Markit U.S. manufacturing PMI (expected unchanged at 55.7 after March's +0.6 to 55.7), (3) March new home sales (expected -4.5% to 515,000 after Feb's +7.8% to 539,000), (4) the April Kansas City Fed manufacturing activity index (expected expected +2 to -2 after March's -5 to -4), and (4) the Treasury's auction of $18 billion of 5-year TIPS.

There are 54 of the S&P 500 companies that report earnings today with notable reports including: Google (6.63), Microsoft (0.53), Amazon.com (-0.12), Starbucks (0.33), Caterpillar (1.34), GM (0.97), Capital One (1.87), PepsiCo (0.79), Procter & Gamble (0.92), AbbVie (0.85), Baxter (0.88), Raytheon (1.35), Nasdaq (0.78), PulteGroup (0.20).

U.S. IPO's scheduled to price today include: Apigee Corp (APIC), Viking Therapeutics (VKTX).

Equity conferences during the remainder of this week include: IHS CERAWeek Energy Conference on Mon-Thu, Capital Link Closed-End Funds & Global ETFs Forum - Panel on Thu, RSA Conference on Thu.

OVERNIGHT U.S. STOCK MOVERS

Texas Instruments (TXN +0.98%) slipped 5% in after-hours trading after it reported Q1 EPS of 61 cents, below consensus of 62 cents.

Eli Lilly (LLY +0.12%) reported Q1 EPS of 87 cents, higher than consensus of 76 cents.

Valmont (VMI -0.31%) reported Q1 EPS of $1.28, well below consensus of $1.49.

O'Reilly Automotive (ORLY -0.18%) reported Q1 EPS of $2.06, better than consensus of $1.94.

Xilinx (XLNX +0.32%) slid 5% in after-hours trading after it reported Q4 EPS of 50 cents, right on consensus, but Q4 revenue of $567 million was less than consensus of $569.5 million.

Oceaneering (OII +3.66%) reported Q1 EPS of 70 cents, above consensus of 62 cents.

Ameriprise (AMP +0.99%) reported Q1 EPS of $2.18, weaker than consensus of $2.3.

United Stationers (USTR +0.36%) reported Q1 adjusted EPS of 52 cents, right on consensus, although Q1 revenue of $1.33 billion was below consensus of $1.35 billion.

eBay (EBAY +0.58%) rose over 5% in after-hours trading after it reported Q1 EPS of 77 cents, above consensus of 70 cents.

Equifax (EFX -0.31%) reported Q1 adjusted EPS of $1.07, higher than consensus of $1.02.

Las Vegas Sands (LVS +1.71%) fell nearly 3% in after-hours trading after it reported Q1 adjusted EPS of 66 cents, below consensus of 72 cents.

Skechers (SKX +1.38%) reported Q1 EPS of $1.10, higher than consensus of $1.01.

Plexus (PLXS -0.86%) reported Q2 EPS of 69 cents, right on consensus, although Q2 revenue of $651 million was above consensus of $645.45 million.

AT&T (T +0.61%) reported Q1 adjusted EPS of 63 cents, better than consensus of 62 cents.

Qualcomm (QCOM +0.54%) declined over 3% in after-hours trading after it reported Q2 EPS of $1.40, above consensus of $1.33, but then lowered guidance on fiscal 2015 EPS view to $4.60-$5.00 from $4.85-$5.05, at the low end of consensus at $5.00.

Facebook (FB +1.21%) fell over 1% in after-hours trading after reported Q1 EPS of 42 cents, higher than consensus of 40 cents, although Q1 revenue of $3.54 billion was below consensus of $3.56 billion.

MARKET COMMENTS

June E-mini S&Ps (ESM15 -0.24%) this morning are down -5.25 points (-0.25%). Wednesday's closes: S&P 500 +0.51%, Dow Jones +0.49%, Nasdaq +0.56%. The S&P 500 on Wednesday closed higher on support from a rally in the Nikkei index to a 15-year high and a rally in China's Shanghai Composite index to a fresh 7-year high. In addition, U.S. March existing home sales showed a strong increase of +6.1% to 5.19 million and Greek tensions eased a bit.

Jun 10-year T-notes (ZNM15 +0.11%) this morning are up +5 ticks. Wednesday's closes: TYM5 -16.00, FVM5 -7.25. Jun 10-year T-notes on Wednesday closed lower on the stronger-than-expected +6.1% increase in U.S. Mar existing home sale to a 1-1/2 year high and reduced safe-haven demand as the Greek bond yield fell sharply and as U.S. stocks rallied.

The dollar index (DXY00 +0.09%) this morning is up +0.031 (+0.03%). EUR/USD (^EURUSD) is up +0.0015 (+0.14%). USD/JPY (^USDJPY) is up +0.08 (+0.07%) at a 1-week high. Wednesday's closes: Dollar Index -0.072 (-0.07%), EUR/USD -0.00108 (-0.10%), USD/JPY +0.248 (+0.21%). The dollar index on Wednesday closed slightly lower in mostly technical trade. The dollar received support from the stronger-than-expected U.S. Mar existing home sales report but was undercut by EUR strength tied to reduced Greek tensions. The yen showed weakness with USD/JPY posting a 1-week high on news that Japan Mar imports plunged by -14.5% y/y, the biggest decline in 5-1/3 years.

Jun WTI crude oil (CLM15 -0.37%) this morning is down -16 cents (-0.28%) and Jun gasoline (RBM15 +0.35%) is up +0.0054 (+0.28%). Wednesday's closes: CLM5 -0.45 (-0.79%), RBM5 +0.0339 (+1.79%). Jun crude oil closed lower on Wednesday after U.S. crude oil inventories rose by +5.315 million bbls to a record 489 million bbl. However, gasoline prices closed higher after weekly EIA gasoline inventories fell -2.135 million bbl to a 4-month low of 225.7 million bbl.

Click on picture to enlarge

Disclosure: None.