Morning Call For April 14, 2015

OVERNIGHT MARKETS AND NEWS

June E-mini S&Ps (ESM15 -0.06%) this morning are down -0.17% and European stocks are down -0.94% ahead of Q1 earnings results from JPMorgan Chase and Johnson & Johnson. Losses were limited on increased M&A Activity as Alcatel-Lucent SA jumped 12% in pre-market trading after Nokia Oyj said it was in advanced talks to buy the company. Asian stocks settled mixed: Japan +0.02%, Hong Kong -1.62%, China +0.34%, Taiwan -0.25%, Australia -0.23%, Singapore +1.05%, South Korea +0.79%. China's Shanghai Composite Index climbed to a fresh 7-year high on speculation the government will boost stimulus measures to spur economic growth.

Commodity prices are mixed. May crude oil (CLK15 +1.12%) is up +0.71% and May gasoline (RBK15 +1.11%) is up +0.65% after the EIA said late Monday that U.S. crude output from the shale oil boom will decline by -57,000 bpd in May, the first time the EIA has forecast a decline in output since it began issuing a monthly drilling productivity report in 2013. Metals prices are weaker. Jun gold (GCM15 -0.90%) is down -0.92% at a 1-1/2 week low. May copper (HGK15 -1.29%) is down -1.31% at a 3-week low. Copper prices are also being weighed down by Chinese demand concerns with tomorrow's China Q1 GDP expected to be reported at a 7.0% y/y pace, the slowest since the global recession of 2009. Agriculture prices are mixed with May wheat down -0.80% at a 2-week low after recent rains alleviated drought concerns in the U.S. Great Plains.

The dollar index (DXY00 -0.05%) is down -0.06% and EUR/USD (^EURUSD) is up +0.02%. USD/JPY (^USDJPY) is down -0.37% at a 1-week low after Koichi Hamada, a consultant to Japanese Prime Minister Abe, said that an exchange rate of 105 yen per dollar would be "appropriate," which undercut expectations for additional easing from the BOJ.

Jun T-note prices (ZNM15 +0.13%) are up +6.5 ticks on carry-over support from a rally in German bunds to a record high. The yield on the 10-year German bund fell to an all-time low of 0.134% after Moody's Investors Service warned that the ECB could run out of eligible bonds to buy from some governments around the end of the year, which may force the ECB to loosen the rules of its QE program and further suppress bond yields.

U.S. STOCK PREVIEW

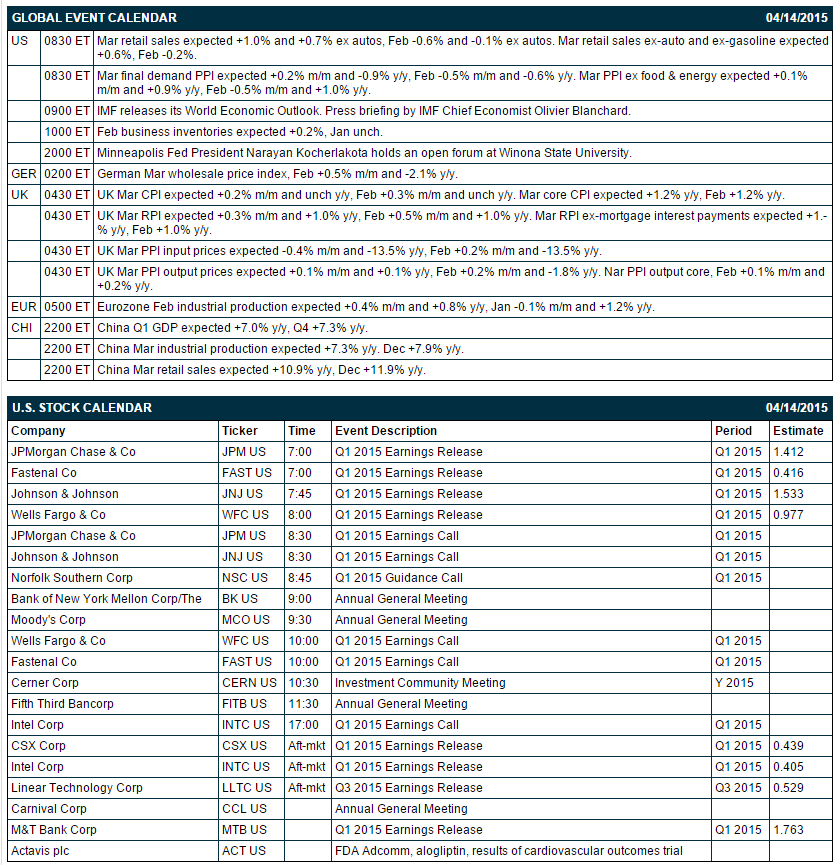

Key U.S. news today includes (1) March retail sales (expected +1.0%, +0.7% ex-autos, and +0.6% ex-autos and ex-gasoline), (2) March final-demand PPI (expected -0.9% m/m vs Feb's -0.6%) and March core PPI (expected +0.9% y/y vs Feb's +1.0%), (3) Feb business inventories (expected +0.2% after Jan's unchanged), (4) Minneapolis Fed President Narayan Kocherlakota's open forum at Winona State University, and (5) the IMF's release of its World Economic Outlook.

There are 8 of the S&P 500 companies that report earnings today: JPMorgan Chase (consensus $1.41), Intel (0.41), Wells Fargo (0.98), M&T Bank (1.76), Fastenal (0.42), Johnson & Johnson (1.53), CSX (0.44), Linear Technology (0.53).

U.S. IPO's scheduled to price today include: Smart & Final Stores (SFS), XBiotech (XBIT), Cidara Therapeutics (CDTX).

Equity conferences during the remainder of this week include: World Strategic Forum on Mon-Tue, Cantor Fitzgerald First Annual ETF and Indexing Forum on Wed.

OVERNIGHT U.S. STOCK MOVERS

JPMorgan Chase (JPM +0.60%) reported Q1 EPS of $1.61, better than consensus of $1.41.

Fastenal (FAST +0.02%) reported Q1 EPS of 43 cents, higher than consensus of 42 cents.

Urban Outfitters (URBN +0.25%) were upgraded to 'Outperform' from 'Market Perform' at BMO Capital.

Qualcomm (QCOM -0.62%) and Western Digital (WDC -0.41%) were both upgraded to 'Buy' from 'Neutral' at BofA/Merrill Lynch.

Ulta Salon (ULTA +0.21%) was initiated with a 'Buy' at Evercore ISI.

Molson Coors (TAP -1.63%) was initiated with a 'Positive' at Susquehanna with a price target of $97.

Pep Boys (PBY -0.10%) reported an unexpected Q4 EPS loss of -50 cents with items, well below consensus of a 3 cent profit.

Norfolk Southern (NSC -1.39%) dropped over 4% in after-hours trading after it lowered guidance on Q1 EPS to $1.00, below consensus of $1.27.

Scripps Networks (SNI +0.80%) was downgraded to 'Neutral' from 'Overweight' at Piper Jaffray.

AMC Networks (AMCX +0.20%) was initiated with an 'Overweight' at Piper Jaffray with a price target of $90.

MARKET COMMENTS

June E-mini S&Ps (ESM15 -0.06%) this morning are down -3.50 points (-0.17%). Monday's closes: S&P 500 -0.46%, Dow Jones -0.45%, Nasdaq-0.29%. The U.S. stock market on Monday fell back from a 3-week high and closed lower on concerns about the impending Q1 earnings season and on weakness in GE that weighed on industrial stocks.

Jun 10-year T-notes (ZNM15 +0.13%) this morning are up +6.5 ticks. Monday's closes: TYM5 +5.50, FVM5 +4.25. June T-notes on Monday closed higher on weakness in stocks, the sharp decline in Chinese March exports that raised worries about Chinese economic growth, and the decline in the 10-year breakeven inflation expectations rate to a 1-week low.

The dollar index (DXY00 -0.05%) this morning is down -0.057 (-0.06%). EUR/USD (^EURUSD) is up +0.0002 (+0.02%). USD/JPY (^USDJPY) is down-0.45 (-0.37%). Monday's closes: Dollar Index +0.152 (+0.15%), EUR/USD -0.0031 (-0.29%), USD/JPY -0.07 (-0.06%). The dollar index on Monday closed mildly higher on continued support from divergent monetary policies. Meanwhile, USD/JPY fell back from a 3-week high on ideas that the BOJ will not expand its stimulus further after Japanese Prime Minister Abe said that monetary policy is working and that the yen is weak in terms of purchasing power.

May WTI crude oil (CLK15 +1.12%) this morning is up 37 cents (+0.71%). May gasoline (RBK15 +1.11%) is up +0.0118 (+0.65%). Monday's closes: CLK5 +0.27 (+0.52%), RBK5 +0.0015 (+0.08%). May crude oil and gasoline on Monday closed higher as doubts continue to grow about an Iranian nuclear deal as Congress returned to session in a mood to force through legislation that would require Congressional review of any nuclear deal. However, sentiment remains bearish with the market expecting another increase in this week's weekly EIA U.S. crude oil inventories report.

Disclosure: None.