Morning Call - 10/31/2014

OVERNIGHT MARKETS AND NEWS

December E-mini S&Ps (ESZ14 +1.07%) this morning are up +1.16% at a contract high and European stocks are up +1.96% as global stocks rallied sharply after the BOJ unexpectedly expanded stimulus. The BOJ said it will increase holdings of government bonds to 80 trillion yen ($724 billion) from as much as 70 trillion yen and will boost exchange-traded fund purchases to 3 trillion yen. Asian stocks closed higher: Japan +4.83%, Hong Kong +1.25%, China +1.60%, Taiwan +0.98%, Australia +0.92%, Singapore +1.23%, South Korea +0.65%, India +1.90%. Japan's Nikkei Stock Index soared to a 7-year high and China's Shanghai Stock Index climbed to a 1-1/2 year high on the unexpected action by the BOJ to raise stimulus. Japanese stocks also received a boost after Japan's Government Pension Investment Fund, the world's biggest pension fund, said it will raise its allocation target for Japanese and overseas equities to 25% from 12%. In an attempt to stop the slide in the ruble, the Bank of Russia raised its key interest rate to 9.5% from 8.0%. Commodity prices are mostly lower as the dollar surged after the BOJ's action to expand stimulus. Dec crude oil (CLZ14 -0.83%) is down -0.86%. Dec gasoline (RBZ14 -1.07%) is down -1.05%. Dec gold (GCZ14 -2.12%) is down -2.18% at a 4-1/4 year low. Dec copper (HGZ14 +0.65%) is up +0.60%. Agriculture prices are mixed. The dollar index (DXY00 +0.46%) is up +0.53% at a 4-week high. EUR/USD (^EURUSD) is down -0.29% at a 3-week low after Eurozone Oct core CPI rose at the slowest pace of increase on record. USD/JPY (^USDJPY) is up +2.30% at a 6-3/4 year high as the yen plunged following the increase in quantitative easing by the BOJ. Dec T-note prices (ZNZ14 -0.21%) are down -5.5 ticks.

The BOJ unexpectedly expanded its stimulus measures by raising the target for enlarging the monetary base to 80 trillion yen ($724 billion), up from 60 to 70 trillion yen. The BOJ also lowered its estimate for the core consumer price index to +1.7% for the fiscal year through Mar 2016, down from a previous estimate of +1.9%.

The Eurozone Oct CPI estimate rose +0.4% y/y, right on expectations. The Oct core CPI rose +0.7% y/y, less than expectations of +0.8% y/y and matched the smallest pace of increase since the data series began in 1997.

The Eurozone Sep unemployment rate remained unchanged at 11.5% y/y, right on expectations.

German Sep retail sales tumbled -3.2% m/m, a bigger decrease than expectations of -0.9% m/m and the largest monthly decline in 7-1/3 years. On an annual basis, Sep retail sales rose +2.3% y/y, more than expectations of +1.2% y/y.

Japan Sep national CPI rose +3.2% y/y less than expectations of +3.3% y/y and the slowest pace of increase in 6 months. Sep national CPI ex-fresh food rose +3.0% y/y, right on expectations, and Sep national CPI ex food & energy rose +2.3% y/y, a faster pace of increase than expectations of +2.2% y/y.

The Japan Sep jobless rate rose +0.1 to 3.6%, right on expectations. The Sep job-to-applicant ratio fell -0.01 to 1.09, slightly weaker than expectations of unch at 1.10.

Japan Sep overall household spending dropped -5.6% y/y, a bigger decline than expectations of -4.3% y/y and the sixth consecutive month that spending has fallen.

U.S. STOCK PREVIEW

Today’s final-Oct U.S. consumer confidence index from the University of Michigan is expected to be unchanged from early-Oct at 86.4, thus leaving the index up by +1.8 points from Sep. Today’s Sep PCE deflator is expected to be unchanged from Aug at +1.5% y/y and for the Sep core PCE deflator to also be unchanged from Aug at +1.5% y/y. Today’s Oct Chicago PMI report is expected to fall -0.5 points to 60.0, adding to the -3.8 decline to 60.5 seen in September.

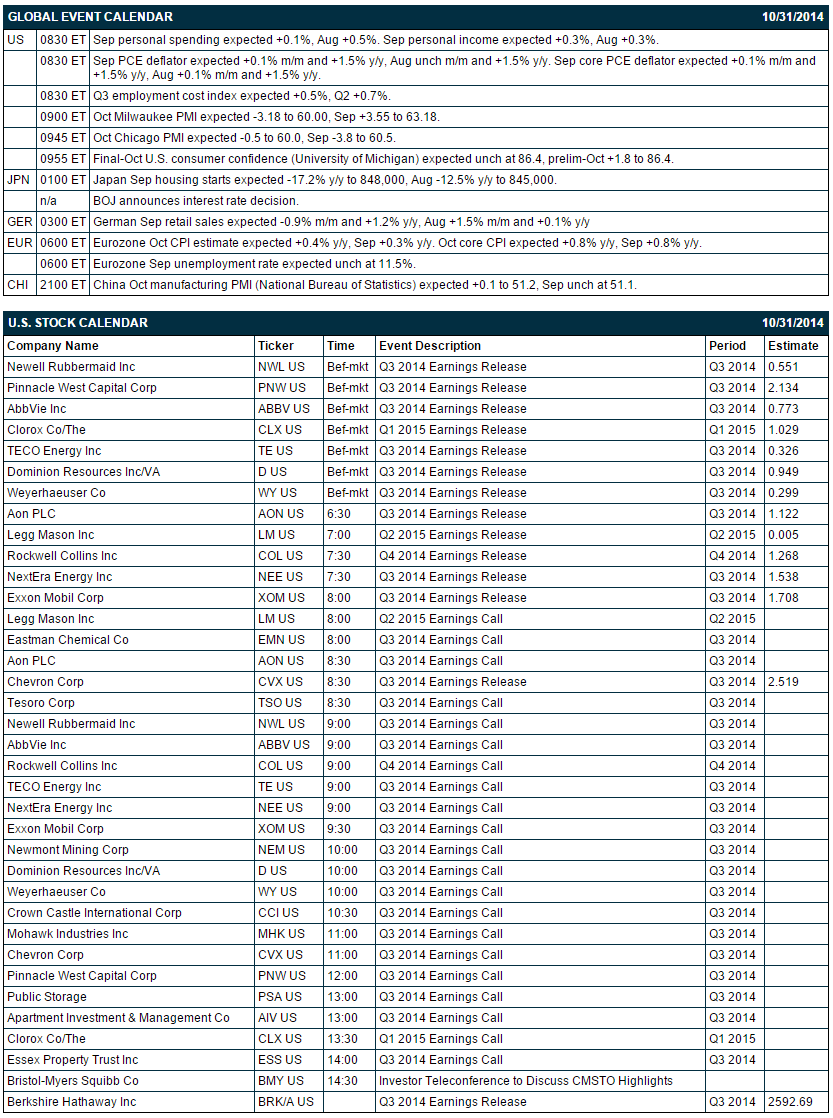

There are 14 of the S&P 500 companies that report earnings today with notable reports including: Berkshire Hathaway (consensus $2,592), Exxon (1.71), Chevron (2.52), AbbVie (0.77), Newell Rubbermaid (0.555), Weyerhaeuser (0.30), Aon (1.12). There are no equity conferences today.

OVERNIGHT U.S. STOCK MOVERS

Wyerhaeuser (WY +1.39%) reported Q3 EPS of 33 cents, higher than consensus of 30 cents.

Citigroup (C +0.95%) fell 1% in after-hours trading after it lowered its Q3 results due to a $600 million increase in legal accruals.

Mohawk (MHK +0.80%) reported Q3 EPS ex-items of $2.44, better than consensus of $2.42.

Fluor (FLR +1.36%) reported Q3 EPS of $1.15, higher than consensus of $1.10.

Live Nation (LYV +0.44%) reported Q3 EPS of 49 cents, stronger than consensus of 38 cents.

Standard Pacific (SPF +0.25%) reported Q3 EPS of 14 cents, less than consensus of 15 cents.

Mylan (MYL +2.99%) reported Q3 EPS of $1.16, better than consensus of $1.14, and then raised guidance on fiscal 2014 EPS view to $3.54-$3.60, above consensus of $3.49.

Groupon (GRPN +3.45%) reported Q3 EPS of 3 cents, triple consensus of 1 cent, but then lowered guidance on Q4 Q4 EPS ex-items to 2 cents-4 cents, below consensus of 7 cents.

Expedia (EXPE +1.50%) reported Q3 adjusted EPS of $1.93, higher than consensus of $1.74.

Western Union (WU +1.64%) reported Q3 EPS of 44 cents, stronger than consensus of 38 cents.

Crown Castle (CCI +0.90%) reported Q3 FFO of $1.05, better than consensus of $1.01.

Starbucks (SBUX +1.02%) fell over 3% in after-hours trading after it reported Q4 adjusted EPS of 74 cents, right on consensus, although Q4 revenue of $4.20 billion was slightly less than consensus of $4.23. Starbucks then lowered guiidance on fiscal 2015 EPS to $3.08-$3.13, below consensus of $3.16.

LinkedIn (LNKD +1.70%) climbed more than 4% in pre-market trading after it reported Q3 EPS of 52 cents, stronger than consensus of 47 cents, and then raised guidance on fiscal 2014 EPS to $1.89, higher than consensus of $1.87.

Columbia Sportswear (COLM +0.16%) reported Q3 EPS of 93 cents, better than consensus of 87 cents, and then raised guidance on fiscal 2014 EPS to $1.80, higher than consensus of $1.76.

MARKET COMMENTS

Dec E-mini S&Ps (ESZ14 +1.07%) this morning are up sharply by +23.00 points (+1.16%) at a fresh contract high. The S&P 500 index on Thursday climbed to a 1-month high and closed higher: S&P 500 +0.62%, Dow Jones +1.30%, Nasdaq +0.25%. Bullish factors included (1) U.S. Q3 GDP that grew at a +3.5% q/q annualized pace, stronger than expectations of +3.0% q/q annualized, (2) strong Q3 stock earnings results with about 80% of reporting S&P 500 companies having beaten earnings estimates, and (3) reduced European recession concerns after Eurozone Oct economic confidence unexpectedly rose +0.8 to 100.7, better than expectations of -0.2 to 99.7.

Dec 10-year T-notes (ZNZ14 -0.21%) this morning are down -5.5 ticks. Dec 10-year T-note futures prices on Thursday closed higher: TYZ4 +5.50, FVZ4 +4.75. Supportive factors included (1) slack price pressures after the U.S. Q3 core PCE deflator increased at a +1.4% q/q pace, well below the Fed's 2.0% target, which fueled curve flattening trades where investors sell short-term Treasuries (i.e., 2-year and 5-year T-notes) and buy longer-term Treasuries ((i.e., 10-year T-notes and 30-year T-bonds), and (2) carry-over support from a rally n German bunds on speculation the ECB may expand stimulus measures after German Oct CPI rose less than expected.

The dollar index (DXY00 +0.46%) this morning is up +0.458 (+0.53%) at a 4-week high. EUR/USD (^EURUSD) is down -0.0036 (-0.29%) at a 3-week low. USD/JPY (^USDJPY) is up +2.51 (+2.30%) at a 6-3/4 year high. The dollar index on Thursday posted a 3-week high and closed higher. Closes: Dollar index +0.195 (+0.23%), EUR/USD -0.00189 (-0.15%), USD/JPY +0.325 (+0.30%). Bullish factors included (1) signs of U.S. economic strength after U.S. Q3 GDP expanded at a stronger-than-expected +3.5% q/q annualized pace, and (2) weakness in EUR/USD which fell to a 3-week low on speculation the ECB may expand stimulus after German Oct CPI fell -0.3% m/m, more than expectations of -0.1% m/m and the largest decline in 5 months.

Dec WTI crude oil (CLZ14 -0.83%) this morning is down -0.70 cents (-0.86%) and Dec gasoline (RBZ14 -1.07%) is down -0.0227 (-1.05%). Dec crude and Dec gasoline on Thursday closed lower. Closes: CLZ4 -1.15 (-1.40%), RBZ4 -0.0239 (-1.10%). Bearish factors included (1) Wednesday's action by the Fed to end QE3 along with the hawkish post-FOMC statement that boosted the dollar index to a 3-week high, and (2) carry-over bearishness from Wednesday's weekly EIA data that showed U.S. crude production rose to 8.97 million bpd, a 40-year high.

Disclosure: None