More Time

Healing is a matter of time, but it is sometimes also a matter of opportunity - Hippocrates

Extra time sometimes makes for better outcomes. Tests are usually easier if you don’t have to rush, but trade negotiations might be different. Buying more time just makes the price of failure more expensive. We don’t know and won’t know now until April. Somewhere between the Trump 60-day extension to his trade deal deadline and the stronger Chinese export data, markets got bullish. Throw in the Trump likely signing of the Congressional wall compromise funding, Japan’s 4Q GDP bounce back and you have nirvana for risk-takers but they didn’t find much joy in Asia as it was seemingly already priced. Brent is up 20% on the year as oil reflects the refound faith in global growth and perhaps that explains some of the correlation, or perhaps more time isn’t a solution but for Europe which seemingly wins with the US/China trade story. Only problem is that the data from Europe is grim as the German economy only narrowly escaped a technical recession, as the Eurozone job growth slows and as the EU growth looks set for 1% in 2019. Markets are risk-on but not convincingly so as bonds are also bid making this a risk-parity day more passive than active to trade and wait for the US data. What seems most clear about markets is that FX is out of step with the bond and equity story. The USD is more bid than offered and the risk for JPY 112 or EUR 1.12 breaks seems in play today should the data support it. So perhaps we are back to diversity and correlations driving excess returns. For many this will be in the commodity linked currencies with the CAD the front line as it plays out the issues of the day with US trade, China and policy entwined. Watch 1.3130 or 1.3330 for larger confirmation of risk-on or off.

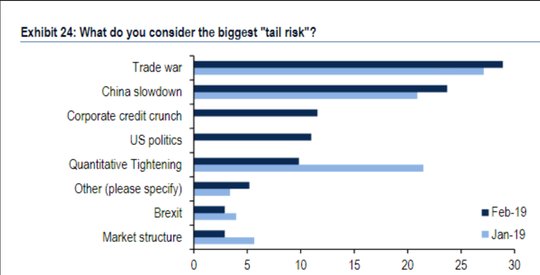

Question for the Day: Are markets over the wall of worry? The BoA/ML investor survey for February was out this week and its worth checking the boxes to see if markets have managed to overcome all fears from January. The chart makes clear that China growth and US/China trade talks are the giant issue still. The delay in getting this resolved maybe less helpful than headlines suggest. Markets are watching to see if the US government avoidance of a shutdown and the Trump push for a deal with Xi will be sufficient to keep February worries at bay and extend the 1Q rally up in risk beyond the S&P500 2800 resistance.

What Happened?

- Japan 4Q preliminary GDP 0.3% q/q, 1.4% y/y after -0.7% q/q, -2.6% y/y – as expected. The 3Q revised down from -0.6% q/q, -2.5% y/y. The Price index was unchanged at-0.3% y/y. The Capex was up 2.4% q/q after -2.7% q/q – more than the +1.8% q/q expected. Private consumption was up 0.6% q/q after -0.2% - less than the 0.8% q/q expected. External demand -0.3% q/q after -0.1% q/q – in line with expectations.

- China January trade surplus $39.16bn after $57.06bn – bigger than $34bn expected. China exports rebounded up 9.1% y/y after -4.4% y/y – much better than the -3.3% expected. The imports fell 1.5% y/y after -7.6% y/y – also less than the -9% drop expected. China exports to the US fell 2.4% after -3.5% but imports from the US are down 41.2%. The trade surplus with the US narrowed to $27.3 billion, compared with $29.87 billion in December.

- India January WPI slips to 2.76% y/y from 3.8% y/y - less than 3.65% y/y expected – 10-month lows. The Fuel component slows to 1.85% from 8.38% y/y, Food rose to 2.34% from -0.07% y/y while manufacturing moderated to 2.61% from 3.59%.

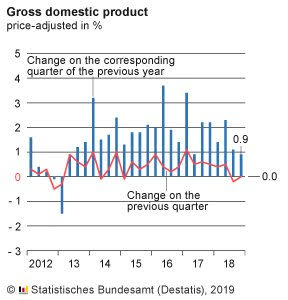

- German 4Q preliminary GDP 0% q/q, 0.6% y/y after -0.2% q/q, 1.1% y/y – less than the 0.1% q/q, 0.8% y/y expected. Growth from domestic demand particularly from capital formation and construction drove. While household final consumption expenditure increased slightly, general government final consumption expenditure was markedly up at the end of the year.

- German January WPI -0.7% m/m, +1.1% y/y after -1.2% m/m, 2.5% y/y – less than the +0.3% m/m expected.

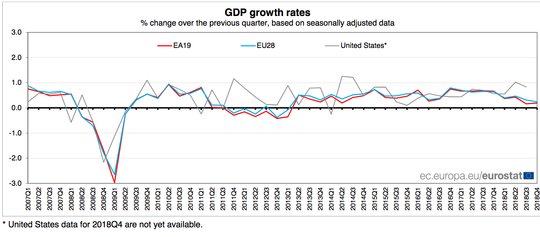

- Eurozone 4Q GDP unrevised at 0.2% q/q, 1.2% y/y after 3Q 0.2% q/q, 1.6% yy – as expected. Eurozone 4Q employment up 0.3% q/q, 1.2% y/y after 0.2% q/q, 1.3% y/y – weaker than 1.5% y/y expected.

Market Recap:

Equities: The S&P 500 futures are up 0.3% after a 0.3% gain yesterday. The Stoxx Europe 600 is up 0.45% with gains in industrials. The MSCI Asia Pacific fell 0.1%.

- Japan Nikkei off 0.02% to 21,139.71

- Korea Kospi up 1.11% to 2,225.85

- Hong Kong Hang Seng off 0.23% to 28,432.05

- China Shanghai Composite off 0.05% to 2,719.70

- Australia ASX off 0.01% to 6,139.60

- India NSE50 off 0.44% to 10,745.05

- UK FTSE so far up 0.2% to 7,206

- German DAX so far up 0.35% to 11,207

- French CAC40 so far up 0.7% to 5,110

- Italian FTSE so far off 0.15% to 19,960

Fixed Income: Risk on continues but the better economic stories in Asia reverse in Europe leaving markets back to buying bonds – German 10-year Bund yields off 1bps to 0.11%, French OATs off 1bps to 0.54% and UK Gilts off 2bps to 1.16%. Periphery mixed with Spain up 1bps to 1.25% as election risk returns, Portugal off 1bps to 1.60%, Greece off 5bps to 3.86% while Italy up 2bps to 2.809%.

- UK DMO sold GBP2.25bn of 10Y 1.625% Gilts at 1.159% and 2.08 cover - previously 1.268% and 2.22 cover

- US Bonds slightly bid with data ahead key – 2Y flat at 2.53%, 5Y off 1bps to 2.52%, 10Y off 1bps to 2.70%, 30Y off 1bps to 3.02%.

- Japan JGBs stuck with GDP/BOJ driving – 2Y flat at -0.16%, 5Y off 1bps to -0.16%, 10Y off 1bps to -0.01%, 30Y flat at 0.62%.

- Australian bonds see curve flatter watching US/China still – 3Y flat at 1.70%, 10Y off 2bps to 2.14%.

- China bonds flat with trade talks focus – 2Y flat at 2.64%, 5Y up 2bps to 2.88%, 10Y flat at 3.10%.

Foreign Exchange: The US dollar index up 0.05% to 97.17 recovering from Asia. EM is mostely USD bid – Asia: KRW off 0.1% to 1125.10, INR off 0.4% to 71.158; EMEA: RUB off 0.55% to 66.889, ZAR off 0.4% to 14.112 and TRY off 0.4% to 5.301

- EUR: 1.1275 up 0.15%. Range 1.1249-1.1295 with 1.1250-1.1320 keys but test for 1.1215 expected more than 1.14. US data key.

- JPY: 111.05 up 0.05%. Range 110.87-111.13 with EUR/JPY up 0.25% to 125.20 with equities not as key as rates and technical support now 125 and 110.50

- GBP: 1.2830 off 0.1%. Range 1.2813-1.2878 with EUR/GBP .8785 up 0.25%. Still about Brexit but focus is on EU growth issues and EUR with 1.28-1.30 still holding 1.26 risk rising.

- AUD: .7105 up 0.25%. Range .7085-.7132 with NZD .6830 up 0.5% - gaining on China trade and the RBNZ still with .7050 A$ and .6920 NZ$ both key.

- CAD: 1.3265 up 0.1%. Range 1.3229-1.3274 with Oil not enough for 1.32 breakwon watching 1.3220-1.3320 now with BOC and data key.

- CHF: 1.0085 off 0.1%. Range 1.0076-1.0098 with 1.0070 pivot for 1.02 again. EUR/CHF 1.1370 flat – all about JPY not CHF with 1.02 $ rising risk.

- CNY: 6.7695 up 0.15%. Range 6.7570-6.7770 – a quick test lower on the trade data reversed with EUR and flat market in equities reflecting less trade hope – PBOC fixed weaker at 6.7744 from 6.7675.

Commodities: Oil up, Gold down, Copper up 0.8% to $2.7960

- Oil: $54.50 up 1.1%. Range $53.90-$54.68 with China trade, equities and OPEC driving. Watching $54-$55 for breaks. Brent up 1.65% to $64.66 with $65 key resistance.

- Gold: $1308.70 off 0.5%. Range $1308-$1312.60 with USD holding, risk-on driving - $1305-$1320 keys with risk for $1298 again. Silver $15.55 off 0.7%, Platinum $787.70 off 0.6% and Palladium $1383 up 0.75%.

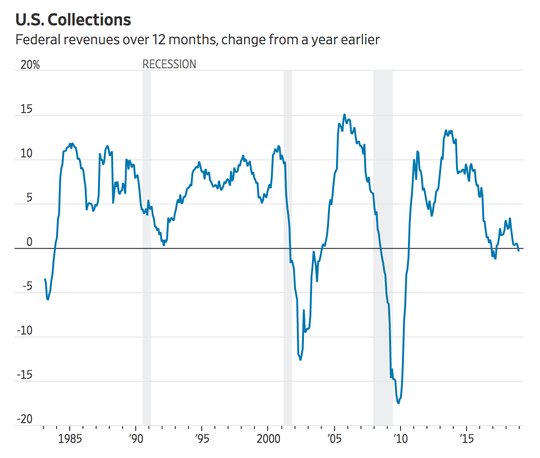

Conclusions: Is the US budget deficit the weak link in the USD chain? The USD bid is often questioned by those that watch the Current Account deficit. The US budget deficit is problematic as it means the US needs foreigners to fund itself or a more serious push to get US savers to buy the debt. The data from the US Treasury on the full 2017 tax reform effect isn’t so encouraging as the revenues didn’t go up as some in the White House hoped. This means the deficit will remain a key issue for politics in the US and in markets.

Economic Calendar:

- 0830 am Canada Dec new home prices (m/m) 0%p 0%e (y/y) 0%p 0.1%e

- 0830 am US weekly jobless claims 234kp 225ke

- 0830 am US Jan PPI (m/m) -0.2%p +0.1%e (y/y) 2.5%p 2.1%e

- 0830 am US Dec retail sales (m/m) 0.2%p 0.2%e /ex-autos 0.2%p 0.1%e

- 1000 am US Nov business inventories (m/m) 0.6%p 0.2%e

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.