Monthly Market Review For October 2019

Highlights

- The Federal Reserve cut rates by another quarter of a percent for the third consecutive month in a row.

- The U.S. stock market continues to rise despite a slowing global economy as trade optimism between the U.S. and China is regained.

- The overall U.S. economy continues to look stable with moderate GDP growth and strong jobs growth, however, the manufacturing sector remains in a technical recession.

Economic Review

Gross Domestic Product (GDP), a measure of the U.S. economy grew at fairly strong annualized rate of 1.9% in the third quarter of 2019. However, Real GDP (i.e. inflation-adjusted GDP) appears to be more moderate with a year-over-year growth rate of 2.03%. Despite more moderate real GDP growth, consumer spending (which accounts for nearly 70% of GDP) continues to look strong as it rose at an annualized rate of 4.6% in the third quarter of 2019.

Job growth also looks strong, with the U.S. adding 128,000 jobs in October and total non-farm payrolls rising at a year-over-year rate of 1.40%. Meanwhile, the unemployment rate sits at a historically low 3.6% and wage growth at 3.49%, its highest since early-2009.

Inflation remains stable with the Core Consumer Price Index (CPI) rising at a strong year-over-year rate of 2.36%. However, the Federal Reserve preferred Core Personal Consumption Expenditures (PCE) price index has risen at a more moderate 1.67%.

Even though the overall U.S. economy appears to be fairly stable with moderate GDP growth, a strong jobs market, and moderate inflation, the U.S. manufacturing sector remains in a technical recession as a slowdown in global growth and a U.S.-China trade war causes headwinds. That said, industrial production has fallen by 0.14% over the past year, its first drop into negative territory since early-2015. Meanwhile, new orders of durable goods have fallen by 5.35% over the past year, and continues to worsen.

With a slowdown in global economic growth and core PCE (inflation) remaining below the Federal Reserve’s 2.0% target, the Feds decided to cut interest rates by another quarter of a percent to a target range of 1.50%-1.75%. This marks the third consecutive monthly rate cut by the Fed with Fed Chairman Jerome Powell stating that he believes the current monetary policy “is in a good place”, and it will take a “material” change in the Fed’s economic outlook to justify further rate cuts.

Market Review

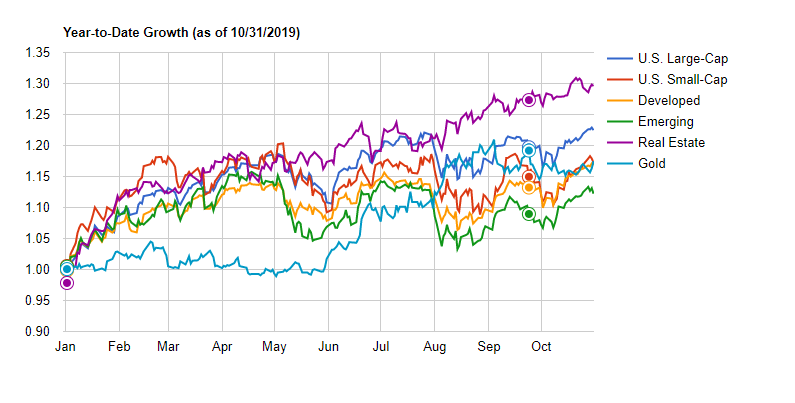

Despite overall pessimism and headwinds the stock market has experienced from retaliatory tariffs between the U.S. and China, trade optimism was regained in October sending the global stock market higher. Benefiting the most were international markets as they rose over 3.0% for the month of October while the U.S. market rose just over 2.0%. More specifically, emerging markets benefited the most, rising nearly 4.0% on the month since they rely more heavily on exports.

Since the beginning of the year, U.S. large-cap stocks have outperformed U.S. small-cap stocks by over 5.0% as small-cap earnings have suffered. However, small-cap earnings turned around in the month of October and lead them to outperform large-cap stocks by approximately 0.5% for the month.

Real estate (REITs) have dominated in performance this year with a year-to-date return of nearly 30% amid falling mortgage-rates, but have underperformed the overall market in October due to underwhelming housing market data.

The price of gold was essentially flat for the first half of the year but has since risen approximately 17.5% as investors flee to the haven metal due to pessimism surrounding the U.S. and China trade war.

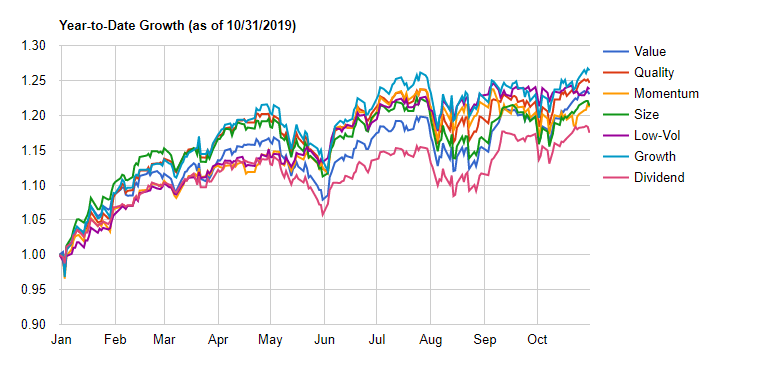

Growth stocks have been the top performing equity factor for the majority of the year and continues to do so in October finishing with the best year-to-date return of approximately 26.4%. Momentum-based stocks were also among the top performing equity factors for the year but have since lost their momentum as they have fallen nearly 2.0% since early September. Dividend stocks have been the worst performing equity factor for the majority of the year and continue their trend in October as one of the worst performing for the month. Meanwhile Value stocks who lagged most other equity factors over the course of the year have been the top-performing equity factor since early-September.

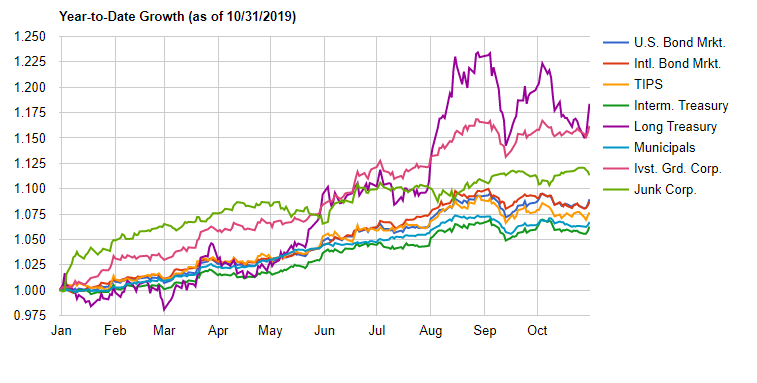

Bond Market Review

With interest rates consistently moving lower for the good majority of the year, the overall U.S. bond market has moved considerably higher (nearly 9.0% year-to-date). However, over the past couple of months yields have started rise higher and thereby hindering the overall U.S. bond market. That said, with long-term treasuries being the most sensitive to changes in interest rates they have largely outperformed the overall bond so far this and have largely underperformed since early-September when interest rates started to bounce back.

Meanwhile investment-grade corporate bonds seemed to have never lost a beat all year with the second best year-to-date return of 16.2% behind long-term treasuries return of 18.3%. However, high-yield “Junk” corporate bonds who outperformed investment-grade corporate bonds for the first half of the year are now underperforming investment-grade corporate bonds by almost 5.0% year-to-date as investors flee to the safer of the two.

Inflation-protected treasuries (TIPS) has outperformed non inflation-protected treasuries (Interm. Treasuries) so far this year as inflation has mostly exceeded expectations.However, with inflation more recently coming in below expectations treasuries have outperformed TIPS by approximately 0.85% since early-September.