MJ: Mary Jane’s Last Dance, Global Stocks +$50 Trillion Since Pandemic, Microcap And Penny Stocks, UBER Earnings

In prepositioning myself to be sold to a SPAC I am considering purchasing billions in Bitcoin, investing in EVs, launching rockets to Venus and developing the next generation of on-line payment processing simultaneously - while buying substantial out of the money call options.

— Peter Atwater (@Peter_Atwater) February 10, 2021

Tesla (TSLA), GameStop (GME), Bitcoin (BITCOMP) and now Marijuana Stocks ETF (MJ). We’ve experienced a succession of mini-bubbles that I’ve never seen before. The current one is the rage for marijuana stocks which can be seen in the performance of the sector’s main ETF, MJ, which holds popular marijuana stocks like Tilray (TLRY – 20.44% of the ETF), Aphia (APHA – 14.40%), Canopy Growth Corporation (CGC – 7.07%) and GW Pharmaceuticals (GWPH – 6.13%).

Its creators cleverly chose the ticker MJ which stands for Mary Jane which is slang for marijuana. Well Mary Jane has been smoking this week up 42% Monday, Tuesday and Wednesday, including 15% Wednesday on almost 7x three month average volume. When the chart goes parabolic it’s usually time to sell so I’d expect a nasty shakeout sometime soon. Short term technician and trading wizard Scott Redler, who has played the move in marijuana stocks, thinks “it’s time for a pause”.

The Weed ETF $MJ is +42% this week! Today it was +14.91% on almost 7x three month average volume. Blow off top? @RedDogT3 says: "Now I think it's time for a pause" pic.twitter.com/F5FFjHEWm2

— Top Gun Financial (@TopGunFP) February 11, 2021

Marijuana stocks aren’t the only sector of the market investors are speculating in. In general, the smaller the stock, the riskier and investors have moved into microcaps and penny stocks. The iShares Microcap ETF (IWC) is +165% since March 19, 2020 and is now an insane 54.61% above its 200 DMA.

Micro-caps are now 54.61% above their 200-day moving average. This has been a phenomenal move risk-on move, nearly doubling the previous peak in 2009. $IWC $SPY pic.twitter.com/2FzOPpagHA

— Matthew Timpane, CMT (@mtimpane) February 10, 2021

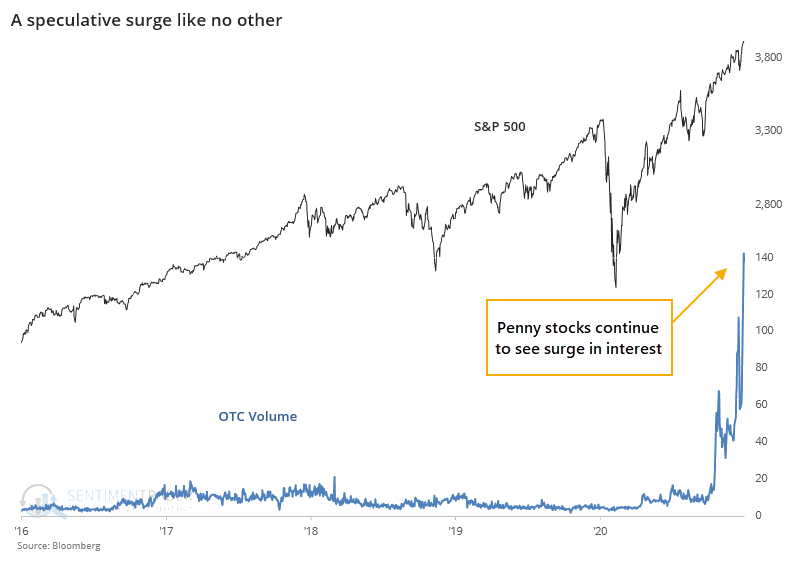

Not content to speculate in microcaps, investors have also moved into over the counter (OTC) or penny stocks who don’t meet the qualifications to be listed on the NYSE or NASDAQ. This is truly the wild west of the stock market where you have almost no idea what you are buying. OTC volume has skyrocketed in recent weeks (Chart Source: “Speculative volume skyrockets as smart money sells”, Sentimentrader, February 10).

While everyone’s focus has been on obscure sectors of the market, global stocks as a whole continue to rise. In fact, they are now +$50 trillion during the pandemic.

Value of global stocks nears $110 trillion. Cheers pic.twitter.com/I7PIWj561u

— David Ingles (@DavidInglesTV) February 10, 2021

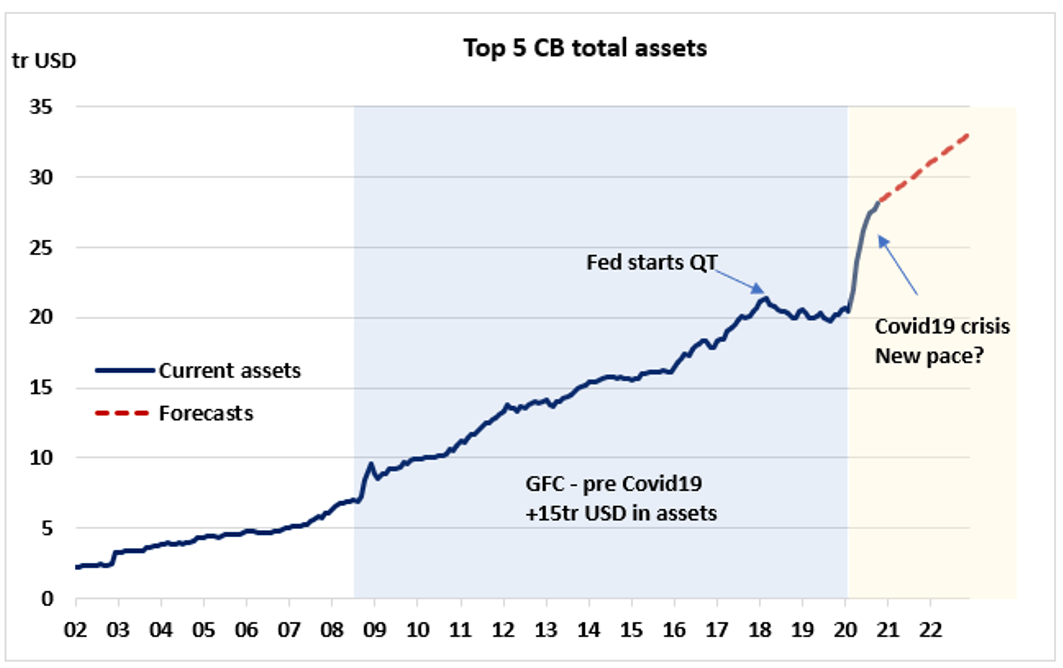

There are two basic explanations for this. The first one, favored by The Kiddie Technicians among others, is that we are the beginning of a mega bull market. Stocks are acting so strong because they are discounting enormous growth going forward. I wish that were true but the real reason global stocks are levitating is massive liquidity injections by global central banks. We’re not on the verge of a mega bull market. We’re on a manic crack high created by historically unprecedented easy money (Chart Source: Rothko Research).

Before concluding, let’s analyze Uber (UBER – $108 billion market cap) earnings before we too lose contact with reality. UBER is interesting at the moment because it has two main businesses, ride hailing and food delivery, that are being oppositely effected by the pandemic. Ride hailing is being badly hit, as we saw yesterday with Lyft (LYFT). UBER 4Q20 Mobility (Ride Hailing) Bookings were -50% and Revenue -52%. Delivery (Food Delivery), on the other hand, saw 4Q20 bookings +130% and Revenue +224% as people stay at home and order delivery. Overall, UBER is still a massive money losing operation with a $968 million 4Q20 Net Loss. The stock is currently down about 4.5% in the premarket.

Quite an interesting analysis indeed. Thanks for the insights. But unless I do not understand the numbers it seems odd to equate a decrease in profits to a loss. That has been a puzzle for a while. Certainly some things do not generate as much profit as they had in the past, or as some optimist predicted, but a lower profit does not equate to a loss as I see it. Certainly it could be a failure to meet predictions, but not an actual loss.