Minimum Gains Give Bulls Reason For Optimism

Traders had a weekend to stew over Friday's losses and a weak open on global markets could have set a more negative tone. However, this proved not to be the case.

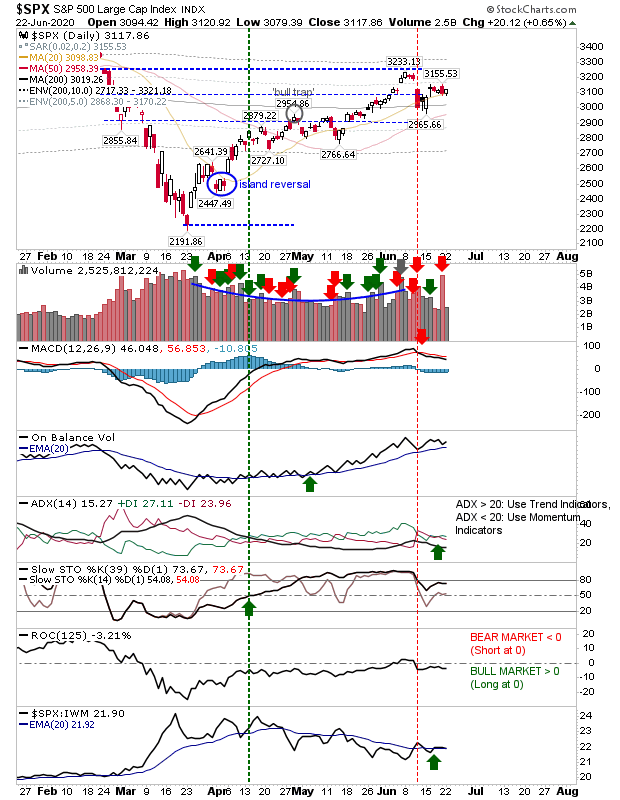

The S&P staged a small rally from its 20-day MA. The rally hasn't yet undone the 'sell' trigger in the MACD but the sequence over the last five days has mapped a consolidation handle which has the potential to challenge and get past 3,200.

The Nasdaq's gains are pressuring against the 'bull trap' but still haven't yet negated it. The MACD trigger 'sell' is still there but other technicals are healthy. A break above 10,100 would attract momentum traders and accelerate these gains - but it needs a catalyst. Although this catalyst may not be an obvious one, e.g. it's unlikely to be a vaccine for COVID or the defeat of Trump.

The Russell 2000 is struggling to catch up with the Nasdaq or S&P. It remains below its 200-day MA but it has a nice handle setup as for the Nasdaq or S&P. Any move above the 200-day MA would likely be low key. As for the aforementioned indices, it has a MACD trigger 'sell' to overcome, but it also has to reverse a relative loss 'signal' against the Nasdaq.

The indices have been swinging between rally - loss - rally - loss over relatively tight intraday ranges. Today didn't deliver an answer but it did show a preference to hold gains; whether that's Johnny-come-lately propung up stocks or low key buying in preparation for a larger move higher. However, I think a range-bound scenario into the election seems most likely; the Covid19 pandemic and a weak incumbent president offer too many substantive unknowns to be pushing big gains, but value buyers will always be active.