Mindbody IPO Lockup Expiration Warrants Your Attention

Mindbody, Inc. (NASDAQ:MB)

Sell or Short Recommendation

$17.25 Price Target

December 16, 2015, concludes the 180-day lockup period on Mindbody, Inc.

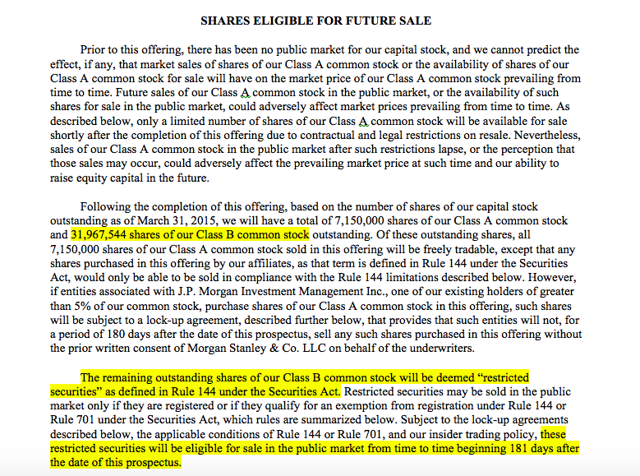

When the lockup period ends for Mindbody, its pre-IPO shareholders, directors and executives will have the chance to sell their ~30 million shares.

(Click on image to enlarge)

We previewed MB on our IPO Insights platform.

The potential for a sudden increase in stock available in the open market may cause a significant decrease in Mindbody shares.

Business Summary: Cloud-based platform that offers management and payment tools focused on the wellness service provider sector

Cloud-based software that provides management and payment tools for specific industries remains popular, and Mindbody software focuses on the wellness service provider sector. The company has over 50,000 local business subscribers across 130 countries. These subscribers provide wellness services to more than 27 million consumers via 250,000 wellness practitioners.

The integrated management and payments platform streamlines a variety of tasks for SMBs, which in turn allows entrepreneurs to focus on building their client base, growing sales revenue, and offering services to clients that allow them to evaluate and improve their overall health and wellness. CurrentlyMindbody is the largest online platform that focuses primarily on the wellness services sector.

The Mindbody platform offers a wide range of typical business tasks such as managing staff members, class and appointment schedules, online bookings, client data, payroll, inventory, and sales for such endeavors as yoga, Pilates, martial arts, dance exercise, indoor cycling, personal training, barre, in addition to integrative health facilities, dance studios, children's activity centers, spas, and salons.

The software is designed specifically for SMBs, and its supported on Android, iPhone, iPad, Mac, Windows, Web-based, and Mobile Web App for mobile devices. It is supported across the United States, United Kingdom, Latin America, Germany, Europe, Canada and Australia for English, French, German and Spanish languages.

Financial Highlights For Q3: Revenue Up, Losses Narrowing

- Total revenue was $26.1 million up 48% from Q3 2014.

- GAAP net loss attributable to common stockholders in the third quarter of 2015 was $(9.6) million, or $(0.25) per basic and diluted share, compared to a GAAP net loss attributable to common stockholders in the third quarter of 2014 of $(11.4) million, or ($1.03) per basic and diluted share.

Management Team Overview

CEO, President and Chairman Richard Stollmeyer co-founded Mindbody in 2000. After serving as a Naval Submarine Officer, Mr. Stollmeyer graduated with a bachelor's degree in Political Science and Russian Language in 1987 at United States Naval Academy in Annapolis, Maryland. He later earned his Bachelor's of Science in International Relations & Engineering.

Chief Product Officer and Co-creator Chet Brandenburg joined Mindbody in 2002. Mr. Brandenburg also served as Chief Technology Officer from May 2006 to July 2011 and as Vice President, Development from October 2004 to May 2006. Mr. Brandenburg holds a B.S. degree in Computer Science from California Polytechnic State University, San Luis Obispo.

Competition: Quickbooks, Windows Azure, Salesforce.com, and Dropbox

Business management software is available in a wide array of formats and programs. Mindbody provides services focused on the health and wellness industry, and other companies that offer similar software include eFitfinancial.com. Generalized business software that can be tailored for specific businesses include Dropbox, Windows Azure (NASDAQ:MSFT), Quickbooks, Intuit (NASDAQ:INTU), Salesforce.com (NYSE:CRM), Amazon EC2 (NASDAQ:AMZN), Officetime, Adobe Forms Central (NASDAQ:ADBE), SageOne, Office 365 and others.

Early Market Performance: Good Start, Strong Performance after Slight Drop

MB's IPO priced at $14 per share, at the low end of its expected price range of $14 to $16. The stock opened on the first day of trading at $16.22 and closed at $11.56, for a decline of 18 percent. Since then the stock reached a low of $9.99 on August 6. Currently, the stock trades at $17.90 (12.4.2015, late morning).

(Click on image to enlarge)

Source: Nasdaq.com.

Conclusion: Short MB Ahead of December 16th

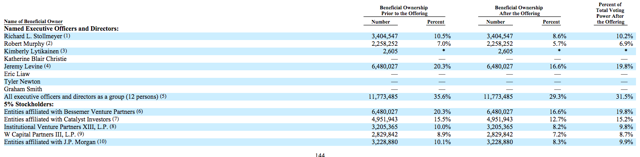

Given MB's steady increases, its major pre-IPO shareholders could be ready to take profits.

These insiders include five firms and twelve individuals. If even a portion of the group decides to sell, it could significantly depress MB's share price.

(Click on image to enlarge)

Our firm has found abnormal negative returns for IPO lockup expirations to be over 4% in a 1-2 week window, leading up to,and shortly following the expiration date.

Disclosure: None.