Middle-Aged Millennials Succumb To The American Dream: Taking On Debt And Buying A House

The stereotype of the typical millennial renter living at home in mom's basement may turn out to be not entirely accurate.

While we're sure there is still a fair share of stereotypical millennials, there's also many - some of whom are getting close to turning 40 - who are middle-aged homeowners, looking to pay down debt and improve their financial situation by contributing to their retirement.

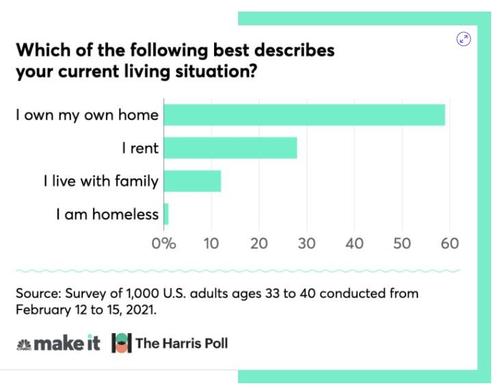

A new CNBC survey revealed that despite millennials constantly being painted as renters, many are actually now homeowners. The data comes as a result of a survey that polled 1,000 U.S. adults ages 33 to 40.

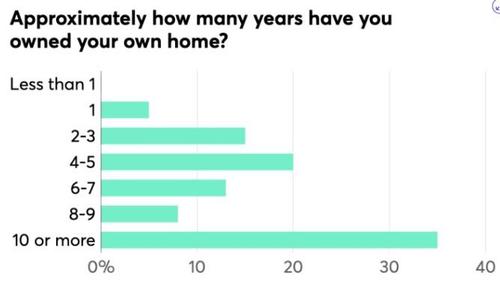

"Most older millennials have owned their home for several years," the survey found, with over half of them buying their home more than 5 years ago. 40% have owned their home one to five years.

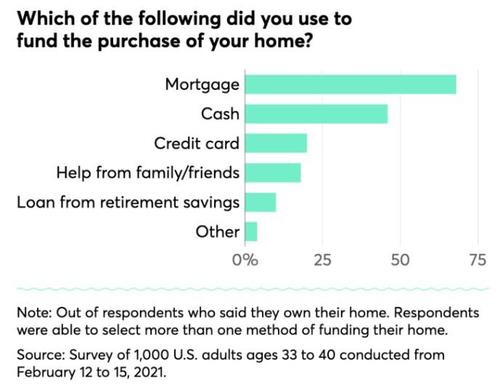

And despite this data, homeownership wasn't always easy. About 10% of millennials reported taking loans from retirement accounts. 20% of millennials said they used a credit card to help with home purchase and/or closing costs. “When it comes to achieving homeownership, older millennials were just scrappy and very resourceful,” Harris Poll CEO John Gerzema told CNBC.

About 28% of millennials still rent and about 12% are living with parents or family members, the survey revealed.

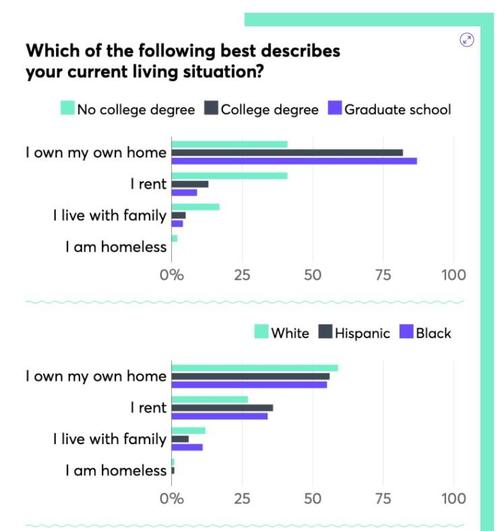

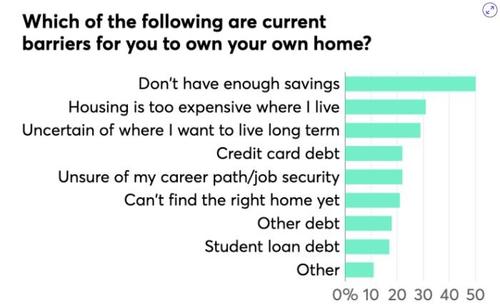

About 17% of millennials say that loans of debt present a barrier to them owning a home. Jung Hyun Choi, a senior research associate with the Housing Finance Policy Center at the Urban Institute commented: “With higher debt, it became more difficult for millennials to save.”

Additionally, lower savings rates - being attributed to a poor job market during 2007/2008 - have held many back from buying homes. “At that time, the unemployment rate was significantly high, so it meant that a lot of them faced difficulty finding jobs,” Choi continued.

St. Louis Federal Reserve economist Bill Emmons also said that Dodd-Frank was making it harder to get a mortgage: “The underwriting process for mortgage lending changed a lot from the pre- to the post-bubble period — and it would be groups like young people who would be most affected by that.”

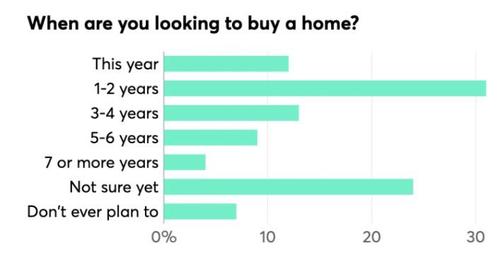

Despite Covid presenting a tailwind for many who were considering buying a home, only about 5% of older millennials bought a home over the past year, the survey revealed. The lack of a home can negatively affect people's financial stability going forward, Choi said. “Having a home does not just give you an opportunity to access wealth and build wealth, but it also gives you more stability.”

And Emmons thinks a small "delay" from Covid that pushes homeownership back for millennials isn't all that bad: “If it’s just a little bit of a delay, then maybe it’s not such a problem. Particularly if people are living longer, if they’re working longer or staying healthy longer, perhaps it’s not necessarily all bad.”

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more