Mid Cap Best And Worst Report - July 31, 2014

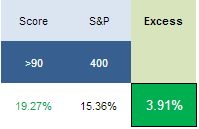

The highest scoring names in mid cap from 1 year ago returned 391 bps more than the S&P 500. The best performers have been UA up 106%, STZ up 66%, ACT up 62%, GMCR up 57%, CW up 53%, and ALXN up 44%.

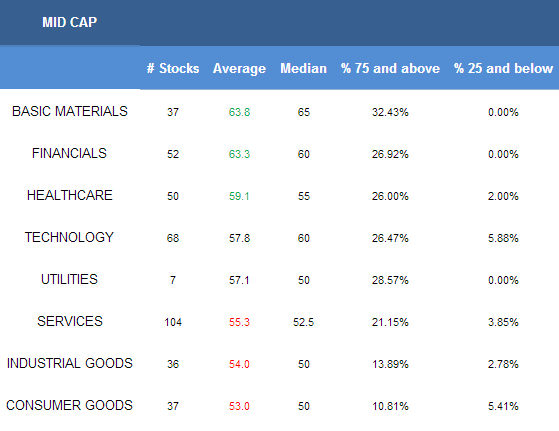

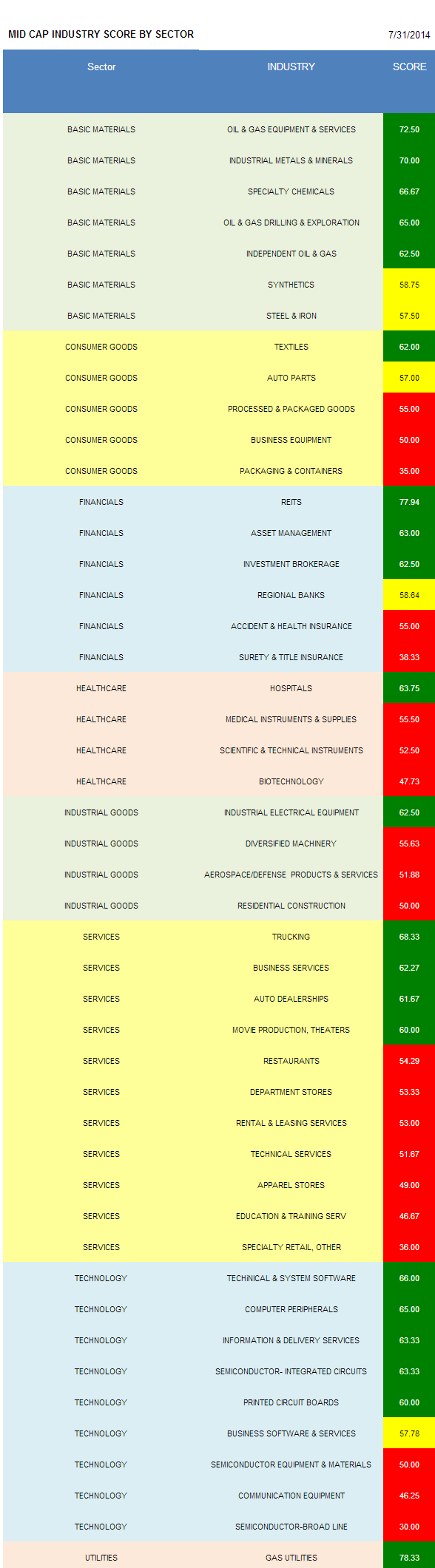

- The best mid cap sector is basic materials.

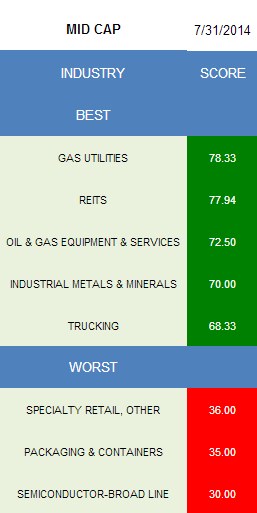

- The top scoring mid cap industry is gas utilities.

The average mid cap score is 57.78 this week, below the four week moving average score of 59.89. The average mid cap is trading -14.45% below its 52 week high, 0.97% above its 200 dma, has 7.83 days to cover held short, and is expected to post EPS growth of 19.17% next year.

The best mid cap sector is basic materials. Financials and healthcare also score above the average universe score. Technology and utilities score in line. Services, industrial goods, and consumer goods score below average.

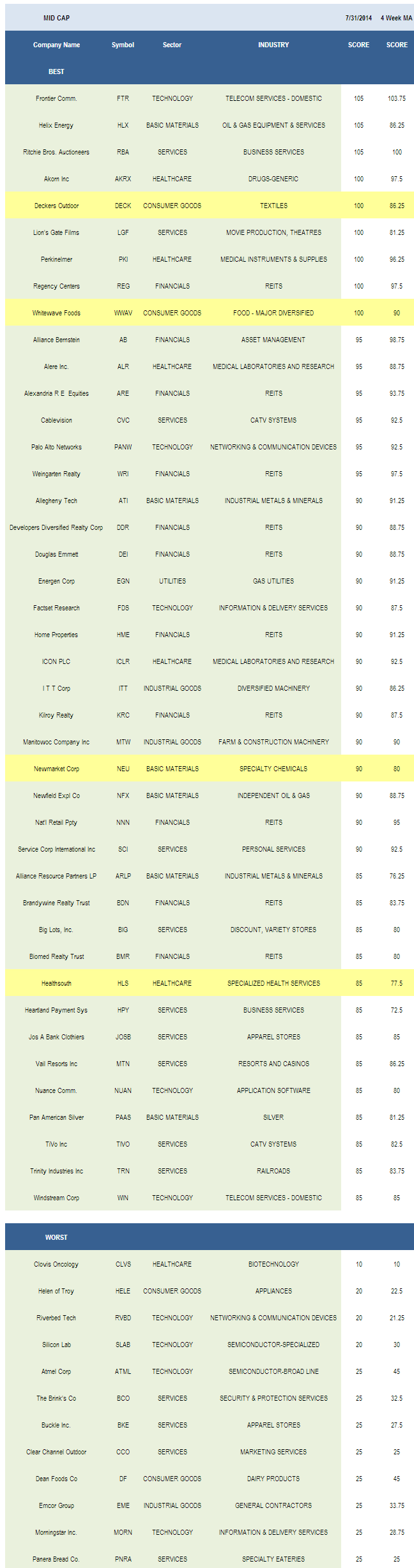

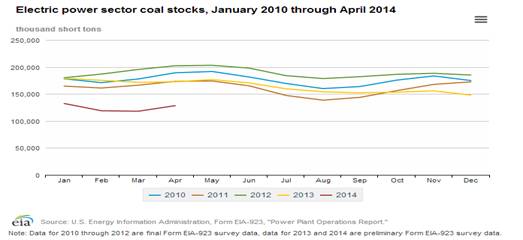

The best mid cap industry is gas utilities (EGN, NJR). REITs (REG, WRI, ARE, NNN, KRC, HME) score highly and benefit from new projects and cheap financing. Effective rent remains strong and stubborn, but falling, vacancy rates in commercial and office offer opportunity. Oil and gas equipment and services (HLX, PDS) stocks are enjoying stronger year-over-year demand thanks to increased activity. Industrial metals & minerals (ATI, ARLP) are intriguing given utility stockpiles have fallen and coal pricing has stabilized. Year-to-date coal railcar shipments are up 1%. Trucking (HTLD) volume supports spot rates. Intermodal rail activity supports logistics plays with volume up 6% this year versus a year ago.

In basics, buy oil & gas equipment & services, industrial metals & minerals, and specialty chemicals (NEU). The number of active rigs in the U.S. is up 107 from last year, according to Baker Hughes. In consumer, only textiles (DECK, SKX) score above average. Auto parts score in line. REITs, asset managers (AB), and investment brokers (GBL) are best across financials. In healthcare, only hospitals (SEM, LPNT) score above average. Bad debt expense will continue to fall post-reform, and reform enrollment offers revenue growth opportunity for outpatient facilities. Industrial electrical equipment (RBC, AOS) is best in industrial goods. In services, focus on trucking, business services (RBA, HPY, PRAA), and auto dealers (PAG, GPI). Retail is typically weak through summer and rebounds in the fourth quarter. Use weakness through September to slowly bulk up exposure to top scoring names. Technical & system software (MCRS, CDNS), computer peripherals (ZBRA, EFII), and information & delivery services (FDS, DNB) are best in technology.

Disclosure: None.