Mid Cap Best & Worst Report - September 3,2014

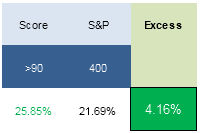

The highest scoring names in mid cap from 1 year ago returned 416 bps more than the S&P 500. The best performers have been UA up 83%, CW up 71%, ACT up 63%, OTEX up 62%, and UTHR up 60%.

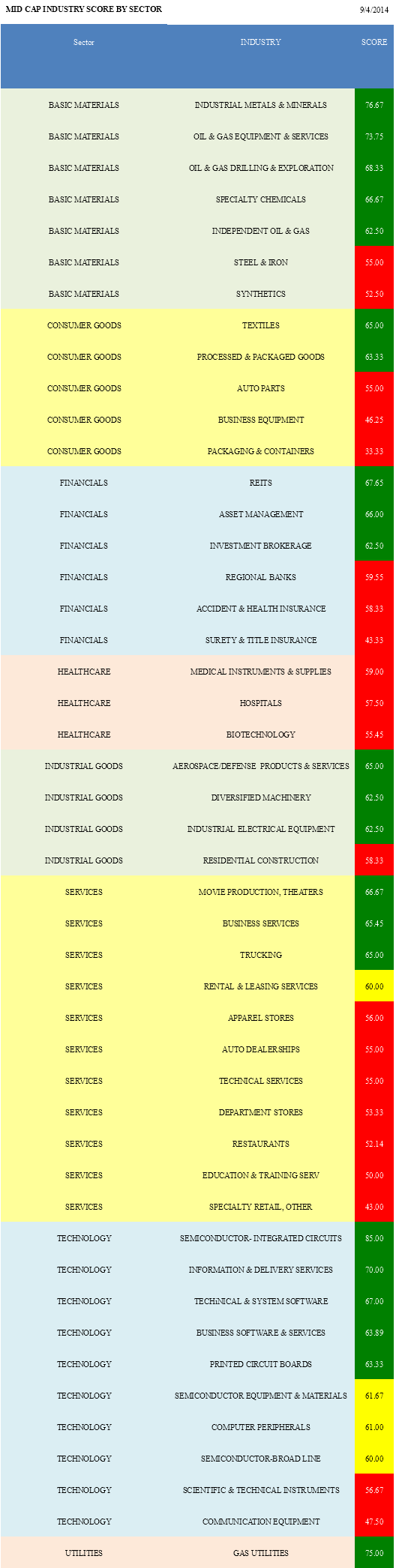

- The best scoring mid cap sector is technology.

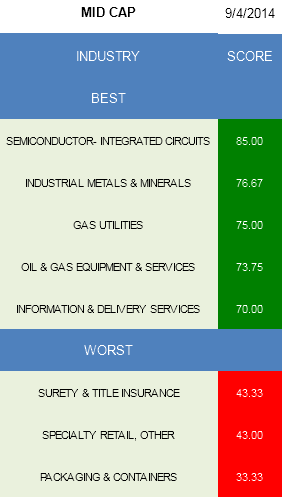

- The top scoring industry is semi ICs.

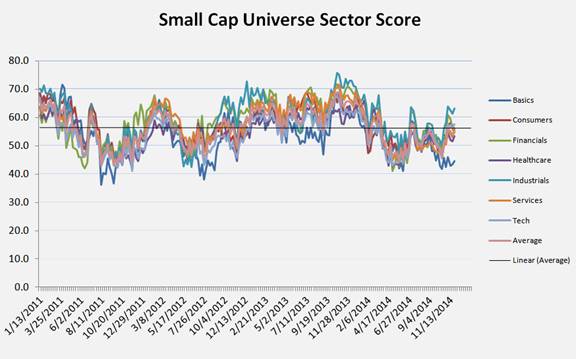

The average mid cap stock score is 60.02, below the four week moving average score of 60.67. The average mid cap stock is trading -12.78% below its 52 week high, 3.24% above its 200 dma, has 7.79 days to cover held short, and is expected to grow EPS by 19.1% next year.

Technology is the top scoring mid cap sector. Basics and financials also score above average. Healthcare scores in line. Industrials, services, utilities, and consumer goods score below average.

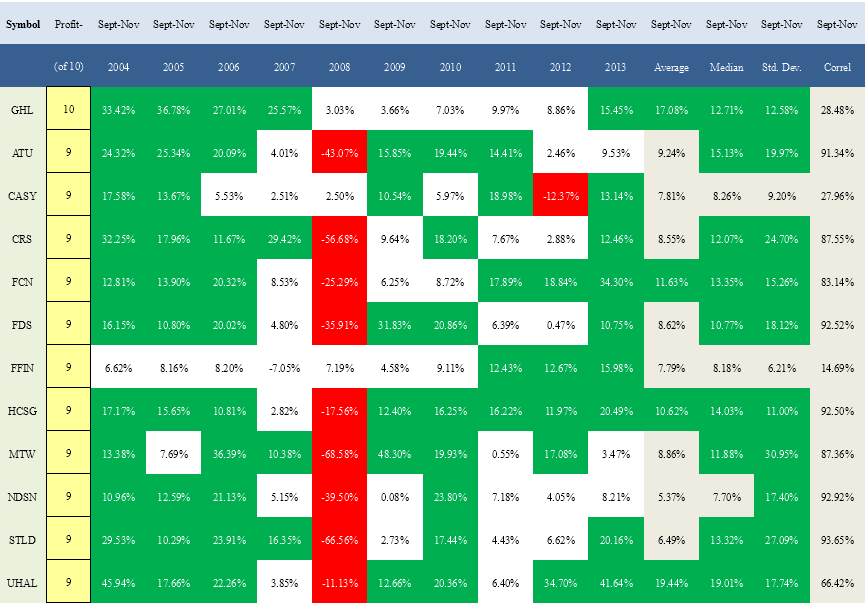

The following mid cap stocks have finished November higher than they begin September in at least nine of the past 10 years.

Internet of Things continues to support semi ICs (MSCC, IRF, FCS). Auto and industrial technology also supports the basket. Utility coal stockpiles support coal inventory building/volume and pricing given that capacity has significantly been taking offline (ARLP). Specialty metals demand benefits from aerospace production growth (ATI). Gas utilities (PNY) score high on consumer and industrial switching driven demand. Oil & gas equipment and services (HLX, RES, EXH) utilization benefits from year-over-year rig activity. Information & delivery services (DNB, FDS) rounds out this week's mid cap industry ranking.

In mid cap basics, buy industrial metals & minerals, oil & gas equipment & services, and drillers (PTEN, ATW). Textiles (DECK, SKX, CRI) and processed & packaged goods (HAIN, GIS) score above average in consumer goods. REITs (REG, WRI, DDR, BMR, BDN), asset managers (AB, EV), and investment brokers (GBL, GHL) are best in financials. In healthcare, trade up in market cap where possible. Managers should overweight aerospace/defense (CW, TDY, HXL, ESL), diversified machinery (ITT, DRC, NDSN), and industrial electrical equipment (RBC, AOS) in industrial goods. The top services groups include movies (LGF, RGC, CNK), business services (HMSY, HPY, RBA, DLX), and truckers (HTLD). In technology, buy semi ICs, information & delivery services, and technical & system software (CDNS, MCRS).

Disclosure: None.