Mid Cap Best & Worst Report - May 6, 2015

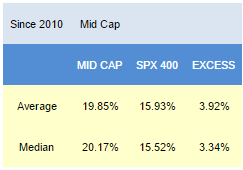

Since 2010, the best scoring names in our weekly mid cap report have outpaced the S&P 400 by a median 334 bps in the following year.

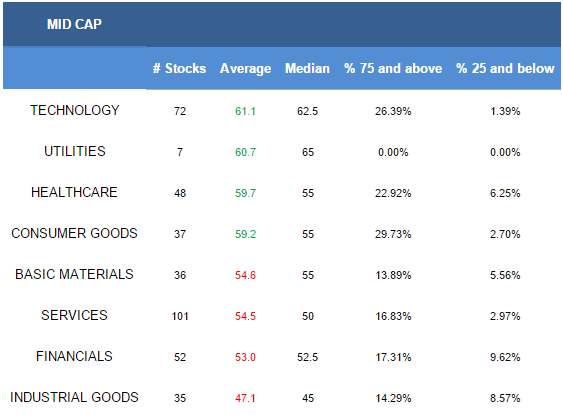

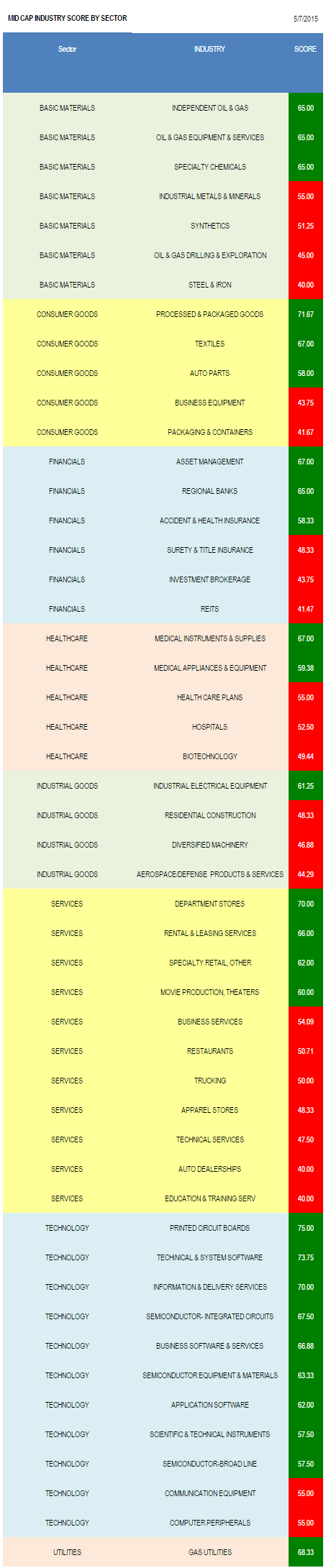

· Technology is the best mid cap sector.

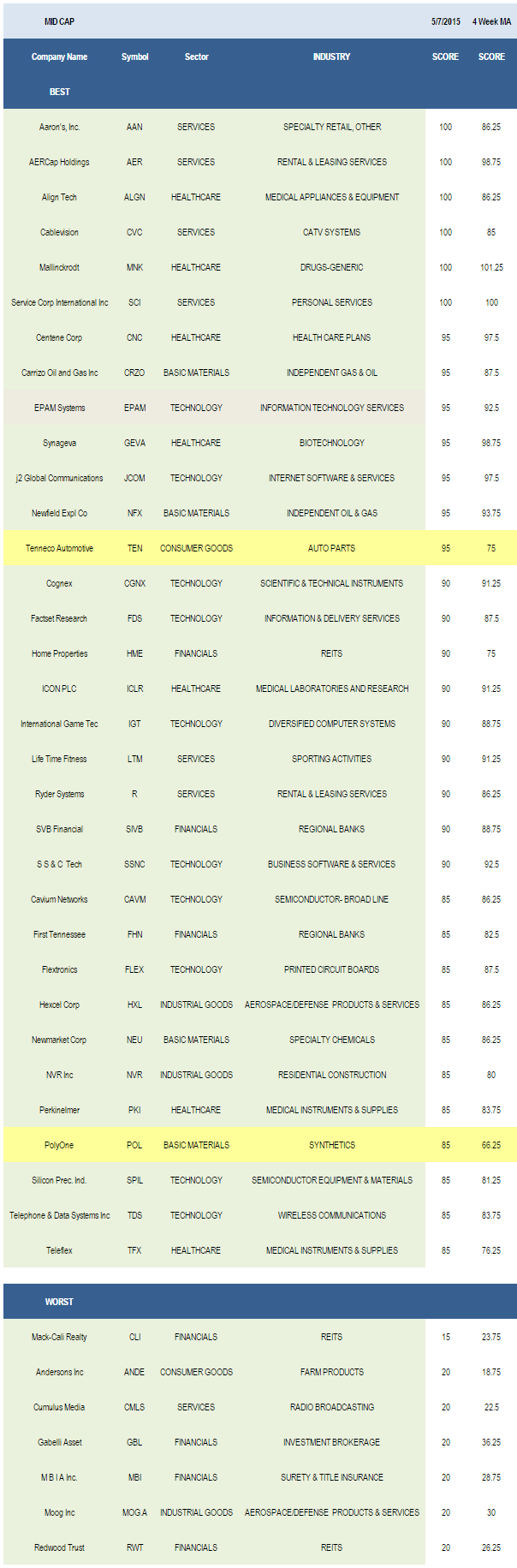

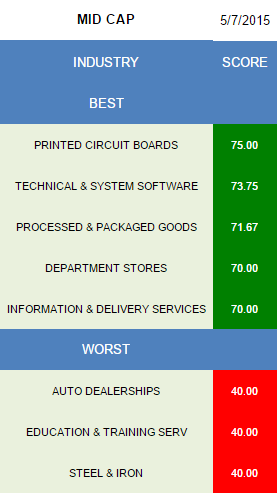

· The top mid cap industry is printed circuit boards.

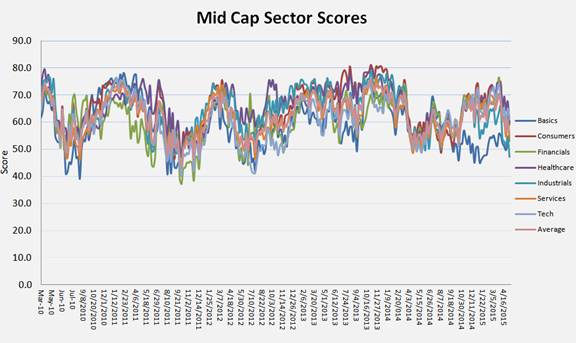

The average mid cap score is 56.04. That is below the average score of 58.86 over the past four weeks. The average mid cap stock in our universe is trading -14.58% below its 52 week high, 3.45% above its 200 dma, has 6.78 days to cover held short, and is expected to deliver EPS growth of 16.17% in the coming year.

The best mid cap basket is technology. Utilities, healthcare, and consumer goods can also be overweight. Basic materials, services, financials, and industrial goods score below average. Underweight those baskets until scores improve.

The best mid cap industry is printed circuit boards (FLEX, CLS, JBL). M&A activity and the evolving Internet of Things continues to support demand across consumer goods and industrials. Technical & system software (TYL, MENT, ACIW) offer an opportunity for ongoing growth tied to the shifting of process and practices online. Processed & packaged goods (HAIN, FLO) benefit from expansion into the convenience store channel and from emerging market opportunities. Department stores (DDS, JCP) and information & delivery services (FDS, MORN) round out this week's mid cap best industry ranking.

Unlike in large cap, a few basics baskets score above average in mid cap, including independent oil & gas (NFX, STR), oil & gas equipment & services (PDS, RES), and specialty chemicals (NEU, PPO). In consumer goods, focus attention on processed & packaged goods, textiles (SKX, CRI, COLM), and auto parts (TEN). Auto parts demand could pick-up if EU QE accelerates sales/production. In financials, overweight asset managers (OZM, AB) and regional banks (SIVB, FHN, OZRK, CATY). The top healthcare buckets are medical instruments (TFX, PKI, NUVA, HRC, THOR, MR) and medical appliances (ALGN, SIRO). Only industrial electrical equipment (RBC) has an above average score in industrial goods. The top services groups are department stores, rental & leasing (AER, R, UHAL), and specialty retail (AAN, OUTR); however, long term subscribers know that retailers typically offer up a better entry later in the third quarter. In technology, buy printed circuit boards, technical & system software, and information & delivery services

Disclosure: None.